ASIC биткоин-майнеры – машины, оптимизированные исключительно для добычи биткоина - в настоящее время продаются по ценам, которых не было с 2020 и 2021 годов.

⠀

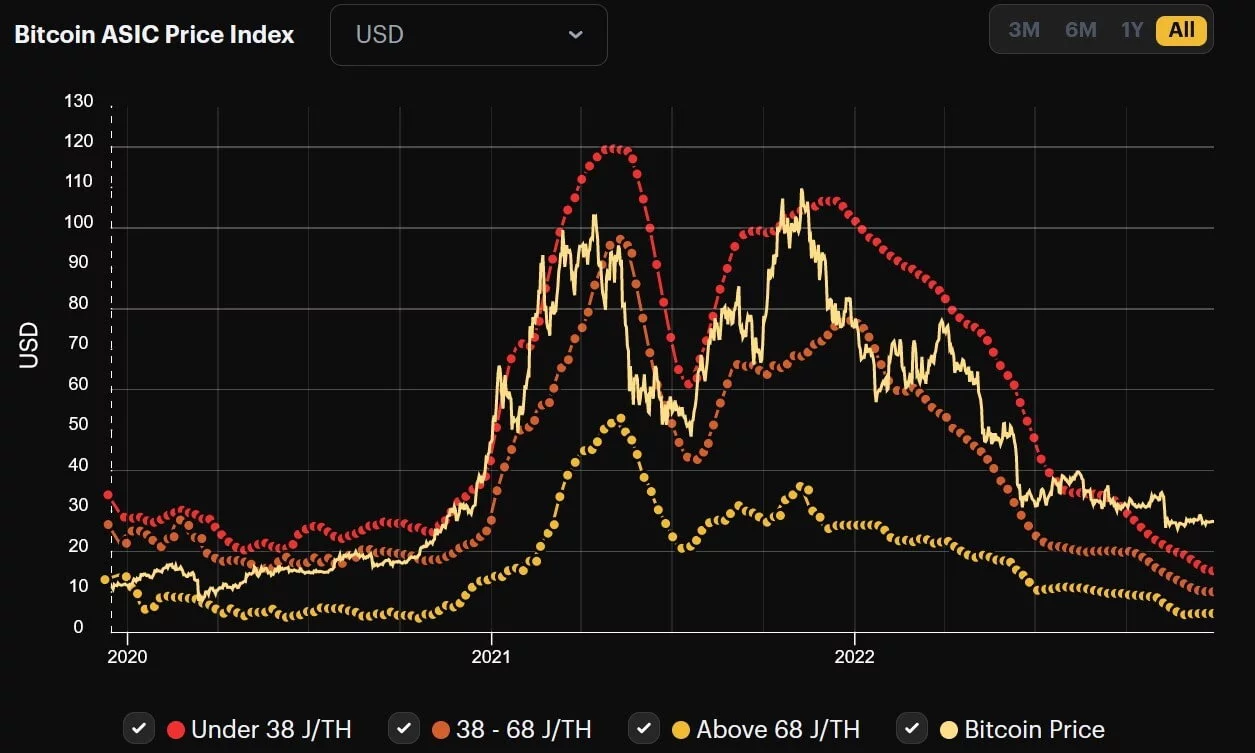

Согласно последним данным Hashrate Index, цены на самые эффективные ASIC-майнеры, мощностью не менее одного терахеша на 38 джоулей энергии, упали на 86,82% с пикового значения, зафиксированного 7 мая 2021 года: с $119,25 за терахэш до $15,71 по состоянию на 25 декабря.

⠀

К майнерам этой категории относятся Antminer S19 от Bitmain и Whatsminer M30s от MicroBTC.

⠀

То же самое можно сказать и о машинах среднего уровня: цены на них сейчас в среднем составляют $10,23 за терахэш. С пиковой значения в $96,24 7 мая 2021 года цена упала на на 89,36%.

⠀

При этом, для наименее эффективных машин, расходующих более 68 Дж на 1 терахэш вычислительной мощности, падение цены за терахэш составило 91% - $52,85 до $4,72. Последний раз цена была близка к этой отметке 5 ноября 2020 года.

⠀

Индекс цен на ASIC биткоина-майнеры для машин с разным уровнем эффективности. Источник: Hashrate Index.

⠀

Падение цен в значительной степени связано с проблемами у крупных майнинговых компаний, которые борются за сохранение прибыльности на протяжении всего медвежьего тренда на рынке криптовалют. Многие из них либо подали заявление о банкротстве, либо взяли на себя долговые обязательства, либо продали свои запасы BTC и оборудование, чтобы остаться на плаву.

⠀

К числу таких компаний относятся Core Scientific, Marathon Digital, Riot Blockchain, Bitfarms и Argo Blockchain.

⠀

Однако, такое резкое падение цен вызвало интерес у некоторых покупателей. Среди них многие майнинговые предприятия из России, такие как BitRiver, которые работают в плюс за счёт выгодных условий на размещение мощностей, поскольку стоимость электроэнергии в стране гораздо ниже, чем во многих регионах мира. На некоторых современных аппаратных средствах майнеры из России способны добывать один биткойн (BTC) по цене около $0,07 за киловатт-час.

⠀

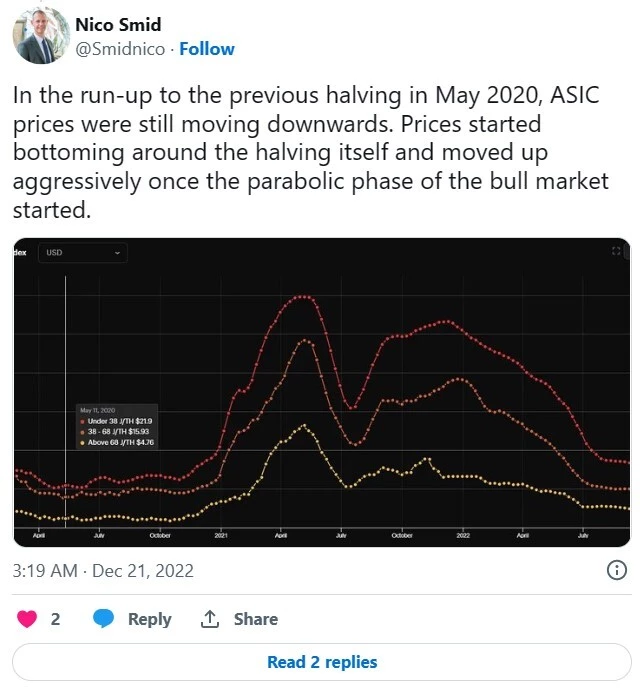

Хотя трудно предсказать, в каком направлении будут двигаться цены на ASIC-майнеры дальше, Нико Смид из Digital Mining Solutions отметил в своем твите от 21 декабря, что цены на ASIC-майнеры достигли дна во время последнего халвинга биткоина 11 мая 2020 года и вскоре после этого активно пошли вверх. Подобный сценарий может повториться во время следующего халвинга, который, как ожидается, произойдет 20 апреля 2024 года.

⠀

Источник: @Smidnico/Twitter

⠀

«В преддверии предыдущего халвинга в мае 2020 года цены на ASIC-майнеры стремились вниз. Они достигли дна около самого халвинга и активно пошли вверх, когда рынок перешёл к бычьей стадии параболического роста».

⠀

Автор: Brayden Lindrea. Источник: Cointelegraph.