Original byPrince

Compiled | Odaily Planet Daily Golem(@web 3_golem)

The failure of fixed-rate lending in the crypto space is not solely because DeFi users reject it. Another reason for its failure is that DeFi protocols designed credit products based on money market assumptions and then deployed them into a liquidity-oriented ecosystem; the mismatch between user assumptions and actual capital behavior has kept fixed-rate lending a niche market.

Fixed-Rate Products Are Unpopular in the Crypto Space

Today, almost all mainstream lending protocols are building fixed-rate products, largely driven by RWA. This trend is understandable because once closer to real-world credit, fixed terms and predictable payments become crucial. In this context, fixed-rate lending seems like the inevitable choice.

Borrowers crave certainty: fixed payments, known terms, no surprise repricing. If DeFi is to function like real finance, then fixed-rate lending should play a central role.

Yet, every cycle proves the opposite. The floating-rate money market is huge, while the fixed-rate market remains sluggish. Most "fixed' products end up performing like niche bonds held to maturity.

This is no accident; it reflects the composition of market participants and how these markets are designed.

TradFi Has Credit Markets, DeFi Relies on Money Markets

Fixed-rate loans work in the traditional financial system because the system is built around time. The yield curve anchors prices, and benchmark rates move relatively slowly. Some institutions have the explicit mandate to hold duration, manage mismatches, and remain solvent when funds flow one way.

Banks issue long-term loans (mortgages being the most obvious example) and fund them with liabilities that don't belong to 'mercenary capital.' When rates move, they don't need to liquidate assets immediately. Duration management is achieved through balance sheet construction, hedging, securitization, and a deep layer of intermediation dedicated to risk-sharing.

The key isn't the existence of fixed-rate loans, but that there is always someone to absorb the mismatch when the terms of lenders and borrowers don't perfectly align.

DeFi never built such a system.

What DeFi built is more like on-demand money markets. Most capital providers have simple expectations: earn yield on idle funds while maintaining liquidity. This preference quietly determines which products can scale.

When lenders behave like cash managers, markets clear around products that feel like cash, not those that feel like credit.

How DeFi Lenders Understand the Meaning of "Lending"

The most important distinction is not fixed vs. floating rates, but the withdrawal promise.

In a floating-rate pool like Aave, providers get a token that is essentially a liquidity inventory. They can withdraw funds at any time, rotate capital when better opportunities arise, and often use their positions as collateral elsewhere. This optionality is itself a product.

Lenders accept a slightly lower yield for this. But they are not stupid; they are paying for liquidity, composability, and the ability to reprice without additional cost.

Using a fixed rate upends this relationship. To get the duration premium, lenders must give up flexibility and accept their funds being locked for a period. This trade is sometimes justified, but only if the compensation is right. In practice, most fixed-rate schemes don't offer enough compensation to offset the loss of optionality.

Why Does Liquid Collateral Pull Rates Towards Floating?

Today, most large-scale crypto lending is not credit in the traditional sense. It is essentially margin and repo-style lending backed by highly liquid collateral. Such markets naturally gravitate towards floating rates.

In traditional finance, repo and margin financing also reprice continuously. The collateral is liquid, risk is marked-to-market. Both parties expect the relationship to adjust at any time, and the same is true for crypto lending.

This also explains an issue lenders often overlook.

To gain liquidity, lenders have effectively accepted far less economic benefit than the nominal rate suggests.

On Aave, there is a large spread between what borrowers pay and what lenders earn. Part of this is protocol fees, but a significant portion is because the utilization ratio must be kept below a certain level to ensure smooth withdrawals under stress.

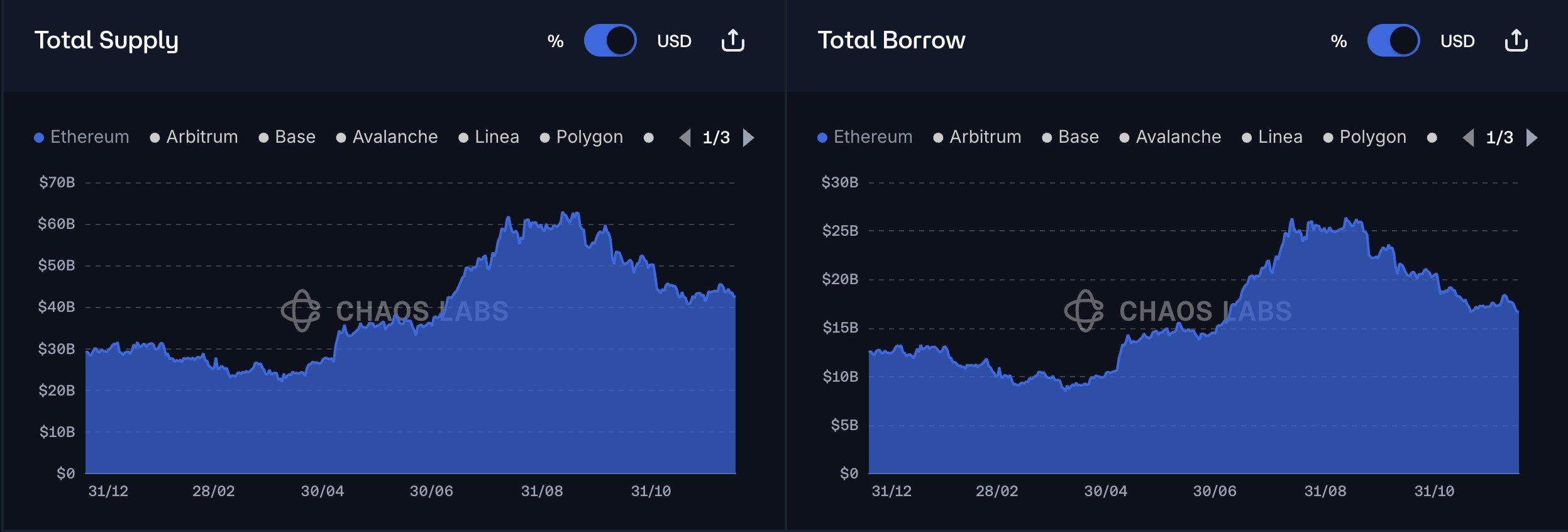

Aave One-Year Supply vs. Demand

This spread manifests as a lower yield, which is the price lenders pay to ensure smooth withdrawals.

Therefore, when a fixed-rate product appears, offering a modest premium in exchange for locking funds, it is not competing against a neutral benchmark product, but against a product that intentionally suppresses yield but is highly liquid and safe.

Winning requires much more than offering a slightly higher APR.

Why Do Borrowers Still Tolerate Floating-Rate Markets?

Generally, borrowers like certainty, but most on-chain lending is not home mortgages. It involves leverage, basis trading, avoiding liquidation, collateral recycling, and tactical balance sheet management.

As @SilvioBusonero showed in his analysis of Aave borrowers, most on-chain debt relies on revolving loans and basis strategies, not long-term financing.

These borrowers don't want to pay a high premium for long-term loans because they don't plan to hold them long. They want to lock in rates when convenient and refinance when not. If rates work for them, they keep the position. If things go wrong, they close quickly.

Thus, we end up with a market where lenders demand a premium to lock funds, but borrowers are unwilling to pay that fee.

This is why fixed-rate markets keep evolving into one-sided markets.

Fixed-Rate Markets Are a One-Sided Market Problem

The failure of fixed rates in crypto is often blamed on implementation. Auction mechanisms vs. AMMs (Automated Market Makers), rounds vs. pools, better yield curves, better UX, etc.

Many different mechanisms have been tried. Term Finance does auctions, Notional built explicit term instruments, Yield tried term-based automated vault mechanisms (AMM), Aave even tried simulating fixed-rate lending within a pool system.

The designs vary, but the outcome converges. The deeper issue is the mindset behind it.

The argument ultimately turns to market structure. Some argue that most fixed-rate protocols try to make credit feel like a variant of a money market. They retain pools, passive deposits, and liquidity promises, merely changing how the rate is quoted. Superficially, this makes fixed rates more palatable, but it also forces credit to inherit the constraints of money markets.

Fixed rate isn't just a different rate; it's a different product.

Meanwhile, the argument that these products are built for a future user base is only partially correct. The expectation was that institutions, long-term depositors, and credit-native borrowers would flood in and become the backbone of these markets. But the capital that actually flooded in was more like active capital.

Institutional investors showed up as asset allocators, strategists, and traders; long-term depositors never reached meaningful scale; native credit borrowers do exist, but borrowers are not the anchor of lending markets, lenders are.

Therefore, the limiting factor was never purely distribution, but the interaction of capital behavior with the wrong market structure.

For fixed-rate mechanisms to work at scale, one of the following must be true:

- Lenders are willing to accept locked funds;

- There is a deep secondary market where lenders can exit at reasonable prices;

- Someone hoards duration funds, allowing lenders to pretend they have liquidity.

DeFi lenders mostly refuse condition 1, secondary markets for term risk remain thin, and condition 3 quietly reshapes balance sheets, which is what most protocols try to avoid.

This is why fixed-rate mechanisms are always pushed into a corner, barely surviving, never becoming the default place for capital.

Term Segmentation Leads to Liquidity Fragmentation, Secondary Markets Remain Weak

Fixed-rate products create term segmentation, and term segmentation leads to liquidity fragmentation.

Each maturity is a different financial instrument with different risks. A claim expiring next week is fundamentally different from one expiring in three months. If a lender wants to exit early, they need someone to buy that specific claim at that specific time.

This means either:

- Multiple independent pools (one for each maturity)

- A genuine order book with genuine market makers quoting across the yield curve

DeFi hasn't delivered a durable version of the second option for credit, at least not at scale yet.

What we see instead is a familiar phenomenon: worse liquidity, larger price impact. 'Early exit' becomes 'you can exit, but at a discount,' a discount that sometimes eats most of the lender's expected yield.

Once a lender experiences this, the position stops feeling like a deposit and becomes an asset to be managed. After that, most capital quietly flows out.

