Bitcoin (BTC) Price Trend and Investor Sentiment Suggest a Bullish December

A new bullish Bitcoin trend is challenging the decade-long bearish seasonal pattern. Will Bitcoin hit a new high by the end of 2025?

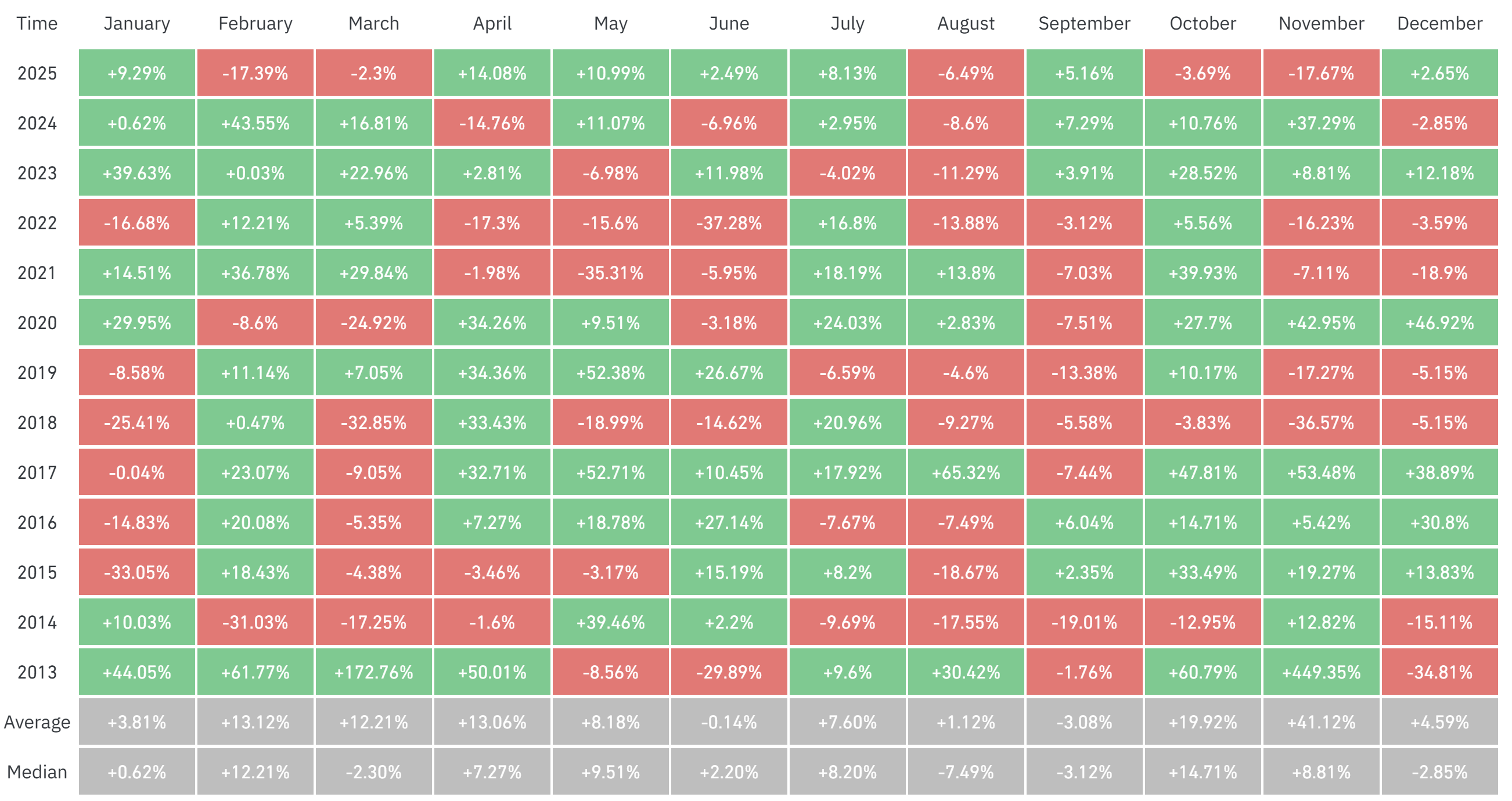

Bitcoin (BTC) enters the new month facing a statistical hurdle it has never overcome: whenever November closes with a loss, December struggles to turn bullish. However, this year's market structure is starkly different from the past, with momentum, liquidity rotation, and cyclical biases collectively offsetting the once-constant 100% bearish seasonal pattern.

