Author: YQ

Compiled by: Saoirse, Foresight News

Since 2015, I have been deeply involved in scaling technology research, studying all iterative solutions from sharding, Plasma, App Chains to Rollup. I have in-depth collaborations with every mainstream Rollup tech stack and team in the ecosystem. Therefore, I always pay close attention when Vitalik publishes content that can fundamentally reshape our understanding of Layer2 (L2). The post he published on February 3rd is such a key piece of content.

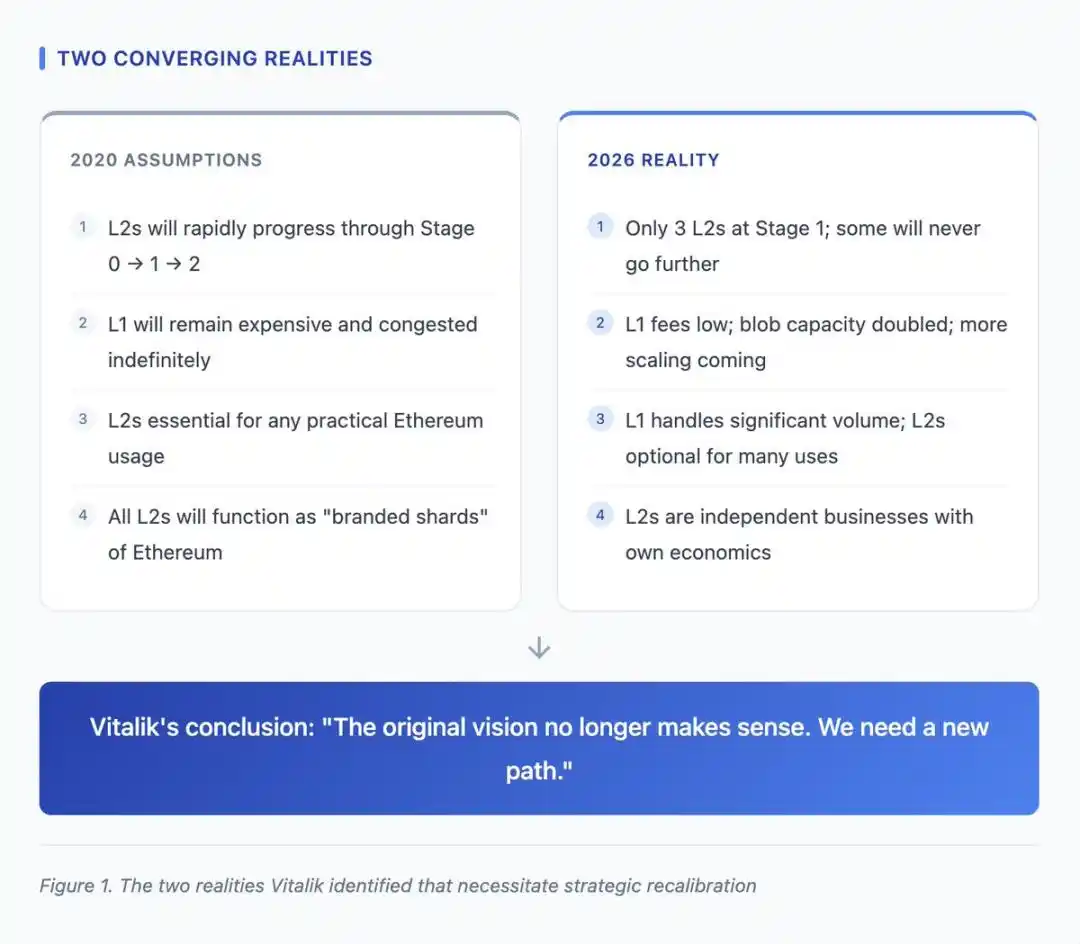

What Vitalik did is not easy — admitting that the core assumptions from 2020 did not materialize as expected. This kind of candor is something most leaders avoid. The "Rollup-centric" roadmap back then was built on the premise that "L2s would act as Ethereum's 'branded shards'." But four years of market data paint a different picture: L2s have evolved into platforms with independent economic incentives, and Ethereum Layer1's scaling speed has far exceeded expectations. The original vision has long been disconnected from reality.

In fact, it would have been easier to continue defending the old narrative — for example, by强行 pushing teams towards a vision the market had already否决. But this is not the mark of good leadership. The truly wise approach is to acknowledge the gap between expectations and reality, propose a new direction, and move towards a brighter future. And this post does exactly that.

The Problems Vitalik Actually Diagnosed

The post points out two core realities requiring strategic adjustment:

First, the decentralization of L2s is much slower than expected. Currently, only 3 mainstream L2s (Arbitrum, OP Mainnet, Base) have reached the first stage of decentralization; some L2 teams have explicitly stated that, due to regulatory requirements or business model limitations, they may never pursue full decentralization. This is not a moral "failure," but a reflection of economic reality — for L2 operators, sequencer revenue is the core business model.

Second, Ethereum L1 has achieved significant scaling. Current L1 fees are low, the Pectra upgrade doubled data blob capacity, and there are plans to continuously increase the Gas limit through 2026. When the Rollup roadmap was designed, "high L1 costs and network congestion" were the basic premises; this premise no longer holds. L1 can now handle a large number of transactions at reasonable costs, which also transforms the value proposition of L2s from "a necessity for ensuring availability" to "an optional solution for specific use cases."

The two realities requiring strategic adjustment as pointed out by Vitalik

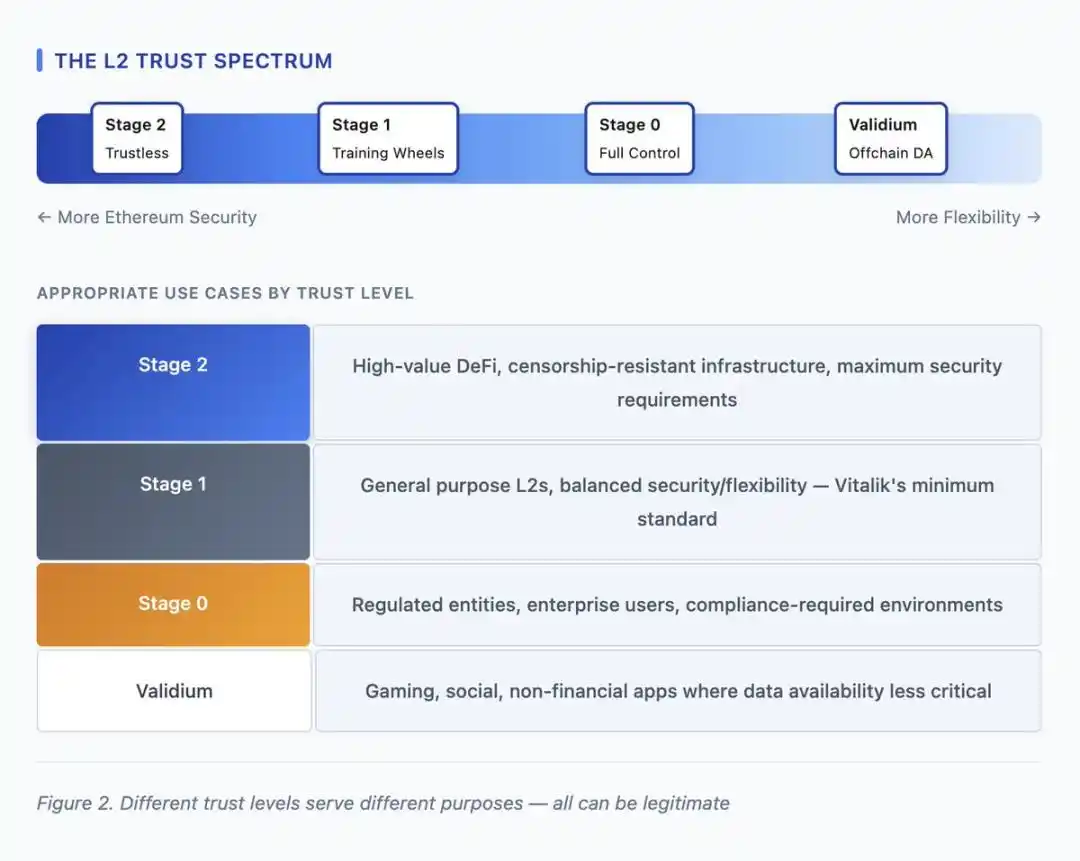

Restructuring the Trust Spectrum

Vitalik's most core conceptual contribution is liberating L2s from the framework of a "single category, uniform obligations" and redefining them as "diverse entities existing on a trust spectrum." The previous metaphor of "branded shards"默认 all L2s needed to pursue Stage 2 decentralization and, as extensions of Ethereum, bear the same value and security commitments as L1. The new framework acknowledges: different L2s have different purposes, and for projects with specific needs, Stage 0 or Stage 1 decentralization can be a perfectly reasonable end goal.

