Charles Hoskinson says a Circle-issued stablecoin product is headed to Cardano after what he described as “deep negotiations” between Circle and a Cardano-aligned negotiating group known as the Pentad (Input Output (IOHK), EMURGO, Cardano Foundation, Midnight Foundation, and Intersect). Speaking from Fukuoka on his Japan tour livestream titled “Circle and Pentad,” Hoskinson framed the deal as a long-awaited step toward bringing “tier one” stablecoin liquidity into Cardano’s DeFi stack.

USDCX To Launch On Cardano After Deal Signed

Hoskinson said the agreement is signed and positioned the integration as near-term rather than aspirational. “This is not something that’s six months out, ink is on paper, deal is signed,” he said, adding that integration work should happen “in short order.” The pitch is that Cardano gains access to Circle’s distribution rails and liquidity network, while developers can build around a familiar dollar asset without needing bespoke plumbing for every application.

What’s coming, per Hoskinson, is “USDCX,” which he described as effectively the same asset as USDC but deployed through a model Circle uses for non-EVM chains. “USDCX is basically same asset and how it works is there’s a one-to-one reserve,” he said. “So for the non-EV chains like Stacks and others there’s a mirroring effect that occurs [...] and then it’s easy through their network to access the same liquidity as USDC. So effectively it’s what we need.”

In Hoskinson’s telling, the practical implication is straightforward: Cardano users and applications get stablecoin functionality tied into Circle’s broader liquidity environment, without waiting for a native issuance path that has been a recurring community demand. “People were asking for a long, long time to get a tier one stable coin to Cardano,” he said. “This is how you do it and now we’re here. So we have access to Circle’s network, Circle’s protocol, Circle’s technology and the great liquidity of the Circle network as a whole.”

Hoskinson also emphasized what he called privacy benefits in the “USDCX” design, though he did not specify implementation details on the stream beyond noting “the added privacy benefits of USDCX and all the technologies therein.” He praised Circle as a counterparty, calling them “consummate professionals” and “tough negotiator[s],” and credited the Pentad for representing Cardano’s interests across the talks.

A key operational question for Cardano’s DeFi market is how quickly the asset becomes usable across the app layer and centralized exchange rails. Hoskinson acknowledged that distribution is not automatic just because a deal is signed.

“We have to make sure that we get USDCX integrated into all of the Cardano applications and so there’s a seamless user experience and a seamless user experience with exchanges so you can go from USDC and back without any additional steps or work,” he said, characterizing the remaining work as “a little bit more integration on our side,” but “not too much.”

He argued that Circle’s prior work on other non-EVM deployments should compress timelines. “That’s one of the advantages of this new USDCX is fast integration time,” Hoskinson said. “It doesn’t require a ton of custom work to get working with Cardano because they’ve already done these types of things with Stacks.”

The announcement lands against a backdrop Hoskinson described as poor market conditions and sour sentiment, which he suggested has fueled skepticism around Cardano partnerships more broadly. In a longer aside, he pushed back on the idea that integrations like these are perpetually “maybe” milestones.

“I do know that there are certain people that are skeptical [...] ‘Well, maybe [it] will come, maybe not. Who knows? We’ll wait and see,’” Hoskinson said. “I don’t know how else to convey than signing the deal, doing the integration work [...] but I understand that the skepticism comes from the market sentiment at the end of the day.”

Circle and Pentad https://t.co/qSfF1D7bcM

— Charles Hoskinson (@IOHK_Charles) January 30, 2026

Hoskinson used the same segment to reiterate that Cardano’s roadmap and partner strategy remains the controllable variable, even if macro headlines and political noise aren’t. “All we have agency over is what we build, who we partner with, and our strategy as a whole,” he said, before citing ongoing efforts including Leios, Hydra, Pentad’s integration push, and Midnight.

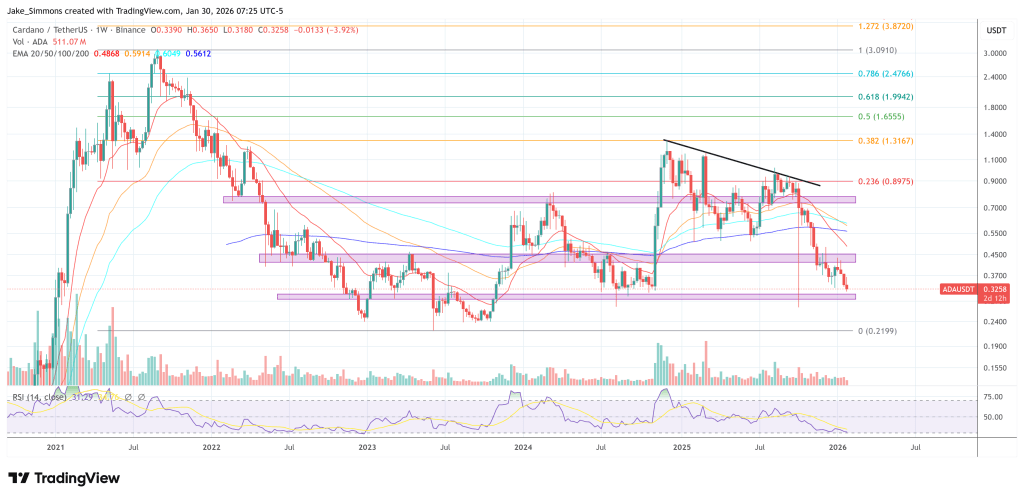

At press time, ADA traded at $0.3258.