The price of Bitcoin has made a solid start to the new year, jumping above the $90,000 mark on Friday, January 2nd. While this newly-found momentum could have been triggered by a plethora of factors, an on-chain expert has pointed out that whale activity is not one of them.

Look Closer: BTC Whale Holdings Actually In Decline

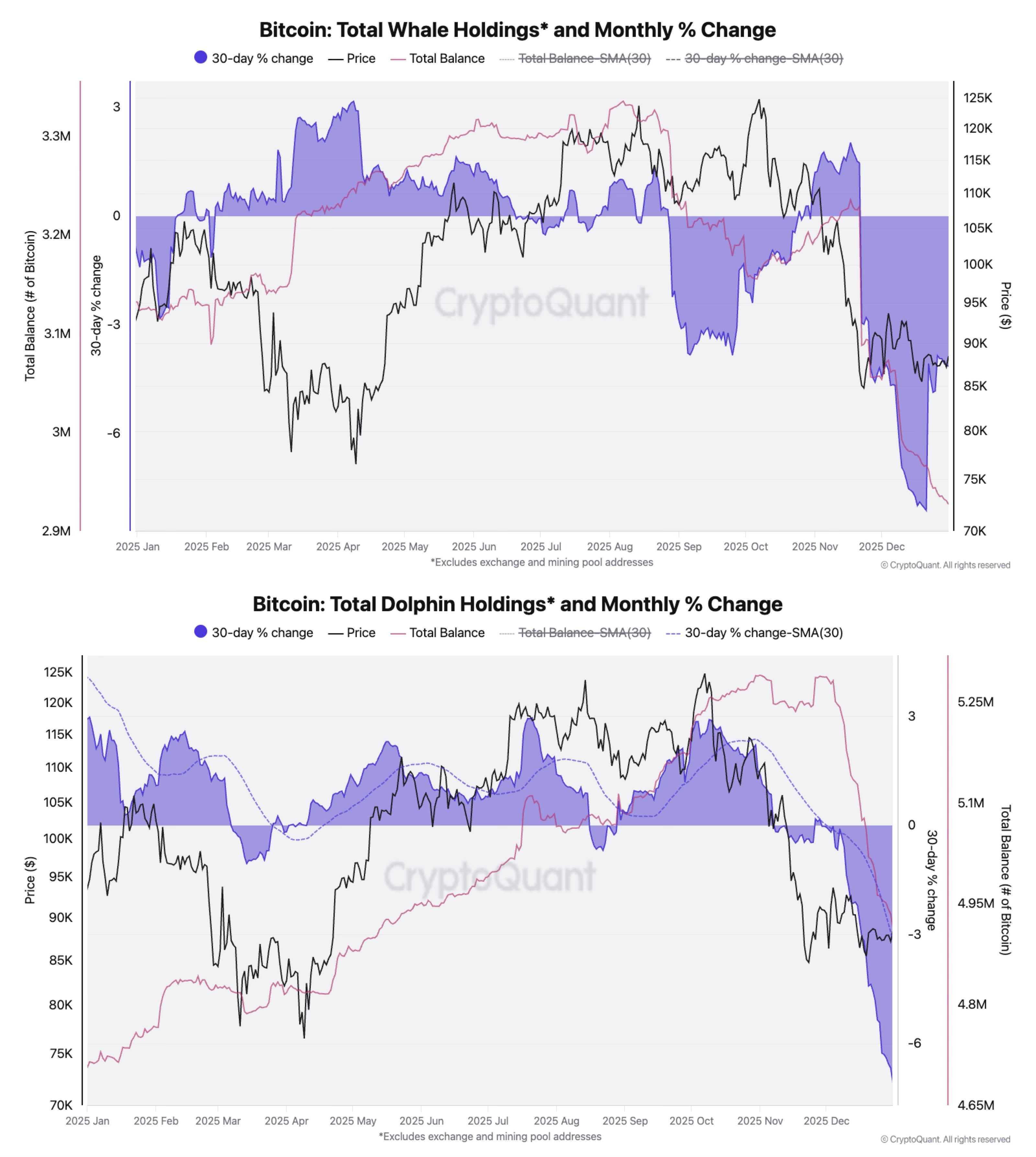

In a recent post on the social media platform X, CryptoQuant’s head of research Julio Moreno argued that the largest Bitcoin investors are not back buying enormous amounts of BTC. This conclusion is based on the Total Whale Holdings and Monthly % Change and Total Dolphin Holdings and Monthly % Change chart.

As the name suggests, the Total Whale Holdings and Monthly % Change chart shows the total balance of addresses with more than 1,000 coins and how it has changed in the past month. Meanwhile, the Total Dolphin Holdings and Monthly % Change chart depicts the change in the balance of investors with between 100 and 1,000 BTC (capturing exchange-traded fund holdings).

What’s more peculiar is that the Total Whale (and Dolphin) Holdings and Monthly % Change excludes exchange wallet addresses. According to Moreno, the majority of Bitcoin whale data has been skewed by exchanges consolidating a lot of their holdings into fewer addresses with larger balances, explaining why whales seem to be in a reaccumulation phase recently.

Interestingly, the data is indeed skewed, as upon removing all exchange addresses’ data, the total Bitcoin whale balances shows a decline rather than an ascent. The same trend can be seen in the lower Total Dolphin Holdings and Monthly % Change chart in the image below.

Source: @jjc_moreno on X

This shrinking balances of Bitcoin whales tells a story of waning demand in the market, sending signals of the start of a bear market. As seen in past cycles, the lack of apparent demand growth is the most telltale sign of impending correction phase for the Bitcoin price.

As of this writing, the price of BTC stands at around $90,320, reflecting an over 2% leap in the past 24 hours.

Spot Bitcoin ETFs Suffering Historic Losses

Since its trading debut, the US Bitcoin ETF market has been an excellent way to judge investor demand in the cryptocurrency market. However, market data hasn’t been telling a pretty story for the flagship cryptocurrency in recent weeks.

For context, the largest Bitcoin ETF, BlackRock’s IBIT, posted roughly $244 million in net outflows last week, marking its 2nd-consecutive weekly withdrawal. The fund has now witnessed net withdrawals in 8 of the last 10 weeks, with a total of just 20 weekly outflows since its launch two years ago.

According to recent data, crypto funds registered approximately $446 million in net outflows last week, marking the sixth week of withdrawal over the last nine weeks.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView