Author: Thejaswini M A

Original Title: Coinbase's Walled Garden

Compiled and Edited by: BitpushNews

Across different industries, eras, and every market that has ever existed, there is a recurring pattern. First comes explosive growth: a thousand flowers bloom, with every participant claiming they can do a specific job better than others. Specialists proliferate, niche tools multiply. Consumers are told that 'choice is freedom' and 'customization is power,' and that the future belongs to disruptors who break apart monolithic giants.

Then, quietly, the pendulum inevitably swings back.

This isn't because the specialists were wrong, nor because the giants are so great. It's because fragmentation carries an invisible, compounding cost. Each additional tool means another password to remember, another interface to learn, another potential point of failure in the system you're responsible for maintaining. Sovereignty begins to feel like 'work,' and freedom starts to feel like an 'administrative burden.'

In the consolidation phase, the ultimate winners aren't those who do every single thing perfectly. They are those who do enough things well enough that the friction cost of leaving (and rebuilding the entire system elsewhere) becomes insurmountable. They don't trap you with contracts or lock-in periods. They trap you with convenience. Through countless minor integrations and tiny efficiencies, these drips—none of which are worth leaving over on their own—collectively form a moat.

We've seen this in e-commerce. It happened in cloud computing, and in streaming. Now, we're watching it play out in finance.

Coinbase has just placed its bet on the phase of the cycle we're entering.

Background Context

For most of its existence, Coinbase's positioning was clear. It was the place for Americans to buy Bitcoin without feeling like they were committing some vague crime. It had regulatory licenses, a clean interface, and customer support that, while often criticized, at least theoretically existed. In 2021, the company went public with a $65 billion valuation, its logic being that it was the 'on-ramp to crypto.' For a while, that logic held.

But by 2025, being the 'on-ramp to crypto' started to look like a bad business. Spot trading fees were being compressed. Retail trading volume was intensely cyclical: surging in bull markets, collapsing in bear markets. Bitcoin maximalists were increasingly comfortable with self-custody wallets. Regulators were still suing the company. Meanwhile, Robinhood, which started with stock trading and moved into crypto, suddenly had a market cap of $105 billion, nearly double that of Coinbase.

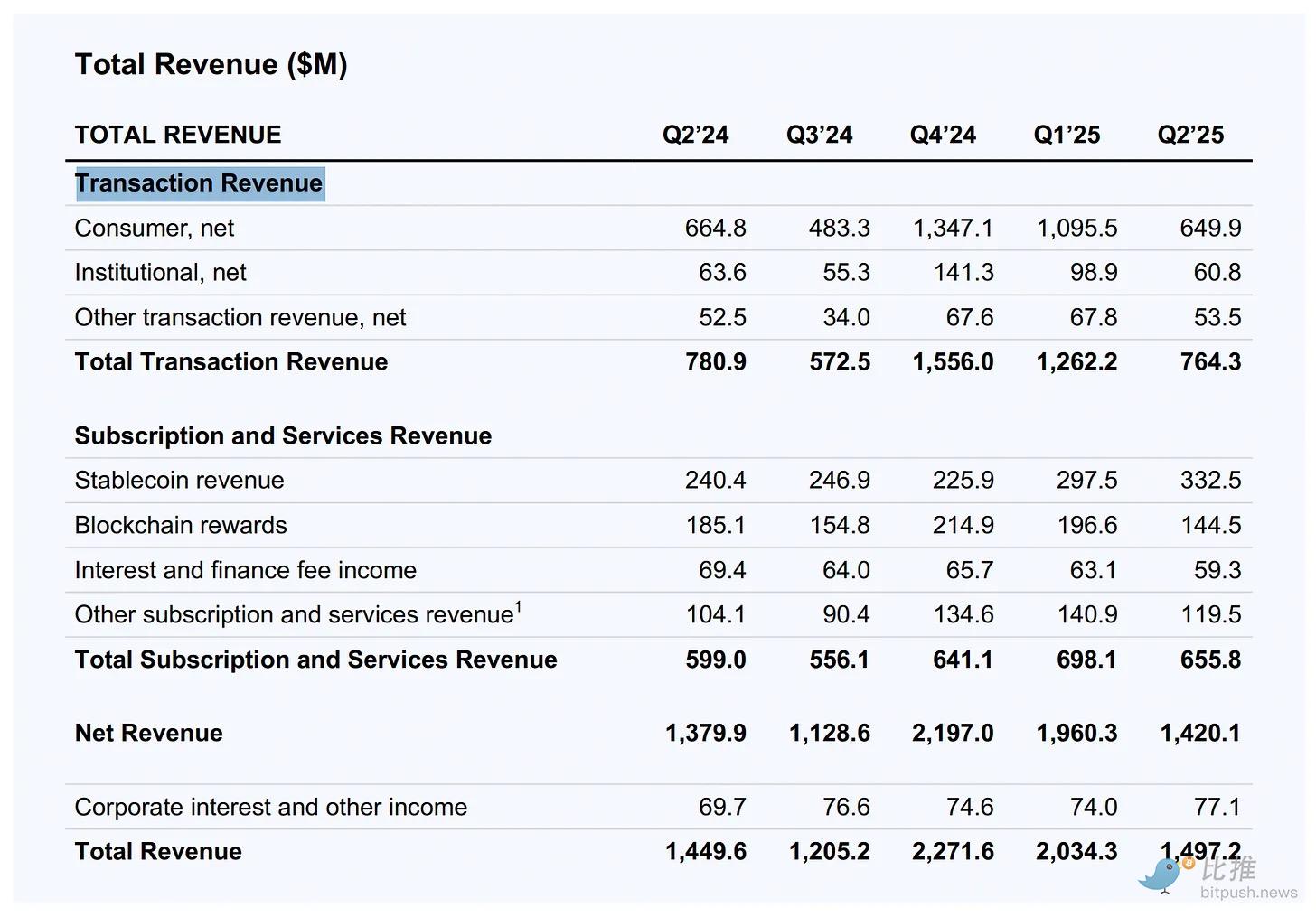

In 2021, over 90% of Coinbase's revenue came from trading commissions. By Q2 2025, that figure had fallen to under 55%.

So, Coinbase did what you do when your core product is under pressure: it tried to become 'everything else.'

The "Everything Exchange" Thesis

The so-called 'Everything Exchange' thesis is a bet: aggregation beats specialization.

-

Stock trading means users can now react to Apple's earnings at midnight using USDC, without leaving the app.

-

Prediction markets mean they can check the price of 'Will the Fed cut rates?' over lunch.

-

Perpetual contracts mean they can slap 50x leverage on their Tesla position on a Sunday.

Each new feature module is another reason to open the app, another opportunity to capture spreads, fees, or stablecoin interest on idle balances.

Is the strategy 'Let's become Robinhood,' or 'Let's ensure our users never need Robinhood'?

There's an old view in fintech: users want specialized apps. One for investing, one for banking, one for payments, one for crypto. Coinbase is betting the opposite: once you've done KYC once and linked a bank account once, you don't want to do it nine more times elsewhere.

This is the 'aggregation beats specialization' argument. In a world where the underlying assets are increasingly tokens on a blockchain, it makes a lot of sense. If stocks are tokens, prediction market contracts are tokens, and meme coins are tokens, why shouldn't they all trade in the same venue?

The mechanical logic is: you deposit dollars (or USDC), you trade everything, you withdraw dollars (or USDC). No cross-chain transfers between platforms, no minimum balance requirements across multiple accounts. Just one pool of capital flowing between asset classes.

The Flywheel Effect

The more Coinbase acts like a traditional broker, the more it must compete on traditional broker terms. Robinhood has 27 million funded accounts, while Coinbase has about 9 million monthly transacting users. The competitive differentiation can't just be 'we have stocks too'; it must be in the underlying rails.

The promise is 24/7 liquidity for everything. No market close times, no settlement delays. No waiting for broker approval on your margin request when the market moves against you.

Does this matter to most users? Probably not yet. Most people don't need to trade Apple stock at 3 a.m. on a Saturday. But some do. If you're the venue that lets them do it, you capture their flow. Once you have flow, you have data. With data, you build better products. With better products, you get more flow.

It's a flywheel, provided the flywheel spins.

The Gamble on Prediction Markets

Prediction markets are the most unusual part of this bundle, and perhaps the most important. They aren't 'trading' in the traditional sense but organized betting on binary outcomes: Will Trump win? Will the Fed hike rates? Will the Lakers make the playoffs?

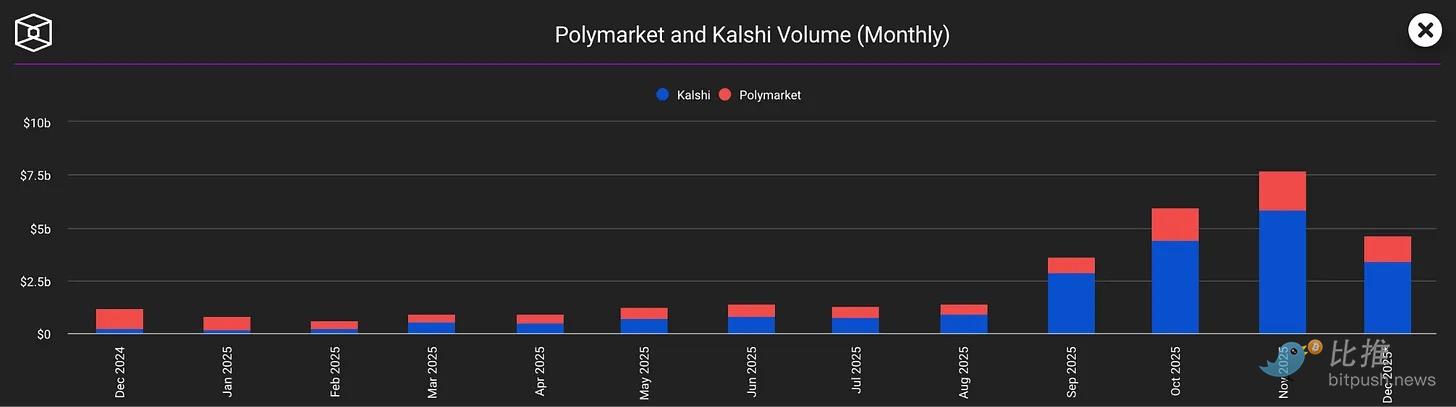

Contracts vanish after settlement, so there's no long-term holder base. Liquidity is event-driven, meaning it's bursty and unpredictable. Yet, platforms like Kalshi and Polymarket saw monthly volume surge past $7 billion in November.

Why? Because prediction markets are social tools. They are a way to express an opinion with chips on the table. They are a reason to check your phone during the fourth quarter of a game or on election night.

For Coinbase, prediction markets solve a specific problem: engagement. Crypto gets boring when prices are flat. Stocks get boring when your portfolio just sits there. But there's always an event happening in the world that people care about. Integrating Kalshi gives users a reason to stay in the app even when Bitcoin isn't moving.

The bet is: users who come for election markets will stay to trade stocks, and vice versa. More feature surface area equals higher user stickiness.

The Business Model's Core: Profit Margins

Strip away the innovative narrative, and what you really see is a company trying to monetize the same user in more ways:

-

Transaction fees from stock trading

-

Spreads from DEX (decentralized exchange) swaps

-

Interest on stablecoin balances

-

Lending fees from crypto-backed loans

-

Subscription revenue from Coinbase One

-

Infrastructure fees from developers using the Base blockchain

This isn't a criticism. This is how exchanges work. The best exchanges aren't the ones with the lowest fees; they're the ones users can't leave—because leaving means rebuilding the entire system elsewhere.

Coinbase is building a walled garden, but the walls are made of convenience, not forced lock-in. You can still withdraw your crypto, you can still transfer your stocks to Fidelity. But you probably won't, because why bother?

Base: The Real Game Changer

Coinbase's advantage was supposed to be its 'on-chain-ness.' It could offer tokenized stocks, instant settlement, and programmable money. For now, its stock trading looks like Robinhood's, just with extended hours; its prediction markets look like Kalshi's, just embedded in a different app.

The real differentiation must come from Base—the Layer 2 blockchain that Coinbase built and controls. If stocks truly flow on-chain, if payments truly use stablecoins, if AI agents truly start trading autonomously using protocols like x402, then Coinbase has built something Robinhood can't easily replicate.

But this is a long-term story. In the short term, the competition is about whose app is the stickiest. And adding more features is not the same as adding stickiness. It can also make the app messy, confusing, and intimidating to new users who just want to buy some Bitcoin.

Scale vs. Purity

A segment of crypto users will hate all of it: the true believers. Those who wanted Coinbase to be the on-ramp to decentralized finance (DeFi), not a centralized 'super app' that happens to bury some DeFi functions in a submenu.

Coinbase has clearly chosen scale over purity. It wants a billion users, not a million purists. It wants to be the default financial venue for the masses, not the favored exchange of those who run their own nodes.

This is probably the correct business decision. The mass market doesn't care about decentralization. The mass market prioritizes convenience, speed, and avoiding financial loss. If Coinbase can deliver that, the underlying philosophy doesn't matter.

But it does create a peculiar tension. Coinbase is both trying to be infrastructure for the on-chain world and a centralized exchange competing with Schwab; it's both trying to be a defender of crypto and a company working to make crypto 'invisible'; it wants to be both rebellious and compliant.

Maybe this is possible. Maybe the future is a regulated, on-chain exchange that feels like using Venmo. Or perhaps, trying to be everything to everyone means you end up being nothing special to anyone.

This is the Amazon strategy. Amazon isn't the best at any single thing: it's not the best bookstore, not the best grocer, not the best streamer. But it's 'good enough' at all of them that most people can't be bothered to go elsewhere.

Yet, many companies have tried to build 'everything apps,' and most have just built a messy app.

If Coinbase can capture the full loop of 'earn, trade, hedge, borrow, pay, recycle,' then it won't matter if individual features are slightly worse than specialized competitors. The switching costs and the hassle of managing multiple accounts will keep users inside the ecosystem.

That's what the Coinbase 'Everything Exchange' is all about.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush