Author: Todd Wenning

Compiled by: Deep Tide TechFlow

Original title: Before Buying the Dip, Understand the Two Types of Market Drawdowns

Deep Tide Introduction: Academic financial theory categorizes risk into systemic risk and idiosyncratic risk. Similarly, stock drawdowns can also be divided into two types: market-driven systemic drawdowns (such as the 2008 financial crisis) and company-specific idiosyncratic drawdowns (such as the current AI-induced software stock crash).

Todd Wenning uses FactSet as an example to point out: during systemic drawdowns, you can leverage behavioral advantages (patiently waiting for the market to recover); but during idiosyncratic drawdowns, you need analytical advantages—having a more accurate vision of the company's future a decade from now than the market does.

Amid the current AI impact on software stocks, investors must distinguish: is this a temporary market panic, or is the moat truly collapsing?

Do not use a blunt behavioral solution to solve a problem that requires nuanced analysis.

Full text below:

Academic financial theory posits two types of risk: systemic and idiosyncratic.

-

Systemic risk is unavoidable market risk. It cannot be eliminated through diversification, and it is the only type of risk for which you are compensated.

-

On the other hand, idiosyncratic risk is company-specific risk. Because you can cheaply purchase a diversified portfolio of uncorrelated businesses, you are not compensated for taking on this risk.

We can discuss Modern Portfolio Theory another day, but the systemic-idiosyncratic framework is very helpful for understanding different types of drawdowns (the percentage decline from peak to trough of an investment) and how we as investors should evaluate opportunities.

From the moment we picked up our first value investing book, we were taught to take advantage of a despondent Mr. Market when stocks are being sold off. If we remain calm while he loses his senses, we will prove ourselves to be stoic value investors.

But not all drawdowns are the same. Some are market-driven (systemic), while others are company-specific (idiosyncratic). Before you make a move, you need to know which type you are looking at.

Generated by Gemini

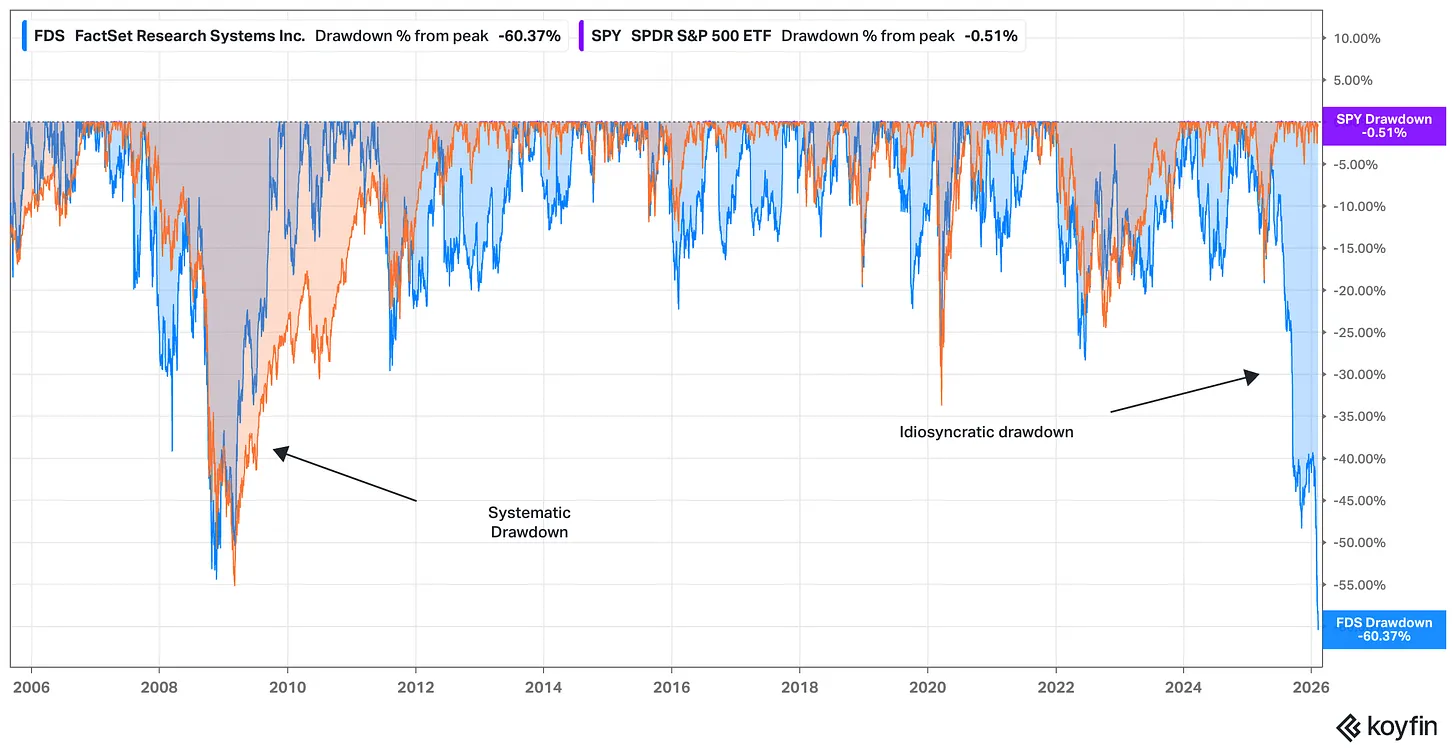

The recent sell-off in software stocks due to AI concerns illustrates this point. Let's look at the 20-year drawdown history between FactSet (FDS, blue) and the S&P 500 (measured via the SPY ETF, orange).

Source: Koyfin, as of February 12, 2026

FactSet's drawdown during the financial crisis was primarily systemic. In 2008/09, the entire market was worried about the durability of the financial system, and FactSet could not be immune to these concerns, especially since it sells products to financial professionals.

At that time, the stock's drawdown had less to do with FactSet's economic moat and more to do with whether that moat would matter if the financial system collapsed.

The 2025/26 FactSet drawdown is the opposite case. Here, the concerns are almost entirely focused on FactSet's moat and growth potential, along with widespread worries about accelerating AI capabilities disrupting pricing power in the software industry.

In systemic drawdowns, you can more reasonably make time arbitrage bets. History shows that markets tend to rebound, and companies with strong moats may emerge even stronger than before. So, if you are willing and able to remain patient while others panic, you can leverage a strong appetite to exploit behavioral advantages.

Photo by Walker Fenton on Unsplash

However, in idiosyncratic drawdowns, the market is telling you that something is wrong with the business itself. Specifically, it suggests increasing uncertainty about the business's terminal value.

Therefore, if you hope to take advantage of an idiosyncratic drawdown, you need analytical advantages in addition to behavioral ones.

To succeed, you need to have a more accurate vision of what the company will look like a decade from now than what the current market price implies.

Even if you know a company well, this is not easy to do. Stocks don't typically fall 50% relative to the market for no reason. Many once-stable holders—even some investors you respect for their deep research—had to capitulate for this to happen.

If you are going to step in as a buyer during an idiosyncratic drawdown, you need to have an answer for why these otherwise well-informed and thoughtful investors who sold were wrong, and why your vision is correct.

There is a fine line between conviction and arrogance.

Whether you are holding a stock in a drawdown or looking to initiate a new position in one, it's important that you understand what type of bet you are making.

Idiosyncratic drawdowns can tempt value investors to start looking for opportunities. Before you venture in, make sure you are not using a blunt behavioral solution to solve a problem that requires nuanced analysis.

Stay patient, stay focused.

Todd

Twitter:https://twitter.com/BitpushNewsCN

BitPush TG Discussion Group:https://t.me/BitPushCommunity

BitPush TG Subscription: https://t.me/bitpush