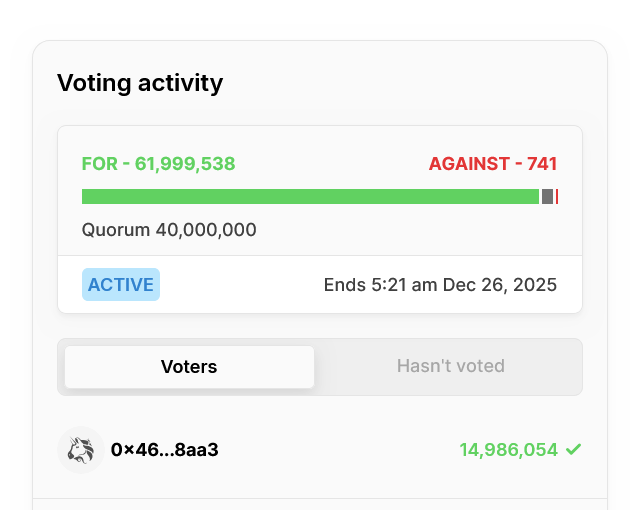

The highly-anticipated Uniswap protocol fee switch, dubbed “UNIfication,” is set to pass and go live later this week, having reached the 40 million vote threshold needed to trigger one of the biggest upgrades in the decentralized exchange protocol’s seven-year history.

As of early Monday, nearly 62 million votes have already been cast in favor of the UNIfication governance proposal since voting opened on Dec. 20, with voting set to close on Thursday, Christmas Day.

Uniswap Labs CEO Hayden Adams said on Thursday that a successful vote would follow a two-day timelock period in which Uniswap v2 and v3 fee switches would flip on the Unichain mainnet, triggering the burning of more Uniswap (UNI) tokens.

The proposal will see 100 million UNI tokens burned from the Uniswap Foundation’s treasury, while a Protocol Fee Discount Auctions system to increase liquidity provider returns would also be implemented.

The changes are expected to significantly improve the supply-demand dynamics of the UNI token and make it a more appealing token to hold over the long-term.

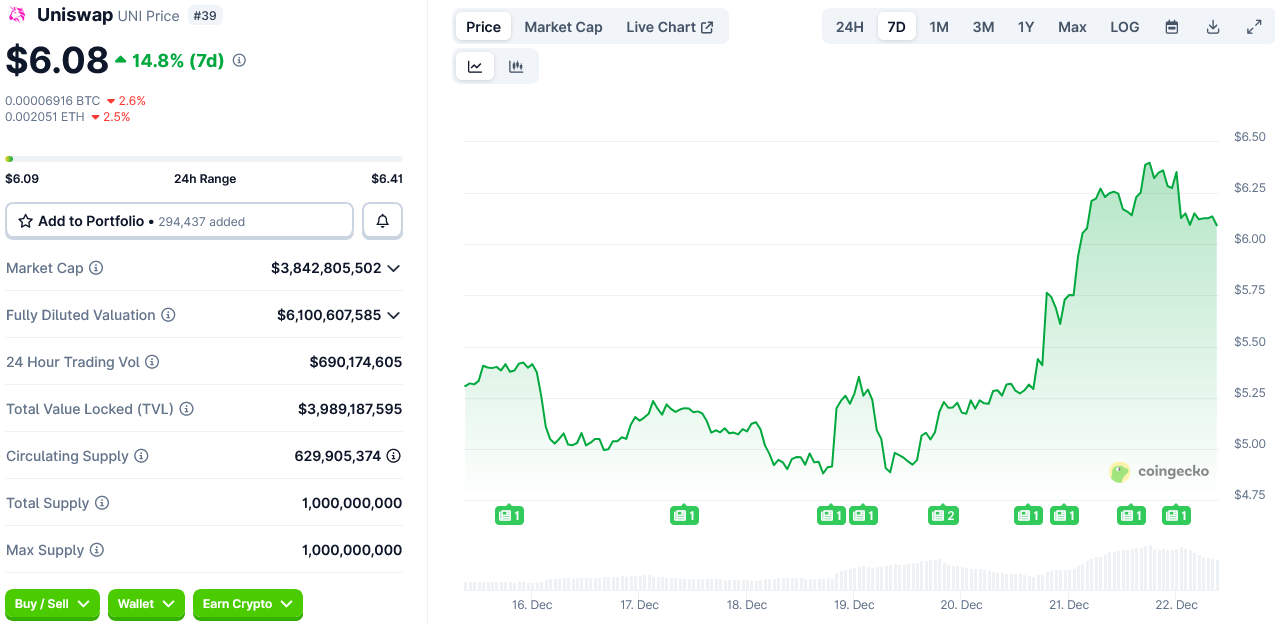

UNI has gained around 25% since the UNIfication voting opened, and is currently trading at $6.08, helping to pull it out of a month-long slump amid a broader market pullback that saw it fall to a seventh month low of $4.88.

News of the UNIfication proposal in early November spurred a near 40% rally in the UNI token, taking it from about $7 to $9.70 on Nov. 11.

Uniswap is the largest decentralized exchange and has processed more than $4 trillion in trading volume since launching in November 2018. CoinGecko data shows that UNI is the 39th largest token by market cap, at $3.8 billion.

Big names back UNIfication proposal

Several crypto heavyweights with significant voting power backed the UNIfication proposal, including Jesse Waldren, founder and managing partner at crypto-focused venture capital firm Variant, Kain Warwick, the founder of decentralized finance protocols Infinex and Synthetix, and Ian Lapham, who previously worked as an engineer at Uniswap Labs.

Related: Altcoin season never ended, traders just missed the winners: Hayes

Only 741 votes, about 0.001% of those cast, have opposed the proposal so far, while a little over 1.5 million votes have abstained.

Uniswap will still prioritize protocol development

At the time the proposal was made, the Uniswap Foundation assured builders that it wouldn’t scrap issuing grants to improve protocol development and growth, stating that supporting builders would remain a priority.

The Uniswap Foundation plans to create a Growth Budget to meet these goals, which would involve distributing 20 million UNI tokens.

Magazine: 11 critical moments in Ethereum’s history that made it the No.2 blockchain