A Concrete Comparison: Aave vs. Term Finance

Let's look at where the money actually goes.

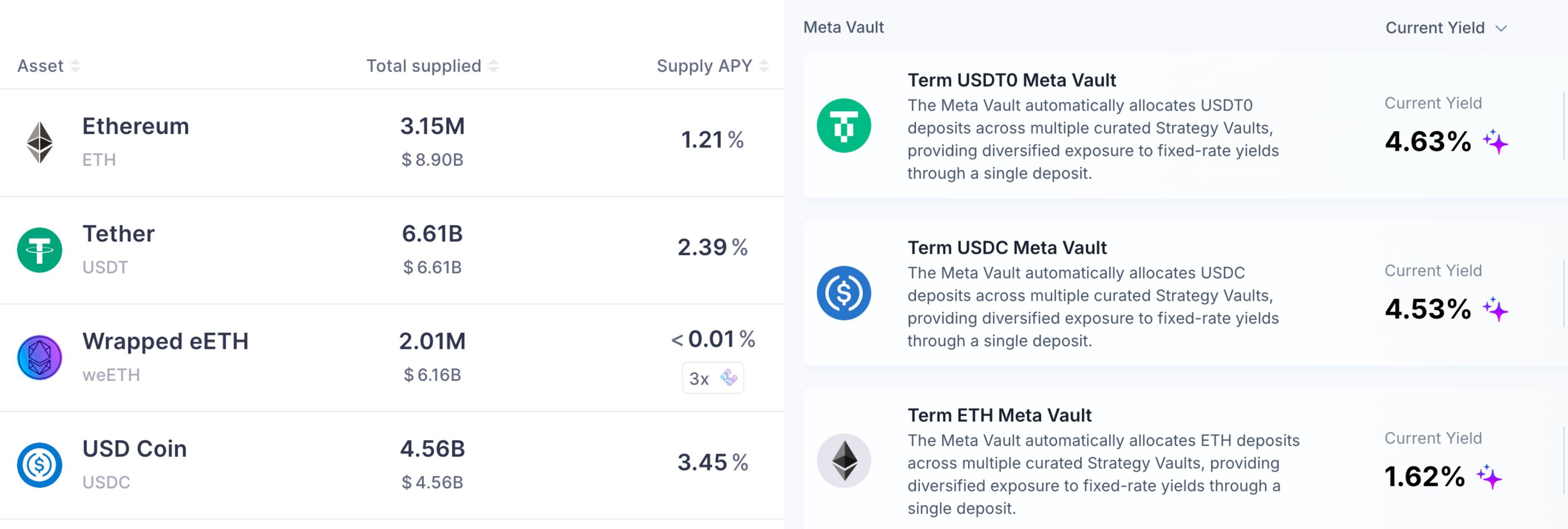

Aave operates at massive scale, with billions in loans, while Term Finance is well-designed and fulfills everything fixed-rate advocates want, yet remains small compared to money markets. This gap isn't branding; it reflects the actual preferences of lenders.

On Ethereum Aave v3, USDC providers get ~3% APY while maintaining instant liquidity and highly composable positions. Borrowers pay ~5% APY over the same horizon.

In contrast, Term Finance often clears 4-week fixed-rate USDC auctions in the mid-single digits, sometimes higher, depending on collateral and conditions. On the surface, this seems better.

But the key is the lender's perspective.

If you are a lender considering these two options:

- ~3.5% yield, cash-like (exit anytime, rotate anytime, use position elsewhere);

- ~5% yield, bond-like (hold to maturity, exit liquidity limited unless someone takes over).

Aave vs. Term Finance Annual Percentage Yield (APY) Comparison

Many DeFi lenders choose the former, even if the latter is numerically higher. Because the number isn't the full return; the full return includes the optionality.

Fixed-rate markets require DeFi lenders to be bond buyers, while in this ecosystem, most capital is trained to be mercenary liquidity providers.

This preference explains why liquidity concentrates in specific areas. Once liquidity is insufficient, borrowers immediately feel the impact of worse execution efficiency and constrained funding capacity, and they revert to floating rates.

Why Fixed Rates Might Never Be the Default in Crypto

Fixed rates can exist; they can even be healthy.

But they won't be the default place for DeFi lenders to park capital, at least not until the lender base changes.

As long as most lenders expect par liquidity, value composability as much as yield, and prefer positions that adapt automatically, fixed rates remain structurally disadvantaged.

Floating-rate markets won because they match the actual behavior of participants. They are money markets for liquid capital, not credit markets for long-term assets.

What Needs to Change for Fixed-Rate Products?

If fixed rates are to work, they must be treated as credit, not masquerading as savings accounts.

Early exit must be priced, not just promised; term risk must be explicit; when funds flow in opposite directions, someone must be willing to take the other side.

The most viable path is a hybrid model. Floating rates as the base layer for capital placement, fixed rates as an optional tool for those explicitly looking to buy or sell duration.

The more realistic path isn't forcing fixed rates into money markets, but preserving liquidity flexibility while providing opt-in pathways for those seeking certainty.