With the Bitcoin price steadily trading sideways over the past few weeks, determining a buying entry has become extremely difficult. However, a key on-chain metric is now in the spotlight, providing valuable insights into the matter and allowing investors to pinpoint when to re-enter the market.

Is Buying Bitcoin Now The Right Time?

The ongoing volatility across the broader cryptocurrency market has capped Bitcoin’s upside attempts, keeping it well below the $70,000 mark. In this unfavorable environment, investors and traders are watching closely for a definitive signal like a price bottom before they can reenter the market.

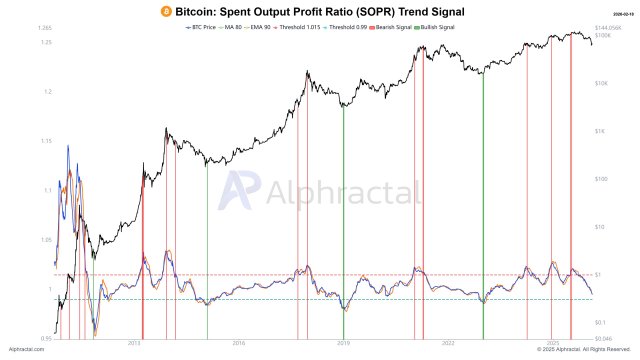

While investors ponder reentering the market, Joao Wedson, a market expert and founder of Alphractal, has published a chart that suggests that now is not the ideal time. After a period of bearish action, Bitcoin’s on-chain metrics are beginning to display signs of stabilization. However, a definitive buy signal has yet to emerge from the waning price performance.

The sole metric here is the Bitcoin Spent Output Profit Ratio (SOPR) Trend Signal. Currently, this metric is on a downward trend, indicating that market players are either taking lesser profits on their transactions or experiencing losses more frequently. However, for a confirmed bottom signal to occur, it must drop further below the lower dotted line on the chart, and a crossover between the metrics must take place.

Even with pockets of accumulation and recent price consolidation, the indicator that has historically signaled significant market bottoms has not been activated. Meanwhile, the expert claims that it is possible that a price bottom earlier than in past market cycles, when compared to the time often needed.

Furthermore, it is possible there may be multiple purchase signals, one for the upcoming months and another for a later stage of the cycle. In the meantime, Wedson has declared that the best strategy for reacting to the current market state is to continue monitoring the Alpha metrics.

BTC Latent Profits Are Fading

Following an analysis of the Bitcoin Net Unrealized Profit/Loss (NUPL), Darkfost discloses that latent profits are melting away as BTC’s correction expands. The metric is an effective measure for gauging the weight of profits and losses in the market and offers a clear view of the market when it reaches bearish levels.

Currently, the metric has fallen to 0.18, and a drop into negative territory signals that latent losses dominate the market, typically marking the last phase of capitulation. This positioning implies that the average latest profit is 18%, nearing 0. Meanwhile, the six-month average is positioned at 0.42, which shows how fast these corrections have grown, pushing the NUPL down rapidly.

When the metric falls this quickly and reaches such levels, it is a sign that Bitcoin is still in a bear phase. With reduced latent profits, investors become unstable. Darkfost stated that a trend reversal under these circumstances seems difficult and will take some time to materialize.