Bitcoin’s (BTC) price failed another attempt at breaking above resistance at $94,000 on Tuesday as volatility hit the market ahead of the Fed rate cut decision on Wednesday.

Key takeaways:

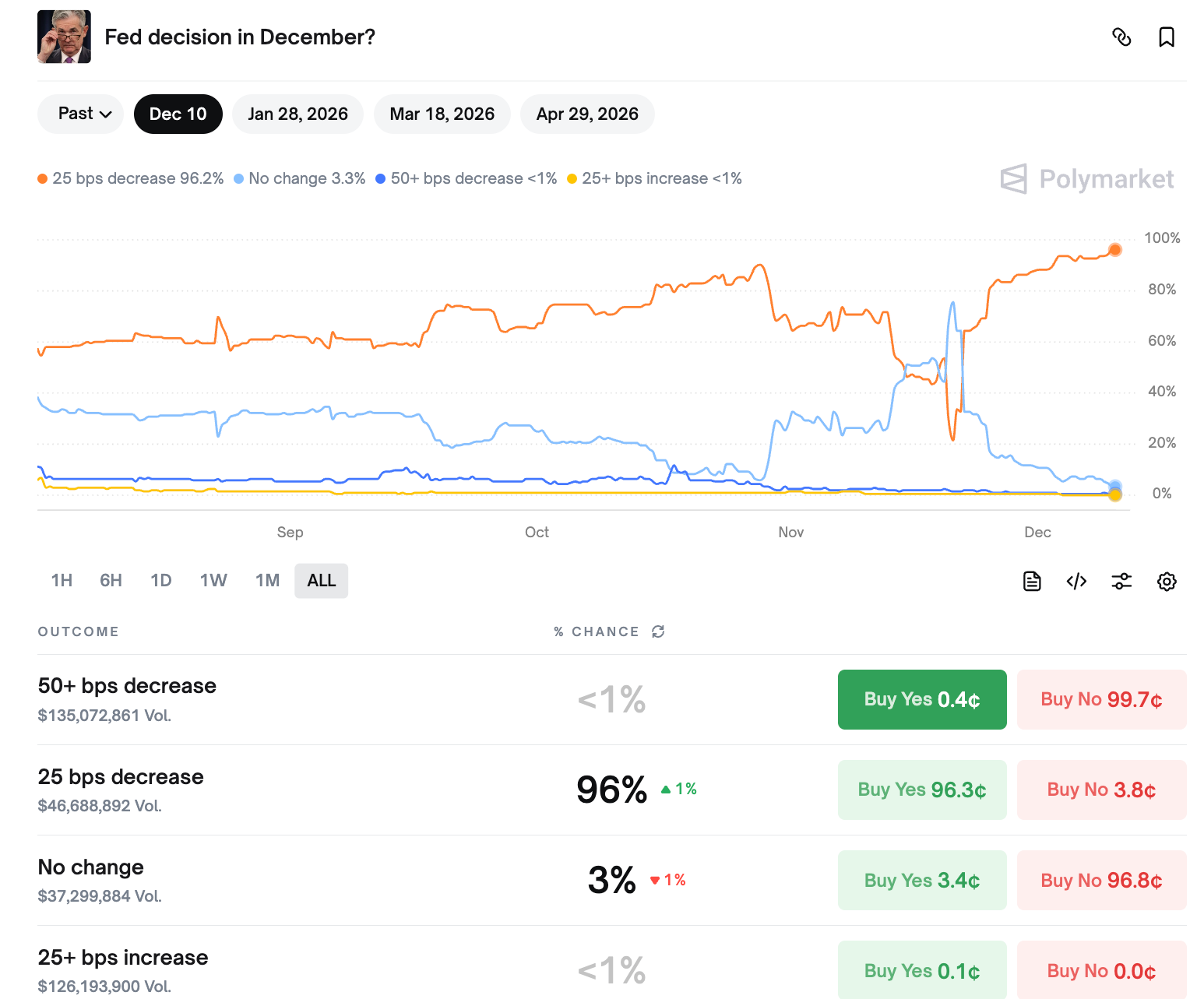

The odds of a 25 bps cut on Dec. 10 now stand at 96%, according to Polymarket

BTC price may drop as low as $84,000 if key support levels are broken.

96% chances of a 25 basis points cut

The year’s last US Federal Open Market Committee (FOMC) two-day meeting began on Tuesday, with the policy decision on interest rates expected on Wednesday at 2:00 pm pm ET.

Market participants expect the Federal Reserve to lower interest rates by 0.25%, marking its third cut of the year.

Related: Bitcoin FOMO trickles back at $94K, but Fed could spoil the party

Polymarket shows a 96.8% chance that interest rates will be cut to between 3.50% and 3.75%, with a 3% probability that the rates will remain unchanged.

However, any bullish price action from reduced interest rates is likely already priced in.

Bitcoin was retreating toward $92,000 on Wednesday as fears mounted that Fed Chair Jerome Powell’s speech after the meeting could put the market back on shaky ground.

“Yesterday’s weak jobs data knocked rate-cut hopes slightly and rattled TradFi markets; all eyes now on the Fed and wage data,” Bitcoin analyst AlphaBTC said in a Wednesday post on X, adding:

“If the Fed surprises hawkishly or wages stay firm, expect another sell-off.”

Therefore, the market will keenly watch Powell’s language at the FOMC news conference to see if there is any shift in tone.

Right now, the market is pricing a “25bps rate cut, but the real drama will come from Jerome Powell’s speech,” market commentator Wess said on Tuesday.

Key Bitcoin price levels to watch

Bitcoin must flip the yearly support at $93,300 into support to target higher highs above $100,000.

For this to happen, BTC/USD must first regain its position above the 50-day simple moving average (yellow line) at $98,000.

The $100,000 psychological level is important for BTC price because repeated rejections from this point could lead to another sell-off, as seen in February.

Above that, a major supply zone extends all the way to $108,000, where the 200-day SMA is located. This trendline was lost on Nov. 3 for the first time since April 22.

Bulls will also have to overcome this barrier in order to increase the chances of BTC’s run to $110,000.

Conversely, the bears will attempt to maintain the $94,000-yearly open resistance level, thereby increasing the likelihood of new lows below $90,000.

A key area of interest lies between $90,000 and the previous range lows at $87,500, reached on Sunday. Below that, the next move would be a retest of the Nov. 21 lows of $84,000, erasing all the gains made over the last three weeks.

Bitcoin analyst AlphaBTC eyed BTC’s rally toward $98,000, warning a drop below $91,000 would be catastrophic for the market.

“But Bitcoin must hold 91.5K now IMO, otherwise we will see blood in the streets.”

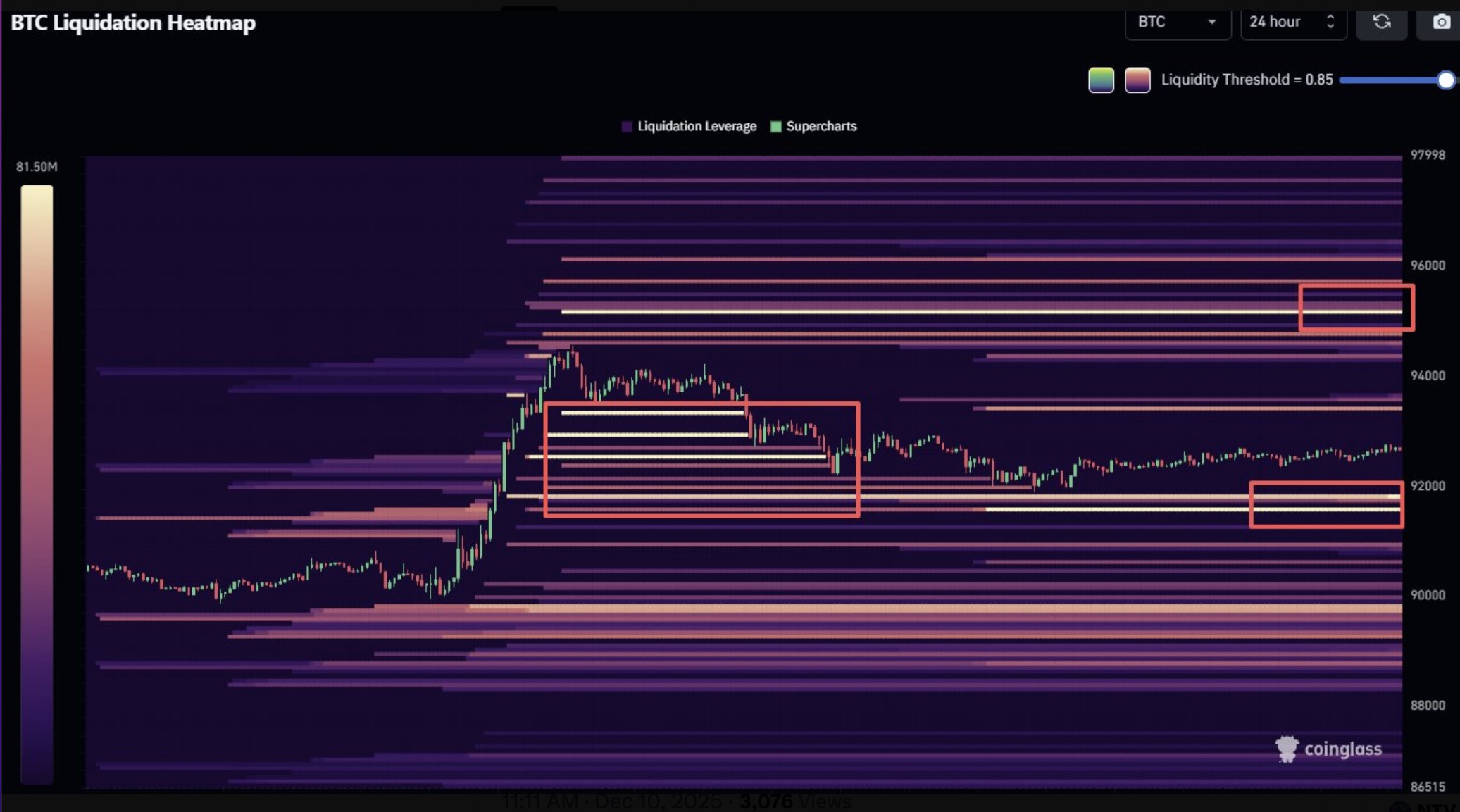

The Bitcoin liquidation heatmap reveals a large liquidity cluster between $93,000 and $96,000. Below the spot price, the area to watch is $91,500.

This highlights areas where the price might swing to, depending on the outcome of today’s FOMC meeting.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.