Original Author: Mankun Brand Department

Original Title: Cash for Cryptocurrency: How Part-Time Jobs Become Tools for Money Laundering in the Black Market?

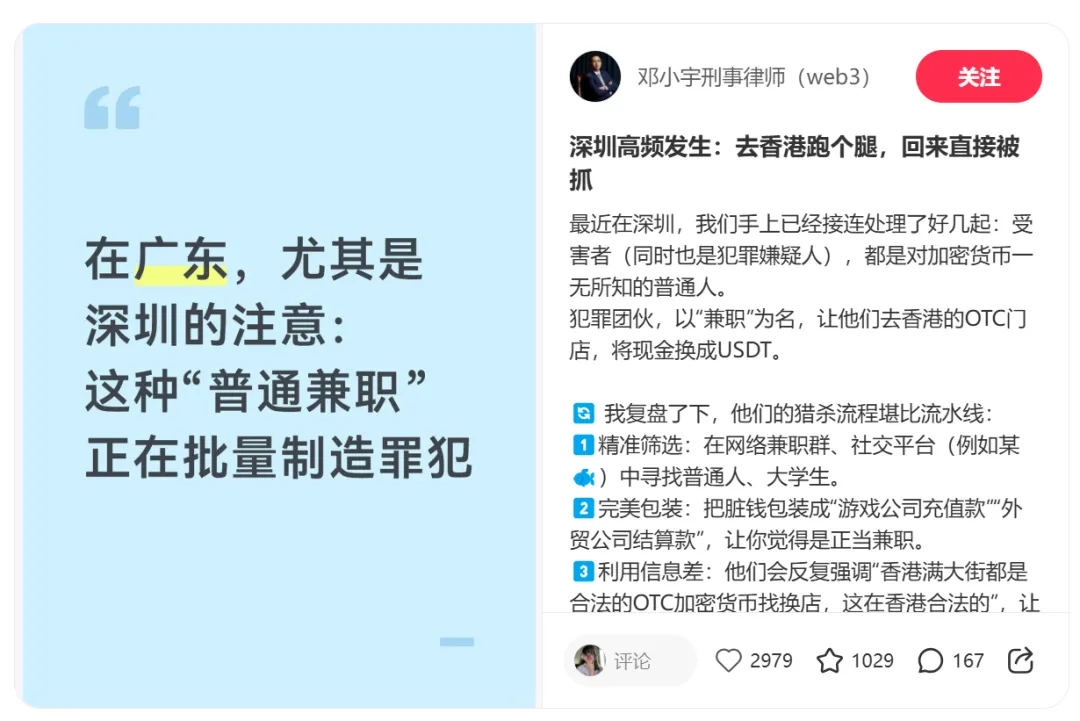

"In Guangdong, especially in Shenzhen, some seemingly ordinary part-time jobs are mass-producing criminal suspects." This is a warning recently posted by Lawyer Deng Xiaoyu, Partner at Mankun (Shenzhen) Law Firm, on the Xiaohongshu platform. In the post, he pointed out that this type of part-time job, known as 'cash for cryptocurrency' or 'offline cryptocurrency exchange errands,' has formed a highly streamlined 'hunting mechanism,' and those primarily targeted are often highly educated young people with insufficient risk awareness.

In these tasks, part-time workers are usually only required to follow instructions to convert funds into Hong Kong dollars and then go to a designated OTC cryptocurrency exchange shop to complete the transaction. What seems like a simple 'errand' unknowingly completes a critical link in money laundering crimes—'human border crossing.' Once the funds are identified as illegal proceeds, participants may be directly exposed to criminal risks.

Lawyer Deng Xiaoyu believes that in recent years, this 'low-threshold, high-reward' part-time model has been systematically used by criminals for money laundering activities. Many participants, without realizing the nature of their actions, have already crossed the boundary of criminal law.

Based on the above judgment, Lawyer Deng Xiaoyu (Partner at Mankun Law Firm, specializing in criminal cases involving crypto assets) and Huang Wenjing (Compliance Consultant at Mankun Law Firm) recently accepted an interview with Shenzhen News Network. Starting from real cases, they systematically dissected the related criminal models, social harms, and legal risks, attempting to 'cut open' this hidden and complex money laundering network to allow more people to see the legal truth within.

