The Senate Banking Committee has pulled the scheduled Thursday markup of its crypto asset market structure bill after a late-stage flare-up with Coinbase, freezing what had looked like a tightening path toward action. The pause lands at a sensitive moment for Washington’s crypto negotiations: industry heavyweights are publicly splitting over the Senate draft even as lawmakers insist bipartisan talks are still alive.

Senate Banking Committee Chairman Tim Scott (R-S.C.) said Wednesday the committee will postpone the markup “as bipartisan negotiations continue,” framing the delay as tactical rather than terminal. “I’ve spoken with leaders across the crypto industry, the financial sector, and my Democratic and Republican colleagues, and everyone remains at the table working in good faith,” Scott wrote on X. “As we take a brief pause before moving to a markup, this market structure bill reflects months of serious bipartisan negotiations and real input from innovators, investors, and law enforcement.”

Scott positioned the bill as a foundational framework rather than a narrow industry carveout. “The goal is to deliver clear rules of the road that protect consumers, strengthen our national security, and ensure the future of finance is built in the United States,” he added.

Coinbase Breaks Ranks Late

The immediate catalyst was Coinbase CEO Brian Armstrong, who said the exchange “can’t support the bill as written” after reviewing “the Senate Banking draft text over the last 48hrs.”

Armstrong argued the draft contains multiple provisions he says would be “materially worse than the current status quo,” contending that it amounts to “a defacto ban on tokenized equities,” includes “DeFi prohibitions” that expand government access to financial records and erode privacy, and would “stifl[e] innovation” by weakening the CFTC relative to the SEC.

He also pointed to “draft amendments” he said “would kill rewards on stablecoins,” warning the changes could allow banks to “ban their competition.” Armstrong’s bottom line was blunt: “We’d rather have no bill than a bad bill.” Still, he struck a conciliatory note about process and odds of a compromise, adding he was “quite optimistic” that continued work could produce “the right outcome.”

After reviewing the Senate Banking draft text over the last 48hrs, Coinbase unfortunately can’t support the bill as written.

There are too many issues, including:

– A defacto ban on tokenized equities

– DeFi prohibitions, giving the government unlimited access to your financial...— Brian Armstrong (@brian_armstrong) January 14, 2026

That posture split the difference between hard opposition to the text and support for continued negotiations,an important distinction as the markup process is typically where senators offer and vote amendments.

Crypto Industry Split

Coinbase’s stance quickly triggered a counter-response from other major crypto firms and advocacy groups backing the Senate Banking GOP’s push. Support was voiced by a16z, Circle, Kraken, The Digital Chamber, Ripple, and Coin Center, coalescing into a public front aimed at keeping momentum intact despite the delay.

Ripple CEO Brad Garlinghouse cast the bill as overdue but directionally positive. “While long-overdue, this move by @SenatorTimScott and @BankingGOP on market structure is a massive step forward in providing workable frameworks for crypto, while continuing to protect consumers,” he wrote. He said Ripple would remain engaged, adding: “We are at the table and will continue to move forward with fair debate. I remain optimistic that issues can be resolved through the mark-up process.”

Meanwhile, Tim Draper said Armstrong’s opposition is justified, arguing the Senate compromise “is worse than no bill at all” and suggesting that “the banks have been meddling.”

Ryan Rasmussen, Head of Research at Bitwise Asset Management , called the current CLARITY Act draft broadly harmful, listing tokenization, stablecoins, DeFi, privacy, builders, users, investors, and innovation, and concluded that the industry would “rather have no bill than a bad bill.”

White House Crypto Czar David Sacks urged the industry to treat the delay as a narrow window to align rather than an opening to splinter. “Passage of market structure legislation remains as close as it’s ever been,” Sacks wrote. “The crypto industry should use this pause to resolve any remaining differences. Now is the time to set the rules of the road and secure the future of this industry.”

Galaxy Digitall’s CEO Mike Novogratz struck a more optimistic tone, saying: “While the crypto bill might be delayed to keep working on it, I am very confident that a bill will get done soon. I have spoken to over 10 senators on both sides of the aisle in the past 24 hrs and I believe they all are working in good faith to get something done. Always gets tense at the end.”

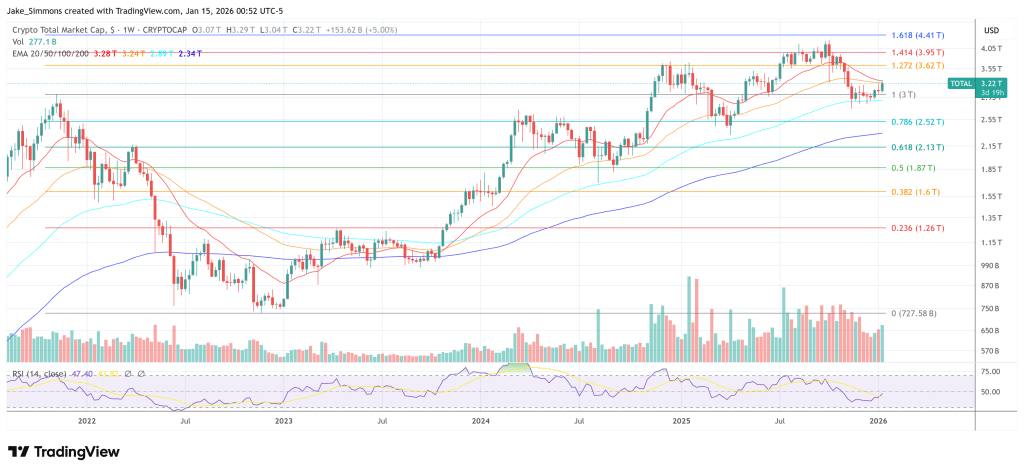

At press time, the total crypto market cap stood at $3.22 trillion.