Le fondateur d'Aave, Stani Kulechov, est sous le feu des critiques concernant son récent achat de tokens AAVE d'une valeur de 10 millions de dollars, certains membres de la communauté crypto affirmant qu'il a été utilisé pour renforcer son pouvoir de vote dans une proposition de gouvernance clé.

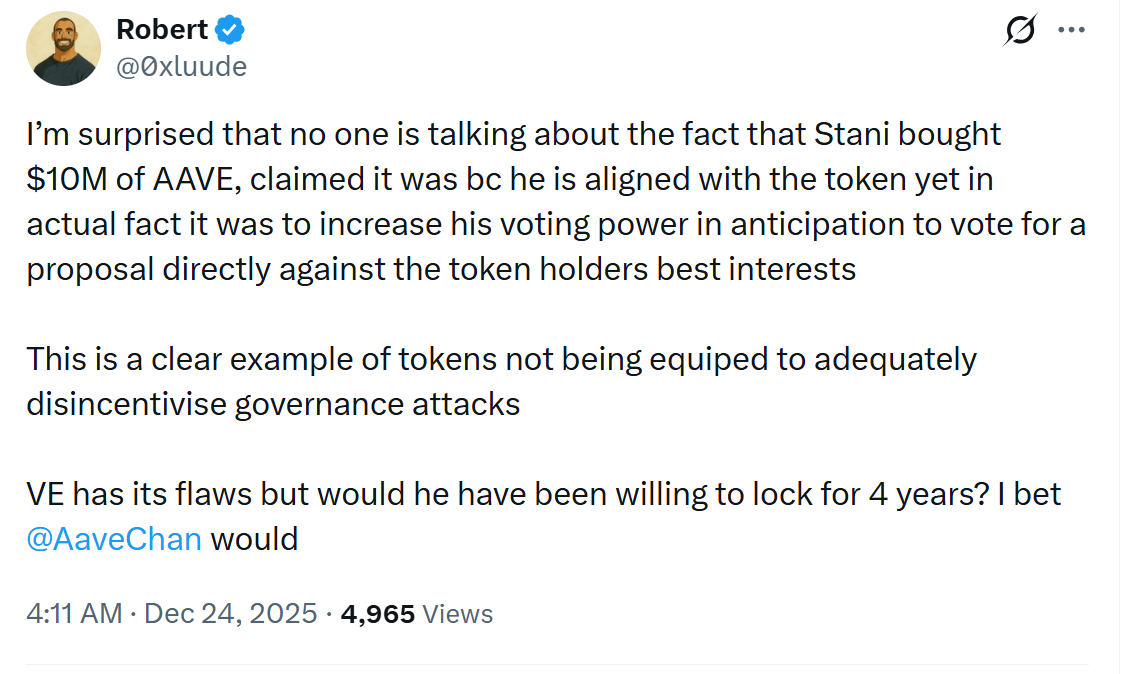

Dans un message publié mercredi sur X, Robert Mullins, stratège en finance décentralisée (DeFi) et spécialiste de la liquidité, a soutenu que cet achat visait à augmenter le « pouvoir de vote de Kulechov en prévision d'un vote pour une proposition allant directement à l'encontre des intérêts des détenteurs de tokens. »

Il a ajouté : « C'est un exemple flagrant de tokens qui ne sont pas équipés pour décourager adéquatement les attaques de gouvernance. »

L'utilisateur crypto prominent Sisyphus a fait écho à ces préoccupations, affirmant que Kulechov aurait pu vendre des tokens Aave (AAVE) pour une valeur de « millions de dollars » entre 2021 et 2025, remettant en question la logique économique derrière cette manœuvre.

La controverse survient alors que les détenteurs de tokens Aave débattent de la manière dont le pouvoir de gouvernance est exercé au sein de l'un des plus grands protocoles DeFi, les critiques affirmant que les achats importants de tokens peuvent influencer matériellement les résultats des votes sur des propositions à enjeux élevés. Le différend a ravivé les inquiétudes quant à savoir si la gouvernance basée sur les tokens protège adéquatement les détenteurs minoritaires lorsque les fondateurs ou les initiés précoces conservent un levier économique significatif.

Le vote de gouvernance d'Aave provoque un tollé

Comme Cointelegraph l'a rapporté, le vote de gouvernance d'Aave a déclenché un tollé après qu'une proposition visant à reprendre le contrôle des actifs de marque du protocole a été poussée vers un vote snapshot malgré un débat en cours.

La proposition demande si les détenteurs de tokens AAVE devraient retrouver la propriété des domaines, des comptes sociaux et de la propriété intellectuelle via une structure légale contrôlée par une DAO.

Plusieurs parties prenantes ont contesté cette décision, arguant que la proposition a été escaladée prématurément.

L'ancien CTO d'Aave Labs, Ernesto Boado, répertorié comme l'auteur de la proposition, a déclaré que le vote a été escaladé sans son consentement et a brisé la confiance de la communauté.

Lire aussi : Le fondateur d'Aave présente son « plan directeur » pour 2026 après la fin de l'enquête de la SEC

Concentration du pouvoir de vote dans l'Aave DAO

Samuel McCulloch de USD.ai a pointé du doigt la concentration du pouvoir de vote. Dans un post sur X, il a décrit le vote d'Aave comme « absurde », ajoutant qu'un petit groupe de gros détenteurs représentait environ la moitié du poids total du vote.

Les données Snapshot de l'Aave DAO montrent que les trois premiers votants à eux seuls contrôlent plus de 58 % de l'ensemble des votes. Le plus grand votant, 0xEA0C...6B5A, détient 27,06 % du pouvoir de vote (333k AAVE), tandis que le deuxième plus grand votant, aci.eth, contrôle 18,53 % (228k AAVE).

Cointelegraph a contacté Kulechov pour un commentaire, mais n'a pas reçu de réponse au moment de la publication.

Magazine : La baleine Bitcoin Metaplanet est « sous l'eau » mais envisage d'acheter plus de BTC : Asia Express