Compiled & Edited by: Deep Chao TechFlow

Podcast Source: Taiki Maeda

Original Title: Why I’m Shorting $1M of ETH (Again)

Release Date: December 18, 2025

Key Takeaways

Taiki returns to the market, shorting $1 million worth of ETH. In this video, Taiki reviews the bearish arguments around ETH from the past few months and explains why he decided to re-enter the short market.

Highlights Summary

-

We should welcome bear markets because that's where the money-making opportunities are; real wealth is accumulated by buying at the bottom.

-

When Tom Lee pours massive money into ETH, you can choose to sell your assets; and when they might stop buying, you can start shorting.

-

Whenever the ETH price rises, OGs tend to sell; ETH acts more like a primary exit liquidity tool rather than an asset suitable for long-term holding.

-

I believe the actual fair value of ETH might be between $1,200 and $2,200.

-

The cryptocurrency market currently lacks new marginal buyers; the bubble has burst, and the market is in an unstable phase post-excitement.

-

Some investors don't genuinely want to hold ETH long-term; they just want quick profits.

-

The crypto market currently exhibits a PvP (player vs. player) competitive state with no clear advantage.

-

Tom Lee's operational strategy is not only to push ETH's price up but also to maximize personal and corporate gains.

-

Once the funds are depleted or market demand weakens, ETH's price could drop rapidly.

-

Tom Lee's goal is to increase ETH's market share to 4% or 5% within six months.

-

January 15, 2026, is not only the date when Bitmine's board decides on bonuses but also the deadline when MSTR could face delisting. If MSTR is delisted, it could trigger billions in capital outflows, creating massive selling pressure on the market.

-

I once delusionally believed ETH would reach $10,000 and held on, only to see it drop from $4,000 to $900.

-

The way I analyze the market is more based on the fundamentals of numbers and capital flows, rather than simply drawing charts or lines to predict price movements.

-

Almost no one is actually using ETH.

-

Market maturity in crypto means understanding that something can be technologically excellent, but that doesn't necessarily make it a good investment.

-

The current market phase can be summarized as: DATs pushed prices up, and people are gradually realizing this frenzy may have gone too far, and ETH's actual value might be much lower. This is precisely where my bet is placed.

-

Shorting ETH is a simple and effective strategy.

Shorting $1M Worth of ETH

-

Over the past two months, I've made over $500,000 by shorting ETH and altcoins at market highs. In this video, I'll explain why I decided to short another million dollars worth of ETH, as I believe ETH's price will fall further.

-

I've held a very bearish view of the market for the past two months. I expressed this view by shorting ETH and altcoins and have re-entered the trading arena. About ten days ago, I re-established my ETH short position. A few weeks ago, when ETH dropped to around $2,650, I closed the position once, but shorted again after the price rebounded.

-

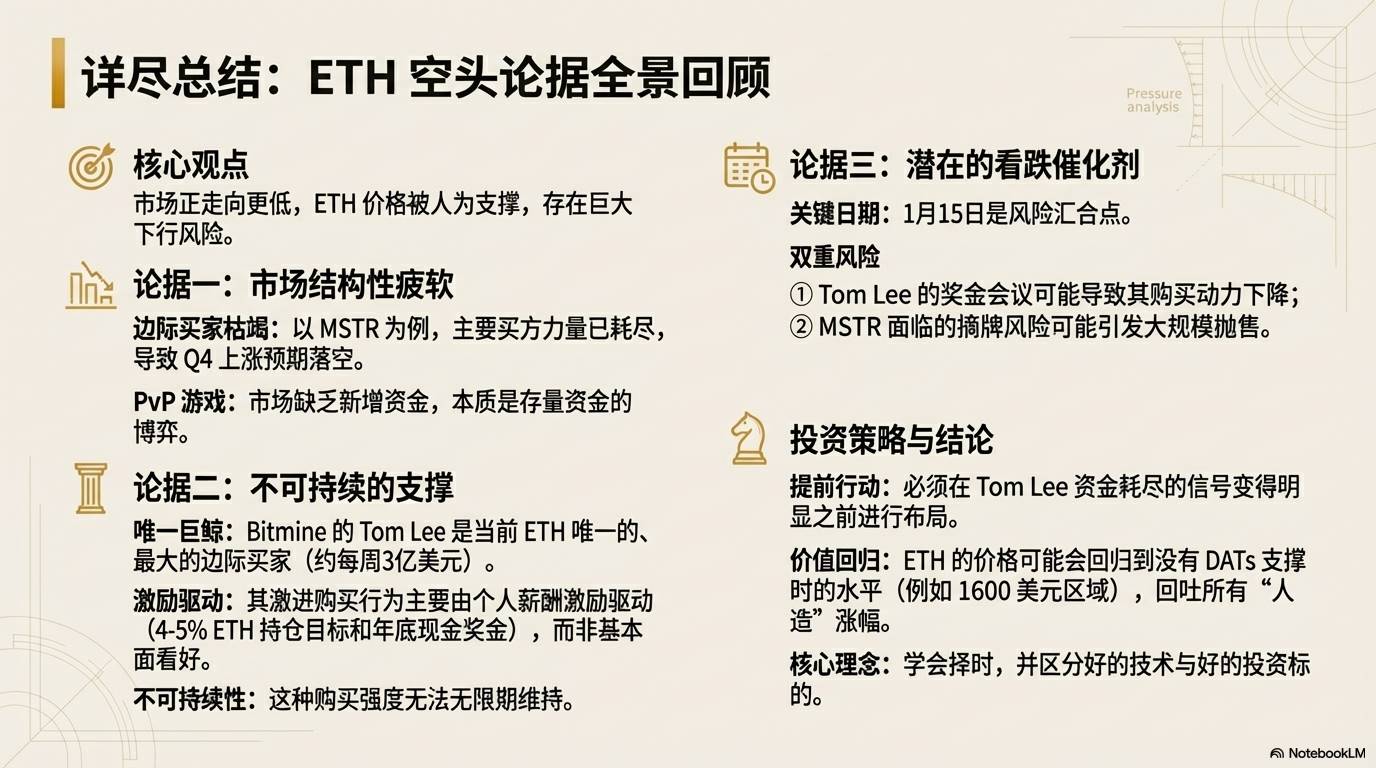

Since I posted that on Twitter, I've increased my position. Currently, my average entry price is $3,133, with a total value of about one million dollars, and an unrealized P&L of approximately $56,000.

Reviewing the Bearish ETH Thesis

-

Now, let's review my summary of the bearish thesis for ETH. The first part of my short on ETH was based on the understanding that MSTR and Michael Saylor have run out of funds, making a Q4 rally unlikely, especially after the October 10th liquidation event. Therefore, shorting ETH above $4,000 was reasonable—a fairly straightforward trade.

-

MSTR's Net Asset Value (MNAV) continued to shrink, reminiscent of the last cycle near the market top. If Saylor can't buy, we lose one of the biggest Bitcoin marginal buyers, which isn't good. The question I posed to viewers was: If the guaranteed Q4 rally doesn't materialize, what happens to ETH and alts? Everything falls, right? That's exactly what happened.

-

October 10th was a good catalyst. Once alts fell, you should have anticipated the fundamentals for ETH, Solana, and all these shitcoins would worsen. This is because the capital deployed on-chain aims for yield, which comes from alts, so expect DeFi TVL to decrease. In a sense, the decline in alts acts as a leading indicator for on-chain adoption, as people withdraw funds after major liquidation events.

-

-

I believe we are now in the second part, somewhat similar to the first. Tom Lee has been one reason for my ETH short, as I think he pushed the price above fair value. So, shorting it back down makes sense. But I still think he is propping up ETH, which presents an interesting opportunity. Because I believe once he runs out of funds or starts to, ETH will truly revert to fair value.

-

I do think ETH should fall lower, but Tom Lee is preventing it. However, at some point, he will run out of money. The issue with DATs is I don't like them; no one enters crypto to study DATs. But in my view, they control the market, they control the marginal money flows in crypto, so we must study them.

-

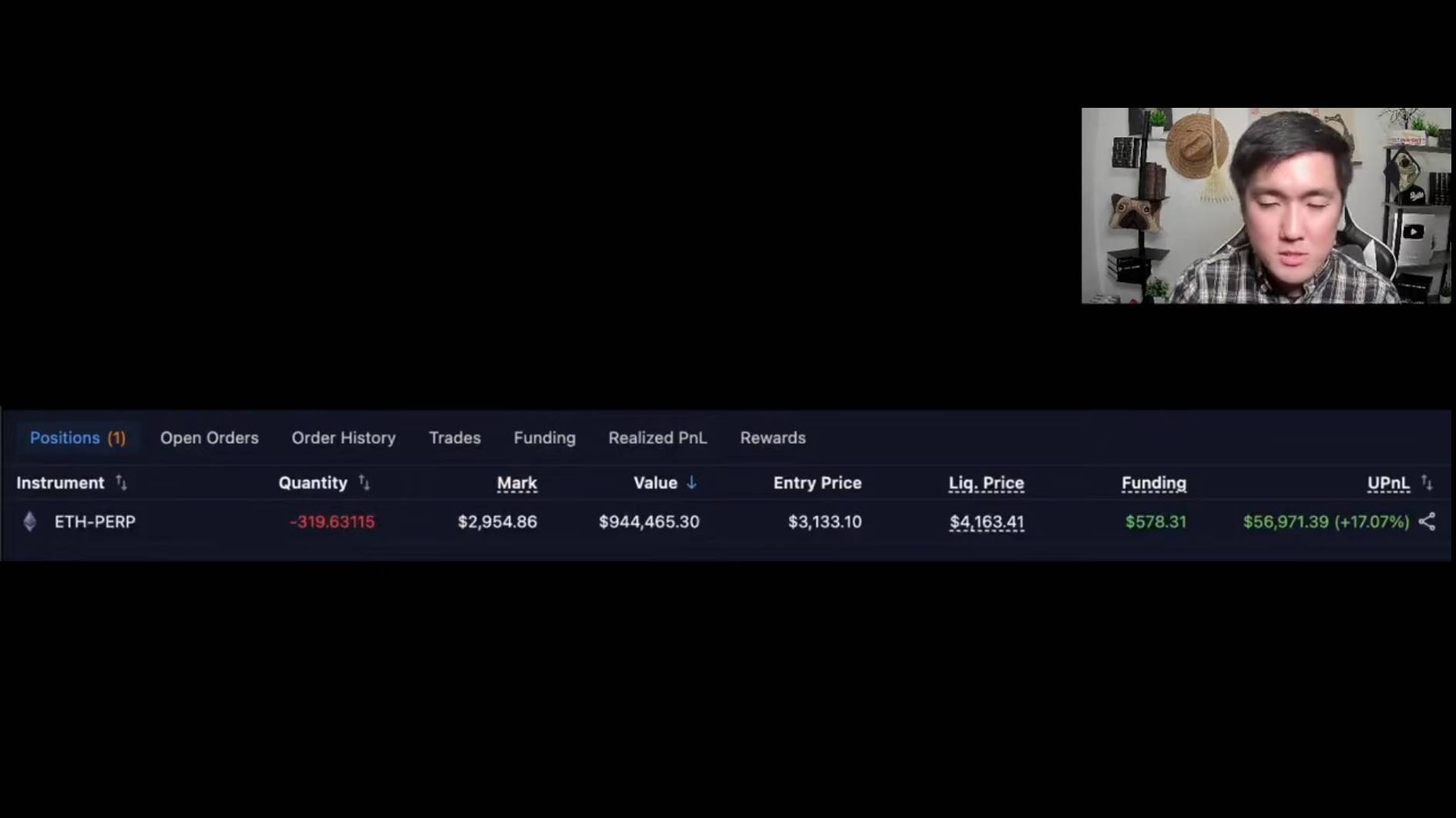

I think Tom Lee pumped ETH's price a lot, and now the amount he buys is decreasing over time. I think ETH will converge to fair value. I don't know what fair value is, but it could be much lower. You can see this is Tom Lee's activity; he bought a lot above $4,000, but if you understand how DATs work, when crypto is rising, people flock to these assets because the market is reflexive. So these DATs buy heavily on the way up, and then once the downtrend persists for a long time, they can't keep buying.

-

-

Saylor accumulated over 3% of Bitcoin over 5 years, a move that drove Bitcoin's price from around $10,000 to $85,000. In contrast, Tom Lee concentrated over 3% of ETH purchases in just 5 months, yet during this period, ETH's price only inched up from $2,500 to $2,900. Whenever ETH's price rises, OGs tend to sell, making ETH more of a primary exit liquidity tool rather than an asset for long-term holding, a point I've emphasized over the past few months.

Tom Lee's Impact on ETH

-

In crypto markets, holding a contrarian view often pays off, as you can validate your judgment through capital trades. If your prediction is correct, the market rewards you with more capital, which you can reallocate elsewhere.

-

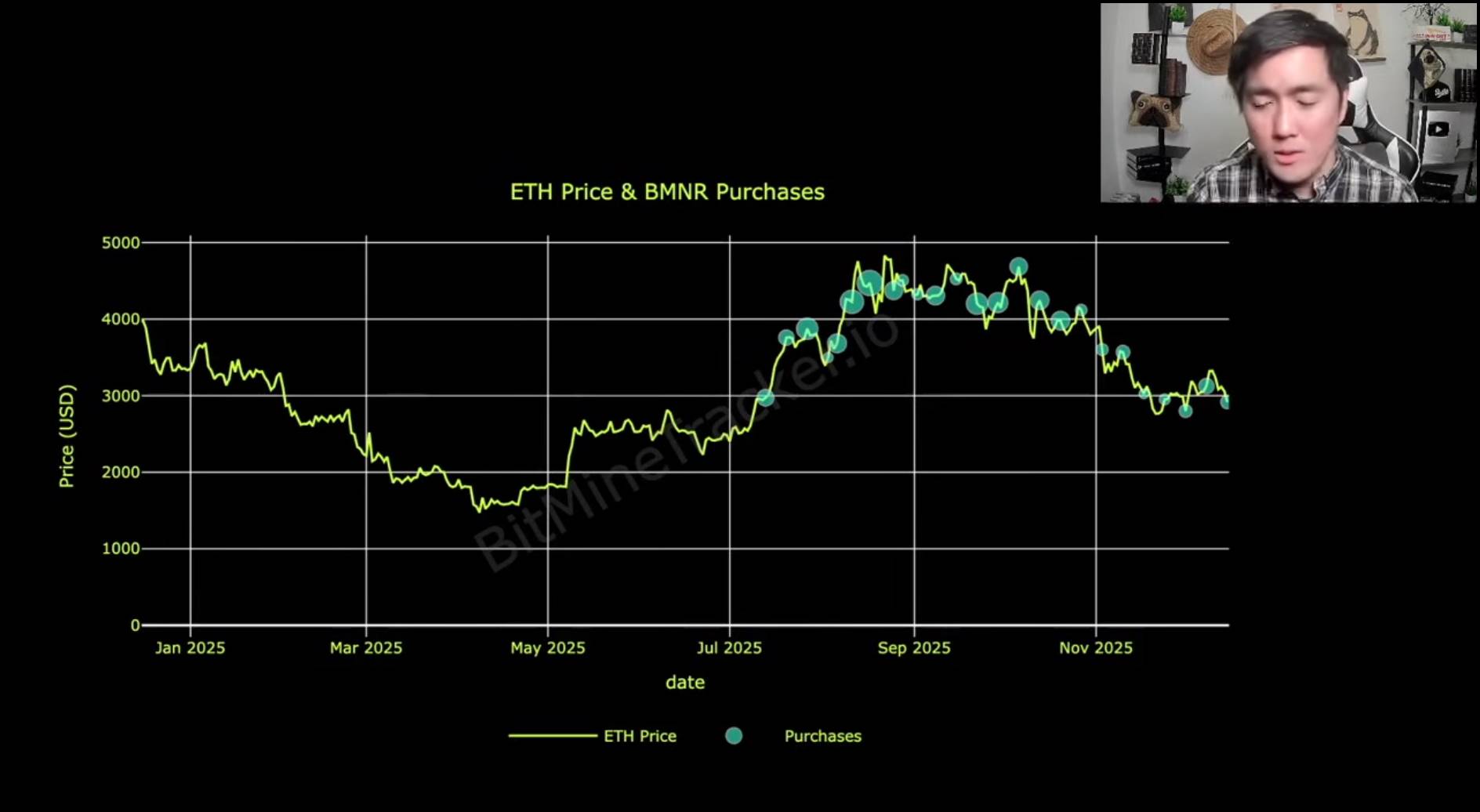

Recently, Tom Lee has been investing about $300 million weekly to buy ETH, which is particularly staggering in the current market environment. He publicly stated at Binance Blockchain Week that ETH's price has bottomed and that he is increasing his purchases. His exact words were: "We believe ETH has bottomed, so we are buying more." To time their buys precisely, they hired Tom Demar—an expensive but highly capable consultant. Tom Lee predicted ETH could reach around $22,000 and gave a fair value range: $12,000 to $22,000. However, I personally think this prediction might be wrong, and the actual fair value could be $1,200 to $2,200.

-

Over the past few weeks, Tom Lee's public statements indicate they are accumulating ETH heavily, which has made ETH outperform other altcoins lacking marginal buyers, such as Solana. Chart-wise, ETH's price action is noticeably stronger. However, from a market game theory perspective, I think the cryptocurrency market currently lacks new marginal buyers. Most potential buyers are already in, the market is in an unstable phase post-excitement, the bubble has burst, and we are trying to figure out how low these assets might go.

-

