Executive director of the President’s Council of Advisors for Digital Assets Patrick Witt said US officials are actively examining how Venezuela’s Maduro regime was financed, including whether any value sits in Bitcoin and “digital assets,” as speculation mounted earlier this month that recent Venezuela-linked actions may have surfaced a large Bitcoin cache. The comments stop short of confirming any seizure, but they place Bitcoin explicitly inside an ongoing national-security review.

White House Adviser Confirms Bitcoin Investigation

In a CoinDesk interview on Tuesday, Witt was asked whether digital assets were seized and what the US might do with them. Witt declined to provide specifics, citing the sensitivity of the situation, but described an interagency effort scrutinizing potential funding sources tied to the regime.

“Obviously, developing situation down there, still working through it, a lot of national security equities there,” Witt said. “So folks are talking, they’re looking at the situation overall, how the Maduro regime was financed and where some of those assets, whether it’s on the oil side, actual physical commodities or digital assets maybe. So I can’t comment on anything there as of now, but there’s a number of folks in the national security apparatus engaged and looking into that.”

The key takeaway for markets is procedural rather than tactical: Witt did not validate any claim that bitcoin or other tokens were seized, but he did confirm that crypto is being considered alongside commodity-linked value as investigators map financing channels.

The White House caution comes against a viral claim that Venezuela may control more than 600,000 BTC, an assertion amplified by a widely circulated Whale Hunting / Project Brazen newsletter by Bradley Hope and Clara Preve. That piece framed the idea as a thesis driven by intelligence sourcing and circumstantial financial logic, not on-chain attribution.

Subsequent on-chain analysis has emphasized the gap between the headline number and what blockchain analysts can actually prove. DL News reported that forensics firms “have struggled to find any Bitcoin at all held by the regime,” citing Arkham and TRM Labs as saying they had not identified holdings at the scale being claimed.

Skepticism has also centered on the lack of traceable starting points. Fortune quoted Nansen principal research analyst Aurelie Barthere saying the Project Brazen report “does not mention any addresses as a starting point, making it difficult to verify” the speculation.

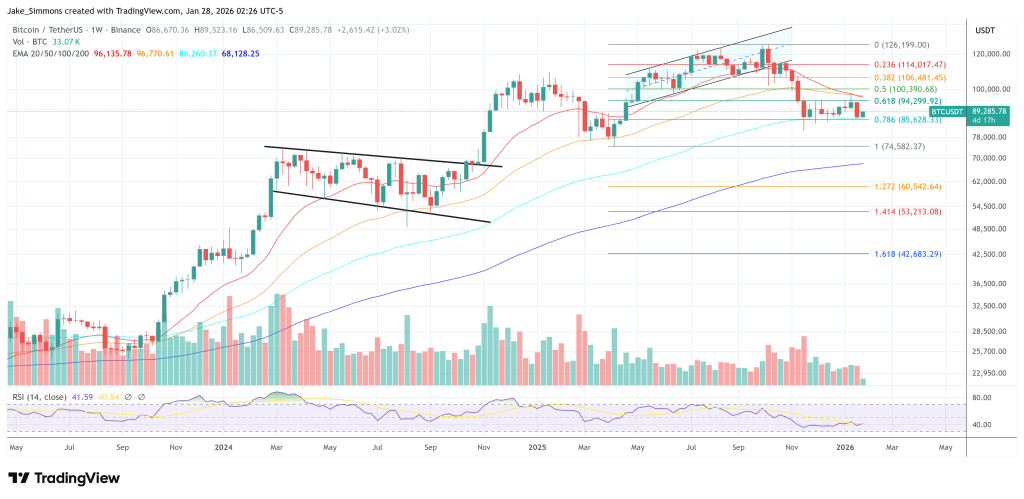

At press time, Bitcoin traded at $89,285.