Fed's Wavering Rate Cut Decision, But Bitcoin's "Fragile Zone" Still Suppresses BTC Price Below $100,000

The Federal Reserve internally approved a 0.25% rate cut, but inflation concerns and slowing growth expectations, combined with Glassnode data showing BTC's "fragile zone," may continue to hinder its breakthrough above $100,000.

On Wednesday, the U.S. Federal Reserve approved a 25 basis point rate cut, marking the third rate cut this year, in line with widespread market expectations. Continuing the price performance before the previous FOMC decision, Bitcoin once broke through $94,000 on Monday. However, the hawkish description of this rate cut by the media reflects significant internal disagreements within the Fed regarding the direction of U.S. monetary policy and the economic outlook.

Given that this week's rate cut was labeled as "hawkish," Bitcoin prices may face a "sell the news" effect and continue to range-bound until new market drivers emerge.

CNBC reported that the Fed's "9 to 3" vote result clearly indicates committee members' continued concerns about inflation persistence, while economic growth rates and future rate cut steps may slow in 2026.

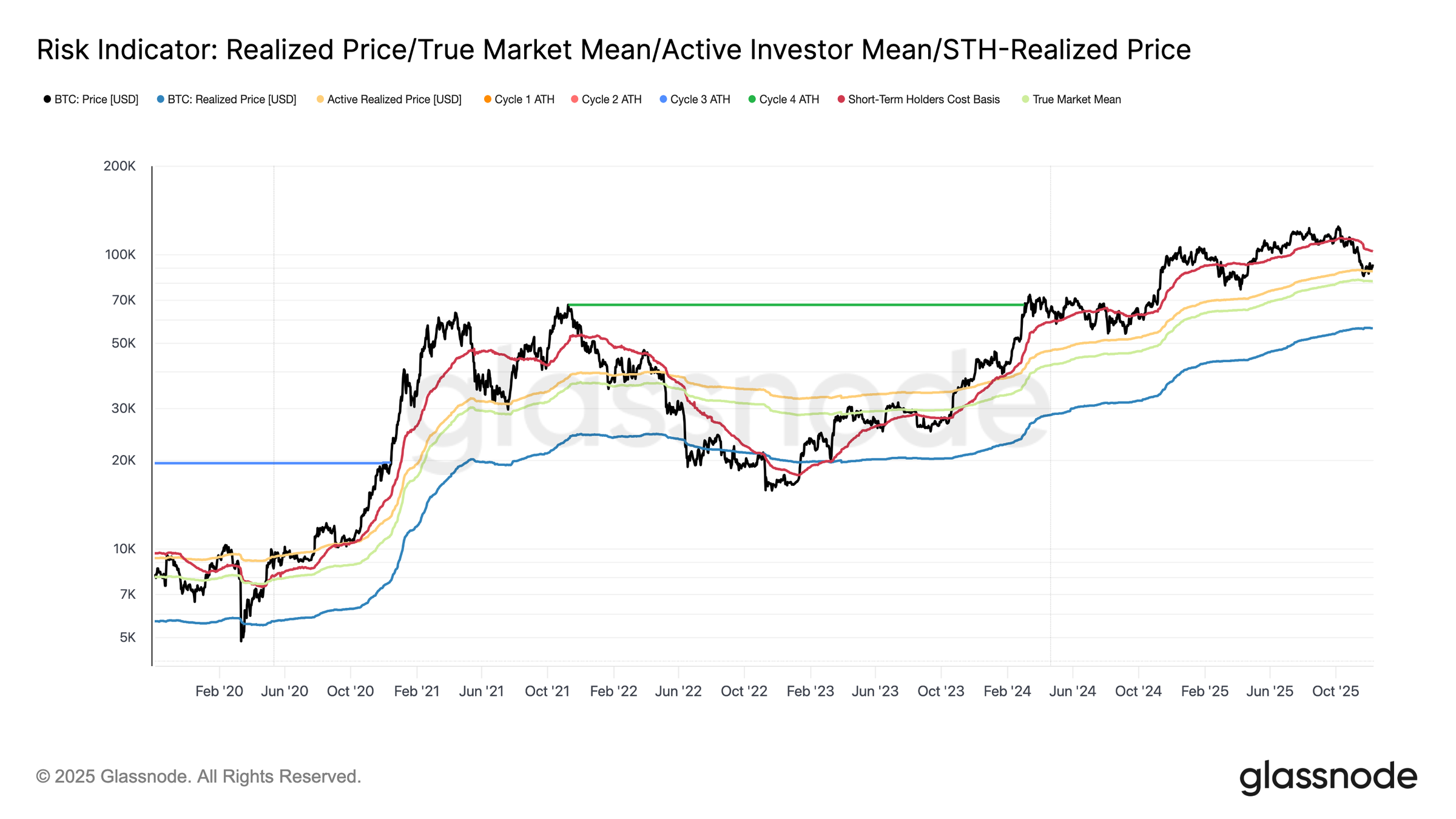

Glassnode analysis shows that BTC is still trapped within the structural fragile zone below $100,000, with price trends constrained between the short-term cost basis of $102,700 and the "realized market value" of $81,300.

Glassnode data further reveals that weak on-chain conditions, reduced futures market demand, and persistent selling pressure collectively form the market environment hindering BTC's breakthrough above the $100,000 mark.

Key Points:

BTC's structural fragile zone has trapped the market below $100,000, while unrealized losses continue to expand.

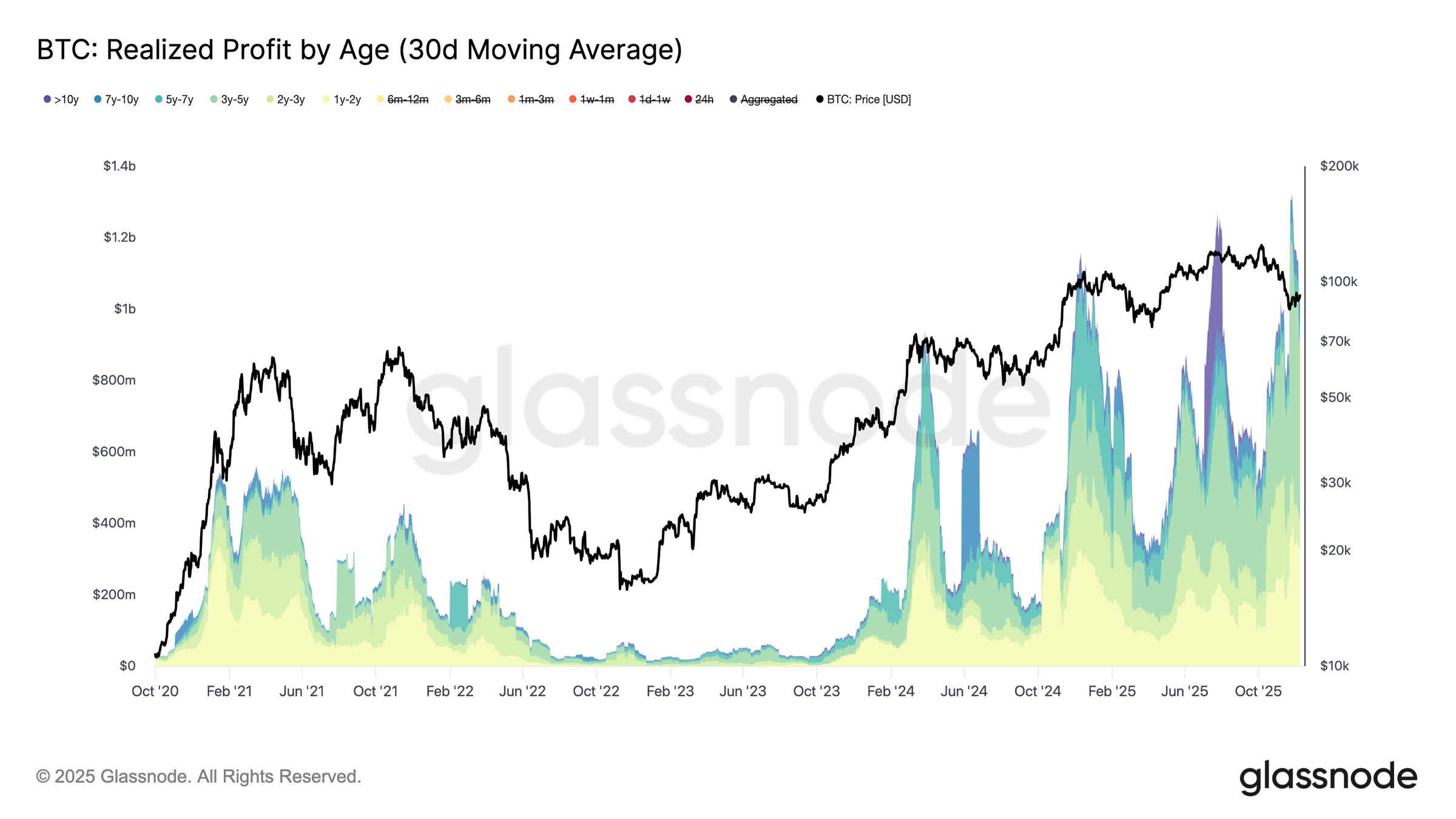

Realized losses have surged to $555 million daily, reaching the highest level since the FTX collapse in 2022.

Large-scale profit-taking by long-term holders (over one year), combined with the capitulation sentiment of top buyers, is hindering a renewed breakthrough of the short-term holder cost basis.

The Fed's rate cut policy may not provide significant near-term support for BTC prices.

Time is running out for BTC to return to $100,000

According to Glassnode analysis, BTC's failure to break through the $100,000 price level reflects an increasingly severe structural pressure: time is working against the bulls. The longer the price stays within this fragile zone, the more unrealized losses accumulate, increasing the likelihood of forced investor selling.

Relative unrealized losses (30-day moving average) have climbed to 4.4%, ending a two-year period of stability below 2%, indicating the market is turning towards a higher-pressure environment. Even though Bitcoin rebounded from the November 22 low to about $92,700, the adjusted realized losses continued to grow, reaching $555 million daily, a level previously seen only during the FTX crash.

At the same time, long-term holders (held for over one year) realized profits exceeding $1 billion daily, with a peak reaching a record $1.3 billion. Analysts point out that this capitulation by top buyers, combined with large-scale distribution behavior by long-term holders, may prevent Bitcoin from breaking through the key cost basis threshold, making it difficult to re-challenge the resistance zone of $95,000-$102,000, which has been limiting this fragile price range.

Spot-led rebound meets a shrinking Bitcoin futures market

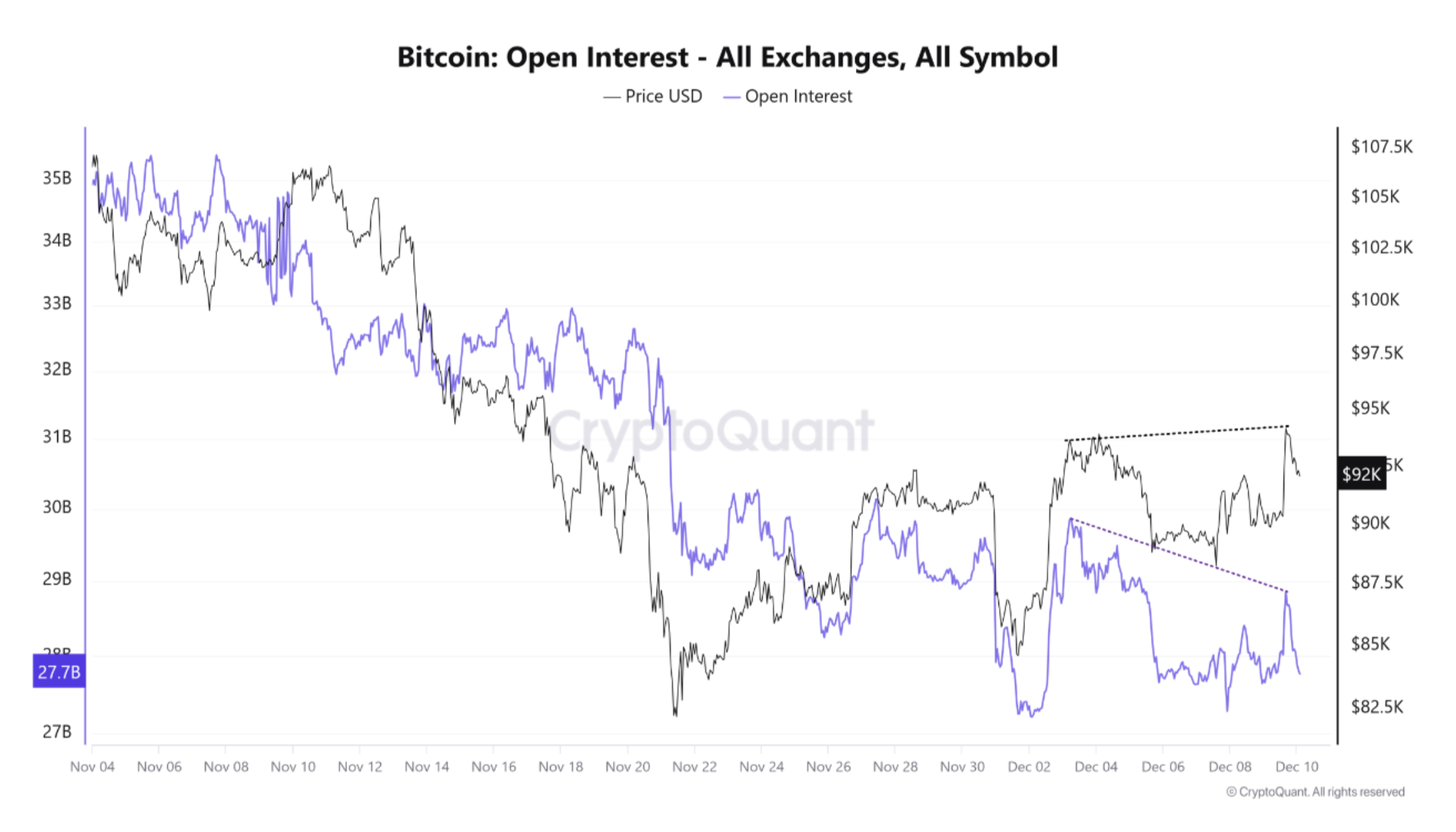

CryptoQuant data shows that the cryptocurrency market typically rises before Federal Open Market Committee (FOMC) meetings, but a significant divergence has recently emerged: while Bitcoin prices rose, open interest (OI) continued to decline.

Open interest has been declining during the adjustment phase since October, but notably, even after Bitcoin hit bottom on November 21, despite prices creating higher highs, open interest continued to shrink. This indicates that the current rebound is primarily driven by spot demand, not leveraged speculative behavior.

CryptoQuant added that although spot-led upward trends are generally healthier, historical experience shows that sustained bullish momentum requires increased leverage positions as support. Considering that derivative trading volume structurally dominates, with spot trading accounting for only 10% of derivative activity, if rate cut expectations weaken before the meeting, the market may struggle to maintain the current momentum.

Related recommendation: Short the dip and buy the rise? FOMC results reveal the truth behind Bitcoin (BTC) price trends

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements subject to risks and uncertainties. Cointelegraph is not responsible for any losses or damages resulting from reliance on this information.