If Tom Lee continues buying $200-300 million worth of ETH weekly in the short term, the market might be influenced by him. In this scenario, short-term traders might choose to buy whenever ETH dips, anticipating Tom Lee's funds will push the price up, and then sell for profit. For short-term traders, Tom Lee's buying undoubtedly provides liquidity support. Psychologically, I call this the "perceived Tom Lee safety effect." Knowing he is buying makes people more willing to hold ETH in the short term over Bitcoin or Solana. If you're waiting for a market bounce to trade, holding ETH might be the more rational choice.

-

Even though I'm short ETH, I still think in the short term, ETH is a better hold than other assets, simply because of Tom Lee's continuous buying. However, we need to realize that once Tom Lee's funds are depleted, ETH's price could drop significantly. This phenomenon is similar to when Saylor announced a $1 billion Bitcoin purchase, but the price crashed. The market understood he couldn't buy indefinitely, so each purchase reduced future buying capacity.

-

Additionally, there's a Chinese whale named Garrett Bullish, who allegedly manages others' funds. He was short before the October 10th market crash but then bought over $500 million worth of ETH on-chain on Hyperliquid and is now down about $40 million. I think his investment logic might be partly influenced by Tom Lee. However, this behavior is more about making "fast money"; these investors don't genuinely want to hold ETH long-term, they just want quick profits.

-

The crypto market currently exhibits a PvP (player vs. player) competitive state with no clear advantage. Although there is still capital flowing in the market, the overall trend is capital gradually flowing out of the ecosystem. This might also be why we've seen recent price volatility. As market participants, it's important to understand Tom Lee's buying capacity, scale, and potential stopping point. I personally think his funds might run out soon, which is why I recently increased my inverse position.

Tom Lee's ETH Operational Strategy

-

Let's analyze Bitmine's current financial situation. A month ago, they held about 3.5 to 3.6 million ETH and $600 million in cash. According to the latest announcement yesterday, their ETH holdings have increased to nearly 4 million, and cash reserves have grown to about $1 billion. Clearly, Tom Lee is operating very boldly and efficiently. He is expanding his holdings by buying ETH while also raising more cash.

-

Tom Lee's strategy involves using media publicity to attract investor attention to Bitmine and Ethereum. By showcasing the company's assets and market potential, he attracts people to buy Bitmine stock. He then issues more stock and uses part of the proceeds to buy ETH. Reportedly, he recently sold about $500 million worth of stock to Bitmine shareholders, with about $300 million used to buy ETH. This method sustains demand and trading volume for Bitmine, allowing him to continue raising funds.

-

However, this strategy also carries risks. Although Tom Lee's brand effect and market reputation might attract investors, Bitmine's stock price performance doesn't look optimistic. I personally think this model is difficult to sustain long-term and might eventually halt due to depleted funds. After all, raising capital isn't infinite, and the market won't stay irrational forever.

-

Tom Lee, as a well-known market figure, has been a crypto bull for the past decade and has been correct most of the time. His business model is also very successful, e.g., selling services like news briefings. However, why is he risking his reputation to push ETH's price so high? I think the answer lies in incentives. As Charlie Munger said: “Tell me the incentive, and I will tell you the outcome.” If we analyze Bitmine's incentive structure, we can better understand his behavior.

-

According to Bitmine's SEC Schedule 14A filing, Tom Lee's compensation is closely tied to company performance. His performance awards are linked to Bitcoin revenue, ETH holding ratio, Bitcoin price, and company market cap. Additionally, the board can vote annually to grant him a cash bonus of $5 to $15 million. More importantly, the equity incentive mechanism stipulates that if Bitmine's ETH holdings reach 4%, Tom Lee will receive 500,000 shares, estimated to be worth about $15-20 million at current stock price; and when holdings reach 5%, he gets 1 million shares, doubling the reward.

-

It's worth noting that Bitmine's revenue primarily comes from asset management fees. For example, if Tom Lee buys $10 billion worth of ETH and charges a 2% management fee, company revenue would be $200 million. This model is simple yet effective.

-

Tom Lee's operational strategy is not only to push ETH's price up but also to maximize personal and corporate gains. However, the sustainability of this strategy is questionable. Once funds are depleted or market demand weakens, ETH's price could drop rapidly. As market participants, it's important to understand his fund size, purchase plans, and potential stopping point.

Bearish Factors for January 15, 2026

-

Tom Lee's goal is to increase ETH's market share to 4% or 5% within six months, a move that is very bold and noteworthy. His incentives motivate him to keep investing funds to buy ETH until year-end because there is a potential cash bonus mechanism annually. He hopes to showcase excellent performance at the January 15th board meeting, e.g., "I bought this much ETH, give me my $15 million bonus." This reward mechanism explains why he accelerates ETH purchases before year-end.

-

Once Tom Lee reaches the 4% or 5% market share target, his buying motivation might weaken, as the marginal benefit of the incentive mechanism decreases. Of course, he might still need to keep buying to maintain ETH's price, but the driving force for pushing the price up will diminish. You can see he has a stronger incentive to push the price higher before year-end.

-

Tom Lee's strategy has indeed greatly benefited ETH holders. He boldly invested capital to push ETH's price from $2,500 to $4,900 and is still buying. However, this strategy also carries risks. If ETH's price experiences a significant correction in the future, retail investors might be disappointed, especially those who bought Bitmine stock based on Tom Lee's statements.

-

It's noteworthy that January 15, 2026, is not only the date when Bitmine's board decides on bonuses but also the deadline when MSTR could face delisting. If MSTR is delisted, it could trigger tens of billions in capital outflows, creating massive selling pressure on the market. MSTR's leadership is clearly worried; they even set up a page on their website calling for investor support to avoid delisting. If delisting occurs, it could cause market panic, as MNAV might fall below 1. Although Saylor said he might sell Bitcoin to buy back stock if MNAV falls below 1, the market might pressure test this.

-

Tom Lee's incentives before January 15th motivate him to keep buying ETH. But if MSTR gets delisted and Tom Lee has exhausted his funds buying ETH, the market could crash. This scenario, while extreme, is worth watching. Studying incentives helps us better understand market participants' behavior logic.

Things Could Get Worse

-

I think in cryptocurrency trading, we should always ask ourselves two questions: Who is the marginal buyer? Who is the marginal seller? I raised this question months ago. Back then, the market generally believed Q4 would see a rally and an "altseason." But I kept asking: if everyone is already positioned for the rally, then who will be the marginal buyer? Clearly, they couldn't answer. So I realized these people are actually the marginal sellers. Because if the market doesn't rally as expected, they will sell instead, which provides a great opportunity to short.

-

Lately, I've had to admit a fact: the current cryptocurrency market lacks real "structural buyers." Although this might change in the future, for now, the market is more like a PvP (player vs. player) game. Digital Asset Treasuries (DATs) are propping up the market to some extent, but their funds are limited. If you agree with this view, then the market moves of the past few months are relatively easy to understand. For example, when Tom Lee pours massive money into ETH, you can choose to sell assets; and when they might stop buying, you can start shorting.

-

Take Tom Lee, for instance. He might do large-scale concentrated buying in December, but come the new year, he might slow down his purchases while keeping some cash to protect the stock, as he will need to build cash reserves eventually. The current market situation is somewhat similar; capital is mainly flowing into ETH, supporting its price at a high level. Once Tom Lee slows his buying, the market's long positions might unwind quickly. As I mentioned before, ETH's price could have been lower, but Tom Lee's actions temporarily prevented that. Once he exits the market, ETH's price could drop rapidly.

-

Tom Lee's Bitmine was announced when ETH was at $2,500. I think this entire rally might eventually be completely retraced. Last time Bitcoin traded around $85,000, ETH was around $1,600. While one could argue this was an anomaly due to factors like tariffs, the fact is, at similar Bitcoin price levels, ETH was much lower. I think ETH's price is still around $2,900 now mainly due to continuous DAT buying. These funds do provide support, but they will obviously run out. If you just wait for the funds to run out before shorting, it might be too late. You need to anticipate the market trend beforehand because by the time the funds are depleted, ETH's price might have already fallen significantly.

-

Although my view sounds pessimistic, if you're familiar with my trading style, you know I'm usually bullish. I've made mistakes in the past, always reinvesting all profits back into the market. Whenever clear risks appear in the market, I take profits. Shorting is a strategy I've only recently added; usually, I prefer going long. If you think about it, we should welcome bear markets, because that's where the money-making opportunities are. Many people only think about profiting from the Q4 "altseason," but real wealth is accumulated by buying at the bottom. For example, anyone who bought Bitcoin around $20,000, now at $85,000, that's a 4x gain.

-

I hope everyone understands that the market can always get worse. And unless you sell, you can't actually realize profits. You need cash reserves and must be decisive when the market is cold. I'm not saying you must sell now, just sharing my trading thoughts. In the bear market of the last cycle, ETH fell for 11 consecutive weeks. I thought it should bounce after the sixth week, but it didn't, and it fell for another five weeks. So the market can always get worse.

-

I want to remind everyone not to be content with simply holding cryptocurrencies, as they can drop very quickly. Even in the recent market, no one foresaw it would fall so fast, but it did. Unless you sell, you cannot profit in the cryptocurrency market. Of course, you can choose to HODL Bitcoin or ETH long-term. I personally don't think ETH is a good investment, but if your investment horizon is long enough, say 20 years, and you completely ignore short-term volatility, then maybe it's acceptable. But most people don't have the conditions to become wealthy Bitcoin or ETH whales; we at least need to trade to catch market tops and bottoms, otherwise, we just bear the risk of asset depreciation.

Taiki vs ETH Maximalists

-

Recently, I've received some attacks from ETH maximalists, which is somewhat understandable. For these people, their identity seems entirely built around their early purchase of ETH, and here I am on YouTube bluntly stating that ETH's price might fall further, backed by data and facts. However, I respect ETH supporters like Ryan Burkeman because he genuinely believes in ETH's value. Of course, sometimes I correct his math errors too.

