On-chain data shows the year 2025 saw Bitcoin mining become notably harder for miners as Difficulty witnessed net growth of 35%.

Bitcoin Difficulty Has Crossed 148 Trillion Hashes

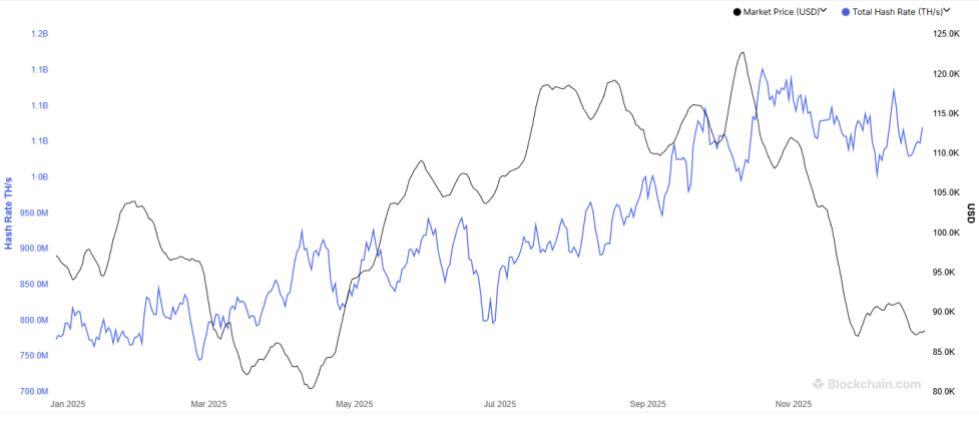

2025 is coming to a close, and it was a year where Bitcoin miners significantly expanded their facilities. According to data from Blockchain.com, the network Hashrate, a measure of the total amount of computing power connected by the miners, has seen its 7-day average value go from 795.7 terahashes per second (TH/s) at the start of the year to 1070.3 TH/s today.

How the BTC Hashrate changed in the past year | Source: Blockchain.com

During this phase of growth, the Hashrate set multiple new records, with the final all-time high (ATH) of 1,151.6 TH/s coming in October. Since then, the metric has slowed down, but even with the decline to the current level, it remains about 34.5% up since January 1st.

Bitcoin miner revenue mostly comes from the block subsidy, which remains fixed in BTC value outside of Halving events, so miners tend to be dependent on growth in the price for a boost in their income. This is why the Hashrate usually follows the price trend.

From the chart, it’s visible that the Hashrate’s ATH came right after the top in the cryptocurrency and the pullback in the metric since then has also come alongside a drawdown in the price. Miners have been more resilient than the asset, however, as BTC is down year-to-date, while the Hashrate is still up notably.

Growth in the Bitcoin Hashrate always results in an increase in another metric, called the Difficulty. The Difficulty is a feature baked into the blockchain’s code, controlling how hard miners would find it to discover the next block on the network.

It automatically changes its value about every two weeks, based on how miners performed since the last adjustment. Satoshi set a standard block time of 10 minutes for the network to follow; if miners take an average period faster than this to add blocks, the chain increases the Difficulty.

The exact degree of the upward adjustment is always just enough to counteract the speed increase of the miners. In other words, it balances out the jump in the Hashrate.

As miners were in a phase of growth this year, Bitcoin had to repeatedly elevate its Difficulty, setting new ATHs in the process.

The trend in the BTC Difficulty over the last twelve months | Source: Blockchain.com

Since setting a new record above 155 trillion hashes in October, the Bitcoin Difficulty has also witnessed a decline. Even so, the metric at its current value of about 148.2 is still 35% up compared to the 109.8 trillion hashes level from the start of the year.

The growth in the Difficulty has been pretty similar to that in the Hashrate, a natural consequence of the former reacting to the latter.

BTC Price

Bitcoin saw recovery above $89,000 earlier, but it seems the rally couldn’t last as the asset is already back at $87,300.

Looks like the price of the coin has been consolidating in recent days | Source: BTCUSDT on TradingView