Ripple (XRP) Buy Signal Flashes as Funding Rate Plummets Deep into Negative: Will Bulls Step In?

XRP's break below $2 pushed its funding rate to extreme lows, which typically encourages bulls to enter. What is holding traders back this time?

Key Points:

Ripple derivatives are dominated by shorts, funding rates are deeply negative, and open interest is stagnant.

Declining XRP ETF trading volume and XRP Ledger TVL indicate waning ecosystem interest, reducing the likelihood of a short-term price rebound.

After facing resistance at $2.18 on Tuesday, XRP fell 9% in two days. The break below $2 caused turmoil in the derivatives market as the cost of holding leveraged short positions surged to a two-month high. Given the slowdown in exchange-traded fund (ETF) activity and the decline in XRP Ledger deposits, traders are concerned that XRP may weaken further.

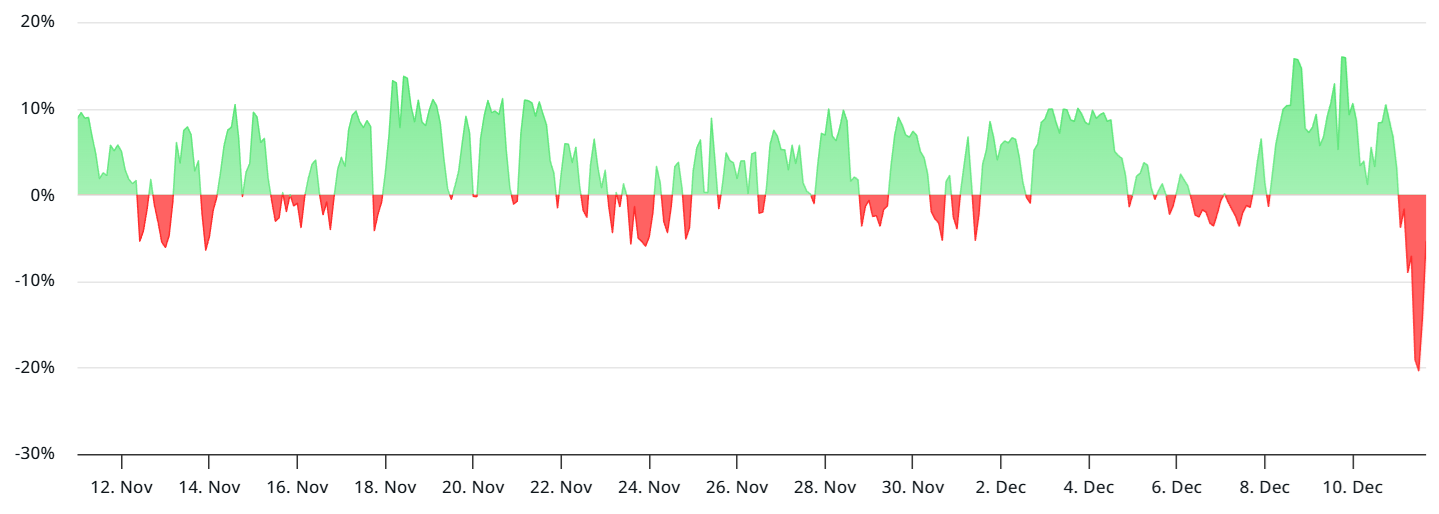

The funding rate for XRP perpetual futures fell to -20% on Thursday, its lowest level since the crash on October 10. Negative values indicate that sellers (shorts) are paying buyers (longs) to maintain open positions, showing an almost complete lack of demand from bullish traders. Under more balanced conditions, this rate typically ranges between 6% and 12% to cover capital costs, with longs bearing the fee.

Such deeply negative funding rates are rare and usually short-lived. Some analysts even view it as a potential reversal signal, although most historical examples occur during rapid crashes rather than prolonged correction phases. Additionally, the drop in leverage requirements has led some to question whether traders are simply exiting XRP.

Total open interest for XRP futures remained at $2.8 billion on Thursday, flat from the previous week. However, leverage has not recovered to the $3.2 billion level seen at the end of November. Data shows that XRP bears are unwilling to increase their exposure, especially after the coin has fallen 45% since touching $3.66 in July.

XRP ETF Activity Decline and XRP Ledger TVL Weakness

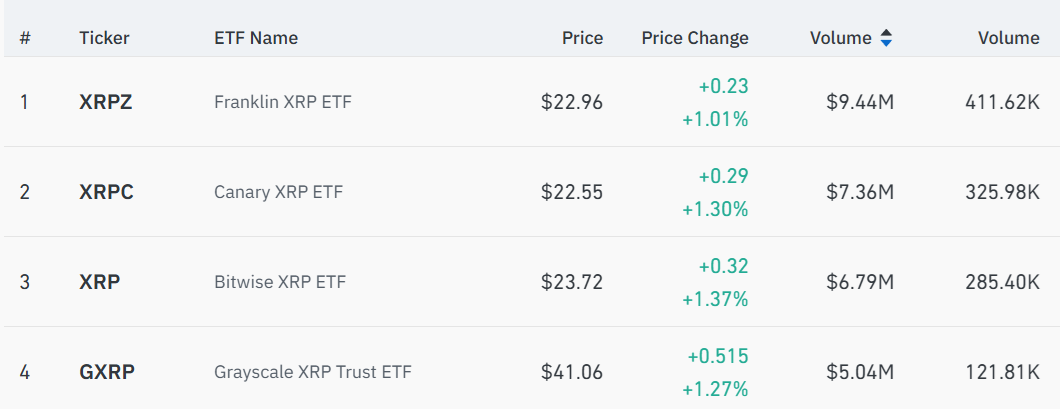

The muted interest in bullish XRP positions can be partly attributed to the decline in U.S.-listed XRP ETF activity. Traders entered November with strong expectations, but fund flows and trading activity plummeted after just three weeks, leaving assets under management stagnant at around $3.1 billion, according to CoinShares data. In comparison, the Solana ETF holds $3.3 billion in assets.

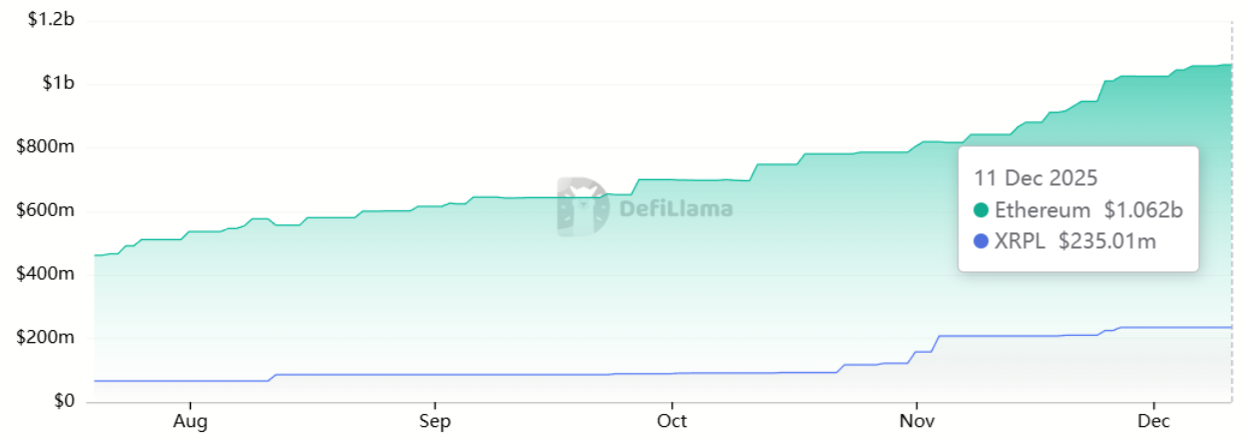

The daily trading volume of U.S.-listed XRP ETFs rarely exceeds $30 million, significantly reducing institutional platforms' interest in them. Weakening demand for the XRP Ledger is another source of concern for holders. Even Ripple's supported stablecoin, Ripple USD (RLUSD), primarily relies on the Ethereum network rather than XRP's native infrastructure.

Over $1 billion of RLUSD is issued on Ethereum, while only $235 million is on the XRP Ledger. More worryingly, the XRP Ledger's TVL has dropped to $68 million, its lowest in 2025, indicating declining relevance for its decentralized applications (DApps). In comparison, although XLM's market cap is 93% smaller than XRP's $121.8 billion, the Stellar blockchain holds a TVL of $176 million.

As competing blockchains like BNB Chain and Solana continue to strengthen their positions in DApp ecosystems, XRP remains under pressure. The limited activity on the XRP Ledger creates a reinforcing cycle, reducing investors' incentive to hold XRP, especially compared to the native staking yields of BNB and SOL.

So far, there is no clear evidence that any increase in XRP Ledger activity will directly translate into benefits for XRP holders.

XRP derivatives show increased bearish confidence, while on-chain metrics and ETF flows indicate waning interest, particularly from institutional investors. Therefore, sustained upward momentum for XRP seems unlikely in the short term.

Related recommendation: Report suggests Coinbase may launch prediction markets and tokenized stocks on Wednesday

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph is not responsible for any losses or damages arising from your reliance on this information.