Why Does 'Just Helping to Exchange Some Crypto' Involve Money Laundering?

Shenzhen News Network Reporter:

Lawyer Deng Xiaoyu, in the cases you have recently handled, how do criminal gangs typically recruit young people under the guise of 'part-time jobs'?

Deng Xiaoyu:

We recently handled a typical case: an mainland college student received a 'errand part-time job' on a second-hand goods trading platform. The other party requested the student to go to Hong Kong to purchase a certain amount of Tether (USDT) through a local cryptocurrency exchange shop (OTC store) and transfer it to a specified blockchain address.

The specific process was: the part-time worker first used their own bank card to receive RMB, then exchanged it for HKD cash at a mainland currency exchange point, then went to the designated Hong Kong OTC store to purchase USDT, and the store directly transferred the cryptocurrency to the specified wallet.

After the student purchased USDT worth tens of thousands of RMB through the above method, their bank card and WeChat Pay account were frozen by mainland law enforcement agencies, and they were informed that the funds they collected originated from a victim's transfer in an upstream fraud case.

Afterwards, we collaborated with a professional on-chain technical team for analysis and confirmed that this was a typical 'card reception for U return' money laundering method, and it was linked to organized crime networks in Southeast Asia.

Since then, we have received multiple similar inquiries. Some participants have been investigated for crimes such as fraud, concealing criminal proceeds, and aiding information network criminal activities; although some have not been criminally detained, their bank cards and payment accounts have been frozen for a long time, severely affecting their daily lives, studies, and work.

Shenzhen News Network Reporter:

Advisor Huang Wenjing, why do black market criminal gangs frequently choose Hong Kong cryptocurrency exchange shops (OTC stores) as operational nodes? Is this model harder to track?

Huang Wenjing:

From a practical perspective, there are three main reasons why Hong Kong OTC stores are easily exploited by criminal gangs.

First, the regulatory boundaries are relatively vague, and anti-money laundering requirements are not uniform.

Currently, Hong Kong has a relatively mature licensing and regulatory system for centralized virtual asset trading platforms, but crypto OTC stores are still in a area with relatively vague regulatory boundaries, with various types of entities and inconsistent compliance standards. Some stores have significant shortcomings in fund source verification, transaction monitoring, and anomaly analysis, leaving operational space for the black market.

Second, cash transactions themselves are high-risk scenarios.

OTC stores primarily deal in cash transactions. Anonymous cash lacks the account chain and structured data inherent in bank transfers. Investigations often rely more on physical surveillance, witness testimony, and physical evidence, making overall tracing more difficult.

Third, frequent financial activities provide more space for concealment.

The Hong Kong government also mentioned in the background of the 2024 VAOTC consultation that OTC stores have been used for the first round of cleaning of involved funds in some fraud cases. As an international financial center, Hong Kong's multi-currency circulation and active cross-border transactions make it easier for criminal gangs to package transaction backgrounds and conceal the real purpose of funds.

Dual Loss for Individuals and Society: Criminal Risks Concealed by the 'Legal Narrative'

Shenzhen News Network Reporter:

Lawyer Deng Xiaoyu, in the cases you handle, many so-called 'part-time workers' are highly educated young people. Why are they easily trapped in such traps? Once involved, what legal consequences might they face? What long-term impacts will this bring?

Deng Xiaoyu:

In my opinion, the key reason why this type of part-time job can deceive highly educated groups is that the other party constructs a seemingly complete, reasonable, and legal narrative scenario.

When part-time personnel raise questions, such as 'Why must I go to Hong Kong to operate in person?', the other party usually explains that virtual asset transactions are restricted in the mainland but are legal and open in Hong Kong; and the client is located elsewhere, making a special trip to Hong Kong too costly, so having a nearby part-time worker operate on their behalf is more 'economical and efficient.' Under such a logically self-consistent explanation, many students did not detect obvious abnormalities at the rational judgment level, thus letting their guard down and generating trust.

But criminal risks are often significantly lagging. Many part-time workers only discovered two or three months after the incident that their bank cards and payment app accounts were frozen, or they suddenly received a call from the public security organ, or were even intercepted by customs during normal entry and exit. This sudden change often throws student groups lacking social experience into strong panic, causing持续 impact on their psychological state and normal study and life.

Shenzhen News Network Reporter:

The general public may not be clear about how such part-time jobs, if suspected of money laundering, fuel the black and gray industries? What impact will they have on the financial regulatory order and the anti-money laundering system?

Huang Wenjing:

Taking telecom network fraud crimes, which have been heavily cracked down on by the state in recent years, as an example, 'cheating money' itself is only the first step. The real key lies in how to quickly transfer and conceal the destination of the funds, making them difficult to recover.

If the involved funds only stay in the criminal's account, once the victim reports it, tracking and freezing is not difficult. But through the method involved in this case, the funds are quickly split and circulated in a cross-financial system with 'multiple assets, multiple links, multiple nodes,' eventually forming a vicious cycle of 'cheating faster, transferring faster, and recovering harder.' This type of part-time job is essentially providing key fund channel nodes for the black and gray industry, directly promoting the scale and industrialization of upstream crimes.

From a more macro perspective, money laundering transactions often exhibit characteristics of fragmentation, decentralization, and high frequency, greatly increasing the compliance costs for regulatory departments and financial institutions. If the proportion of such non-real, non-normal economic activity transactions continues to rise in a region's financial system, it will not only distort financial data but also埋下hidden dangers for overall financial security.

Once this risk is noticed by the international community, the region may be labeled a 'high-risk jurisdiction.' For example, some countries and regions are included in FATF's grey list due to insufficient anti-money laundering supervision, and their citizens will face practical difficulties such as restricted account opening and blocked transactions in cross-border financial activities, causing long-term and profound negative impacts on national reputation and economic development.

Characterization and Consequences: The Logic of Identifying Money Laundering Behavior and Sentencing Boundaries

Shenzhen News Network Reporter:

Lawyer Deng Xiaoyu, why did you post on social media specifically to remind the public to be wary of such money laundering traps? From the perspective of criminal law and judicial interpretation, how is this type of behavior usually characterized? How to distinguish between 'occasional personal transactions' and 'operational exchange behavior'?

Deng Xiaoyu:

I post on social media platforms, on one hand, based on my duty as a member of the Shenzhen Lawyers Association Common Crime Defense Committee to popularize legal knowledge, and on the other hand, I hope to protect young people in society as much as possible.

In the cases I接触, the original intention of many part-time workers is to subsidize their living expenses and reduce family burdens through their own labor. But it is this psychology, which is not mixed with malice, that is easily exploited by criminals,进而involved in specific links of money laundering activities.

From judicial practice, the behavior of such part-time workers is more often incorporated into the evaluation system of money laundering crimes. For individuals who simply complete fund exchange and transfer according to instructions, it is generally not appropriate to directly认定as 'illegal business operation罪', but should focus on reviewing whether they objectively participated in the transfer, concealment or hiding of illegal proceeds.

As for the distinction between 'occasional personal transactions' and 'operational exchange behavior', the key is not whether remuneration is received, but whether it has the attributes of sustainability, organization, and external operation. Ordinary part-time workers, if they do not solicit customers externally or form a stable transaction model, usually do not meet the constitutive requirements of the crime of illegal business operation, but this does not mean that there is certainly no criminal risk.

Shenzhen News Network Reporter:

Advisor Huang Wenjing, if the amount involved reaches 'particularly serious circumstances,' what penalties might the relevant personnel face? What are the differences in accountability between unit crime and individual crime?

Huang Wenjing:

Taking the crime of money laundering as an example, according to the "Criminal Law of the People's Republic of China" and the "Interpretation on Several Issues Concerning the Application of Law in Handling Money Laundering Criminal Cases," once it is determined to be '情节严重' (serious circumstances), the sentencing usually directly enters the second level, that is, fixed-term imprisonment of not less than five years but not more than ten years, and also a fine.

It must be emphasized that in judicial practice, the amount involved is only one threshold for incrimination and sentencing. Whether it constitutes 'serious circumstances'还需要be comprehensively judged based on behavioral and result factors such as multiple implementations, causing major losses, and refusing to cooperate in recovering stolen money. A conclusion cannot be simply drawn based on the amount.

In addition, the crime of money laundering applies a 'dual punishment system.' This means that if the act is committed in the name of a unit, the unit itself will be sentenced to a fine; and the directly responsible supervisors and other directly responsible personnel will not be exempted from responsibility because 'the act is under the unit's name,' and still need to bear personal criminal responsibility according to the standards of the crime of money laundering. If the circumstances reach a level for heavier punishment, they may同样face fixed-term imprisonment of not less than five years but not more than ten years and also a fine.

Risk Reminder: How to Avoid Becoming a 'Money Laundering White Glove'?

Shenzhen News Network Reporter:

How should the public identify money laundering risks in part-time jobs? What self-protection measures should be taken once encountering suspicious transactions?

Huang Wenjing:

Actually, to identify this kind of risk, grasping one core judgment is enough:

Any part-time job that asks you to help handle money transactions or account operations is essentially turning you into a fund channel. 99% of them are fraud or money laundering.

In practice, common 'danger signals' include:

-

Asking you to provide or open new bank cards, corporate accounts;

-

Lending WeChat, Alipay payment codes, receiving and paying on behalf of others and immediately transferring out;

-

Requiring offline cash withdrawal, or going to an exchange shop to convert cash into virtual currency, then transferring to a specified address;

-

Repeatedly emphasizing that 'buying and selling virtual currency with cash in Hong Kong is legal,' 'physical stores are open, it can't be illegal,' 'just helping with an errand.'

The common point of these rhetoric is to deliberately divert attention. The real risk does not lie in whether a specific operation is legal in form, but in its purpose to conceal the true source and flow of funds.

Once the funds come from upstream crimes such as telecom fraud or gambling, your account and identity may be regarded as a link in the criminal chain. Lightly, the account may be frozen and investigated; heavily, you may be investigated for criminal responsibility due to serious circumstances.

Shenzhen News Network Reporter:

Lawyer Deng Xiaoyu, what more targeted reminders do you have for young people? Is it necessary to be wary of seemingly legal temptations like 'exchange rate arbitrage'?

Deng Xiaoyu:

I want to particularly remind young people of one sentence:

Any part-time job that uses you as a 'fund channel,' no matter how 'legal and compliant' it is packaged, should be refused at the first moment.

Many people think money laundering is far away from them, but in reality, it is often disguised as 'errand代办,' 'cross-border settlement,' 'point spread or exchange rate arbitrage,' 'buying coins for arbitrage,' and other professional-sounding, even reasonable-sounding terms. In essence, they are all about using your real-name identity to 'pass through'陌生funds.

In the cases we接触, what the other party really values is not the 'labor' of the part-time worker, but their real-name account and the transaction traces formed by their operation, which are used to conceal criminal proceeds. Once the upstream funds are investigated, the original 'part-time worker' may instantly become an 'involved person.' The most direct consequence is account freezing and life restrictions. In serious cases, they may also need to bear corresponding legal responsibilities.

Mankun Lawyer Reminder: Beware of These High-Risk Signals

Based on the interview content and practical experience, we specially提示:

-

Part-time jobs involving代收代付 (acting as payment agent), cash handover, account operations, and加密资产 (encrypted asset) exchange should be highly警惕;

-

Remuneration that明显不匹配 (obviously does not match) the work content is often not a 'good opportunity';

-

The other party刻意回避 (deliberately avoids) questions about the source of funds is an important risk signal;

-

Once doubts arise, the earlier you consult a professional lawyer, the more likely you are to avoid serious consequences.

We will continue to participate in public discussions from a professional perspective, and also hope to help the public better understand legal boundaries and stay away from potential criminal risks through real cases and legal analysis.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush