Ethereum co-founder Vitalik Buterin says he made $70,000 trading prediction markets on Polymarket last year, not by chasing hot narratives, but by fading what he calls collective “madness.” The Ethereum co-founder framed the profit as a function of behavioral reflexes in thin, hype-prone markets, and used the conversation to surface a separate concern: oracle fragility in real-world event settlement.

Here’s How Ethereum’s Buterin Netted $70,000

In an interview posted by Foresight News reporter Joe Zhou on X, Zhou asked whether Buterin still used Polymarket after being active last year. “Yes, I made $70,000 on Polymarket last year,” Buterin replied. When pressed on sizing, he said his initial investment was $440,000, implying a mid-teens return that sits in sharp contrast to the more common retail experience of getting chopped up by headline-driven probability swings.

Buterin described his playbook as opportunistic mean reversion on sentiment rather than prediction as such. “My method is simple: I look for markets that are in ‘madness mode’ and then bet that ‘madness won’t happen,’” he said.

“For example, there’s a market betting on whether Trump will win the Nobel Peace Prize. Or some markets predict the dollar will go to zero next year during periods of extreme panic. When market sentiment enters this irrational ‘madness mode,’ I bet on the opposite, and this usually makes money.”

When Zhou asked where he tends to focus on Polymarket (crypto, politics, entertainment, economics), Buterin said his attention clusters around politics and technology, and reiterated that the edge, in his view, comes from arenas where participants are “caught up in a frenzy and irrationality.”

The more consequential part of the thread moved from trading style to settlement integrity. Zhou raised the question of informational asymmetries and “advance knowledge”, referencing online chatter around a Venezuela-related market and asked whether Buterin had seen similar dynamics. Buterin steered the answer toward oracle vulnerabilities, citing a wartime contract whose outcome hinged on a narrow operational definition.

He described a market on the Ukraine war that settled based on whether Russia “controlled a certain city,” where the smart contract defined “control” as control of the city’s most important train station. The oracle source, he said, was anchored to Institute for the Study of War (ISW) tweets and maps.

Then came the failure mode: “ISW employees, perhaps by mistake, or perhaps intentionally, hacked their own company’s system; their maps suddenly updated to show that the Russian army controlled the train station,” Buterin said. “This caused something that everyone thought had only a 5% probability (almost impossible) to instantly become 100% in the prediction market. Although ISW retracted the update the next day, the money may have already been paid out.”

For Buterin, the lesson is not merely that prediction markets can be wrong, but that the data supply chain they outsource to can be brittle in ways crypto participants systematically underestimate. “This reveals a huge problem: the security standards of current oracle data sources (such as Web2 news websites and Twitter) are too low,” he said. “They never imagined that a single message they posted would determine the ownership of $1 million on the blockchain.”

Asked how to solve the oracle problem, Buterin sketched two broad approaches. The first is a centralized trust model, effectively designating an authoritative publisher like Bloomberg. The second is token voting, a decentralized mechanism he associated with UMA. Buterin said confidence in UMA has been slipping due to a perceived game-theoretic weakness: if a whale coalition can dominate voting, minority “truth” voters can be punished economically, pressuring participants to mirror power rather than reality.

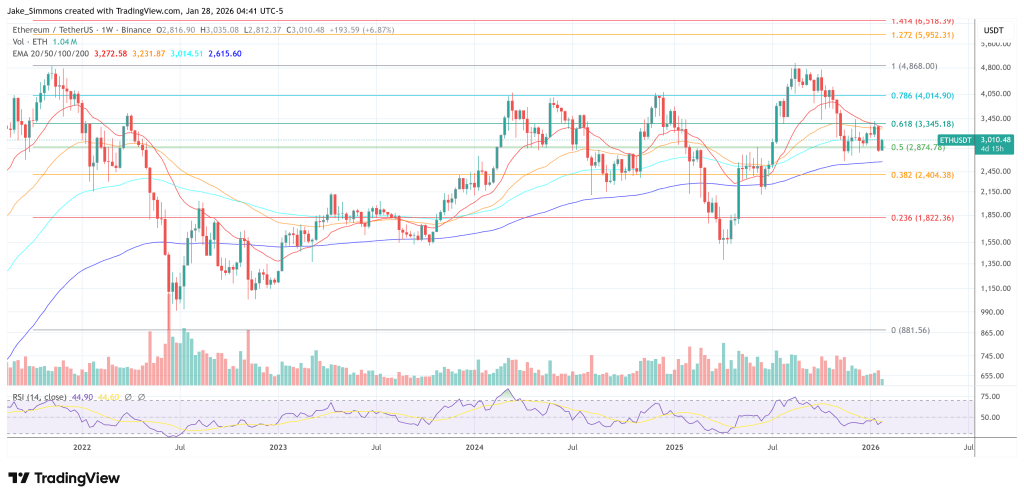

At press time, Ethereum traded at $3,010.