Author: imToken

Can you imagine a company that started with a Crypto background is now buying gold at a scale approaching that of central banks?

According to Bloomberg, USDT issuer Tether has become one of the world's largest holders of gold reserves—currently holding approximately 140 tons of gold, valued at about $23 billion, with over 70 tons purchased last year alone, used to supplement its reserves and issue its gold-backed stablecoin, almost surpassing the declared purchases of most national central banks.

Behind such massive gold purchases, Tether is not betting on the price of gold but is building a long-term, scalable physical gold supply system for its tokenized gold product, XAUt.

I. What is XAUt?

According to the latest whitepaper, "Relevant Information Document – Tether Gold(XAU₮)" released on January 27, 2025, Tether Gold (XAUt) is a gold-backed stablecoin issued by the Salvadoran company TG Commodities, S.A. de C.V.

Each XAUt token represents ownership of one troy ounce (approximately 31.1035 grams) of gold stored in a Swiss vault, meeting the London Bullion Market Association (LBMA) gold bar delivery standards. When an on-chain transaction occurs, the system automatically reallocates the gold shares in the vault to ensure that users' tokens always correspond to specific physical assets.

The physical gold is stored in a high-security vault in Switzerland. The custodian, although an affiliate, operates independently with separate financial accounts and customer records. Users can also access the official "Look-up Website" by entering their on-chain address to directly query the serial number, weight, and purity of the gold bars associated with their assets.

However, delivery must be made in whole gold bars. As described in the whitepaper, since each gold bar varies in weight (typically between 385 and 415 ounces), the official recommends users deposit at least 430 XAUt to ensure coverage. Any excess tokens will be refunded to the user.

Delivery must also occur within Switzerland, or users can request Tether to liquidate the gold into USD in the Swiss gold market, with the proceeds returned after deducting fees.

Source: Tether

It is worth noting that the issuer, TG Commodities, has been authorized by El Salvador's National Digital Asset Commission (CNAD) as a regulated stablecoin issuer and approved digital asset service provider (DASP). A look into the parent company reveals it is wholly owned by Tether Holdings and Tether Operations.

In fact, the early萌芽 of XAUt can be traced back to late 2019 when Paolo Ardoino, then CTO of Bitfinex and Tether, revealed that Tether was planning to launch a gold-backed stablecoin product, Tether Gold. The first version of the XAUT whitepaper was also released on January 28, 2022.

Little did anyone expect that in just four years, Tether would become a super gold buyer comparable to sovereign national central banks.

II. Tether: A New Force in the Gold Market That Cannot Be Ignored

As mentioned above, the whitepaper clearly states that each XAUt token represents ownership of one ounce of physical gold. Tether承诺 that every XAU₮ issued is backed by an equivalent amount of physical gold reserves, all stored in a "Swiss vault with first-class security."

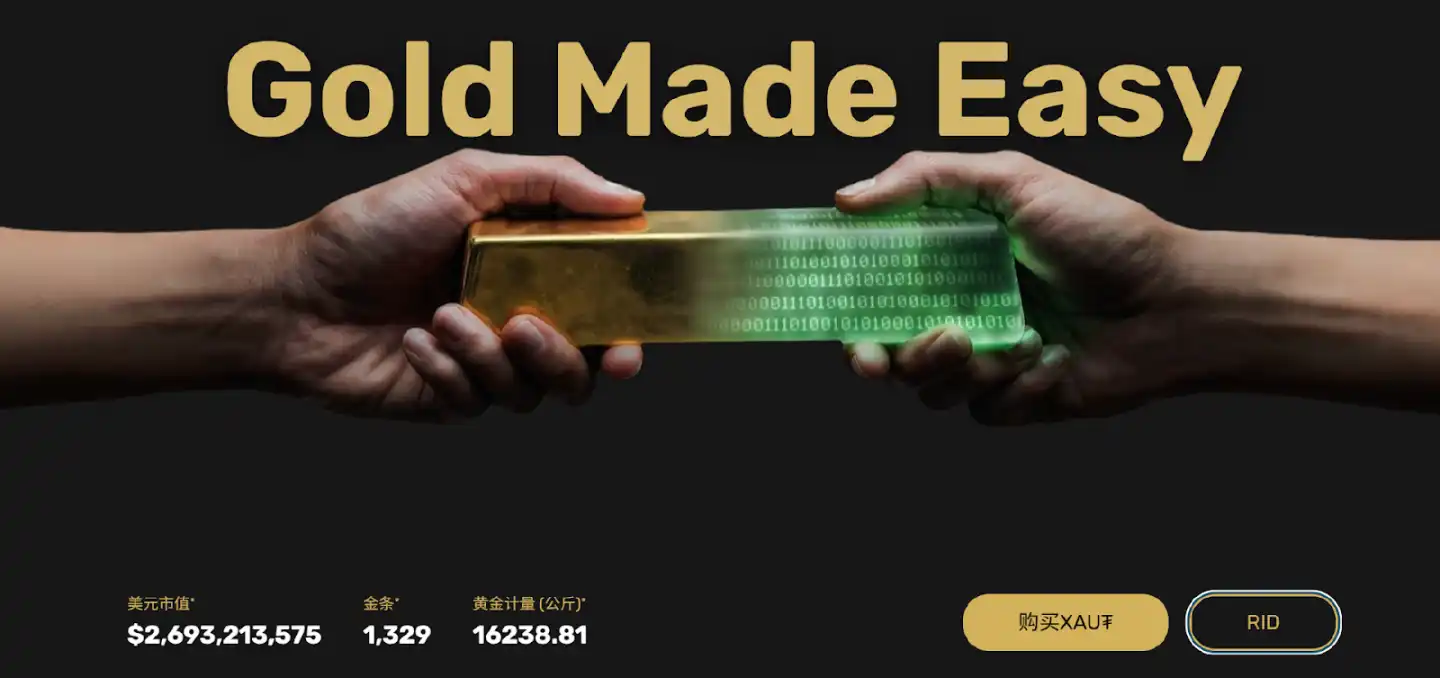

As of the time of writing, the total issuance of XAUt is approximately $2.7 billion, representing the physical reserve of about 1,329 gold bars (totaling 16,238.4 kilograms).

Source: Tether

Interestingly, Tether CEO Paolo Ardoino publicly stated that Tether plans to allocate 10% to 15% of its investment portfolio to physical gold in the future, currently purchasing about one to two tons of gold per week, and intends to continue doing so, aiming for long-term, stable access to gold supply.

According to Bloomberg's calculations, in the last year alone, Tether purchased over 70 tons of new gold to supplement its reserves and support its gold stablecoin issuance. Combining this with Tether's disclosed financial data for the first three quarters of 2025:

Its annual profit is estimated to be nearly $15 billion, with current gold and Bitcoin reserve sizes of approximately $12.9 billion and $9.9 billion, respectively, accounting for about 13% of its total reserves. To reach the 10%-15% target, Tether would need to purchase at least an additional $2-3 billion, effectively doubling the current XAUt规模!

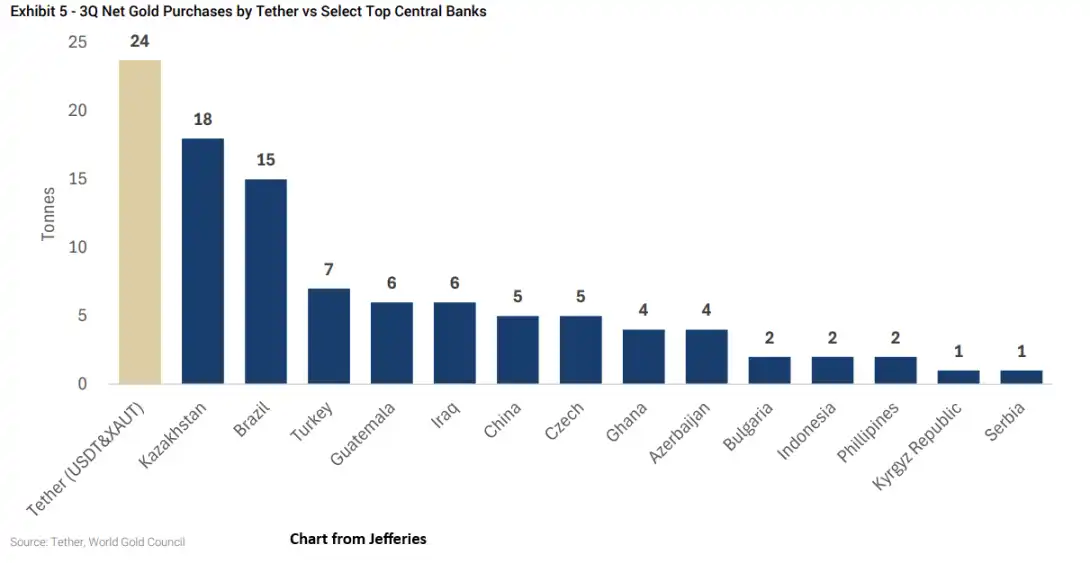

This is why some institutions have begun to view Tether as an unignorable "marginal super buyer" in the gold market. Research from Jefferies shows that in the second quarter, Tether's gold purchases accounted for about 14% of central banks'同期 purchases, and this proportion remained around 12% in the third quarter. It can be said that the timing of the second round of gold price increases高度 coincided with the acceleration of Tether's gold purchasing节奏.

Considering Tether's current strong profitability and the resilience shown by its stablecoin business amid recent crypto market volatility, this gold purchasing target is not激进 from a financial perspective.

Source: Wall Street News

III. How to View Gold-Backed Stablecoins?

Of course, the multi-trillion-dollar market for investment-grade tokenization of gold is far from being a pie that only Tether wants a piece of.

Over the years, several companies have尝试 to provide on-chain representations of gold ownership, including Digix's率先 launched DGX, a stablecoin collateralized by physical gold. Each DGX is backed by 1 gram of LBMA-certified gold bars with 99.99% purity, minted by authoritative companies and stored in The Safe House vault in Singapore.

In addition, there is another more well-known product, PAXG. In 2019, Paxos Trust Company launched PAXG, a gold token approved by the New York Department of Financial Services (NYDFS), also built on the Ethereum ERC-20 protocol. Each PAXG represents one troy ounce of a standard delivery gold bar stored in a professional vault in London.

Paxos users can redeem PAXG for fiat currency, non-bearer gold, or directly redeem physical gold bars, and can随时 query the serial number, brand, weight, and purity of the corresponding gold bar through their on-chain address.

From a product design perspective, the common goal of these gold-backed stablecoins is clear: to make gold more divisible, more liquid, and more aligned with the usage habits of the digital asset era.

However, unlike dollar stablecoins, the value logic of gold stablecoins is more complex. Because the core proposition of stablecoins is built on the demand for fully collateralized, instantly redeemable digital dollars; whereas gold stablecoins inevitably联动 with the cyclical fluctuations of the crypto market itself.

Therefore, when stablecoin demand changes急剧 due to market sentiment or liquidity conditions, this pressure could theoretically传导 to its underlying asset-liability structure—and now, part of that is a real and sizable gold reserve.

Especially as players like Tether hold more and more reserves, is this new narrative a digital rebirth for gold, or is it introducing additional volatility factors to gold?

Perhaps this is one of the issues worth pondering for every holder.