Quick Facts:

- ➡️ Bitcoin is consolidating under $70k; technicals suggest a breakout toward $85k-$100k if resistance at $72.5k clears.

- ➡️ The primary downside risk is losing the $60k support, which could trigger a liquidation cascade toward $52k.

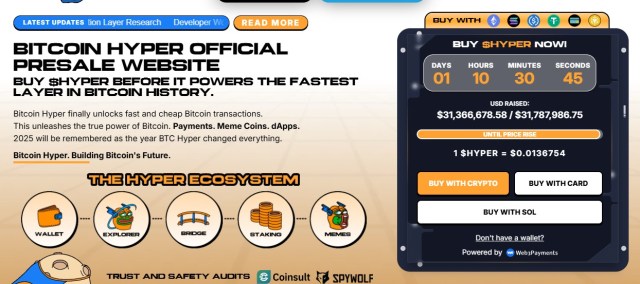

- ➡️ Bitcoin Hyper uses the Solana Virtual Machine (SVM) to bring high-speed smart contracts to Bitcoin, raising over $31M in early capital.

- ➡️ On-chain metrics show accumulation, but low volume on current rallies warrants caution regarding potential fake-outs.

Bitcoin is currently engaged in a tense standoff with the psychological $70,000 barrier, a ceiling that has held firm for weeks.

The market is witnessing a classic consolidation pattern: volatility compressing, leverage flushing, and price trading in a tight range. Historically, this quiet precedes a violent move. While retail traders grow impatient with the chop, on-chain data tells a different story beneath the surface.

The main culprit for this hesitation? A messy mix of macroeconomic ambiguity and short-term profit-taking. Yet, the macro thesis remains solid. With institutional ETF flows providing a soft floor and global liquidity cycles turning, the math favors a breakout. The question isn’t if Bitcoin breaks higher, but when the post-halving supply shock finally dries up the available liquidity on exchanges.

This compression phase forces capital to make a choice. While Bitcoin prepares for its next leg up, risk-tolerant capital is already rotating. Traders looking to maximize the coming cycle are hedging spot holdings with high-beta infrastructure plays.

That rotation suggests that while Bitcoin targets a conservative 2x, emerging protocols like Bitcoin Hyper ($HYPER) are capturing attention (and liquidity) for their potential to fix Bitcoin’s scaling issues before the bull market truly heats up.

Learn more about $HYPER here.

Technical Outlook: The Path to $100K Requires a Clean Break

Despite the immediate resistance at $70,000, Bitcoin’s high-timeframe structure remains aggressively bullish.

Analysts are eyeing the convergence of the 50-day and 200-day moving averages, a setup that historically signals trend continuation rather than reversal. Plus, the Relative Strength Index (RSI) has reset from overbought territory. That gives the asset room to run without overheating.

For the bulls to win, Bitcoin needs to reclaim the $72,500 level with real volume. A daily close above that zone would invalidate the bearish divergence and open a path toward price discovery.

Most technical models project that once $74,000 clears, the psychological vacuum pulls price rapidly toward the $85,000–$90,000 range. Consensus suggests a breakout here puts the $100,000 milestone in play by late Q3, fueled by corporate treasury adoption and ETF rebalancing.

However, risks remain. If the $60,000 support fails during a macro shakeout, the structure weakens significantly.

- Bull Case: A high-volume breach of $72,000 targets $88,000 in the medium term.

- Base Case: Another 2-3 weeks of chop between $64,000 and $71,000.

- Invalidation: A weekly close below $58,500 signals a deeper correction is needed to find liquidity.

Watch spot volume on Coinbase closely. If price pushes up while volume drops? It’s likely a fake-out.

Smart Money Rotates to Bitcoin Hyper ($HYPER) for L2 Utility

As Bitcoin battles resistance, sophisticated investors are looking at the rails that will power the network’s future. The focus is shifting toward Bitcoin Hyper ($HYPER), the first Bitcoin Layer 2 integrating the Solana Virtual Machine (SVM).

While Bitcoin serves as pristine collateral, digital gold, it’s frankly too slow and expensive for DeFi. Bitcoin Hyper solves this by anchoring to Bitcoin for security while using SVM for high-speed execution.

The market’s appetite is clear. According to the official presale page, Bitcoin Hyper has raised $31.3M, with tokens currently priced at $0.0136754. That capital inflow suggests strong conviction in the ‘Bitcoin DeFi’ narrative.

By allowing developers to write in Rust and deploy dApps that settle on Bitcoin, the project bridges the gap between Bitcoin’s $1.3 trillion liquidity and modern functionality.

Whale activity backs this up. Etherscan records show that 3 whale wallets alone have accumulated $1M. The largest transaction, a $500K buy, occurred on Jan 15, 2026. (Note: Large-scale buy orders during a presale usually indicate institutional due diligence is finished).

Still, caution is necessary. Layer 2 protocols are high-risk environments subject to execution hurdles. While the promise of high APY staking and a Decentralized Canonical Bridge is appealing, $HYPER remains a beta play on the ecosystem’s expansion.

Buy $HYPER here.

This article is not financial advice. Cryptocurrencies are volatile assets. The content provided is for informational purposes only. Your should conduct your own independent research and consult with financial professionals before making any investment decisions.