Written by: Ma He, Foresight News

Original title: What's It Like to Turn $12 into 8300 Times on Polymarket?

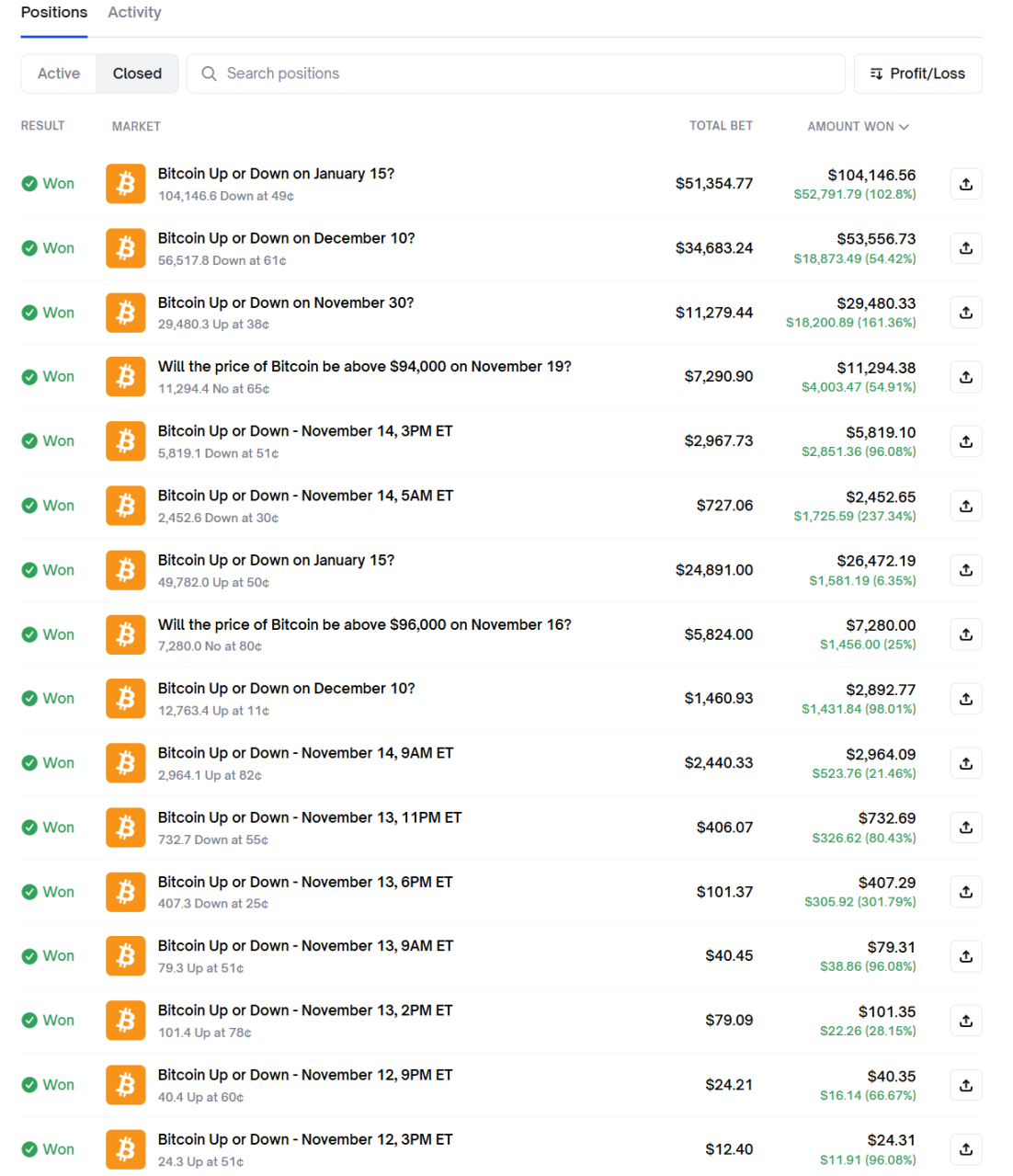

The arena for acquiring wealth through trading is no longer confined to exchanges and DEXs. Imagine opening the Polymarket page, sitting in front of your computer, watching the Bitcoin price chart. On the screen, the Polymarket platform interface flashes with an orange Bitcoin icon. You bet your entire fortune—just $12—wagering that Bitcoin will rise within a certain period. The market odds are highly uncertain, but relying on your analysis of on-chain data, news trends, and candlestick patterns, a few hours later, the market settles, and you win. Your account balance doubles to $24.31. But this is just the beginning. You take a deep breath and go all-in on the next bet. You win again, and the balance becomes $40.35. Just like that, going all-in each time, you accumulate victories like a snowball.

Starting with tens of dollars, then going all-in, winning big again and again, and finally earning over $100,000—this isn't a dream but the masterstroke of the account @ascetic0x.

Ascetic's wealth story quickly went viral, with 4.21 million views, 13,000 likes, and 8,000 bookmarks. In the comments, some exclaimed "legend," while others sighed, "Only Polymarket can let small retail investors turn the tables."

Perhaps, in the heart of every Polymarket player, there has been a dream of making a fortune quickly with a small stake. Ascetic's wealth story was like a shot of adrenaline, giving endless hope to every player hoping to "change their destiny."

But the truth of the story is far from just the surface glamour.

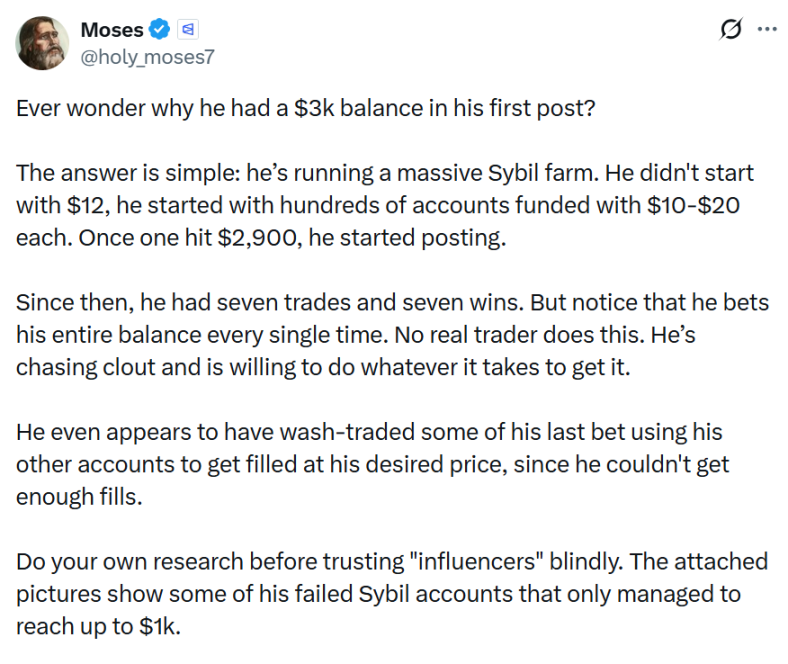

Just one day after his highlight tweet, Twitter user Moses posted to reveal the truth: creating multiple Polymarket accounts and then publicizing the most successful one.

Moses questioned: "Why did his first post already have a $3k balance? The answer is simple: he was operating a large-scale Sybil account. He didn't start with $12; he raised hundreds of accounts simultaneously, each pre-loaded with $10–20. When one account grew to $2,900, he immediately started posting. After that, he made a total of 7 trades, all of which he won. But note: every time, he went all-in with the entire balance. No real trader would play like this.

Moses criticized him for chasing clout and刷存在感 (seeking attention), willing to do anything to become famous. Ascetic even疑似 (suspectedly) used other small accounts to wash trade his last transaction, forcibly taking the order at his desired price because normal orders couldn't get enough volume. Moses advised not to blindly believe these so-called 'influencer big Vs'; do your own homework before deciding what to believe.

