The Bitcoin mining Difficulty is set to see a significant reduction on Saturday, owing to the Hashrate disruption caused by the US snow storm.

Bitcoin Difficulty Is Estimated To Go Down 13% During The Next Adjustment

The Bitcoin “Difficulty” is a metric built into the blockchain that controls how hard miners will find it to mine the next block on the network. This indicator’s value automatically changes roughly every two weeks, based on the speed at which miners performed their task since the previous adjustment.

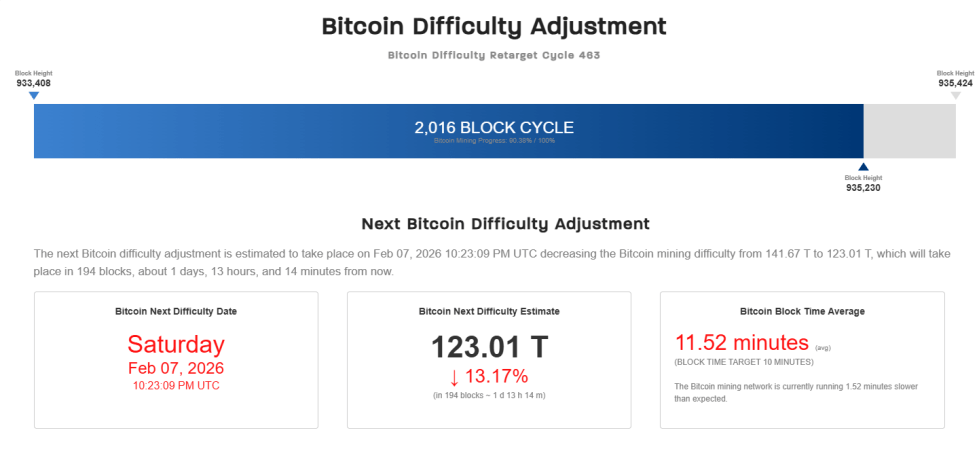

The next such adjustment is scheduled to occur tomorrow, February 6th. According to data from CoinWarz, the network will reduce the Difficulty during this event.

How the blockchain determines whether to increase or decrease the Difficulty is simple: it tries to bring block time back to the standard 10 minutes that Satoshi coded in for the network to follow. Whenever miners produce the average block in a time faster than this, the network responds by raising its Difficulty just enough that miners take 10 minutes between each block again. Similarly, the validators being slow forces BTC to ease the metric.

Since the last adjustment, the average block time has stood at 11.52 minutes, which is much slower than the expected value. As a result of this, Bitcoin is estimated to reduce its Difficulty by a massive 13% during the Saturday adjustment.

The details related to the upcoming Difficulty adjustment | Source: CoinWarz

The reason for the drastic change in Difficulty lies in the crash that the Bitcoin Hashrate has witnessed recently. The “Hashrate” is an indicator that measures the total amount of computing power that miners as a whole have connected to the network.

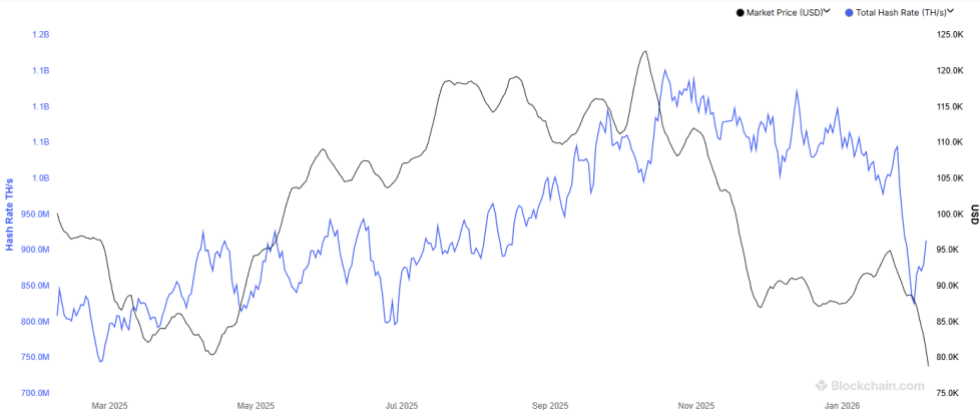

As data from Blockchain.com shows, this metric’s 7-day average value has observed a sharp decline since January 24th.

How the BTC mining Hashrate has changed during the past year | Source: Blockchain.com

On January 24th, the 7-day average Bitcoin Hashrate stood at 1,044 exahashes per second (EH/s). By the end of the month, that value had dropped to just 825 EH/s. This was an unusually rapid drawdown for the indicator, and it indeed had an unusual cause behind it: the US snow storm.

The winter storm disrupted various parts of the nation’s infrastructure, including power. To ease pressure on the grid, American Bitcoin miners curtailed their electricity consumption, which led to Foundary USA, the largest mining pool in the world, witnessing a Hashrate drop of nearly 60%.

In February so far, the US miners have started to bounce back, with the global 7-day average Hashrate returning to 913 EH/s. The decline in the Hashrate only being temporary doesn’t matter to the Difficulty, however, since the network only considers the average block time from the last two weeks.

The fact that the miners produced blocks at a slow rate during this window is already set in stone, so the Bitcoin network has no option other than reducing the Difficulty in the next adjustment.

BTC Price

Bitcoin plummeted all the way down to $60,000 on Thursday, but the cryptocurrency has since bounced back as it’s now trading around $69,300.

The trend in the price of the coin over the last five days | Source: BTCUSDT on TradingView