-

I want to clarify that I am not a blind ETH worshipper. In fact, if you check my on-chain transaction history, I use ETH's ecosystem (e.g., ETH L2s) more frequently than the vast majority of ETH maximalists. Whether on Twitter or YouTube, I might be one of the most active on-chain users; I use blockchain often and have participated in mining.

-

Many people aren't critical enough of ETH. They might simply buy ETH and expect the price to go up, but I make these videos not to attack ETH, as I think ETH is a great technological product. However, we must learn to distinguish between an "asset" and a "technological product"; they are two different things. While technological superiority might influence asset price, it doesn't mean ETH's price will rise forever. We at least need to think critically about what factors are driving ETH's price changes.

-

The 2022 bear market hit me hard. Although I sold near the top, I kept buying lower lows because I firmly believed ETH's price would eventually go much higher. Four or five years ago, I was a delusional ETH bull. I believed DeFi would change the world, ETH was the future of finance, even thought ETH would surpass Bitcoin as better money. But now, I find fewer people hold these views. I once delusionally believed ETH would reach $10,000 and held on, only to see it drop from $4,000 to $900; it was a brutal experience.

-

On my channel, I always strive to share my trading strategies. I don't get every trade right, but at least I try to be honest and authentic. The way I analyze the market is more based on the numbers and capital flow fundamentals, rather than simply drawing charts or lines to predict price movements. For example, ETH rose because of Tom Lee's massive buying, and ETH falls might be due to funds running out. If Tom Lee is still buying, I choose to short his buys and position early to prepare for the market change after his funds are depleted.

Good Tech, Bad Asset?

-

Maybe I'm wrong, but I'm testing my view with my own capital, and all my trades can be verified on-chain. Look at the current situation: almost no one is actually using ETH. Sure, the ETH mainnet is scaling, on-chain transaction costs are getting lower, user activity might shift to L2 (Layer 2), but based on this data alone, you can't simply conclude "global adoption of ETH is happening." At least in my view, such an interpretation doesn't hold up.

-

ETH's current market cap is about $350 billion; this valuation is more like a pie-in-the-sky assumption, e.g., "if global financial activity migrates to ETH, then ETH's market cap will keep rising." But does this logic really hold? Great technology doesn't necessarily drive asset prices up. People keep tagging me, saying: "JPMorgan is issuing stablecoins on-chain, ETH's market cap will reach $10 trillion." But I think market maturity in crypto means understanding that the technology might be excellent, even a net positive for some businesses and regions, but that doesn't mean they are good investments.

-

For example, take Robinhood; they are using the Arbitrum Orbit stack to build their own blockchain. Maybe this decision is beneficial for Robinhood's equity, but not necessarily for Arbitrum's token. So, is it possible that businesses using blockchain technology profit, while the underlying infrastructure sees no significant gains? It might benefit a bit, but not much. This is also hard to accept, but at least worth thinking about.

Summary

-

Once Tom Lee stops buying or exits the market, things could get much worse. As I mentioned before, last time Bitcoin was at similar levels, ETH's price was much lower. I think the current overvaluation is primarily driven by Digital Asset Treasuries (DATs), and these long positions need time to unwind. Simultaneously, market participants need time to realize this price might not be justified.

-

The current market phase can be summarized as: DATs pushed prices up, and people are gradually realizing this frenzy may have gone too far, and ETH's actual value might be much lower. This is precisely where my bet is placed. Of course, I'm not a doomsayer but a long-term supporter of cryptocurrency. My loyal viewers know I'm currently just in cash terms. I think the way to accumulate more cash is by shorting ETH, participating in airdrop farming, and staying calm. I recently joined a trading competition; to kill time, I shorted Solana and ETH, won the competition, and made $50,000.

-

I think shorting ETH is a simple and effective strategy. Although sometimes ETH's price rises due to random factors like Tom Lee, once their buying peaks and as market reliance on them gradually fades, ETH's price will start to slowly decline. Unfortunately, I think the market is currently in such a phase.