The strategic significance of this reframing is that it breaks the implicit judgment that "an L2 not pursuing full decentralization is a failure." For example, a regulated L2 serving institutional clients that requires asset freezing functionality is not a "flawed Arbitrum," but a "differentiated product for a different market." By endorsing this "trust spectrum," Vitalik allows L2s to be upfront about their positioning, without having to make promises of "decentralization" lacking economic incentive support.

Different trust levels correspond to different uses — all levels can reasonably exist

Classification table of trust levels for Ethereum L2s

Native Rollup Precompile Proposal

The technical core of Vitalik's post is the "Native Rollup Precompile" proposal. Currently, each L2 needs to independently build a system for "proving state transitions to Ethereum": Optimistic Rollups use fraud proofs with a 7-day challenge period, while ZK Rollups use validity proofs based on custom circuits. These implementations not only require independent audits but may also contain vulnerabilities, and need to be updated synchronously when Ethereum hard forks cause changes in EVM (Ethereum Virtual Machine) behavior. This "fragmented" status quo brings security risks and maintenance burdens to the entire ecosystem.

The "Native Rollup Precompile" involves building a function for "verifying EVM execution" directly into Ethereum. Then, each L2 would no longer need to maintain custom provers, but only need to call this shared infrastructure. The advantages are significant: only 1 codebase needs auditing (instead of dozens), automatic compatibility with Ethereum upgrades, and once the precompile functionality is battle-tested, it might even allow for the removal of security councils.