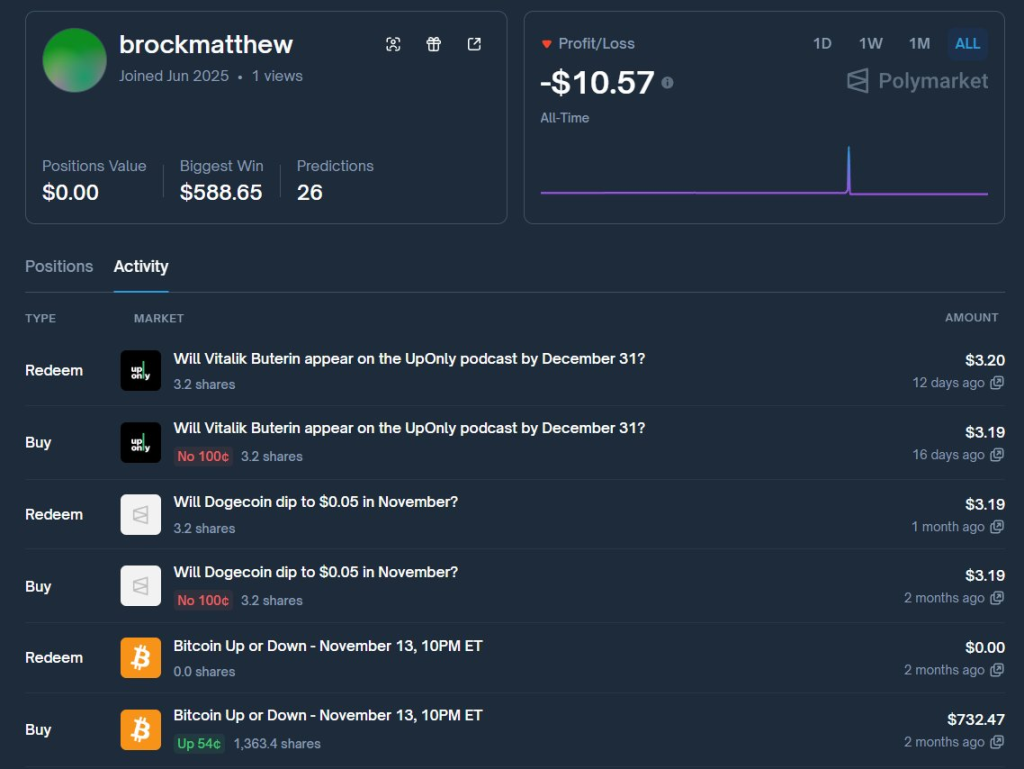

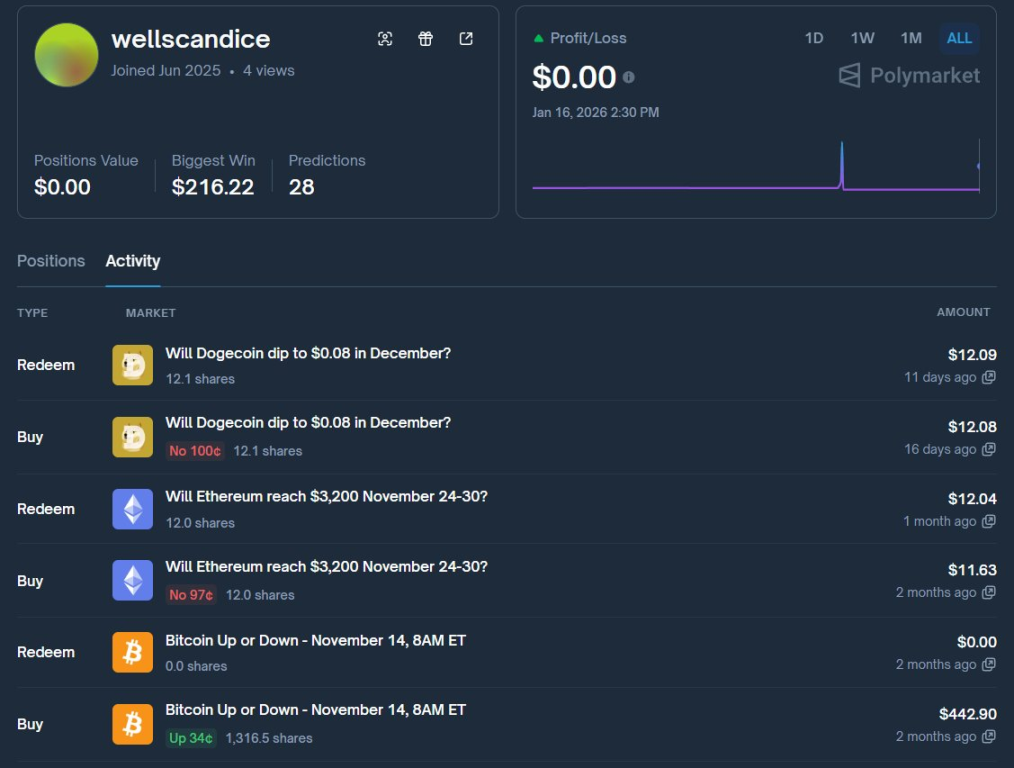

He also posted some of ascetic's failed Sybil small accounts, which at most only reached around $1,000 before collapsing.

