原创 | Odaily 星球日报

作者|jk

原标题|Token2049最大的瓜:飞机偷拍曝光币圈出轨

全球最大的加密货币行业会议之一的 Token 2049 刚刚落幕,但一场意外的“感情风波”却在社区和推特上掀起了轩然大波。事件来自一起发生在万米高空的"取证事件",导致一对加密圈情侣分手。截止发稿,相关帖文浏览量突破 660 万次,几乎比所有的 Token 2049 的项目新闻浏览量都要高。毫无疑问,这已成本届 Token 2049 最具戏剧性的场外新闻。

事件始于 10 月 3 日,推特用户 Kate (@katexbt) 在从新加坡 Token 2049 返程的航班上,无意中目睹了邻座乘客的手机屏幕。这位坐在 15 F 座位的乘客名叫 Chris,是加密货币行业的从业者,而他手机上显示的聊天内容引起了 Kate 的注意。

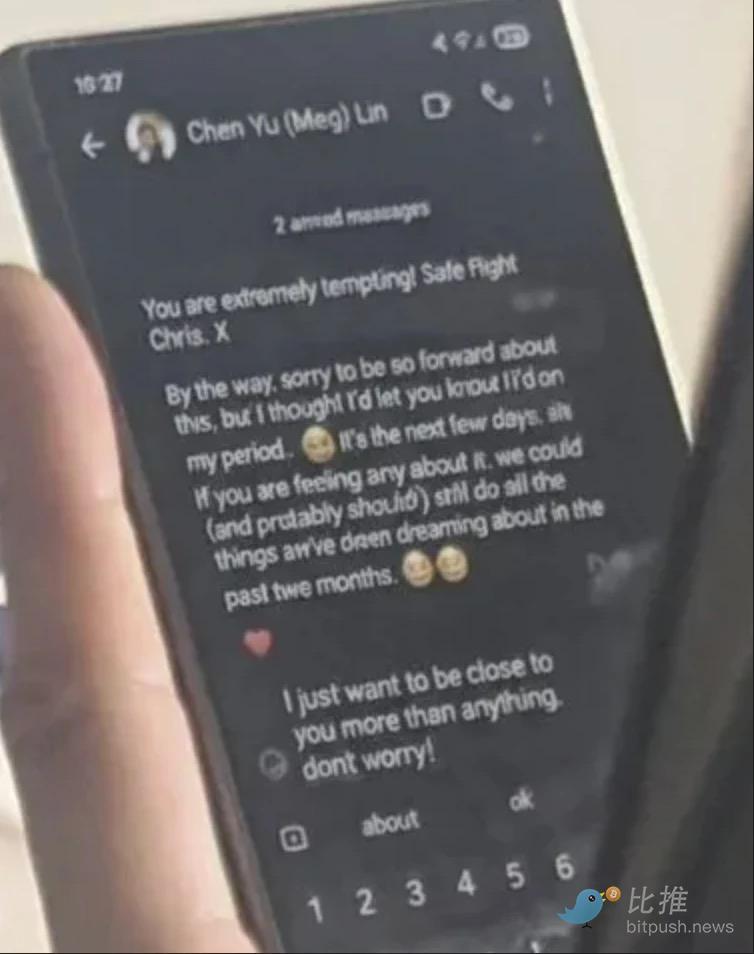

聊天记录显示,Chris 正在与一位女性进行颇为暧昧的对话。女生在消息中写道:"你太诱人了!祝你航程顺利,Chris。顺便说一句,抱歉这么直接,但我想让你知道我正在生理期……已经是最后几天了……如果你对此没问题的话,我们还是可以(也许应该?)做一些我们过去两个月一直梦想的事情。

Chris 被 Kate 发现的时候正在打字回复:“我只是想尽可能离你近一点,别担心。”(I just want to be close to you more than anything, don’t worry)。