Key Takeaways:

Bitcoin's bearish December period may change due to reduced leverage and price recovery of key technical levels, hinting at a more stable setup.

Macroeconomic liquidity and M2 velocity are diverging from Bitcoin's buying activity, which typically occurs in the mid-bull market.

Bitcoin's cycle structure has evolved, with spot ETF inflows and global liquidity dynamics altering the traditional halving cycle.

Seasonal Breakthrough and Bitcoin's Cyclical Bias Case

Bitcoin's long-term fourth-quarter returns exhibit strong seasonality, typically weakening in December after a negative performance. However, the market structure in 2025 has already diverged to some extent from past cycles.

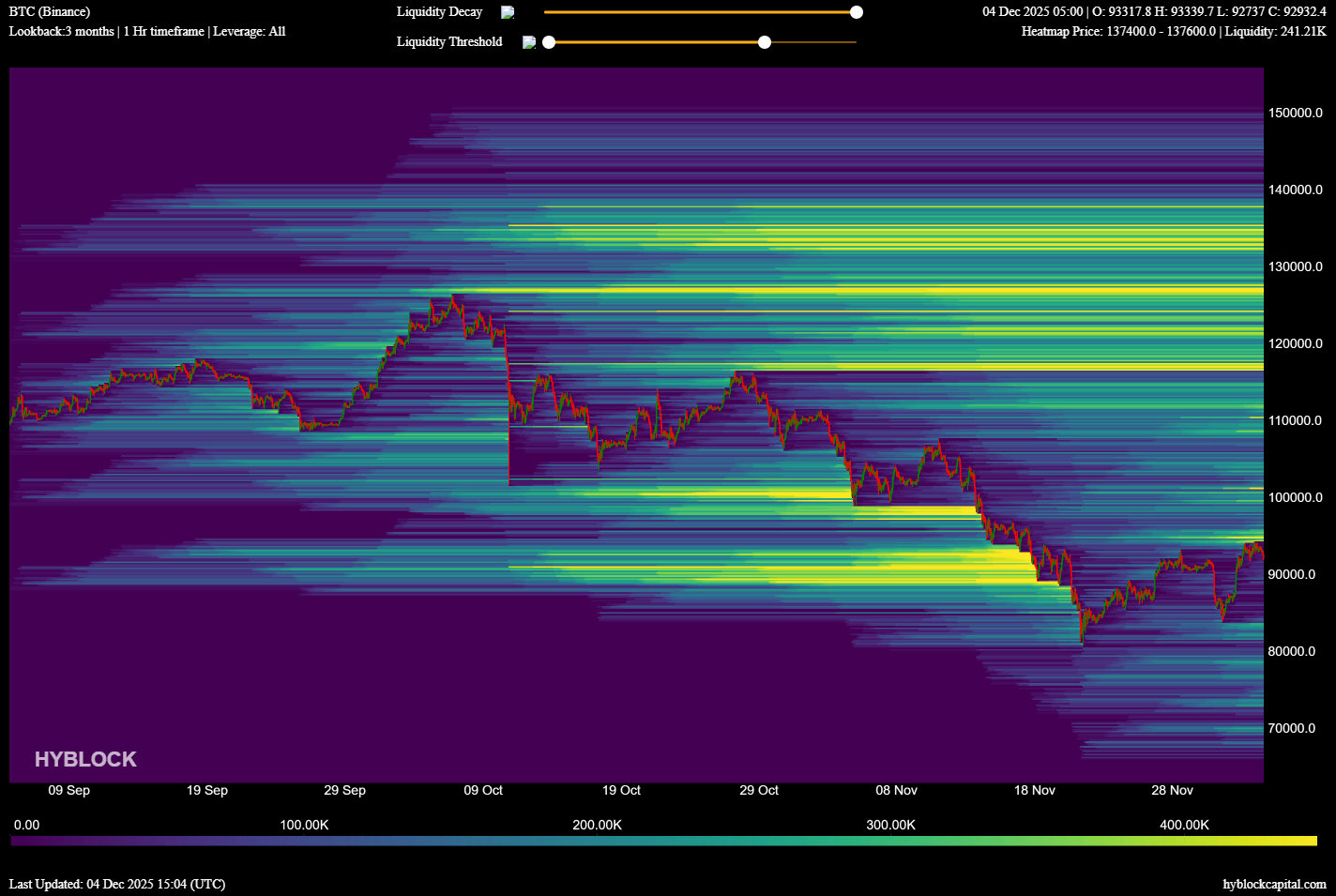

Bitcoin's price has rebounded above its monthly rolling volume-weighted average price (rVWAP) level, showing controlled distribution and high-timeframe trend absorption. Open interest in futures contracts has dropped significantly from $94 billion to $60 billion, and without suppressing spot inflows, the market is normalizing or resetting, creating a clearer foundation for continued gains.

From a technical perspective, the deep liquidity cluster has shifted from November's downward liquidation, with a total of about $1 billion approaching $80,000, moving towards an upward cluster with lower efficiency. Currently, the $3 billion short position size will be liquidated at $96,000, with over $7 billion once Bitcoin reaches $100,000.

Therefore, these factors indeed suggest that December may be misjudged compared to its historical probability curve.

However, the current momentum may be deceptive. Cointelegraph pointed out that the buy-sell ratio is near 1.17, showing urgency rather than depth, and often occurs during overcrowded positions. Market analyst EndGame Macro stated that this reflects aggressive buying but not necessarily sustainable accumulation.

Meanwhile, M2 velocity has stabilized, indicating that even if risk assets continue to rise, the broader economic engine may be losing momentum. This creates a typical late-cycle setup, with a noisy market and a sluggish underlying economy.

Against this backdrop, Bitcoin is attempting to achieve its first green December after a negative November, becoming a test of whether positioning can outweigh broader market fundamentals.

Breaking the Traditional Halving Timeline

In recent months, analysts have pointed out that Bitcoin's four-year cycle is insufficient to fully explain BTC's current market structure. Crypto analyst Michaël van de Poppe noted that the four-year cycle has not disappeared but is no longer aligned with time-based expectations.

Spot BTC ETF inflows have introduced a constant structural buy order, accelerating price discovery and raising Bitcoin's effective floor price, similar to early cycles.

Van de Poppe believes this cycle resembles an extended liquidity phase, similar to mid-2016 or late 2019, when despite uneven macroeconomic data, risk assets remained strong.

Supporting indicators, such as the correlation between CNY/USD and ETH/BTC, typically rise early in the expansion window rather than near market cycle peaks.

At the same time, business cycle signals, such as the Purchasing Managers' Index (PMI), are gradually improving, and gold's relative strength indicates that risk appetite is rebuilding from cyclical lows rather than weakening. Van de Poppe added,

"Now, if we combine the strength of the business cycle with the Bitcoin cycle, the correlation is obvious. This phase is similar to Q1/2 2016, Q4 2019. We are far from Bitcoin's top; we are still in the final easy phase of cryptocurrency, with rich returns."

In this context, Bitcoin's December setup no longer relies on repeating historical seasonality but more on new forces such as spot ETF inflows, liquidity rotation, and changing macroeconomic correlations, whether it can surpass the older halving-driven cycle.

Related recommendation: Poland resubmits the encryption bill, the content remains almost unchanged

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, readers should conduct their own research when making a decision. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements subject to risks and uncertainties. Cointelegraph is not responsible for any loss or damage resulting from reliance on this information.