Bitcoin’s on-chain data highlighted a sharp behavioral split. As volatility rose, retail panic selling accelerated amid deeper drawdown fears.

Consequently, short-term holders sold below cost, locking in losses and reflecting bearish sentiment. During this phase, Short-Term Holder (STH) supply in loss expanded, confirming capitulation.

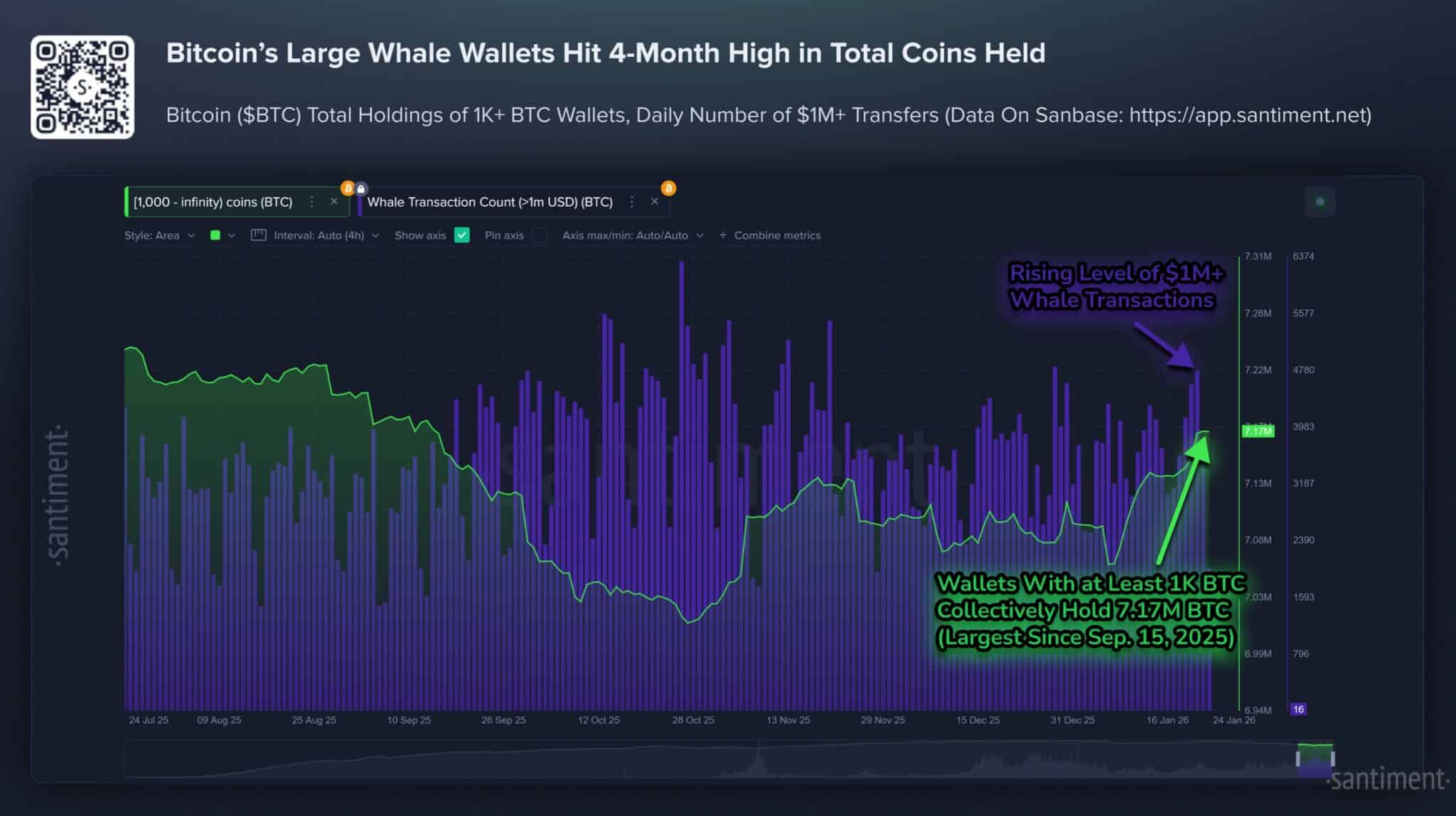

By contrast, whales accumulated steadily for several weeks. Wallets holding at least 1,000 BTC increased collective holdings by 104,340 BTC, a 1.5% rise.

That pushed total whale-held supply to 7.17 million BTC, marking a four-month high.

Meanwhile, over $1 million in daily transfers hit a two-month high, signaling active accumulation. This dynamic implies smart-money absorption as retail exits exhaust.

