Written by: Squid

Compiled by: AididiaoJP, Foresight News

Part 1: What is the Current Market Sentiment?

"What excites you most about cryptocurrency?"

"Which areas are you investing in?"

I always ask these questions to venture capitalists and hedge fund peers at conferences. They usually have the most macro insights into where the industry is heading. But at last December's Breakpoint conference, the answers weren't very inspiring.

Most answers focused on market consensus narratives:

Such as "stablecoins", "perpetual contracts", "prediction markets", "real-world assets (RWA)", "digital banking".

Some answers revealed deeper skepticism:

For example, "Not much is exciting", "Non-crypto businesses using blockchain infrastructure", "Taking a break and waiting for now".

Overall, the bets seemed to lean more towards industry "maturation" rather than "innovation". Underlying these conversations was a pervasive sense of nihilism.

This sentiment, though rarely stated explicitly, is felt by most. It stems from the endless stream of scams, low-float high-valuation token launches, exchange listing pumps, and KOL marketing games. This sentiment is a reflection of the industry's current state, but it cannot predict the future; one could even argue that the future is unlikely to be a continuation of the present.

Betting on mature narratives or areas with proven product-market fit (PMF) is essentially a subconscious "risk-averse behavior", rooted in this nihilism. Participants want to avoid the worst aspects of the industry and are unwilling to take risks on innovation in an environment where token performance is generally weak.

I believe that by 2026, these directions will not be good choices for liquid trading:

The problem is that market efficiency is still low, and this inefficiency continues to support the prices of many altcoins. Industry maturation means prices will revert to fundamental value – which, in practice, would cause most tokens to decline in the medium to short term. Unless you are shorting, it's hard to find investment opportunities based on fundamentals.

Trend continuation trades in areas with PMF are reasonable in direction but difficult to execute in liquid markets due to the persistent "adverse selection" problem. Most of the time, if you buy tokens in consensus narratives, you are either buying low-quality copycats or entering at ridiculously high valuations.

For example: You say you're bullish on prediction markets in 2025? Which token exactly did you buy?

Part 2: Where is the Real Value in Cryptocurrency?

Industry maturation implies moving towards fundamental pricing. But this exposes a core problem: the fundamental scale is too small to support current valuations and drive the market.

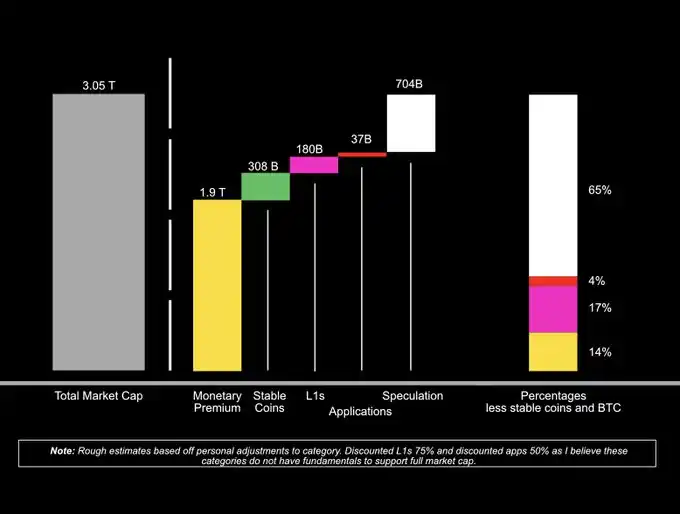

So, what exactly drives token prices? The chart below is a rough breakdown of cryptocurrency market capitalization by asset class, adjusted to illustrate the point more clearly:

Two main adjustments were made:

- Applied a 75% discount to the entire Layer 1 sector

- Applied a 50% discount to the entire Application sector

This reflects the view that a significant portion of these two major asset classes lacks the fundamentals to justify their current valuations.

After adjustments, two points stand out:

1. The market size cannot support grand narratives

Despite the focus on the application layer, the actual market size remains very small. Last year's total on-chain fee revenue was about $10 billion, and not all of this revenue accrues to token holders. In a global context, this figure is negligible. One could even argue that the entire on-chain application ecosystem's total valuation, pre-adjustment, is less than that of a single food delivery company like DoorDash.

2. Even after declines, speculative premium still dominates altcoin valuations

Looking deeper:

Fundamentals

Fundamentals determine the price floor. For most tokens, this floor is far below the current price. Even at current valuation levels, the market cap of the vast majority of tokens is still driven by speculative premium – the value assigned because people expect to sell it to someone else at a higher price in the future. This premium is highly correlated with overall market volatility and naturally decays over time. The more mature the narrative, the smaller the room for speculation.

This situation is unlikely to change in the short term. Therefore, as speculative premium erodes, most existing altcoins will underperform Bitcoin. The faster the industry matures, the sooner this underperformance will arrive.

Layer 1

Layer 1 remains an important category, but the rules of the game have changed. The winner-take-most general-purpose blockchains are likely already identified. Marginal technical improvements are less important than the network effects already formed, such as liquidity, developer ecosystems, and distribution channels. New general-purpose blockchains will not receive the premium they did in past cycles. Application-specific chains will gradually be valued as "Application" class assets.

Revenue & Applications

The direction of "focusing on revenue" is correct, but it is often misunderstood in crypto. People often discuss revenue multiples, but there are very few crypto businesses with durable moats. Much of the revenue comes from incentives, and cash flows have historically been fragile. Even with strong businesses and stable cash flows, it's often unclear whether the token can effectively capture this value. A low valuation multiple does not automatically make it a good investment.

The application layer still holds the greatest long-term potential, but solving real problems takes time. From a liquidity investment perspective, there are huge opportunities here, but the timeline is likely longer than the market generally expects.

"We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run." – Amara's Law

The core conclusion remains: No matter how attractive the revenue narrative, no matter how much capital is betting on industry maturation, speculation remains the primary driver of market capitalization. It will take time for fundamentals to expand to a sufficient scale, and until then, valuations will be set by expectations, not cash flows.

Part 3: Trading Directions Worth Watching in 2026

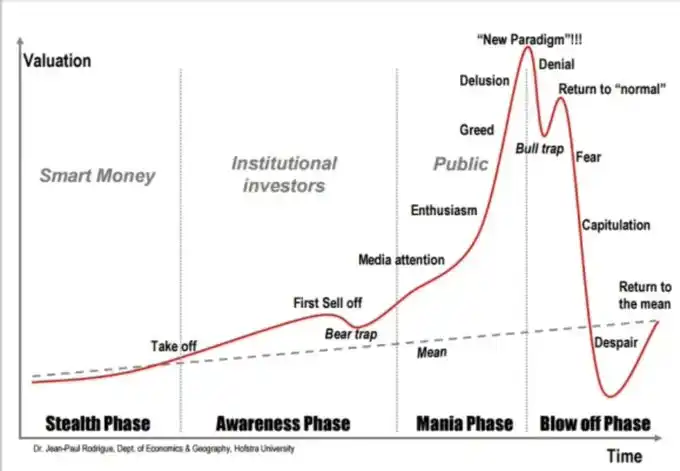

In a single asset or market, speculative premium erodes over time. This is an old story in the crypto world – AI agents, early DeFi, NFTs have all gone through such cycles.

Speculation always flows towards areas where valuation is not yet defined, narratives are still forming, and market size is undefined (imagination space is infinite).

In one sentence: Bet on innovation.

The assets most likely to absorb speculative premium in 2026 typically have the following characteristics:

- Can create entirely new assets or markets on-chain

- Have a viable path to obtaining "monetary premium"

- Are difficult to value due to novelty or unclear cash flow attribution (this is also why the monetary premium narrative is important)

- Have some form of barrier: technical, cognitive, or access barrier (hard to arbitrage + better distribution)

- Align with larger global trends – market size has no upper limit

These conditions delay the arrival of market efficiency, prolonging the window of mispricing, thus leaving room for speculation.

Specific Sectors and Projects to Watch

1. uPOW (Useful Proof-of-Work)

uPOW shifts mining output from pure inflation to output with practical utility, turning "mining for distribution" into "mining to add value to assets". This direction has been discussed for a long time, and the underlying technology is now nearing feasibility. uPOW projects are novel, difficult to value, represent a new class of productive assets, and have the potential to gain monetary premium. Currently focusing on two:

@nockchain: Early project, needs time to develop, fits the theme, and benefits from zero-knowledge proof and privacy narratives.

@ambient_xyz: In private pre-mining stage, expected to launch this year. Highly cyberpunk, using POW to provide compute for evergreen large language models.

2. Ownership Tokens

The era of "vibe coding" is here. Small teams developing short-cycle, niche MVPs will become the norm, and some will grow into real companies. Lightweight funding processes and the growth-enabling effects of tokens will continue to have value. The core issue for these tokens is the claim on business value, but various mechanisms are being explored to solve this. Opportunities lie both in the tokens themselves and in the launch platforms. Watching two:

- @MetaDAOProject: Recommended multiple times, the clear leader in this space

- @StreetFDN: Earlier stage, positioned to serve offline startups

3. Distributed Training & Compute Markets

Distributed training remains one of the most promising areas in AI x Crypto, with rollout slower than expected. Leading teams are beginning testing, hoping for full launch this year. Beyond the project tokens themselves, they are more likely to spawn secondary applications and token ecosystems built on top. The real liquidity opportunity might be there, although project tokens could also appreciate. Leading teams:

- @NousResearch

- @primeintellect

- @pluralis

4. Social Metaverse

Digital social spaces continue to evolve. Product-market fit remains elusive, but experimentation continues. Expect continued trial and error in this area this year. The winner may not have emerged yet, currently watching:

- @zora: Shows strong resilience, huge potential for synergy between creator and content tokens

- @trendsdotfun: Solana ecosystem project, reaching Asia-Pacific markets, not yet widely noticed

- @tryfumo: Included because it proves – execution itself is a moat

- @ShagaLabs: Metaverse data direction – expect more projects like this

5. Solana: @solana ($SOL)

General-purpose blockchains have matured. As network effects strengthen, the importance of marginal technical improvements is less than existing liquidity, developer ecosystems, and distribution channels. The winners are likely already determined.

Solana has a strong core ecosystem, a rare long-term vision among builders and capital, and a reliable roadmap for continued scaling. The next wave of speculation will happen on existing infrastructure. Whatever the specific narrative, Solana is structurally positioned to capture a large amount of this activity.

Areas where I see less opportunity: Bots, Meme coins.

Summary

Nihilism is not insight; it is a lagging emotional reaction to price action, a symptom of the industry's problems, not a prophecy of the future.

When sentiment is low, capital retreats to "mature trades" and consensus narratives to avoid risk. But in crypto, as in other industries, playing it safe does not yield excess returns.

The industry is still structurally in a "pre-fundamental" stage, where price discovery is dominated by speculative capital, not cash flow. This shift will take longer than people think.

Speculative bubbles always follow innovation. Believe in innovation, try new applications, spend time with builders, bet on innovation.