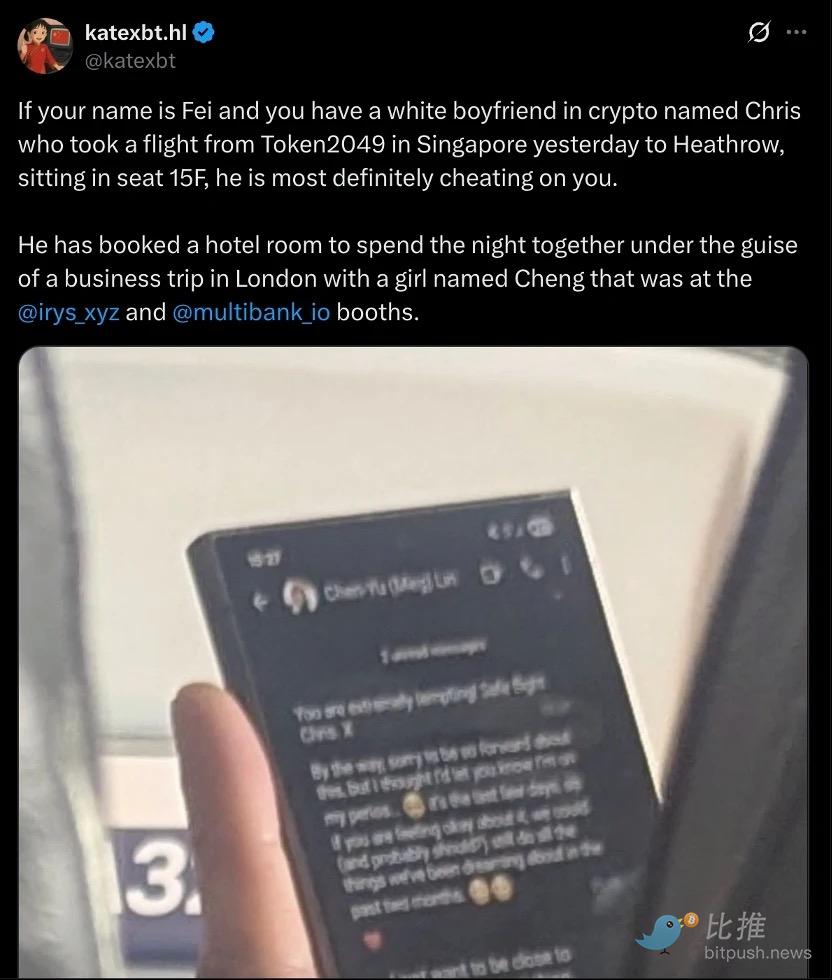

Kate 随即发帖曝光此事,并附上了详细信息:"如果你的名字叫 Fei,你有一个在加密货币圈名叫 Chris 的白人男友,他昨天从新加坡 Token 2049 坐飞机到伦敦希思罗机场,坐在 15 F 座位,那他肯定在出轨。他预订了酒店房间,打算以伦敦商务出差为借口,和一个在@irys_xyz 和@multibank_io 展台遇见的名叫 Cheng 的女孩共度一晚。"

这条帖子迅速在加密社区病毒式传播。数据显示,该帖在短短两天获得了 400 万次浏览、44.4 万次互动、超过 9.7 万次详情展开,以及 2.8 万次个人资料访问。Kate 本人对流量之大也表示惊讶:"我也很意外。"

甚至有搞事的人在后面附上了屏幕上模糊的文字的增强清晰版,读者可以自行查看。

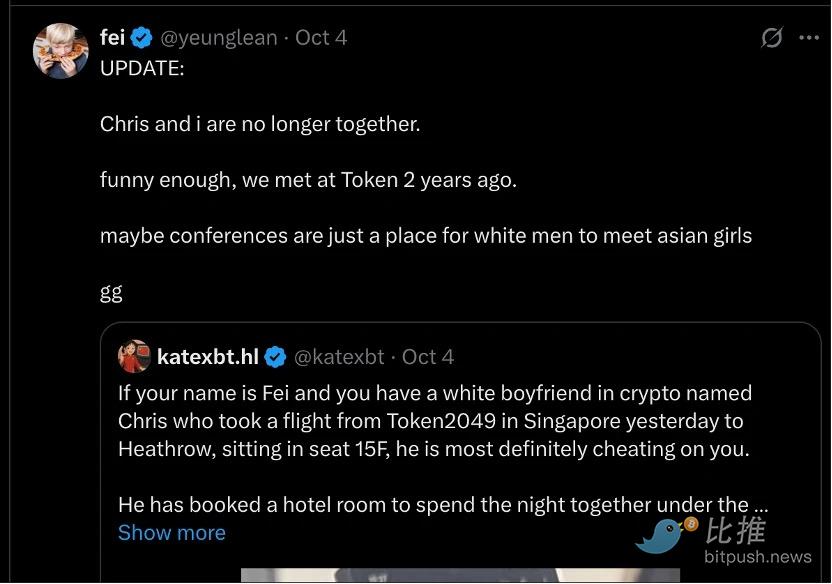

更戏剧性的是,Chris 的女友 Fei (@yeunglean) 当天就看到了这条帖子。同天,她发布分手声明:"更新:Chris 和我刚分手了。有趣的是,我们两年前在 Token 头一次认识;也许行业会议只是白男认识亚洲女孩的地方。gg(游戏结束)。"

该帖子同样获得了 540 万以上的热度。

加密社区对此事的反应可谓五花八门,既有同情支持,也不乏黑色幽默:

首先有相当多的人在指责 Kate,用别人的私事来获取流量。但同时,也有不少女性博主觉得 Kate 是在“主持公道”,“为被蒙在鼓里的女生伸张正义。”

当然也不乏一些神评论。

Irys 创始人 Josh Benaron 在 Kate 的帖子底下表达困惑:"谁是 Cheng?我觉得你搞错项目了。"由于 Kate 的帖子提到 Cheng 曾在 Irys 展台工作,Josh 听起来担心公司被卷入此事。Kate 随即澄清:"可能是与项目无关的人,不是她的错。别担心。爱 Irys。"

Wizard Of SoHo 调侃道:"这就是为什么你永远不要坐经济舱 ;)"Kate 回应:"说得对,大佬。"

用户 jazz (@degenjazz) 说:"卧槽啊 Cheng 是我女朋友",谁也不知道他是不是在开玩笑;

Joe Wong (@KhunJoe 5) 预测:"这可能是 Chris 最后一次 Token 2049 了,直到 2049 年。"Kate 简洁地回应:"真的。"

用户 celestineia 给出了直白的建议:"永远不要和在加密会议上遇到的男人约会。"

Ritesh (@Ritesh_Trades) 评价:"加密圈里的 Coldplay 时刻。"

(Odaily注:在美国波士顿 Gillette Stadium 举行的 Coldplay 演唱会上,Kiss Cam——亲吻镜头——捕捉到一对情侣拥抱的画面。当他们发现自己被投放到体育场大屏幕上时,女方立即用手遮脸,男方则完全躲开镜头。Coldplay 主唱 Chris Martin 还当场调侃:‘要么他们在搞外遇,要么就是非常害羞。’ 这对情侣后来被网友发现是科技公司 Astronomer 的 CEO Andy Byron 和该公司首席人力资源官 Kristin Cabot,两人都已婚且有孩子。视频在社交媒体上疯传,获得超过 3000 万次观看。最终 Andy Byron 辞去 CEO 职位,公司董事会也启动了正式调查。)

长期混加密圈的用户 Code (@CodeXBT) 则说:"你真是个链下 zachxbt(擅长追踪黑客事件的侦探)"。

无论如何,这场始于万米高空的"区块链式取证",以最透明、不可篡改的方式,在推特上留下了一笔永久记录。不管这次的取证到底是否程序正义,有多少争论,但事情的进程也同样无法回滚了。

只不过下一次,我们可能没有办法在 Token 2049 看到 Chris 了。

Twitter:https://twitter.com/BitpushNewsCN

比推 TG 交流群:https://t.me/BitPushCommunity

比推 TG 订阅: https://t.me/bitpush