Bitcoin is struggling to push decisively above the $69,000 level as persistent selling pressure and rising market anxiety continue to weigh on sentiment. After several failed breakout attempts, price action reflects a cautious environment in which traders remain hesitant to commit fresh capital. Volatility has increased alongside deteriorating confidence, reinforcing the perception that the market is still navigating a corrective phase rather than entering a sustained recovery.

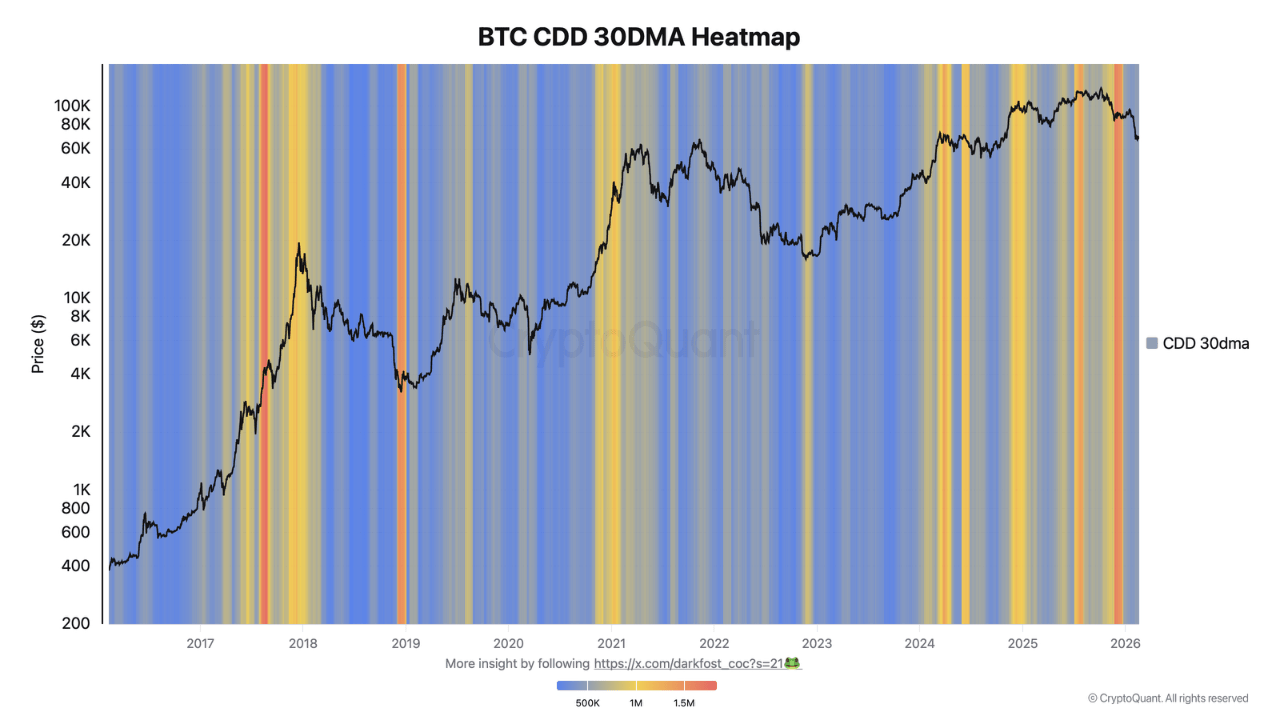

A recent report from analyst Darkfost provides additional context through on-chain data, particularly the Coin Days Destroyed (CDD) heatmap. This indicator measures the number of holding days accumulated by each Bitcoin before it is spent, offering insight into the behavior of long-term holders. When visualized as a heatmap, CDD highlights periods when older coins move, allowing analysts to quickly assess shifts in conviction among historically resilient investors.

Compared with previous cycles, the current market phase appears notable for the elevated activity of long-term holders. The data suggests that this cohort has been more active than in past cycles, potentially contributing to supply dynamics that influence price stability. Whether this reflects strategic redistribution, profit-taking, or broader market repositioning remains a key question for investors monitoring Bitcoin’s next directional move.

According to Darkfost, elevated long-term holder activity has historically intensified near market tops, suggesting that distribution from this cohort has often contributed to the formation of local peaks. When older coins begin moving after extended dormancy, it frequently reflects profit-taking or portfolio rebalancing, both of which can increase available supply and weigh on short-term price stability. In prior cycles, similar spikes in Coin Days Destroyed coincided with phases of overheated sentiment and subsequent corrective moves.

However, interpreting this cycle requires additional nuance. Not all increases in long-term holder activity necessarily signal outright selling pressure. Some of the recent CDD spikes appear linked to operational factors rather than directional positioning. Large entities, including Coinbase and Fidelity Investments, have conducted UTXO consolidation transactions, which can artificially inflate activity metrics without representing net supply entering the market.

Technical changes within the Bitcoin ecosystem have also played a role. The growth of Ordinals and inscription-related activity has encouraged some long-standing holders to migrate funds from legacy addresses toward SegWit or Taproot formats, generating on-chain activity that may distort traditional behavioral signals.

At the same time, deeper institutional liquidity has made it easier for long-term holders to distribute positions gradually, potentially smoothing market impact compared with previous cycles.