Before and after comparison of Ethereum Native Rollup Precompile architecture

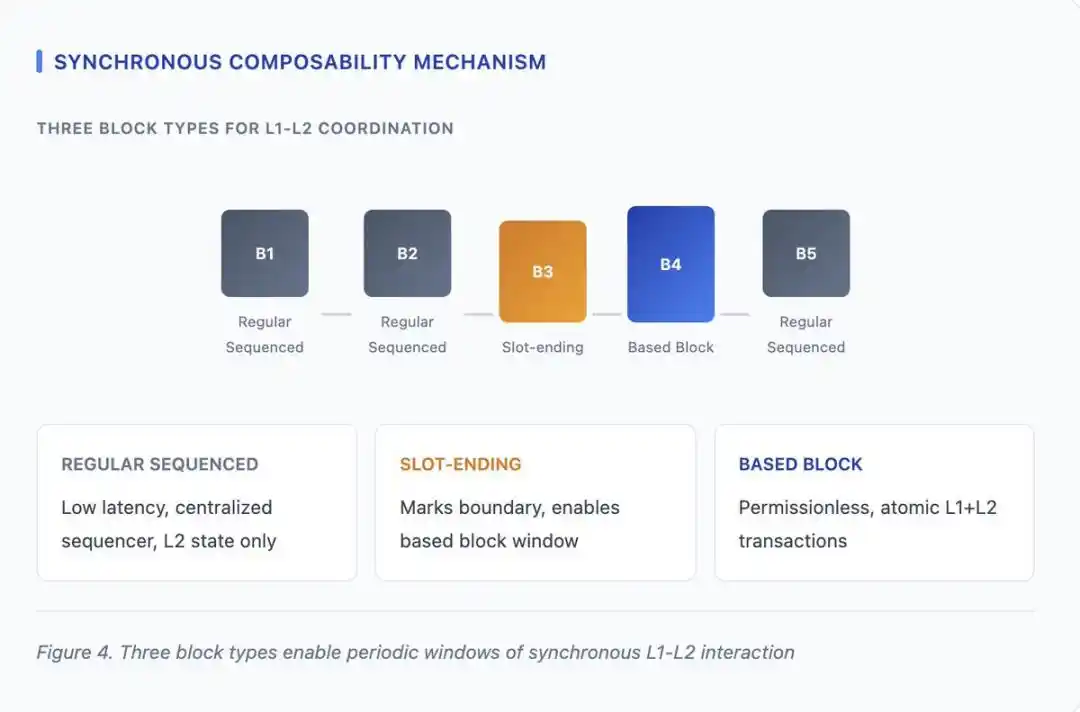

Synchronous Composability Vision

In his post on ethresear.ch, Vitalik detailed a mechanism to achieve "synchronous composability" between L1 and L2. Currently, transferring assets or executing logic across L1 and L2 either requires waiting for final confirmation (7 days for Optimistic Rollups, hours for ZK Rollups) or relies on fast bridges with counterparty risk. "Synchronous composability" would allow transactions to "atomically use L1 and L2 state" — reading and writing data across layers within the same transaction, either completely succeeding or completely rolling back.

The mechanism designs three types of blocks:

- Regular Sequencing Blocks: For processing low-latency L2 transactions;

- Slot End Blocks: Mark the boundary of a time window;

- Base Blocks: Blocks that can be built permissionlessly after the Slot End Block is generated.

During the window for Base Blocks, any block builder can create blocks that interact with both L1 and L2 states simultaneously.

Three types of blocks support periodic synchronous interaction between L1 and L2

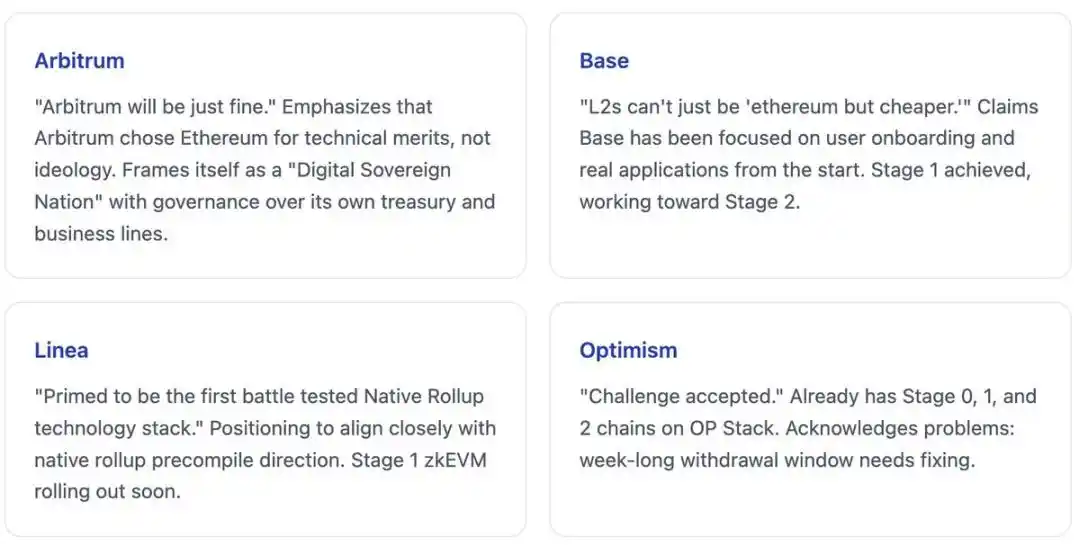

Responses from L2 Teams

Mainstream L2 teams responded within hours, showing a healthy strategic diversity —这正是 Vitalik's "trust spectrum" framework intended to achieve: different teams can choose different positioning without pretending to march towards the same finish line.

Differentiated responses from four mainstream Ethereum L2 projects to Vitalik's "L2 Reset" proposal

This diversity in response is healthy:

- Arbitrum: Emphasizes independence and self-sufficiency;

- Base: Focuses on applications and users;

- Linea: Closely aligns with the Native Rollup direction proposed by Vitalik;

- Optimism: Acknowledges current challenges while宣称持续推进改进 (claiming continued progress on improvements).

These positions are not right or wrong, just strategic choices for different market segments —这正是 the "trust spectrum" framework recognizes as reasonable.

The L2 Economic Reality Acknowledged by Vitalik

One significant meaning of Vitalik's post is the implicit acknowledgment of L2s' economic attributes. When he mentions that "some L2s may 'never progress beyond Stage 1 decentralization' due to 'regulatory requirements' (need to retain ultimate control),". he is essentially admitting: L2s are not idealized "branded shards," but commercial entities with legitimate economic interests. Sequencer revenue is real, regulatory compliance requirements are real — expecting L2s to abandon these interests to cater to ideology was unrealistic from the start.

L2s retain most fee revenue — this economic reality determines the incentive direction for decentralization

The Future Path Outlined by Vitalik

Vitalik's post is not just about "diagnosing problems" but also focuses on "solving problems." He outlines several concrete directions for those L2s that want to maintain value in the context of continued L1 scaling. These are not mandatory requirements, but suggested paths for L2s to differentiate themselves when "cheaper Ethereum" is no longer the core competitive advantage.

Table of differentiated value directions for Ethereum L2s

Rational candor in leadership enables adaptive development for the ecosystem

Summary

In February 2026, the post published by Vitalik Buterin marked a key calibration of Ethereum's strategy towards L2s. Its core insight is: L2s have evolved into independent platforms with legitimate economic interests, rather than "branded shards" with obligations to Ethereum. Vitalik did not fight this reality but proposed embracing it by: endorsing differentiated paths through the "trust spectrum," strengthening collaboration efficiency for those willing to participate in L1-L2 integration through "native Rollup infrastructure," and enabling cross-layer interaction through "synchronous composability mechanisms."

The response from the L2 ecosystem shows healthy diversity: Arbitrum emphasizes independence, Base focuses on applications, Linea aligns with the Native Rollup direction, Optimism acknowledges challenges and pushes for improvements. This diversity is precisely the expected result of the "trust spectrum" framework: different teams can pursue different strategies without pretending to be on the same path.

For Ethereum, this course correction maintains its credibility by "acknowledging reality" rather than "defending outdated assumptions." Considering the maturity of ZK-EVM technology, the related technical proposals are feasible; and the strategic proposals create space for the ecosystem to evolve efficiently. This is the embodiment of "adaptive leadership" in the technology field: realizing the environment has changed, then proposing a new path, rather than stubbornly sticking to a strategy the market has already否决.

Having been deeply involved in scaling research for a decade and operating a Rollup infrastructure company for four years, I have seen too many leaders refuse to adjust when facts change — often with poor results. Vitalik's choice this time was not easy: publicly admitting that the 2020 vision needed updating. But it was the right choice. Clinging to a narrative the market has abandoned benefits no one. The way forward is now clearer than it was a week ago — that in itself is tremendously valuable.

Related Questions

QWhat are the two core realities that Vitalik's post identifies as requiring strategic adjustment for Ethereum's Layer2?

AThe two core realities are: 1) The decentralization of L2s is progressing much slower than expected, with only a few major L2s reaching the first stage of decentralization. 2) Ethereum L1 has achieved significant scaling, with lower fees and increased data capacity, which changes the value proposition of L2s from a necessity for availability to an optional solution for specific use cases.

QWhat is the key conceptual contribution of Vitalik's new framework regarding L2s?

