Original | Odaily Planet Daily (@OdailyChina)

Author | Asher (@Asher_ 0210)

Amid the boring market, a new "airdrop farming" opportunity has arrived.

On the evening of December 12, Jupiter announced on the X platform the launch of a trading card collection event with a total prize pool of 1 million USDC. Users can automatically obtain cards by trading specified trading pairs and meeting the corresponding trading volume; they can also get more cards by inviting friends. The cards have different rarities, and scratching them open can yield corresponding USDC rewards.

Below, Odaily Planet Daily will guide everyone through the details of Jupiter's trading card collection event and the participation guide.

Details of Jupiter's Trading Card Collection Event

Event Overview: Trade specified trading pairs on Jupiter (web or mobile) to automatically receive cards. Open the cards to share the rewards.

Total Event Prize Pool: 1 million USDC.

Event Time: December 11, 2025, 15:00 Beijing Time to February 1, 2026, 07:59.

Card Classification: Users automatically receive cards by trading eligible token pairs on Jupiter (web or mobile). Cards are divided into 5 levels. The specific card levels, probabilities, and corresponding rewards are:

- Common Card: Draw probability 87.399%, reward 1 USDC;

- Uncommon Card: Draw probability 10%, reward 5 USDC;

- Rare Card: Draw probability 2.5%, reward 25 USDC;

- Mythic Card: Draw probability 0.1%, reward 100 USDC;

- Legendary Card: Draw probability 0.001%, reward 10000 USDC.

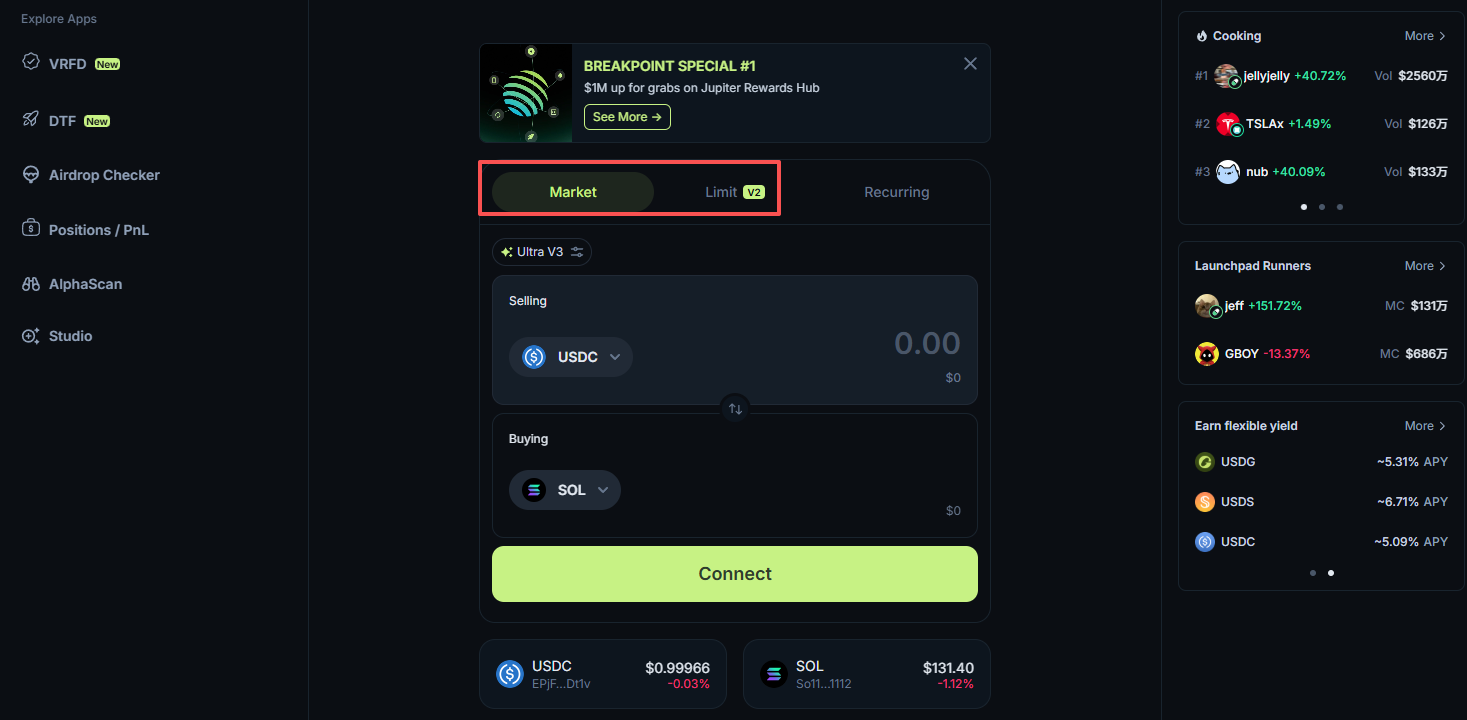

Eligible Trade Types: Only trades executed via Market (Ultra Mode) or Limit Order V2 mode are eligible (V1 and DAC DCA modes cannot participate).

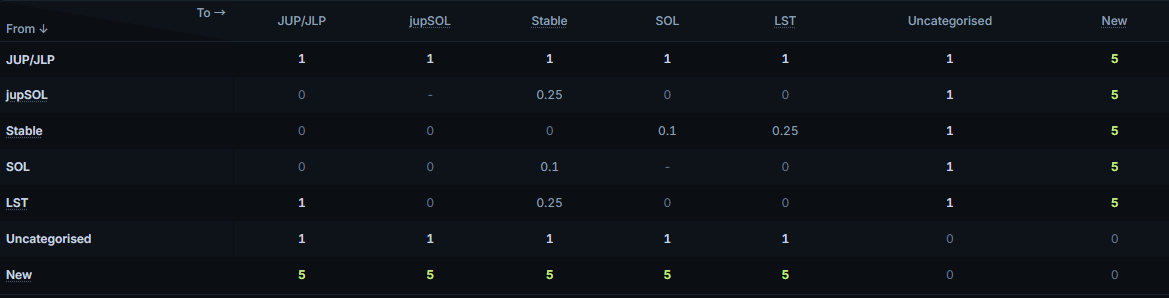

Eligible Trading Pairs: As shown in the table below, including JUP, JUP/SOL, JUP/jupSOL, JUP/Stable, JUP/LST, JUP/Uncategorised, JUP/New (refers to new coins listed on Jupiter within 24 hours). The numbers in the table indicate the number of cards obtained for every $10,000 in trading volume completed. For example, completing $10,000 worth of JUP to SOL trading volume yields 1 card.

Step-by-Step Participation Tutorial

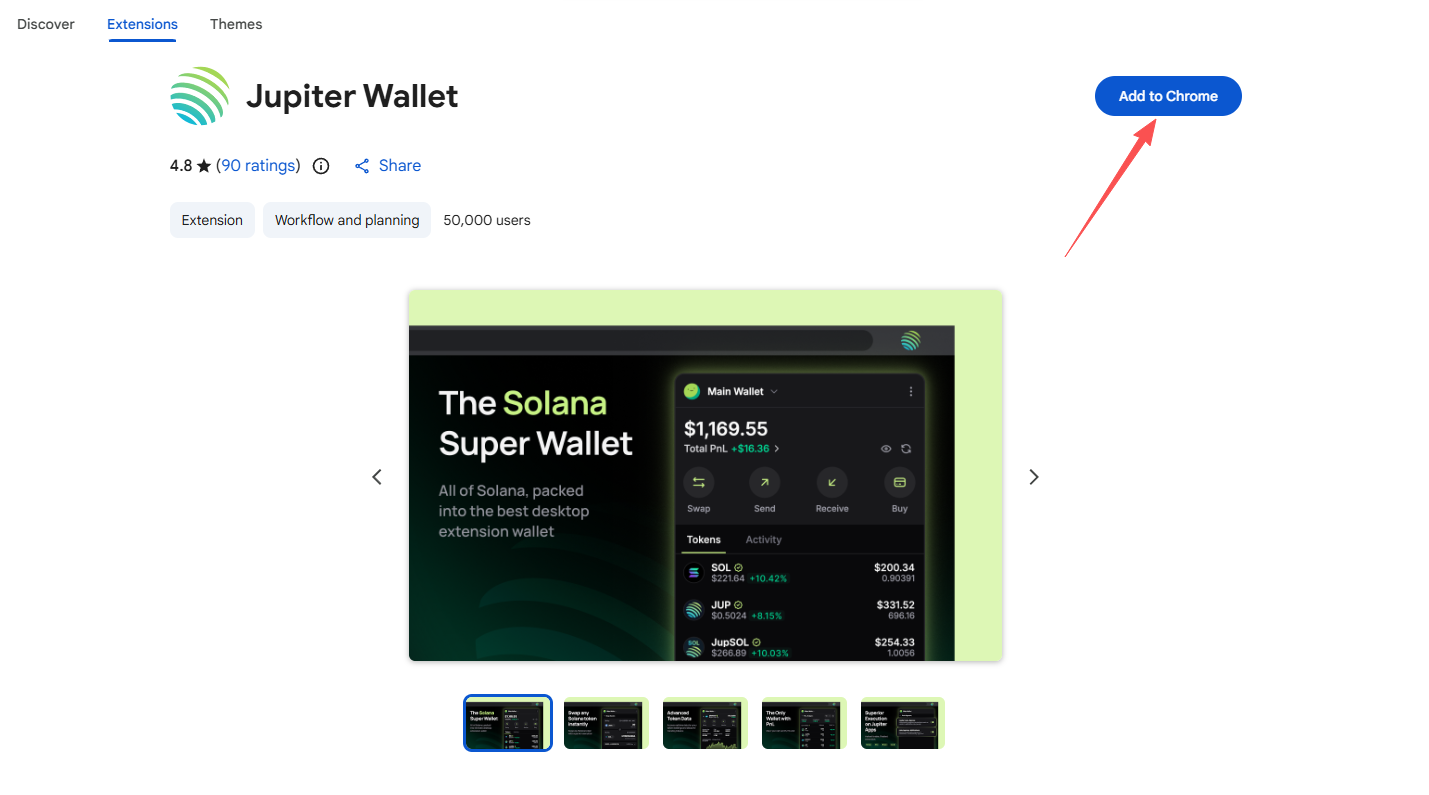

STEP 1. Download the Jupiter wallet from the Chrome Web Store (Link: https://chromewebstore.google.com/detail/jupiter-wallet/iledlaeogohbilgbfhmbgkgmpplbfboh), import an existing wallet address or create a new wallet address. It's worth noting that while participation is possible via mobile, claiming reward cards and opening them must be done on the desktop version.

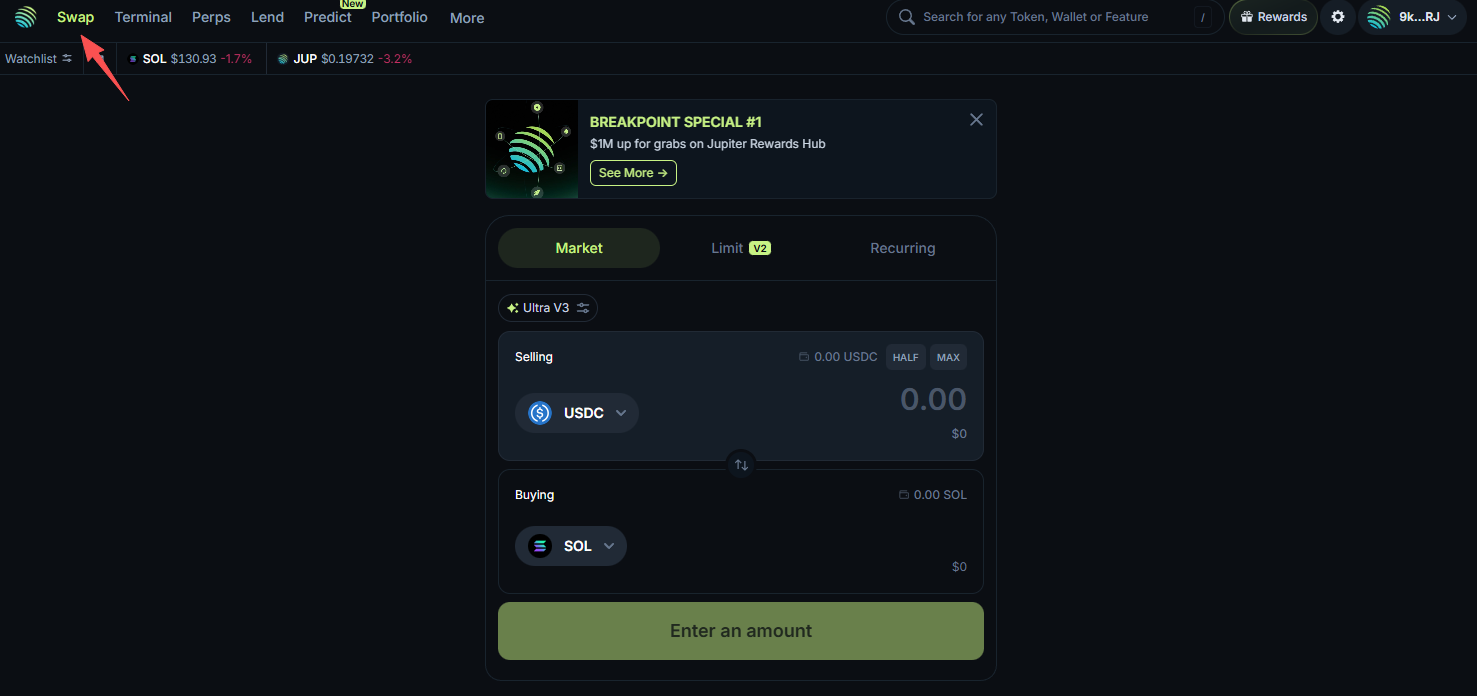

STEP 2. Go to the trading website (Link: https://jup.ag/), generate trading volume to earn cards. Based on实测 data, it costs approximately $3 to $5 to obtain one card.

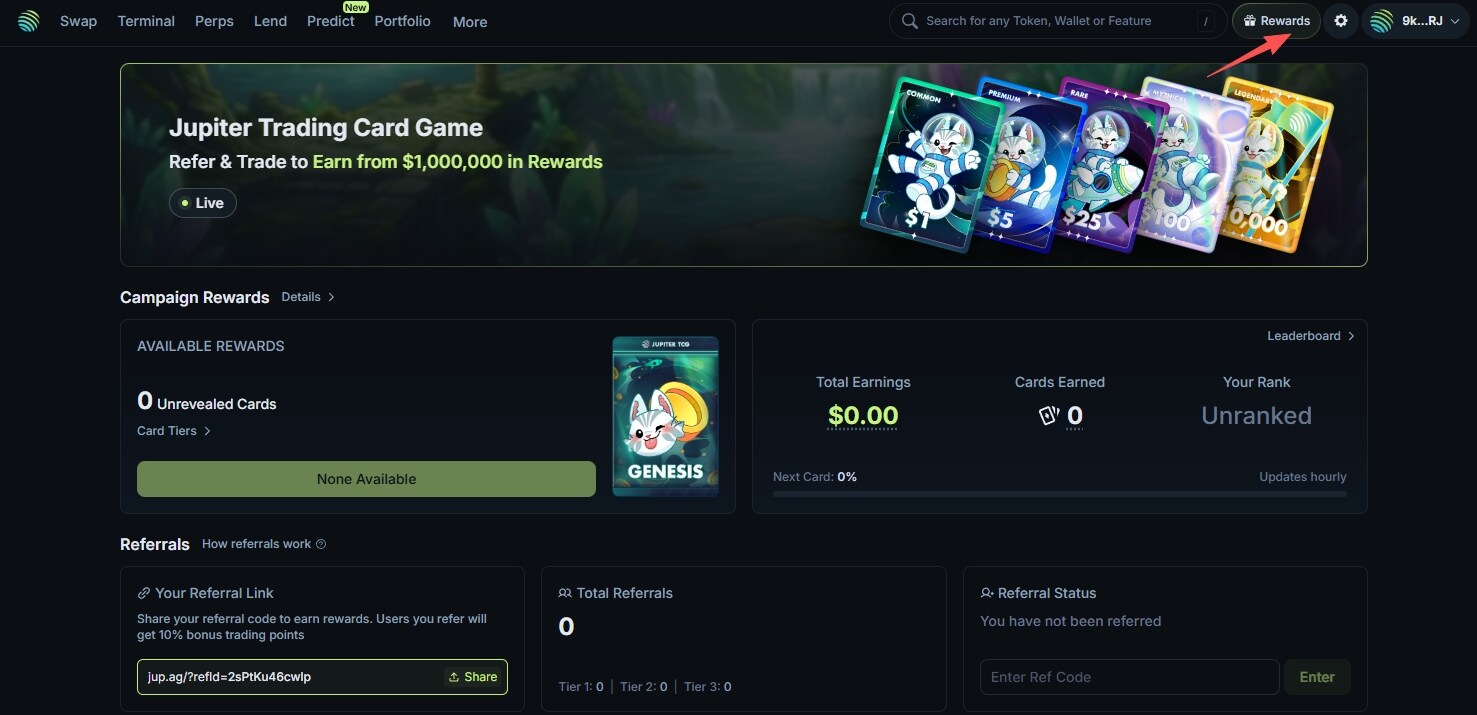

STEP 3. Click on "Rewards" to enter the rewards panel, generate a personal referral link to increase the number of cards. Additionally, this page also allows you to view the number of cards obtained.