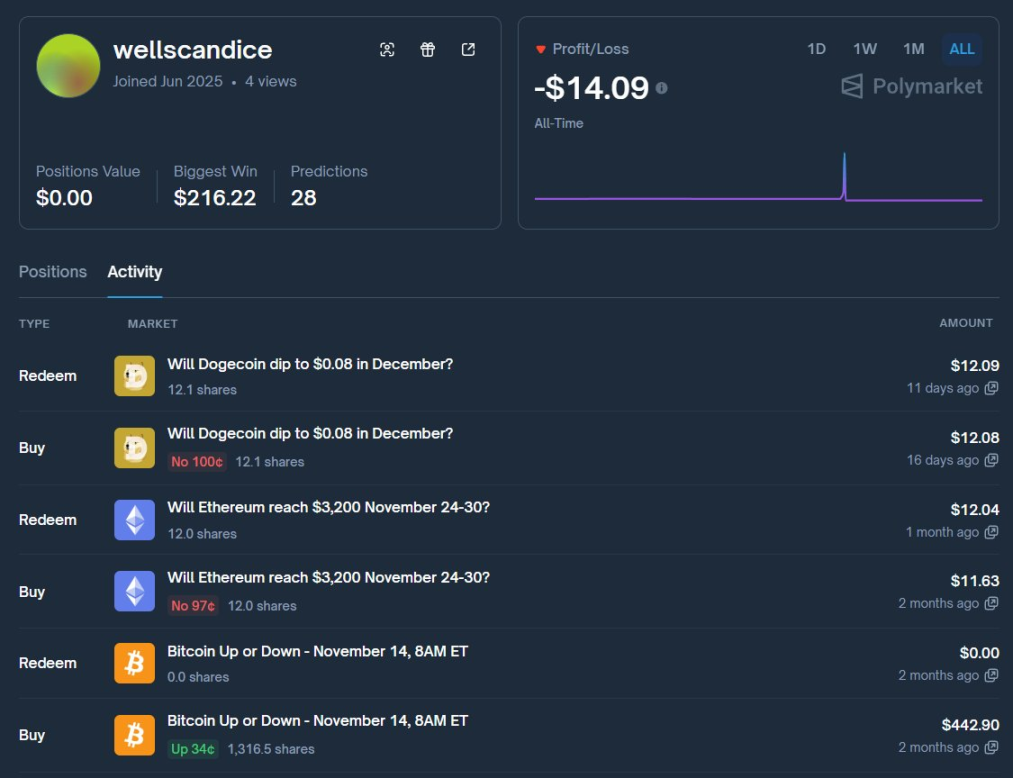

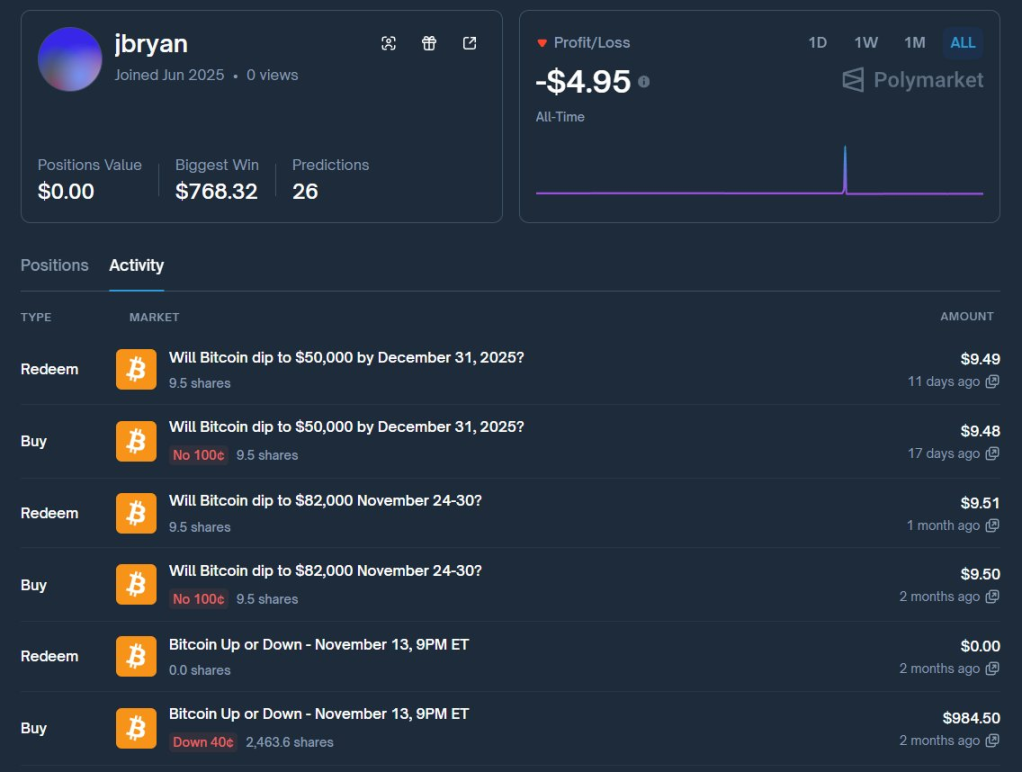

These accounts were created 7 months ago, first绑定 (binding) to random markets for 5 months, then simultaneously started going all-in on Bitcoin short-term markets 2 months ago.

Some accounts quickly lost everything, some reached hundreds or nearly $1k, but only one 'survived' to $2,900 and was made public.

This tactic is very similar to some crypto market analysts who open both long and short positions, trade with multiple accounts, and no matter how the market moves, they can always dig out screenshots of profitable orders, harvesting traffic and attention amidst exclamations of "又麻了" (winning big again).

The controversy quickly escalated.

On January 18, facing overwhelming质疑 (skepticism), ascetic tweeted again in response, saying, "In the past 24 hours, I've received more hate and threats than ever before in my life. Some KOLs, to蹭热度 (ride the trend) and刷流量 (boost traffic), deliberately spread false information about me, organizing hate raids under my posts. Some people didn't even bother to check my homepage before喷 (trashing), completely missing that I've been publicly logging my trades on X for the past two months. They accuse me of operating a bunch of small accounts, but they can't produce any accounts or provide any evidence that these accounts ever existed. I have no connection to Sybil farms; this is pure nonsense."

Ascetic also warned users not to copy trades because the strategy is extremely high-risk, and trading like this long-term will almost certainly lead to liquidation. The individual used such an aggressive approach only because they believed they were a good trader, wanting to prove their skills and establish themselves in the Polymarket Trade community.

What is the truth? It might be an unsolvable mystery, but this incident still offers profound lessons for ordinary players.

Don't blindly follow KOLs. Others' success is often hard to replicate, and there are no real big shots in the market acting like Guanyin (the Goddess of Mercy) to make people rich. In the trading market, the wealth you think is within reach is, most of the time, far beyond your grasp.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush