Coinbase just walked into the prediction market arena. By launching a U.S.-regulated platform for trading event contracts, the American crypto giant is taking a swing at emerging heavyweights like Polymarket and Kalshi.

This isn’t just about competition; it’s a signal. By running these contracts through its CFTC-regulated arm, Coinbase is essentially legitimizing a sector that’s spent years operating in DeFi’s gray zones.

It’s a bold move. Prediction markets used to be a niche curiosity, but recent volume on decentralized platforms proves there’s a massive appetite for betting on real-world outcomes, everything from Fed rates to election results.

Coinbase’s entry suggests infrastructure providers are finally comfortable with the regulatory landscape surrounding these ‘binary options.’ We aren’t just looking at asset speculation anymore; we’re moving toward functional markets where information, probability, and capital actually intersect.

But the democratization of markets isn’t stopping at financial derivatives. While Coinbase tackles the prediction vertical, a different shift is hitting the creator economy. Smart money is rotating into utility-driven protocols that solve actual headaches for non-financial users.

As the hype around prediction markets builds, liquidity is quietly flowing into projects that redefine content monetization. That’s where SUBBD Token ($SUBBD) steps in, a protocol aiming to dismantle the centralized monopolies choking the $85 billion content industry.

Check out the $SUBBD presale here.

SUBBD Token ($SUBBD) Redefining the $85 Billion Creator Economy

The digital content sector is facing a serious centralization problem. Platforms like OnlyFans and Patreon often take a 30% cut of earnings and hold the power to deplatform users on a whim. SUBBD Token ($SUBBD) uses a decentralized architecture to fix these inefficiencies, but it’s not just about lower fees.

By merging Web3 payments with advanced AI tools, the project offers a technological leap rather than just a financial band-aid.

The real differentiator here is the AI integration. According to the project’s whitepaper, SUBBD equips creators with an AI Personal Assistant for automated interactions and proprietary AI Voice Cloning tech.

This allows for ‘AI Influencers’, autonomous personas that generate revenue 24/7. That matters. It shifts the creator economy from a labor-intensive grind to a scalable, asset-based model. Plus, by tokenizing access via Ethereum smart contracts, SUBBD ensures creators keep their data and revenue, not the platform.

The logic is simple: legacy platforms are struggling with payment restrictions and bloated fees, while decentralized alternatives offer better margins. SUBBD supports subscriptions, pay-per-view (PPV), and NFT sales, all governed by the token.

It’s a circular setup where the asset is needed for governance, staking, and premium features, theoretically driving demand as the user base grows.

Visit the $SUBBD presale.

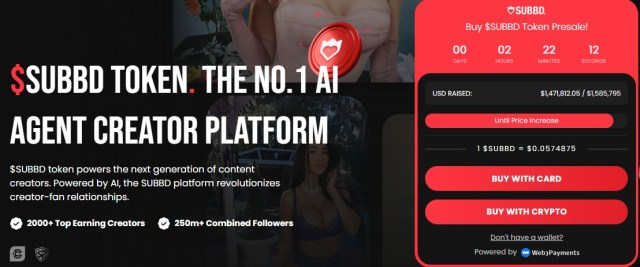

Presale Surges Past $1.4M As Investors Seek Yield

You can see this rotation into utility tokens in the fundraising data. $SUBBD has raised over $1.4M in its ongoing presale, a figure that suggests serious conviction from early backers. With tokens currently priced at $0.05749, the entry point is still accessible relative to the roadmap.

This steady inflow during a choppy market suggests investors are hedging against pure speculation by backing infrastructure plays with clear revenue models.

Staking incentives are also driving retention. SUBBD offers a fixed 20% APY for the first year to users who lock their tokens. That high-yield strategy does two things: rewards early adopters and takes supply off the table during the launch phase.

After that initial period, the model shifts to ‘platform benefit staking.’ Holding tokens then grants access to exclusive livestreams, ‘behind-the-scenes’ drops, and XP multipliers.

This structure makes the ecosystem sticky for active users. Unlike governance tokens that often lack immediate utility, $SUBBD functions as a license to operate within this new creator economy. As Coinbase validates decentralized prediction markets, projects like SUBBD are doing the same for content.

It points to a broader trend: blockchain tech finally replacing middleman-heavy industries.

Buy $SUBBD here.

Disclaimer: The content of this article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry inherent risks, and you should perform your own due diligence before making any investment decisions.