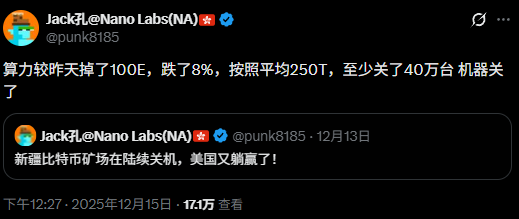

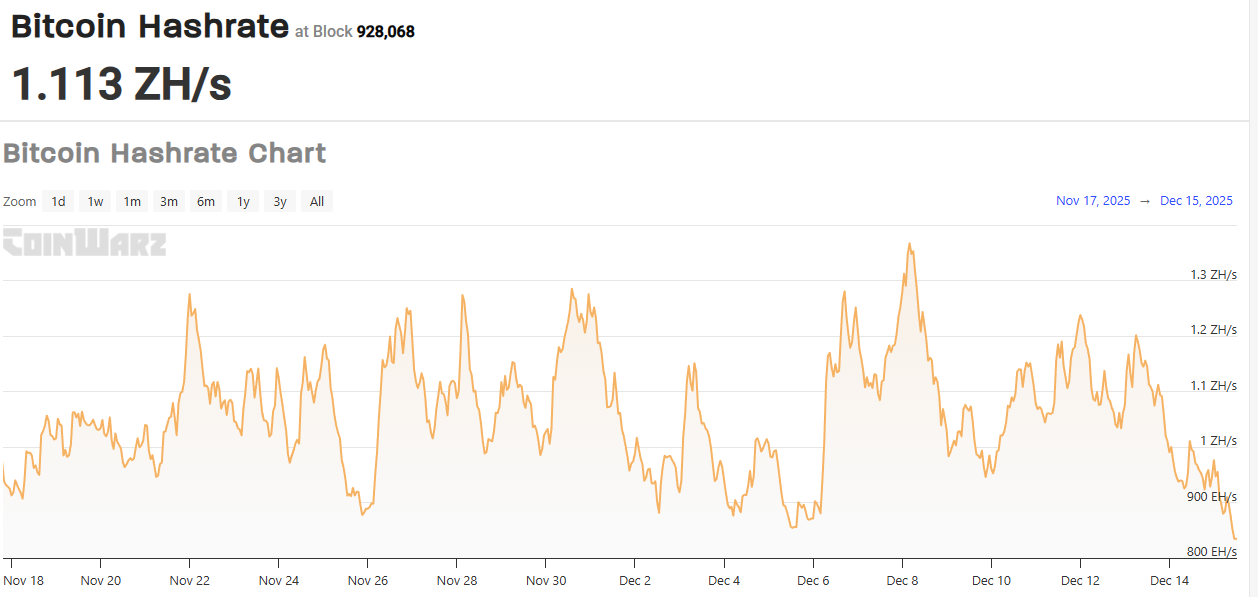

On December 16th, Beijing time, the Bitcoin network suddenly slammed on the brakes. The hashrate curve showed a significant drop within two days, and the mining community's explanation was highly consistent: concentrated shutdowns occurred at multiple mining farms in Xinjiang, with some equipment being confiscated or cleared out, leading to a sudden "chunk" of the total network hashrate being pulled away. The market's debate wasn't about whether the shutdowns happened, but about the actual scale—rumored figures ranged from over 200,000 to 400,000 units.

The most commonly cited estimate comes from an engineer's algorithm in the mining circle: roughly calculated based on contemporary mainstay machines at about 250 TH/s each, if 400,000 units were successively powered down, the corresponding hashrate gap would be enough to cause a drop on the order of hundreds of EH/s for the entire network. Some put the more aggressive hashrate point more bluntly: the total hashrate once dropped from nearly 1200 EH/s to around 836.75 EH/s, a decline of nearly 30%. Different platforms and different calibers don't completely agree on the "lowest point," but one fact is hard to ignore: this isn't the fluctuation of a few mining farms "turning off a few rows of cabinets," but a widespread concentrated shutdown.

What's truly worth追问 is the two halves of this story: Why did mining in Xinjiang resurge under the ban? And why did the clearance come so quickly and so fiercely?

Why Did Mining in Xinjiang Come Back?

The underlying driving force behind the "resurgence" of Xinjiang's computing power wasn't a sudden policy shift, but three real-world pressures being squeezed into the same outlet.

The first pressure comes from the energy structure. Xinjiang has large-scale power supply and industrial power distribution systems. During certain periods and in some regions, the marginal value of power consumption is not very high. For transmission channels, dispatch, and demand-side承接 capacity, this is a long-term tug-of-war: electricity can be generated, but it can't always be sold in an "ideal way." For asset owners, the most painful thing isn't low electricity prices, but electricity that can't be sold; for miners, this恰恰 constitutes an energy洼地—as long as they can get electricity, they can directly convert it into cash flow.

The second pressure comes from data center facilities and infrastructure. The rapid expansion of data centers across various regions in recent years has left a large amount of存量 capacity where "power is already connected, and facilities are already built." The AI narrative is hot, but AI isn't a case of having a data center就能赚钱: it requires compute cards, big clients, and long-term stable load. The reality is, some data centers haven't secured enough AI orders nor enough compute card resources; equipment sitting idle for a day means real losses from depreciation. Thus, some asset owners see "filling load" as a rigid demand—in the gray area, mining happens to be the easiest application to deploy for filling capacity: it doesn't挑剔 clients or business models, it runs as long as there's power, cooling, and an internet connection.

The third pressure comes from the temptation of ROI and the supply chain. When Bitcoin's price rises, the payback period for miners is significantly compressed; faced with the诱惑 of "breaking even in about six months," many people treat the risks in the gray area as a cost rather than a red line. More crucially, the miner supply chain hasn't disappeared: machines can be bought, transported, and installed, giving the gray area resurgence the physical conditions.

The result of these three pressures converging is a shadow resurgence: local assets (power + facilities) need cash flow, miners need low-cost electricity, the supply chain can deliver the equipment, so Xinjiang once again becomes a magnet for computing power. It's not a gathering place for miner sentiment, but a place where an energy洼地 and an infrastructure洼地 overlap.

This also explains a seemingly contradictory phenomenon: the ban never disappeared, but mining still periodically surfaces. It's not because the red line loosened, but because the constraints of real-world assets never stop: electricity, facilities, power distribution, depreciation, cash flow—all force participants to repeatedly test the boundaries.

Is Mining Illegal in China: An Eliminated Item Doesn't Equal a Criminal Crime, But the Red Line Persists

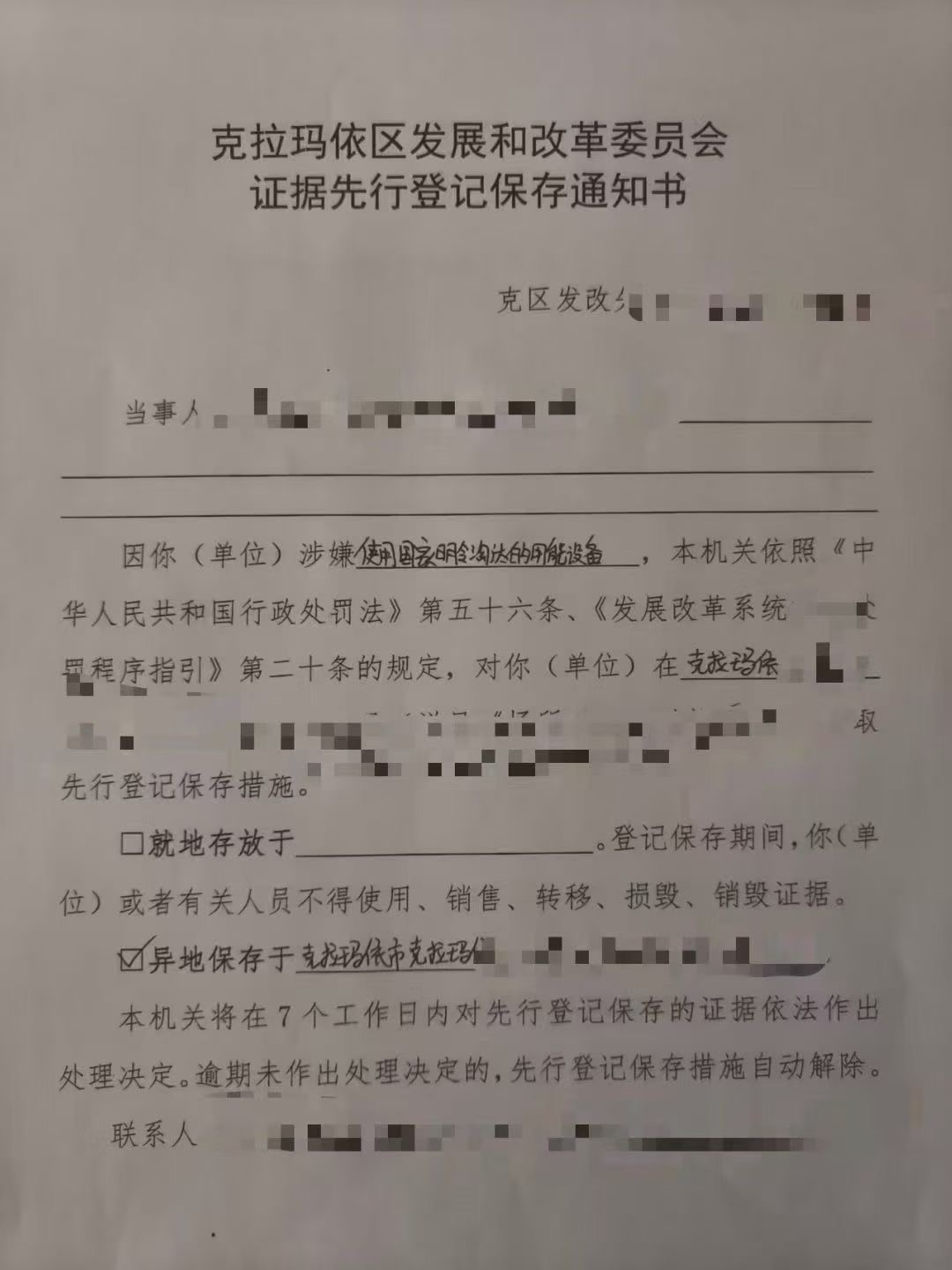

In China, the policy positioning of mining is not an encouraged industry, but an item that must be rectified and pushed for exit. The relevant authorities' rectification documents core requirements are to strictly prohibit new additions, properly handle existing stock, promote orderly exit, and explicitly list virtual currency mining as an eliminated industry, while also emphasizing precise identification through methods like abnormal electricity consumption monitoring and park inspections, and prohibiting mining under the name of data centers.

Looking at real-world governance methods, it's more like a combination of administrative and energy-side measures: differentiated electricity prices or punitive fees, cancellation of preferential policies, cessation of fiscal and financial support, restrictions on power connection and participation in the electricity market, etc. Therefore, the direct consequences for many mining farms when handled are often power cuts, clearance, back payment of electricity fees, and cancellation of policy benefits—this is not the same as legal operation, but it also doesn't equate to "mining itself必然触犯刑法" (necessarily violating criminal law).

What truly escalates the risk are usually actions附带 to mining: electricity theft, illegal power supply, fraudulently claiming subsidies, obtaining support funds under the guise of supercomputing centers or data centers, illegal fundraising, money laundering channels, etc. Once these issues are triggered, it quickly moves from industrial rectification into the realm of public security or criminal law.

At the same time, financial regulation has maintained a tougher stance on virtual currency-related businesses, continuously emphasizing the crackdown on illegal activities related to virtual currency and focusing on anti-money laundering and cross-border capital risks. Putting these two lines together, one can understand why such clearance actions happen repeatedly: mining has long been within the red line of rectification, and once the enforcement end tightens its口径, the power switch is faster than any announcement.

Why Did This Clearance Come So Fiercely

The speed and force of the clearance often depend on two things: whether the signals are unified, and whether the leverage points are clear.

A coordination mechanism meeting led by the central bank with participation from multiple departments in late November was seen as an important node by the mining circle. It released not emotion, but a unification of enforcement port口径: continue to maintain high pressure on virtual currency-related activities, strengthen the narrative on anti-money laundering and cross-border capital risks, and bring issues like stablecoins into a more stringent regulatory view. For gray area industries, this meant "the scope of being watched expanded," and more importantly, local systems knew what to check next, how to check it, who would lead, and who would cooperate.

At the same time, mining in China has long been handled within an industrial policy framework, not just a financial regulatory framework. It is classified as an eliminated industry, with common governance methods including differentiated electricity prices, punitive fees, park inspections, abnormal electricity consumption monitoring, etc. A more realistic risk point is: simply running hashrate might be treated as an eliminated industry, but once it involves electricity theft, fraudulently claiming subsidies, or obtaining support funds under the name of other projects, the nature quickly turns from gray to accountable black.

Therefore, when systems like development and reform, energy, power, and parks start to联动, the clearance often presents a "sudden" feeling: it was running yesterday, but today there's a collective shutdown. To the outside world, this is news; to miners, it's the power switch, and the power switch never needs an advance announcement.

Why Did the Hashrate Drop So Dramatically: Concentrated Power Cuts Get "Amplified" on the Curve

The dramatic drop in hashrate isn't核心ly about "number jitter," but about "concentrated power cuts." After entering the ZH era, the total network hashrate fluctuates daily, but most fluctuations are like ocean waves: rising and falling, looking back it's just noise. This time was more like pulling out a beam—a阶梯式 (stepped) plunge occurring in a short time, combined with highly consistent on-the-ground information from the mining circle pointing to concentrated shutdowns in Xinjiang. This combination is what made the market treat it as a hard event, not normal jitter.

More crucial is the structure. When the resurgence happens in a concentrated form of "few regions + few parks + few data centers," its advantage is fast expansion, its disadvantage is fragility: once the switch is pulled, what drops isn't sporadic mining farms, but an entire chunk of hashrate coming loose together. In other words, the market isn't debating whether the hashrate is an estimate, but reading one thing: what was cut off this time was likely a highly concentrated hashrate pool.

There's another layer of perceptual amplification. Hashrate is estimated based on block production speed: when large-scale shutdowns happen in a short period, the block interval first becomes unstable, and short-term estimates are more prone to exaggerated spikes and deep pits; once the difficulty completes its self-healing in subsequent adjustment cycles, the curve will slowly smooth out. Therefore, this "seemingly scary" plunge is essentially the immediate projection of a regional concentrated shutdown on the network level—it's not a false alarm, but an amplification effect brought by concentration.

What Happens After the Clearance: Miners Hurt Most, Market Most Sensitive, Hashrate Will Continue Migrating

The short-term impact will first land on miner cash flow. Machines being confiscated or shut down means the payback period is instantly interrupted; hosting providers and the power side will become more cautious, and the costs of relocation, restarting, and finding new sockets will increase sharply. These costs will ultimately manifest in two ways: some miners are forced to exit, while other miners raise their risk premium, only willing to restart under higher profit expectations.

At the market level, the most common说法 is that miners will sell coins. This conclusion doesn't always hold directly: whether it's a集中处置 (concentrated disposal), what the disposal path is, whether it enters the secondary market, how long it drags on—all depend on the specific execution method. But the clearance will form a clear signal in sentiment: the policy risk premium is back. Especially in a phase already marked by increased volatility, any news带有 (carrying) the color of concentrated clearance will be amplified, becoming an amplifier for price fluctuations.

In the medium term, the Bitcoin network will use difficulty adjustment to self-heal: after the hashrate declines, block production slows, then the difficulty下调 (drops), short-term收益 (profits) improve for the remaining miners, and hashrate will regrow elsewhere. The protocol doesn't care about Xinjiang or Texas, it only cares about producing a block on average every ten minutes. But for Chinese miners, this means the next migration will be more dispersed, more hidden, more socket-based.

The significance of this clearance in Xinjiang isn't whether the lowest point was exactly 836.75 or some other number, but that it laid bare the true structure of the shadow resurgence: this wasn't an above-board industrial recovery, but a gray area arbitrage driven by electricity, facilities, depreciation, and cash flow. Arbitrage is fast, of course, but when the switch falls, it's equally fast.