AThe key conceptual contribution is reframing L2s from a 'single category with uniform obligations' to a 'diverse existence on a spectrum of trust.' This acknowledges that different L2s have different purposes and that achieving stage 0 or stage 1 decentralization can be a reasonable endpoint for projects with specific needs, rather than a failure.

QWhat is the technical core proposal in Vitalik's post to address the current fragmentation in L2 implementations?

AThe technical core proposal is the 'Native Rollup Precompile.' This involves building a function for 'verifying EVM execution' directly into Ethereum. This shared infrastructure would allow L2s to call this function instead of maintaining their own custom provers, reducing security risks and maintenance burdens.

QHow does the proposed 'synchronous composability' mechanism aim to improve interaction between L1 and L2?

AThe 'synchronous composability' mechanism aims to allow transactions to atomically use both L1 and L2 states within a single transaction, ensuring it either fully succeeds or fully rolls back. It proposes three types of blocks (regular sequencing blocks, slot-end blocks, and base blocks) to enable this cross-layer interaction without the delays or risks associated with current methods like waiting for finality or using fast bridges.

QHow did major L2 teams like Arbitrum, Base, Linea, and Optimism respond to Vitalik's proposal, and what does this indicate?

AThe responses showed healthy strategic diversity: Arbitrum emphasized independence and self-sufficiency, Base focused on applications and users, Linea closely aligned with the native Rollup direction, and Optimism acknowledged current challenges while committing to ongoing improvements. This diversity indicates the success of the 'trust spectrum' framework, allowing different teams to pursue different strategic positions for their respective markets without pretending to move toward the same endpoint.

Related Reads

Trading

Hot Articles

Как купить S

Добро пожаловать на HTX.com! Мы сделали приобретение Sonic (S) простым и удобным. Следуйте нашему пошаговому руководству и отправляйтесь в свое крипто-путешествие.Шаг 1: Создайте аккаунт на HTXИспользуйте свой адрес электронной почты или номер телефона, чтобы зарегистрироваться и бесплатно создать аккаунт на HTX. Пройдите удобную регистрацию и откройте для себя весь функционал.Создать аккаунтШаг 2: Перейдите в Купить криптовалюту и выберите свой способ оплатыКредитная/Дебетовая Карта: Используйте свою карту Visa или Mastercard для мгновенной покупки Sonic (S).Баланс: Используйте средства с баланса вашего аккаунта HTX для простой торговли.Третьи Лица: Мы добавили популярные способы оплаты, такие как Google Pay и Apple Pay, для повышения удобства.P2P: Торгуйте напрямую с другими пользователями на HTX.Внебиржевая Торговля (OTC): Мы предлагаем индивидуальные услуги и конкурентоспособные обменные курсы для трейдеров.Шаг 3: Хранение Sonic (S)После приобретения вами Sonic (S) храните их в своем аккаунте на HTX. В качестве альтернативы вы можете отправить их куда-либо с помощью перевода в блокчейне или использовать для торговли с другими криптовалютами.Шаг 4: Торговля Sonic (S)С легкостью торгуйте Sonic (S) на спотовом рынке HTX. Просто зайдите в свой аккаунт, выберите торговую пару, совершайте сделки и следите за ними в режиме реального времени. Мы предлагаем удобный интерфейс как для начинающих, так и для опытных трейдеров.

378 Total ViewsPublished 2025.01.15Updated 2025.03.21

Sonic: Обновления под руководством Андре Кронье – новая звезда Layer-1 на фоне спада рынка

Он решает проблемы масштабируемости, совместимости между блокчейнами и стимулов для разработчиков с помощью технологических инноваций.

2.0k Total ViewsPublished 2025.04.09Updated 2025.04.09

HTX Learn: Пройдите обучение по "Sonic" и разделите 1000 USDT

HTX Learn — ваш проводник в мир перспективных проектов, и мы запускаем специальное мероприятие "Учитесь и Зарабатывайте", посвящённое этим проектам. Наше новое направление .

1.6k Total ViewsPublished 2025.04.10Updated 2025.04.10