The XRP Ledger (XRPL) closed 2025 with real progress on smart contracts, interoperability, and tokenization, but builders say 2026 needs to focus on removing user friction, improving DEX liquidity, and funding apps that can scale beyond the core community.

What The XRP Ledger Achieved In 2025

XRPL dUNL validator Vet said 2025 was “great” across several areas, led by smart contracts reaching an environment developers can actively test. “Smart Contracts, lots of development to get the alpha test net out — you can deploy and play around with it today,” Vet wrote. “A lot more community awareness.” The implication is straightforward: the work is no longer purely theoretical, and the ecosystem can start converting curiosity into actual deployments.

DeFi, however, did not maintain its earlier pace. Vet wrote that XRP DeFi “came strong out of 2024 with meme coins,” but “activity dried out over the year.” Even so, he argued the floor is higher than before: “DEX baseline activity is higher than before,” he wrote, describing 2026 as an opportunity to “build it out” into something more durable.

XRP Ledger 2025 was great in all of these areas.

– Smart Contracts, lots of development to get the alpha test net out – you can deploy and play around with it today. A lot more community awareness.

– XRP DeFi came strong out of 2024 with meme coins, activity dried out over the... https://t.co/jJViTdWqYL

— Vet (@Vet_X0) December 29, 2025

On interoperability, Vet highlighted a year of shipping. “Interoperability wise we got Wormhole going live, Axelar live + bridged yield bearing issued assets to the XRPL,” he wrote. He also pointed to a possible technical direction for the next phase: “ZKP looks like an enabler for trust minimized bridging,” suggesting zero-knowledge proofs could reduce reliance on trust-heavy bridge designs.

XRPL’s app layer improved, but without a breakout winner. “The existing projects and wallets on the XRPL doubled down a lot,” Vet wrote. “More polished, new features and integrations. No new app that took over the community though.” That matters because UX improvements help retention, but major growth typically follows a flagship product that creates its own gravity.

Tokenization was another bright spot, with Vet calling it “very strong with RLUSD,” alongside “smaller launches of other stables and tokenized funds.” Still, he flagged distribution as a bottleneck: “Distribution channels of those assets is still something we have to work on,” he wrote, tying it directly to the health of DeFi and applications. Issuance alone is not enough; assets need liquidity, integrations, and pathways into end-user products.

What Must Improve In 2026

Anodos Finance co-founder and CEO Panos Mekras used a post to lay out what he wants to see next year, arguing that XRPL has to prioritize both infrastructure and incentives.

“Seeing Batch transactions and sponsored fees/reserves live as soon as possible, which are crucial for removing friction and mass consumer onboarding,” Panos wrote. “More quality assets coming to XRPL, especially RWAs: yield-bearing stablecoins, tokenized stocks, commodities. A serious incentive and grant program finally happening, @XRPLF stepping up with real resources for builders, better dev tools, funding killer consumer apps and use cases that can bring millions to XRPL.”

My top 3 wishes for the XRPL ecosystem in 2026

1. Seeing Batch transactions and sponsored fees/reserves live as soon as possible, which are crucial for removing friction and mass consumer onboarding.

2. More quality assets coming to XRPL, especially RWAs: yield-bearing...

— Panos 🔼🇬🇷 (@panosmek) December 29, 2025

Vet responded: “i agree with all 3 wishes.” Panos also called out DEX/AMM liquidity as “a serious issue,” framing it as a practical constraint on growth rather than an abstract metric.

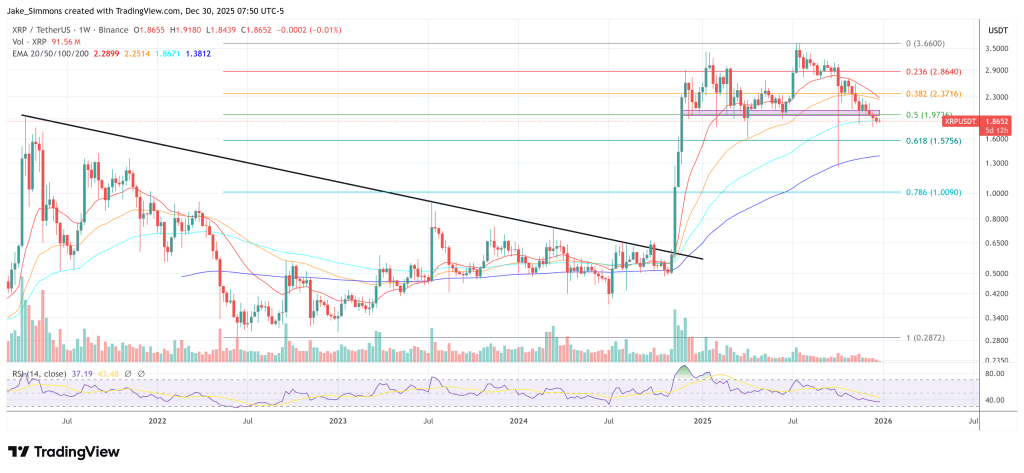

At press time, XRP traded at $1.86.