Auteur|Azuma(@azuma_eth)

Le principal protocole de prêt, Aave, est actuellement au cœur d'une tempête médiatique. Les tensions entre l'équipe et la communauté ne cessent de s'aggraver, ce qui affecte objectivement la confiance des détenteurs de jetons envers le jeton AAVE lui-même.

Tôt ce matin, la deuxième plus grosse baleine détentrice d'AAVE (hors équipe projet, contrats du protocole et CEX) a vendu à perte 230 000 AAVE (d'une valeur d'environ 38 millions de dollars), provoquant une chute de 12 % du cours d'AAVE sur le court terme. Selon les informations, ce « deuxième plus gros détenteur » avait acheté ses AAVE entre fin de l'année dernière et début de cette année à un prix moyen de 223,4 dollars. Le prix de vente à perte aujourd'hui était d'environ 165 dollars, entraînant une perte finale de 13,45 millions de dollars.

- Note d'Odaily : L'adresse de cette baleine est https://debank.com/profile/0xa923b13270f8622b5d5960634200dc4302b7611e.

Origine de l'incident : La controverse sur le flux des frais

Pour comprendre la crise communautaire actuelle d'Aave, il faut remonter à une modification récente de l'interface frontale d'Aave.

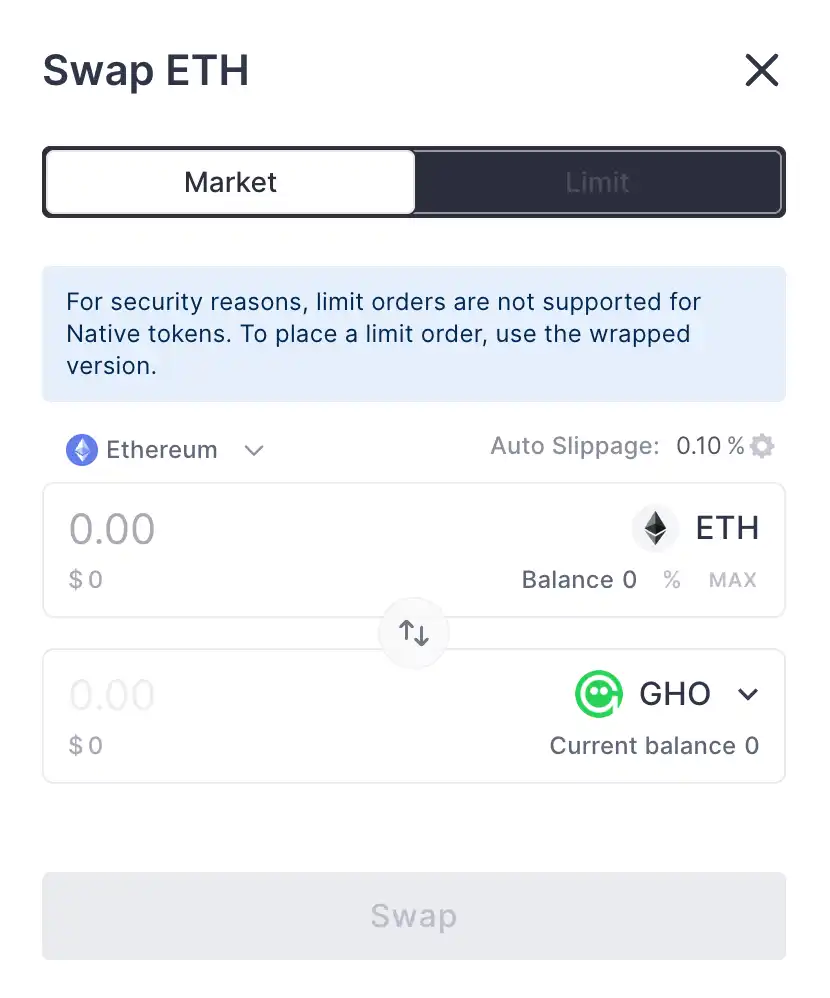

Le 4 décembre, Aave a annoncé un partenariat avec Cow Swap, adoptant ce dernier comme chemin de transaction par défaut pour la fonction d'échange de son interface frontale (Note d'Odaily : auparavant, c'était ParaSwap), afin d'obtenir de meilleures estimations grâce à sa fonctionnalité anti-MEV.

Bien que cela semblait être une mise à niveau fonctionnelle normale, la communauté a rapidement découvert qu'auparavant, lorsque ParaSwap était utilisé, les frais supplémentaires générés par cette fonctionnalité (incluant les frais de référence ou les surplus de slippage positif) étaient destinés à aller au trésor du DAO d'Aave, mais après le passage à Cow Swap, ils ont été redirigés vers l'adresse d'Aave Labs.

Le représentant de la communauté EzR3aL a été le premier à découvrir ce changement, non mentionné activement par Aave. Il a interrogé l'équipe d'Aave sur le forum de gouvernance et a estimé, en se basant sur le suivi des flux de revenus d'Aave sur Ethereum et Arbitrum, que ces frais devraient générer environ 200 000 dollars de revenus par semaine, ce qui correspond à un revenu annualisé de plus de 10 millions de dollars — cela signifie qu'Aave a, presque sans que personne ne le sache, transféré au moins dix millions de dollars de revenus de l'adresse communautaire vers l'adresse de l'équipe.

Controverse centrale : À qui appartient vraiment la marque Aave ?

Avec la popularisation du post d'EzR3aL, de nombreux détenteurs d'AAVE se sont sentis trahis, d'autant plus qu'Aave n'a pas communiqué avec la communauté sur ce changement et ne l'a divulgué nulle part, ce qui suggère une intention de dissimuler cette modification.

Face aux interrogations de la communauté, Aave Labs a répondu directement sous le post d'EzR3aL en affirmant qu'il devait y avoir une distinction claire entre la couche protocole et la couche produit. L'interface frontale d'Aave et sa fonction d'échange sont entièrement exploitées par Aave Labs, qui est responsable des investissements, de la construction et de la maintenance. Cette fonctionnalité est totalement indépendante du protocole géré par le DAO, donc Aave Labs a le droit de décider de manière autonome comment l'exploiter et en tirer des revenus......Les revenus qui étaient auparavant versés à l'adresse du DAO d'Aave étaient un don d'Aave Labs, mais pas une obligation.

En bref, la position d'Aave Labs est que l'interface frontale d'Aave et ses fonctionnalités附属 relèvent essentiellement d'un produit de l'équipe, et les revenus qu'ils génèrent devraient donc être considérés comme des actifs de l'entreprise, et non confondus avec le protocole contrôlé par le DAO et ses revenus associés.

Cette déclaration a rapidement suscité un vif débat au sein de la communauté sur la question de l'appartenance du protocole et des produits Aave. Un analyste DeFi知名 a écrit un article intitulé « Who Owns 'Aave': Aave Labs vs Aave DAO » (À qui appartient vraiment Aave ? : Aave Labs vs Aave DAO), dont Odaily Planet Daily a publié une traduction en chinois ; les personnes intéressées peuvent la lire comme complément.

Le 16 décembre, les tensions se sont encore aggravées. L'ancien CTO d'Aave, Ernesto Boado, a soumis une proposition sur le forum de gouvernance demandant que le contrôle des actifs de la marque Aave (y compris le nom de domaine, les comptes sociaux, les droits de dénomination, etc.) soit transféré aux détenteurs de jetons AAVE. Les actifs concernés seraient gérés par une entité contrôlée par le DAO (dont la forme spécifique sera déterminée ultérieurement), avec la mise en place de mécanismes stricts de protection contre l'appropriation.

La proposition a été lue près de dix mille fois sur le forum de gouvernance d'Aave et a reçu des centaines de réponses de qualité. Les différentes parties prenantes de l'écosystème Aave ont pris position en commentant cette proposition. Bien que certaines voix aient estimé que la proposition n'était pas assez aboutie et risquait d'exacerber les tensions, la majorité des réponses ont exprimé leur soutien.

Le fondateur prend position, mais la communauté n'est pas convaincue

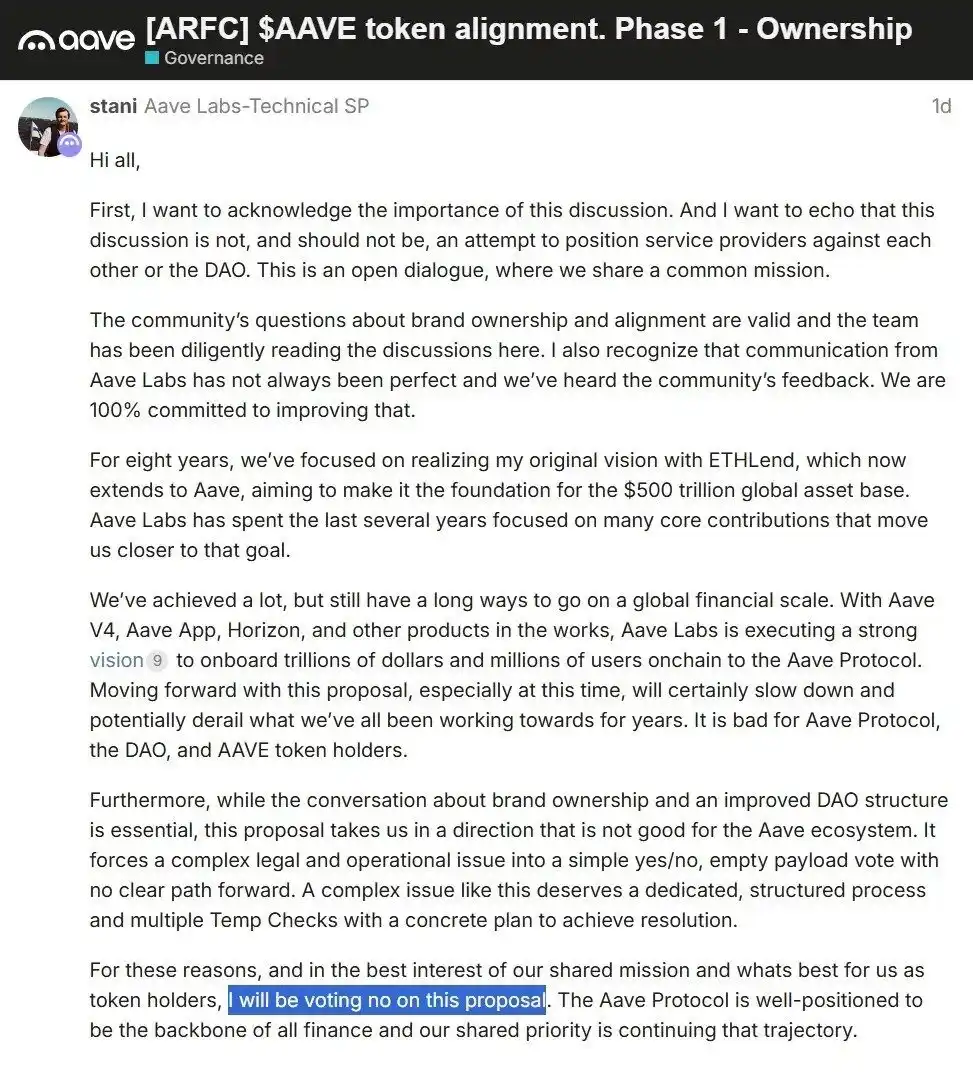

Alors que les tensions communautaires montaient, le fondateur d'Aave, Stani, est intervenu sur le forum pour répondre : « ...... Cette proposition nous oriente dans une direction préjudiciable à l'écosystème Aave. Elle tente de réduire une question juridique et opérationnelle complexe à un simple vote "oui/non", sans fournir de feuille de route claire pour sa mise en œuvre. Pour traiter une question aussi complexe, il faudrait utiliser un processus structuré spécialement conçu, avec de multiples vérifications ponctuelles et des solutions concrètes pour parvenir à un consensus. Pour ces raisons, je voterai contre cette proposition...... »

D'un point de vue commercial, l'affirmation de Stani selon laquelle la proposition est trop hâtive n'est peut-être pas erronée, mais dans le climat actuel de discussion, cette prise de position peut facilement être interprétée comme "le fondateur d'Aave refuse de transférer les actifs de la marque aux détenteurs de jetons", ce qui a visiblement accru les tensions entre la communauté et l'équipe.

Après la déclaration de Stani, des commentaires agressifs à son encontre sont même apparus sous le post original. De plus en plus d'utilisateurs ont exprimé leur mécontentement via le forum ou les réseaux sociaux. Un utilisateur OG a mentionné que c'était la première fois qu'il envisageait de vendre tous ses AAVE, et un fidèle partisan d'AAVE a déclaré : « Les détenteurs d'AAVE devraient réaliser qu'il ne s'agit finalement que d'un jeton DeFi de plus sans valeur. Il n'est ni meilleur ni pire que les autres. »

Et la dernière dynamique communautaire est celle mentionnée en introduction : le deuxième plus gros détenteur a vendu à perte, encaissant une perte de plusieurs millions de dollars.

AAVE est-il toujours un bon investissement ?

Il y a à peine deux semaines, Odaily Planet Daily avait écrit un article intitulé « Que voient donc les smart money qui achètent frénétiquement AAVE à bas prix ? ». À l'époque, AAVE était encore le favori de fonds institutionnels de premier plan comme Multicoin Capital, sa réputation de marque de qualité, ses fonds déposés importants, sa feuille de route claire d'expansion, ses revenus solides et ses rachats de jetons prouvaient tous qu'AAVE était un "jeton à valeur réelle", différent des autres altcoins.

Mais en deux semaines à peine, une crise médiatique, allant de la question de l'appartenance des frais à celle du contrôle de la marque en passant par les relations entre l'équipe et la communauté, a rapidement propulsé AAVE au centre des controverses, le faisant même atterrir en tête des baisses à court terme sous l'effet du choc émotionnel.

Au moment de la rédaction de cet article, Aave Labs a indiqué sous la proposition d'Ernesto avoir lancé un vote snapshot ARFC concernant cette proposition, permettant aux détenteurs de jetons AAVE d'exprimer officiellement leur position afin de clarifier l'orientation future. Le résultat de ce vote ainsi que l'attitude de l'équipe d'Aave Labs dans le traitement ultérieur influenceront inévitablement dans une large mesure la conviction communautaire autour d'Aave et la performance des prix d'AAVE à court terme.

Il est important de souligner que cet événement n'est pas une simple "mauvaise nouvelle" ou un "changement de performance", mais un interrogatoire concentré sur la structure de gouvernance existante d'Aave et les limites des droits.

Si vous croyez qu'Aave Labs restera aligné avec Aave DAO sur les intérêts à long terme, et que les frictions actuelles sont davantage une erreur de communication et de processus, alors le repli des prix, dicté par l'émotion, est peut-être une bonne fenêtre d'entrée ; mais si vous pensez que cette controverse révèle non pas un problème ponctuel, mais une contradiction structurelle où les droits entre l'équipe et le protocole sont flous depuis longtemps et manquent de contraintes institutionnelles, alors cette tempête n'est peut-être qu'un début.

D'un point de vue plus macro, la controverse d'Aave n'est pas un cas isolé. Lorsque la DeFi arrive à maturité, que les revenus des protocoles deviennent réels et substantiels, et que la marque et l'interface frontale commencent à avoir une valeur commerciale, certaines contradictions structurelles entre le protocole et le produit, l'équipe et la communauté, refont surface. Aave se trouve cette fois sous les projecteurs, non pas parce qu'il a plus tort, mais parce qu'il est allé plus loin.

Ce débat sur les frais, la marque et le contrôle doit apporter des réponses bien au-delà d'AAVE ; c'est une question inévitable à laquelle tout l'écosystème DeFi devra tôt ou tard faire face.