Crypto markets saw a slight pickup after the US Federal Reserve’s widely expected rate cut on Wednesday, and a larger bounce could be next, say analysts.

The central bank has executed three consecutive interest rate cuts totaling 0.75% over a three-month period from September to December.

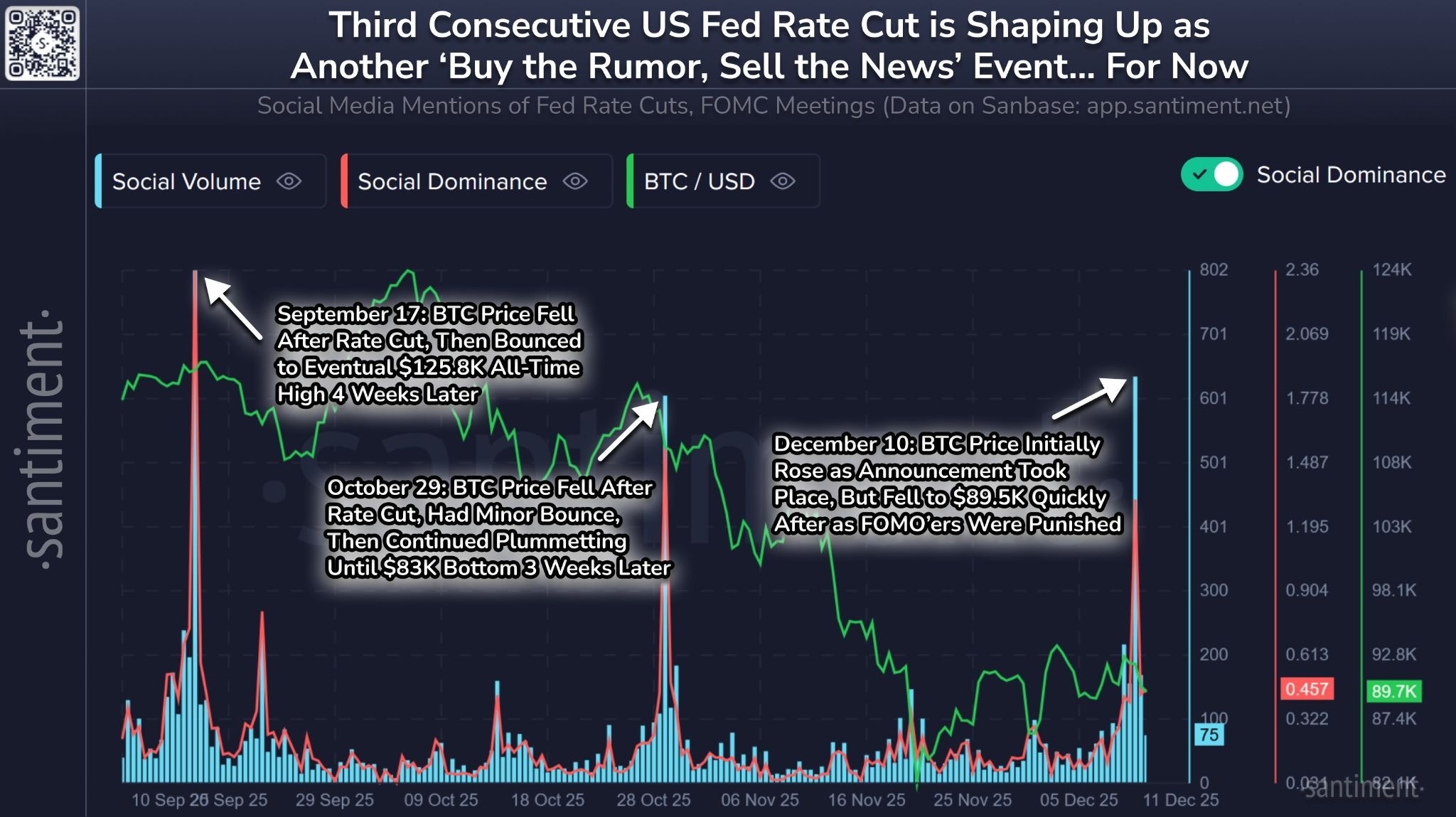

Despite being fundamentally bullish for crypto in the long term, each cut triggered short-term sell-offs, following a classic “buy the rumor, sell the news” pattern, the onchain analytics firm Santiment said on Thursday.

However, there is “typically a bounce after the dust settles,” it added, which can provide predictable trading opportunities.

“Thus far, this latest rate cut has been no different. Look for a slight level of FUD or retail sell-off to indicate that the mild post-cut downswing has ended.”

Lower rates and cheaper borrowing costs typically increase risk appetite and capital flowing into speculative assets, such as crypto.

Fed rate cut widely expected

CoinEx chief analyst Jeff Ko told Cointelegraph that the Fed’s latest rate cut was “widely expected and pretty much priced in,” but its updated dot plot showing where Fed policymakers think the rate is headed next “leaned slightly hawkish.”

Related: Conflicted Fed cuts rates but Bitcoin’s ‘fragile range’ pins BTC under $100K

More importantly, Ko said, the $40 billion short-term Treasury purchases are a “technical maneuver for financial system liquidity to lower short-term rates, not a large-scale, stimulus-driven program.”

“But the markets interpreted this as mildly bullish, with US stocks moving higher and helping Bitcoin stage a rebound alongside broader risk sentiment.”

Bitcoin markets are maturing

Director of Global Macro at Fidelity Investments, Jurrien Timmer, looked at the longer time frame, noting on Thursday that Bitcoin (BTC) has underperformed this year compared to stock markets. However, he said that markets were maturing compared to previous cycles.

“It’s hard to tell in real time whether a new [crypto] winter is upon us, but looking at the evolving wave structure of Bitcoin’s maturing network curve, we can see that the most recent bull market looks pretty mature.”

There has been a slight uptick in crypto markets during the Friday morning trading session, with Bitcoin recovering from its post-cut dip below $90,000 to spike to $93,500 on Coinbase.

However, resistance at this level proved to be too strong once again, sending the asset back to $92,300, where it trades at the time of writing.

Magazine: XRP’s ‘now or never’ moment, Kalshi taps Solana: Hodler’s Digest