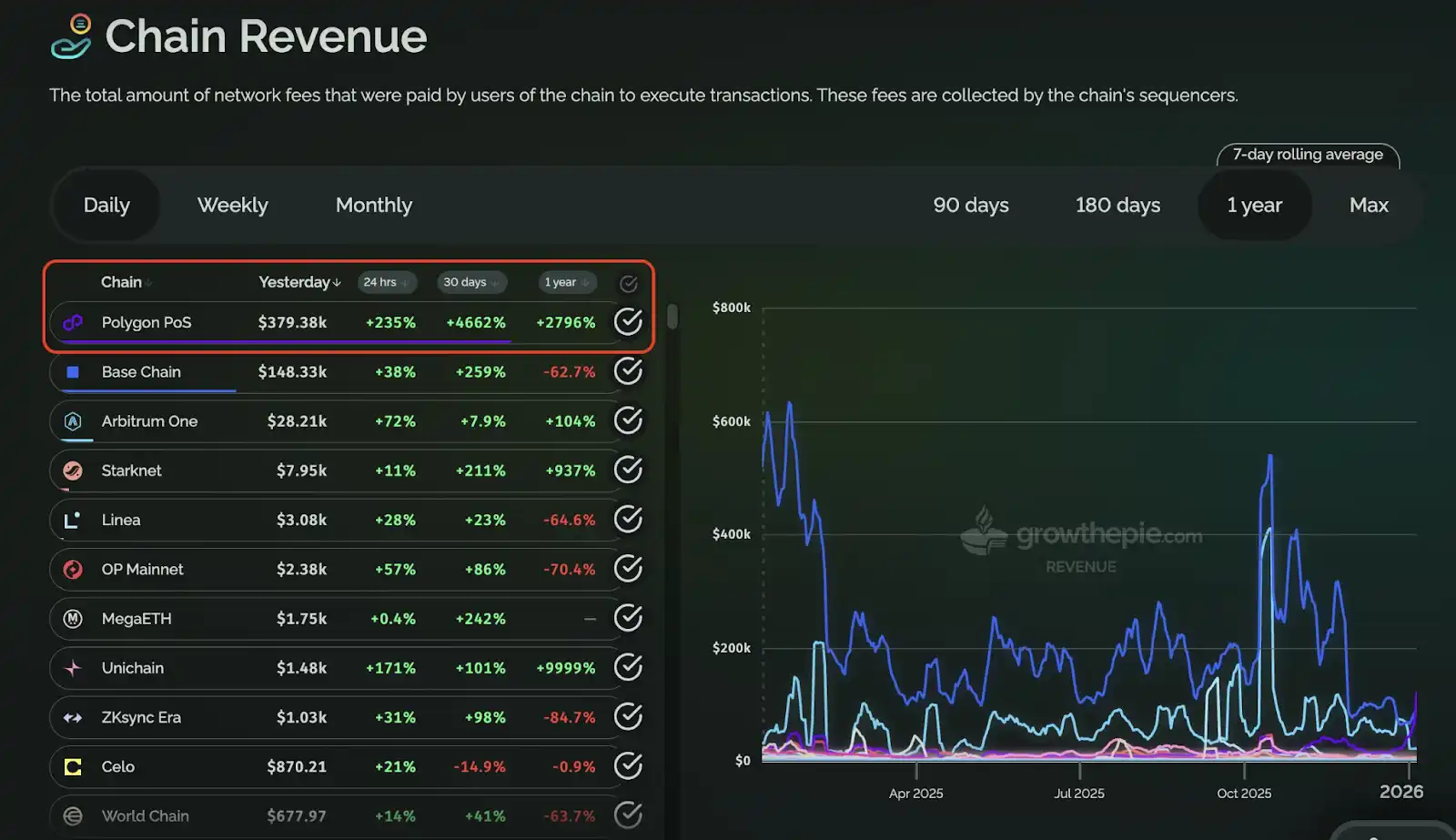

Over the past period, the popularity of the prediction market project PolyMarket has taught the industry a lesson: when a truly in-demand, well-designed application takes off, it not only brings users and buzz but can even push a long-dormant network back into the spotlight—Polygon once topping Chain Revenue, surpassing Base, is a highly representative signal. But more notably, it's the "top priority" that PolyMarket repeatedly emphasized amid the hype: building its own chain.

This sounds like a further technical upgrade, but in essence, it's an inevitable choice as applications enter the deep end of growth. Once product validation is complete, transaction behaviors stabilize, and user scale expands, applications begin to feel dissatisfied with "renting someone else's underlying infrastructure" and instead want to control key experiences and revenue streams. The same path has appeared in another more typical case: the leading Perp DEX, Hyperliquid. It didn't settle for being just an "application" on mainstream public chains but directly built its own App Chain to unify the trading system, execution environment, and user experience, ultimately achieving near "centralized exchange-level" smoothness and throughput, thereby establishing a moat.

Looking at these two cases together, they point to the same trend: App Chain is becoming the new Alpha.

Why "The More Successful the Application, the More It Wants to Build Its Own Chain"?

The more successful an application is, the more likely it is to reach the point of "building its own chain," for practical reasons: when you move from "validating whether the product can run" to the "scaled operation" stage, public chains no longer bring just traffic and tool dividends but a bunch of external variables you can't control. Choosing a public chain early on is, of course, the most cost-effective—quick deployment, mature ecosystem, users and assets are already there; the most important thing is to get the product running and ensure users are willing to keep using it. But once the business explodes, your key paths will be increasingly affected by congestion, fee fluctuations, confirmation times, and other public network conditions. The uncertainty of experience begins to directly erode conversion and retention. At the same time, costs shift from "user complaints" to "financial structure": in high-frequency, high-volume scenarios, gas and infrastructure expenses become a curve that must be meticulously calculated, managed, and that can fluctuate wildly with external conditions.

Furthermore, successful applications care more about "value closure" and "iteration speed." The transactions and growth you generate often have a significant portion captured by the underlying and middle layers, yet you struggle to accurately redirect incentives back to the core users who contribute liquidity and trading. You want to customize rules for key processes and optimize the execution environment but can only make patchwork fixes within the public framework. Thus, projects like PolyMarket, which have already gained momentum, treat "building their own chain" as the main task for the next phase; strong trading products like Hyperliquid directly use App Chain to bind the execution environment, experience, and economic system together, turning controllability into a moat. At this stage, the chain is no longer just a deployment location but part of the product.

The Chain Can Be Launched, but Network Effects May Not Follow

App Chain is indeed becoming a trend, but that doesn't mean the barriers have lowered—more accurately, "launching a chain" is getting easier, while "making the chain actually work" is getting harder. Many teams think that after building their own chain, they can reclaim control over experience, costs, and rules, only to find after launch that the hardest part has shifted from engineering implementation to network management: users won't migrate just because you have an extra chain, and funds won't automatically flow in just because you changed the execution environment. Once the chain becomes independent, it immediately faces the reality of "starting from scratch": how to onboard the first batch of users, how to ensure assets flow smoothly, how to stabilize transaction and usage frequency—none of these are solved simply by launching a chain.

More specifically, App Chains often hit three walls:

- Cold Start: New chains lack default entry points and positioning; users need extra learning, extra switching, and extra trust.

- Liquidity Fragmentation: Once assets are cross-chain, versions and paths proliferate; pools get split, depth becomes insufficient, and the user experience becomes more expensive, slower, and more complex, even leading to confusion like "the same token has different prices in different places."

- Weak Ecological Synergy: You can make your product more specialized and extreme, but if it can't be seen by larger networks and can't form smooth asset and user flows with other chains and applications, it easily becomes a "functionally strong but isolated" new island.

Therefore, the truly scarce capability in the App Chain era is shifting from "can you launch a chain" to "can you make the chain part of the network from day one," ensuring that user and fund flows feel as natural as if they were on the same chain.

Getting App Chain into the Flywheel Faster—From "Launching" to "Using"

The difficulty of App Chain is no longer just "can you launch a chain" but whether it can be used immediately after launch: how users come in, how assets get there, how liquidity is承接, and whether the cross-chain experience will be dragged down by fragmentation. Many ambitious teams consider appchain essentially to "own their own infrastructure" (sequencing, block rhythm, execution model, RPC, transaction revenue, etc.), using more controllable block space to create better products and business; but in reality, poor interoperability and chain-to-chain fragmentation often turn onboarding into a cost black hole, making new chain launches feel like "new islands" rather than "network nodes."

Caldera's entry point is to turn this path into a reusable product组合: using the Rollup Engine to lower the deployment and operational barriers, making chain launches a more controllable routine action rather than heavy engineering; then using Metalayer to make "connection" a default configuration, equipping each chain from day one with a full set of capabilities like cross-chain message passing, fast bridging, bridge aggregation, and development tools, reducing the friction of user and fund cross-chain flows, making "launching" closer to "joining a ready-made interconnected ecosystem." On this basis, Caldera's growth logic isn't single-point SaaS but a network flywheel: each new chain brings new users and liquidity sources, and Metalayer makes these increments更容易 flow within the ecosystem and feed back into existing chains, thereby enhancing the entire network's appeal to the next batch of teams.

The design around $ERA further "accelerates and compounds" the flywheel: it is both the universal participation and economic coordination carrier for Metalayer (the basis for fee pricing of cross-chain interactions, etc.) and, through staking/node participation and governance, binds the incentives of chains, applications, users, and infrastructure participants within the same network, turning collaboration and growth from "possible" to "easier to sustain and roll." A more直观 example is that ecological联动 incentives themselves reinforce network effects in return. For instance, Espresso allocated over 2% of the total $ESP supply to the Caldera community during its TGE and made $ERA holders and stakers key airdrop targets: the value回流 from external high-quality partners enhances the appeal of participating in the $ERA ecosystem; and more holding and staking further strengthen network cohesion and collaboration expectations, in turn促成 more partnerships and more chains choosing to "join the network." Ultimately, Caldera aims to solve this: making App Chain not only launchable but also usable smoothly from day one, entering the growth flywheel faster.

The Alpha of App Chain Isn't in "Launching the Chain" but in "Networking"

From PolyMarket to Hyperliquid, the industry is seeing one thing越来越 clearly: as applications enter the scaled operation stage, the "chain" upgrades from a deployment location to part of the product, with experience, cost structure, iteration speed, and value回流 all being rewritten around it. But the real barrier for App Chain也随之 changes: launching a chain is getting easier; the hard part is ensuring the chain has entry points, asset paths, liquidity, and collaboration from the moment it goes live. Therefore, the next phase's Alpha isn't "who launched more chains" but who can turn "new chain cold start" into an action of "joining the network," reducing fragmentation friction enough that users can naturally complete funding, trading, and cross-chain use as if on the same chain. When this connectivity and incentive mechanism (e.g., participation around $ERA and external partnership回流) can continuously self-reinforce, App Chain will move from single-point success to replicable systemic victory and become a truly sustainable new Alpha.