Coinbase is facing a civil enforcement action in Nevada after state gaming regulators said the company offered event contracts that look like wagers to local users.

Based on reports, the Nevada Gaming Control Board filed suit in state court asking a judge to stop Coinbase from offering these contracts inside Nevada and to grant a temporary restraining order and preliminary injunction.

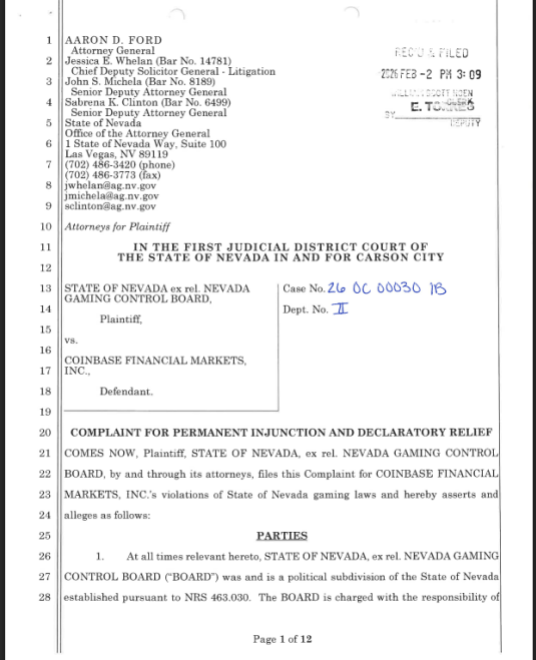

Nevada Files Civil Enforcement Action

The complaint says Coinbase’s event contracts operate like unlicensed sports betting under Nevada law, and that the exchange did not hold the required state gaming license to offer them.

Source: Nevada Gaming Control Board

The filing seeks immediate court steps to halt the products while the state pursues its claims. Reports note the move follows similar actions against other prediction platforms and comes as the legal fight over where these products belong—state gaming law or federal derivatives law—intensifies.

Background On Prediction Markets And Coinbase’s Response

Prediction markets have grown quickly. Coinbase rolled out a prediction market product that lets customers take positions on the outcomes of sports and other real-world events, working with established market operators.

Coinbase has pushed back by suing multiple states in federal court, arguing that event contracts are regulated by the federal Commodity Futures Trading Commission and not by individual state gaming regulators. Those federal suits targeted Connecticut, Illinois, and Michigan, among others.

Federal Regulator Signals New Rules

Reports say the CFTC’s chair has signaled a shift toward clearer federal rules for event contracts and suggested the agency may issue new guidance that affects ongoing state cases.

That announcement could change the legal balance, since a stronger federal stance would bolster exchanges that claim CFTC jurisdiction over these products. Still, state claims press on, and courts will have to sort out who has the power to regulate.

Nevada’s Push Comes As Other States Act

Nevada’s action is not isolated. A Nevada state court recently granted a temporary restraining order that barred another major prediction platform from offering event contracts in the state for a short period while the matter moved toward a hearing.

Regulators in several states have issued cease-and-desist letters or sued operators they say are offering unlicensed wagering.

Featured image from Shutterstock, chart from TradingView