Quick Facts:

- ➡️ Reports say a Bithumb employee mistakenly distributed 2,000 $BTC, triggering a brief ~10% $BTC price dislocation on that exchange versus others.

- ➡️ Bitcoin remains volatile near ~$66K today, and operational mishaps can amplify spread widening, liquidity stress, and confidence-driven selling.

- ➡️ Infrastructure narratives tend to strengthen in chaotic markets because users prioritize fast execution, low fees, and predictable settlement paths.

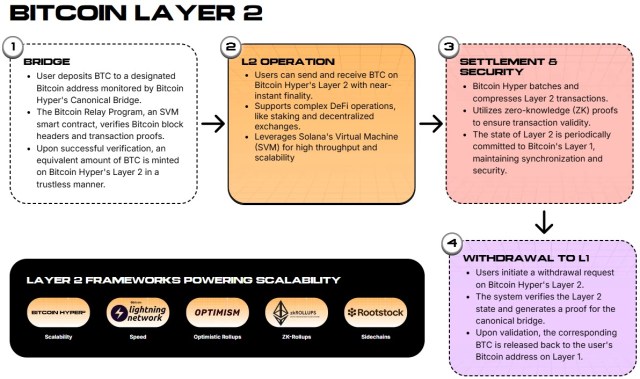

- ➡️ Bitcoin Hyper positions itself as a Bitcoin Layer 2 with SVM execution to enable faster smart contracts and higher-throughput Bitcoin-adjacent apps.

A fresh shock just hit the crypto trading ‘trust layer.’

Reports circulating on Feb. 6, 2026, indicate employees at South Korea’s Bithumb mistakenly distributed 2,000 $BTC to hundreds of user accounts, apparently sending actual Bitcoin instead of a planned 2,000 KRW reward. Oops.

The immediate reaction wasn’t a global collapse, but a localized dislocation. Bitcoin’s price on Bithumb briefly traded ~10% below other venues as users scrambled and liquidity fragmented.

That highlights a reality most coverage misses: in stressed moments, execution and settlement mechanics become the trade. Not narratives.

If a venue glitches, even temporarily, traders start pricing in withdrawal risk, reversal risk, and ‘will my funds move when I need them to?’ anxiety. That’s when spreads widen, arbitrage gets messy, and confidence becomes as valuable as liquidity.

The backdrop is already fragile. Bitcoin is sitting around $66K today per CoinMarketCap, reflecting elevated volatility and a market still nursing drawdowns from late-2025 highs. Traders watching this setup will notice that in this kind of tape, operational mishaps don’t stay isolated, they become accelerants.

That’s exactly why the market keeps rotating back to infrastructure: faster execution, cheaper transactions, and fewer bottlenecks. That rotation is where Bitcoin Hyper ($HYPER) starts to look less like a speculative side quest and more like a ‘what if Bitcoin actually moved like a modern chain?’ bet.

Buy $HYPER here now.

Bitcoin Hyper Brings SVM-Speed Execution To Bitcoin Rails

The Bithumb episode is a stark reminder that users don’t just want number-go-up, they want reliable movement of value when things get chaotic. Bitcoin still settles like Bitcoin: secure, but slow and fee-variable during congestion.

The second-order effect? Simple. When UX breaks down at the venue layer, people look for alternatives that make using $BTC feel less like waiting and more like transacting.

That’s the pitch behind Bitcoin Hyper. As Bitcoin’s ‘fastest L2 ever’, Bitcoin Hyper presents itself as a modular design where Bitcoin L1 handles settlement and a real-time SVM Layer 2 handles execution.

The goal? Extremely low-latency processing and low-cost transactions. The technical hook is the Solana Virtual Machine (SVM) integration, allowing it to support fast smart contracts while staying anchored to Bitcoin’s settlement guarantees.

The more interesting angle is developer gravity. By leaning into Rust tooling plus an SDK/API approach, Bitcoin Hyper essentially says: ‘Don’t wait for Bitcoin to become programmable, build high-throughput DeFi, payments, NFTs, and gaming on an execution layer designed for it.’

In a market where confidence is routinely stress-tested (sometimes by pure operational slapstick), infrastructure narratives can turn sticky fast.

Learn more about $HYPER here.

$HYPER Presale Gains Traction As Whales Accumulate

In a risk-off stretch, presales only work when they attach to a clear market need.

Bitcoin Hyper ($HYPER) attempts this by framing Bitcoin’s biggest constraints, slow transactions, higher fees under load, and limited programmability, as an addressable infrastructure gap.

According to the official presale page, Bitcoin Hyper has raised $31.2M, with tokens currently priced at $0.013672.

Those aren’t small numbers for a market still digesting volatility in majors. (It suggests capital is still hunting asymmetric exposure, just more selectively.)

Practically, that signals some large buyers are willing to take presale exposure despite choppy macro and the ongoing “exchange risk” headlines. The risk, of course, is that whale buys aren’t always fundamentals, often just positioning.

On staking, the project advertises high APY (without publishing a specific rate). The key detail is structural: staking is planned to be immediate after TGE, with a 7-day vesting period for presale stakers, and rewards tied to community/governance participation.

That’s designed to encourage post-launch stickiness rather than pure flip behavior, though token emissions and real yield sustainability are always the caveat with any APY-forward pitch.

If the market stays volatile, traders will keep paying up for two things: speed and certainty. Bitcoin Hyper is aiming at both—on Bitcoin’s doorstep.

Visit the $HYPER presale now.

This article is not financial advice; crypto is volatile, presales are risky, and operational/security or regulatory events can change outcomes fast.