Author: Jae, PANews

Original Title: Overtaking PayPal and Entering the Top Five in Half a Year: The "Game of Thrones" of Trump's Stablecoin

Not long ago, Eric Trump, the second son of U.S. President Trump and co-founder of WLFI, tweeted that the scale of USD1 had surpassed PayPal's stablecoin PYUSD. In just over half a year, USD1's market capitalization has reached $4.9 billion, ranking among the top five in the stablecoin track with astonishing growth speed.

The rapid rise of USD1 is not merely a commercial victory. The issuer of USD1 is not a traditional bank or a fintech giant but World Liberty Financial (WLFI), which is closely related to the family of the current U.S. President Trump. With the加持 of Trump's political光环 and the support of policy红利, a crypto-financial "open scheme" is emerging.

In the history of the crypto industry, no project has ever intertwined family interests, political power, and digital finance as deeply as WLFI and its stablecoin USD1.

From Aggressive Subsidies to Full-Scenario Penetration: Launching a Liquidity Blitz via Binance

In the competition of the stablecoin track, liquidity is the lifeline. The rapid growth of USD1's market capitalization and its overtaking of PYUSD are not accidental.

On one hand, WLFI联合头部交易所币安 launched a "liquidity blitz," injecting liquidity into USD1 through the latter's主导的 "USD1 Booster" plan.

This is a typical combination of "high-yield subsidies + full-scenario penetration." Through high-yield subsidies and全平台账户激励, Binance provided sufficient liquidity depth for USD1.

USD1's cold start strategy adopted the classic "liquidity mining" model of the DeFi market, but with Binance's加持, its scale and coverage were amplified exponentially.

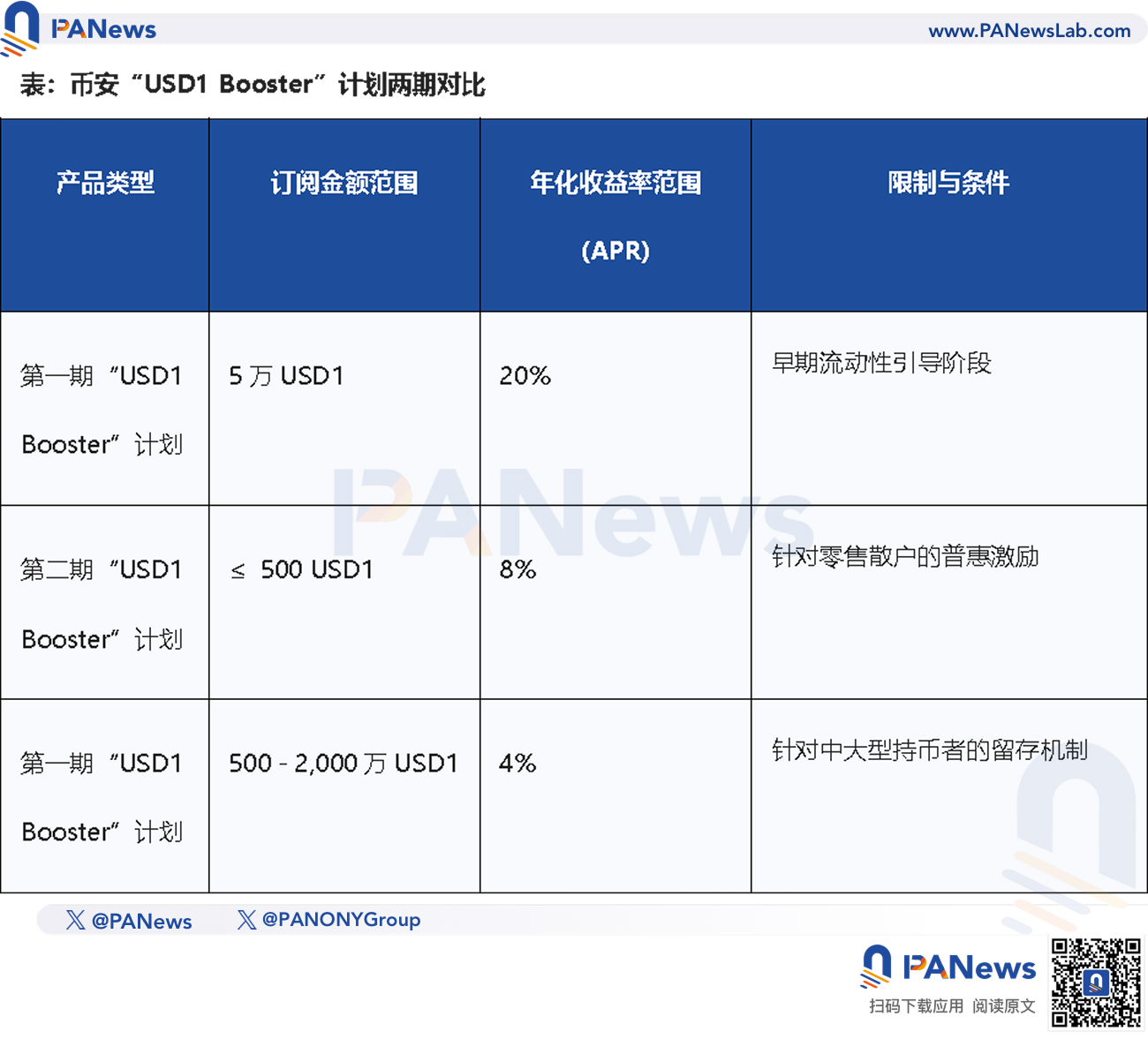

The first phase of Binance's "USD1 Booster" plan offered an annualized yield of up to 20%, which was considered by the market as an "artificial subsidy" customer acquisition手段. Against the backdrop of macro interest rate fluctuations, this yield level far exceeding traditional finance quickly attracted a large number of retail investors.

However, this ultra-high yield did not come from the协议's sustainable profitability but was borne by a fixed prize pool provided by WLFI, aiming to absorb massive funds in a short time.

As the first phase was about to end, Binance promptly launched the second phase of the "USD1 Booster" plan, but the yield was adjusted to a tiered structure of 8% and 4%. This adjustment also reflected USD1's strategic shift from "expansion" to "retention."

Targeting different user profiles, the "USD1 Booster" plan designed a tiered interest rate structure to maximize USD1's user coverage and achieve its retention goals.

To further enhance USD1's practical utility, Binance also launched a WLFI token incentive activity worth $40 million.

The innovation of this activity lies in its "full-account coverage" feature. Users only need to hold USD1 in their spot accounts, funding accounts, leverage accounts, or even futures accounts to share in the weekly $10 million token airdrop, embedding USD1 into every user touchpoint.

Meanwhile, Binance also introduced a "reward multiplier" mechanism to encourage users to use USD1 in leverage trading scenarios.

However, according to estimates, the annualized yield of this activity is expected to be between 10%-15%, and the activity duration is only one month, so the actual yield is less than 2%. Investors need to综合考虑兑换磨损 and WLFI token price fluctuations.

With Binance's strong boost, USD1's market capitalization grew by approximately $2 billion, a环比涨幅 of over 40%. As the "flagship product" of the Trump family project, USD1 also brought Binance a high-quality asset with strong political背书.

Relationship Network Business: From Cooperation with Pakistan's Central Bank to U.S. Bank Charter Application

Compared to USD1's progress in the crypto industry, its expansion in the sovereign credit market is even more eye-catching.

On January 14, the State Bank of Pakistan signed a memorandum of understanding with WLFI's affiliated company SC Financial Technologies to explore the use of USD1 for cross-border payments and remittances.

Pakistan, as a major global labor exporter, receives over $36 billion in overseas remittances annually and has approximately 40 million cryptocurrency users. However, traditional remittance channels like the SWIFT system are not only inefficient but also have high intermediary costs.

USD1 offers an almost instant, low-cost alternative. The Pakistan Virtual Asset Regulatory Authority and the central bank plan to integrate USD1 into a regulated digital payment framework, allowing it to operate in parallel with Pakistan's own central bank digital currency pilot project.

By cooperating with sovereign states, USD1 attempts to upgrade itself from "just another stablecoin" to a "national-level payment infrastructure," its ambition is self-evident.

For the Pakistani government, embracing USD1 not only optimizes financial infrastructure but also serves as a名片 of geopolitical diplomacy to the new U.S. administration; for the Trump family, this is a key step for USD1 towards becoming a "sovereign-level credit tool," but this is no longer just a company开拓市场, but an infiltration of political influence and state capital.

The facilitator of this cooperation includes WLFI co-founder Zach Witkoff, the son of U.S. Special Envoy to Pakistan Steve Witkoff.

This kind of "political spillover" effect is obvious. USD1's positioning is no longer just a单纯的商业产品, but also an extension tool of U.S. foreign policy.

USD1 is becoming a core component of U.S. dollar hegemony in the digital finance领域. By first establishing Pakistan as a strategic outpost to set payment standards, and then deeply binding USD1 with the payment infrastructure of various emerging market countries, WLFI is essentially executing a "digital dollar hegemony" strategy, attempting to ensure that the U.S. dollar can maintain its global reserve status through digital finance paths in the face of de-dollarization challenges.

The outline of this "open scheme" is also gradually显露. WLFI's affiliated entities have applied to the U.S. Office of the Comptroller of the Currency (OCC) for a national trust bank charter. Although the OCC stated that it would strictly review according to procedures, the current Comptroller, a Republican, was appointed by Trump's nomination and is an old subordinate of the Trump administration.

If successful, USD1 will leap from a controversial private project to a正式银行机构 under federal regulation. At that time, the Trump family will彻底模糊 the boundaries between private finance, political power, and national will, creating an unprecedented precedent.

Regulatory Amnesty Meets Questions of Allegiance, Trump Family Enjoys 75% Net Profit Share

The rapid rise of USD1 is离不开 a complex and隐秘的利益同盟 network, whose core participants are mostly crypto giants who were once in the eye of regulatory storms.

Since Trump's return to the political stage, the regulatory strategy of the U.S. Securities and Exchange Commission (SEC) has undergone翻天覆地的变化. Since 2025, the SEC has withdrawn multiple lawsuits against industry giants such as Binance, Coinbase, and Kraken.

-

Binance: In March 2025, Abu Dhabi investment institution MGX injected $2 billion into Binance through USD1. Two months later, the SEC announced the exercise of prosecutorial discretion and withdrew some charges against Binance.

-

Justin Sun: Justin Sun spent at least $75 million to acquire WLFI tokens and serves as an advisor. Subsequently, the SEC's fraud investigation into his affiliated companies entered a "stalled" state, seeking a settlement.

A series of "coincidences" in the timeline have sparked widespread market质疑 about "pay-to-play." Crypto giants are supporting the Trump family's project in exchange for regulatory leniency. According to SEC official documents, the Trump family could profit approximately $80 million annually just from USD1's reserve management fees and various抽成.

WLFI's business terms show that the Trump family's affiliated entities have a净收益分成 of up to 75% in token sales and stablecoin profits. This means that the higher USD1's market share and the stronger its liquidity, the faster the Trump family's wealth grows.

The错综复杂的利益交换 behind USD1 also places it in a special "regulatory vacuum." It enjoys the compliance红利 brought by the *[Note: The original Chinese text mentions "《天才法案》" which might be a specific or mistyped reference. Translating literally as "Genius Act" but context suggests it might refer to favorable legislation, perhaps related to innovation or crypto. Keeping it as is might be best unless a specific act is known.]* Genius Act, while its special political背书 makes常规的审计与透明度要求 appear苍白无力.

Insufficient Reserve Management Transparency, Potential Political清算 Risk

Although USD1 has achieved阶段性巨大成功 on the books, its underlying fragility and potential political risks cannot be ignored.

USD1 claims to be custodied by BitGo Trust, with the underlying reserves 100% backed by assets including U.S. dollar cash, short-term U.S. Treasury bills, and money market funds, managed by Fidelity Investments.

However, compared to Circle's (USDC) monthly attestation reports released on time, USD1's reports are sometimes delayed and lack the背书 of the global Big Four accounting firms.

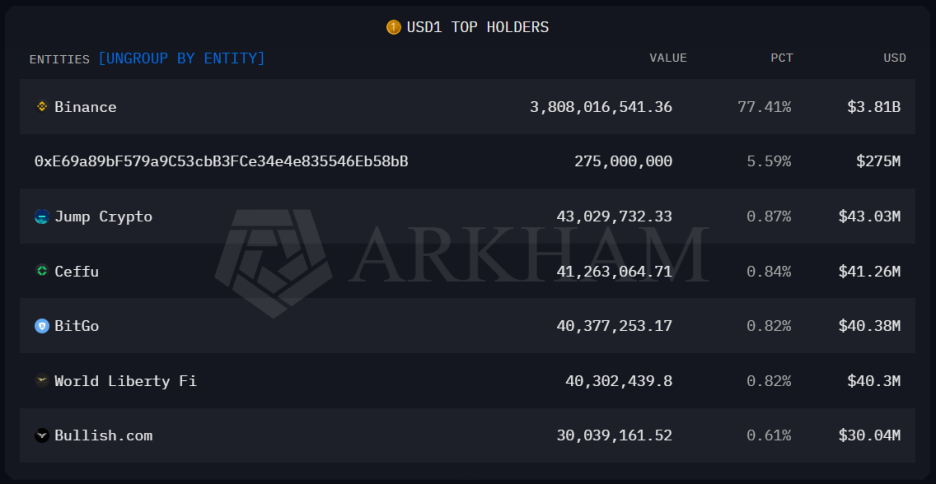

Furthermore, USD1's liquidity is overly concentrated. In the address distribution, nearly 80% of the liquidity is聚集在 Binance alone. This highly centralized liquidity structure raises doubts about USD1's survivability under stress tests. For example, when Binance's subsidies end and USD1 incentives drop to real interest rates, if it cannot provide additional on-chain utility, it could lead to a large-scale capital flight.

The "暗箱操作" where DWF Labs injected approximately $300 million in secret funds into USD1 through anonymous wallets has further sparked market质疑 about the authenticity of USD1's peg.

Compared to challenges on the capital side, risks on the political side are even more concerning.

If the peg of most stablecoins in the market is built on market confidence, then USD1's confidence largely depends on Trump's political influence. If the political environment changes drastically, or if the WLFI token price collapses, it could trigger a run on USD1.

Moreover, once the White House changes hands, USD1 may face harsh audits and compliance accountability due to its利益相关 with the former president's family.

The Trump family's stablecoin open scheme本质上 is leveraging the huge流量 of political status and权力红利 to complete a特许经营权变现 in the crypto industry.

USD1's narrative is also shaping a new logic: in the era of digital finance, code is not only law, but politics can also become part of the code.

Although in the global stablecoin landscape, USDT still maintains massive liquidity dominance, and USDC consistently upholds the high ground of compliance, USD1 has开辟了一条 a "power-driven" new track.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush