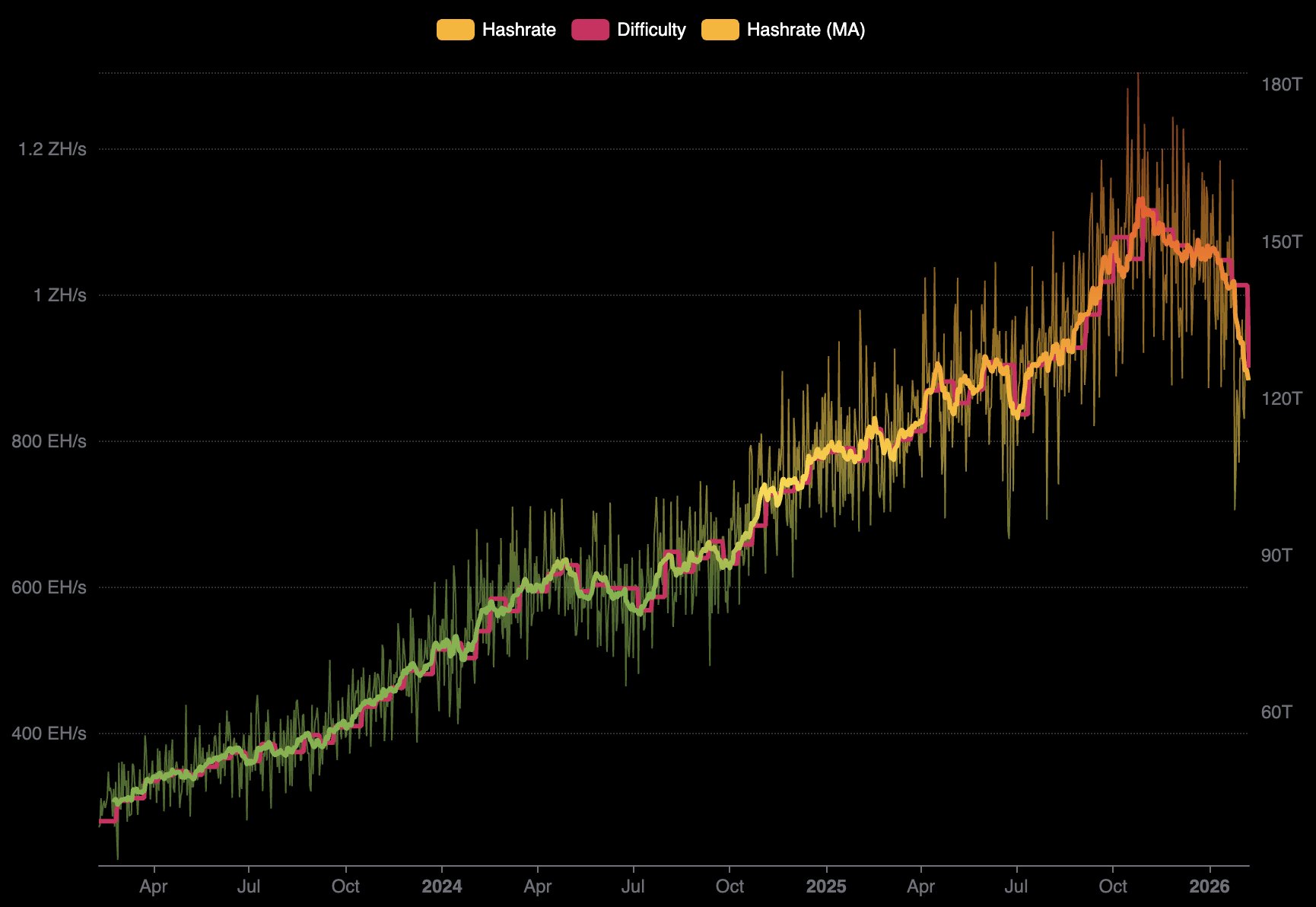

Recent data shows that the Bitcoin mining difficulty has experienced a major decline in the last day. This development follows significant bearish price struggles in the past week, which saw Bitcoin fall by an aggregate 11%.

Bitcoin Mining Difficulty Records Historic Fall Since China’s Crackdown

The mining difficulty, as the name implies, measures how hard it is for miners to solve the mathematical problem required to add a new block to the Bitcoin blockchain. Therefore, a rise in difficulty suggests that mining is challenging for the average network node and vice versa.

Generally, the Bitcoin network adjusts this metric every 2,016 blocks (approximately two weeks). According to the developer mononaut, Bitcoin recorded an 11.6% drop in mining difficulty over the past 24 hours, representing the largest single adjustment since China’s ban and the tenth largest negative adjustment of all time.

In 2021, the Asian nation issued a prohibitive order against all forms of Bitcoin mining activities within its borders, effectively eliminating over half of the global hashrate. In line, mining difficulty also crashed, dropping the participation barrier for new miners.

According to more data shared by mononaut, the Bitcoin mining difficulty now stands at 125.86T after the recent decline, which kicked in at block 935,429.

Mining Difficulty Crash Reflects Harsh Price Environment

While a fall in Bitcoin mining indicates an increased ease in mining activity, it also suggests a surge in miner capitulation, i.e., where miners become unprofitable and shut down. This is usually due to energy cost spikes, a regulatory crackdown like in China, or market crashes, as recently seen. Notably, Bitcoin prices recorded an initial loss of 28% in February’s opening week, to trade as low as $60,000 before rebounding to $70,000. Therefore, it’s likely this latest correction pushed many miners into a heavy loss position.

However, it’s worth noting that Bitcoin’s difficulty adjustment is a self-sustaining mechanism designed to ensure new blocks are continuously mined regardless of how many miners are participating. In addition, a new influx of miners is expected, considering the most recent negative adjustment, thus raising no cause for alarm.

Meanwhile, data from MARA Holdings’ disclosure in Q3, 2025, indicated the average Bitcoin mining cost to be at $67,704. According to Julio Moreno, Head of CryptoQuant, most Bitcoin mining companies are likely in steep losses at present market prices and are expected to increase selling activity, contributing to the recent miner flight. At press time, Bitcoin trades at $69,357 after a 1.71% loss in the past day.