STHs capitulate as realized losses remain elevated

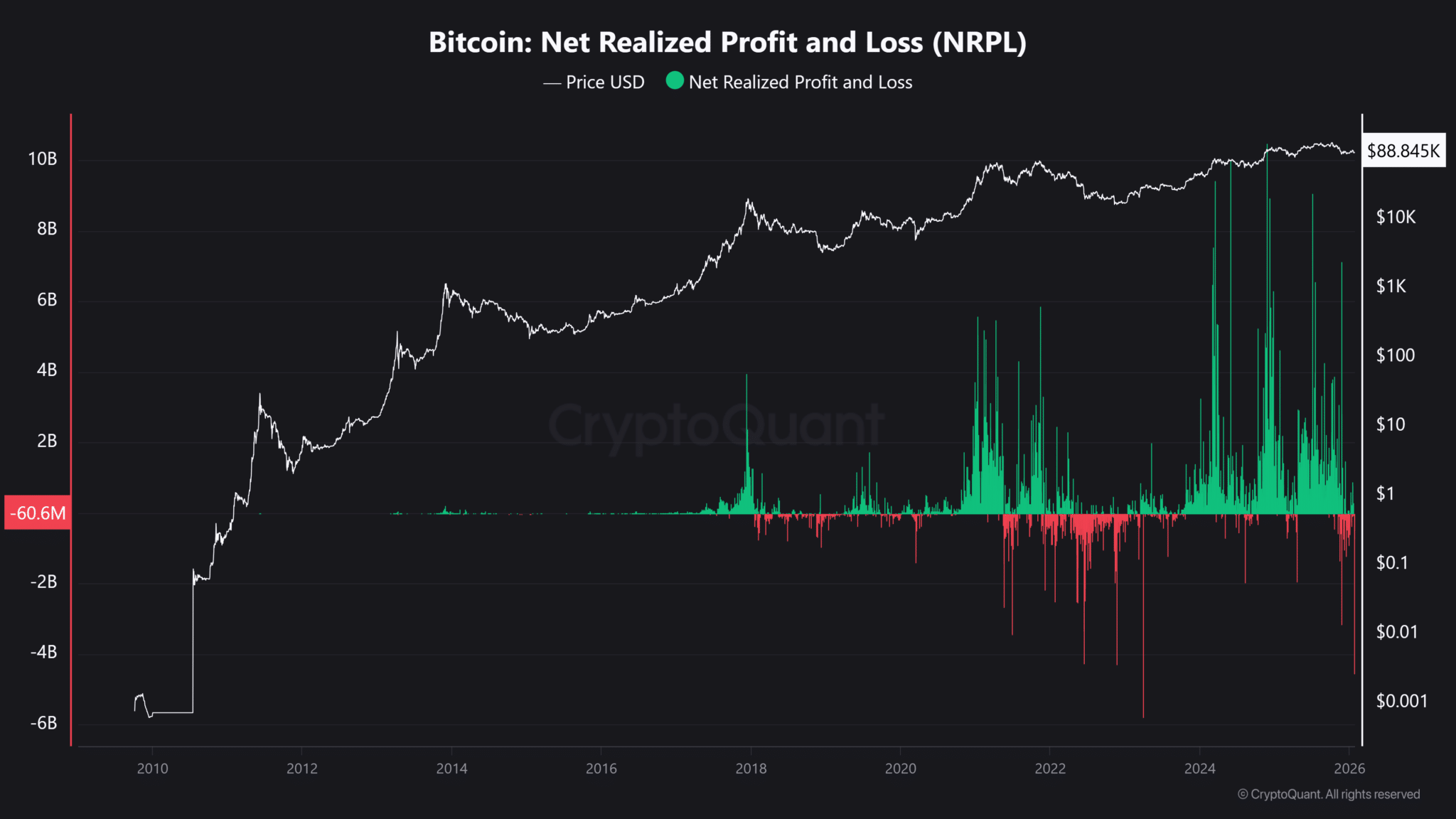

Bitcoin’s [BTC] Net Realized Profit and Loss analysis showed that the $4.5 billion realized loss did not occur in a single print but accumulated through repeated downside spikes.

This indicated prolonged stress rather than a single capitulation event.

As BTC price stalled near highs, distribution intensified. Consequently, losses expanded as short-term holders sold into drawdowns, driven by macro uncertainty, ETF outflows, and fading momentum.

Historically, similar NRPL flushes appeared in 2018, 2020, and late 2022. Notably, the last comparable event saw Bitcoin near $28,000, followed by a long basing phase.

These losses correlate with capitulation. Recovery typically emerges once selling exhausts and accumulation absorbs supply.

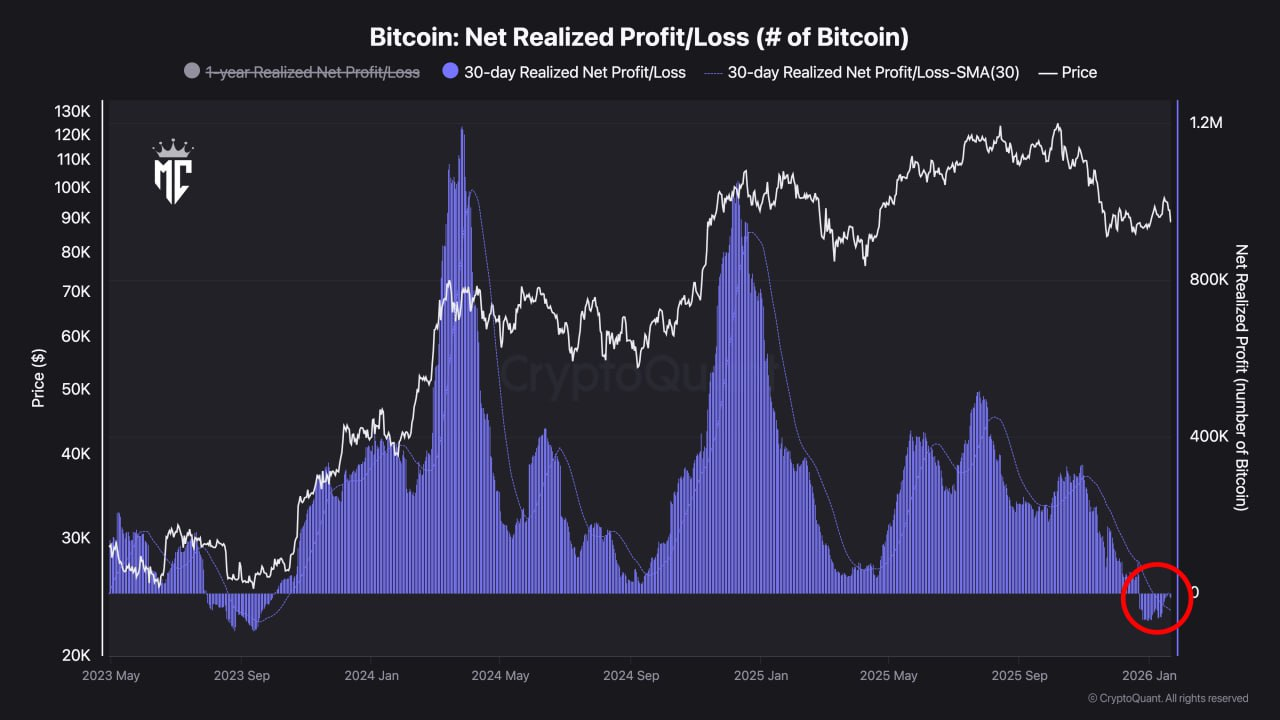

Building on the spike in dollar-denominated NRPL, the 30-day realized net profit/loss in BTC terms adds clarity to who is selling and how.

The analysis showed the metric slipping below zero near late 2025, marking the first sustained negative print since September 2023.

Importantly, this selling is gradual, not abrupt, indicating pressure rather than panic.

These losses largely come from short-term holders, as recent buyers sell below cost after failed breakouts above $90,000.

Macro uncertainty, ETF flow volatility, and leverage unwinds reinforce this behavior. As a result, supply caps upside and stalls price.

From a positioning perspective, bulls will have to monitor signs of loss and exhaustion, while bears remain focused on the persistence of distribution.

Range holds as losses shape structure

Short-term holder loss realization continued to shape Bitcoin’s structure, keeping the price confined within a wide consolidation range.

Selling below cost added supply during rebounds, which limits breakouts above the $95,000-$100,000 resistance zone.

At the same time, selling pressure has eased near $85,000–88,000, where buyers have shown willingness to absorb supply.

This balance favored sideways price action rather than a sustained trend. A breakout would likely require realized losses to decline alongside stronger Spot demand.

On the downside, renewed increases in loss realization could weaken support and trigger another retest of lower levels.

Final Thoughts

- Bitcoin’s drawdown reflected short-term holder capitulation, with realized losses transferring supply toward whales that continued accumulating despite price stagnation.

- Persistent selling kept Bitcoin range-bound between $85,000–$88,000 support and $95,000–$100,000 resistance, leaving direction dependent on loss exhaustion and renewed Spot demand.