Despite Fed Policy Shift, Bitcoin (BTC) Rally Stalls at $94,000

Even as traders turn optimistic about the long-term outlook for U.S. monetary policy and the crypto market, Bitcoin's price continues to face resistance after touching the $94,000 threshold.

Bitcoin (BTC) price action remains weak this week, continuing to consolidate around the $90,000 level after the Federal Reserve cut rates by 25 basis points and another attempt to reclaim the monthly volume-weighted average price (VWAP) failed. The market continues to suppress any effective push to break above $93,000, limiting the upside momentum for bulls.

Key Points:

A Bitcoin analyst pointed out that liquidity contraction is suppressing Bitcoin's upside potential, leading to relatively weakened buying demand compared to selling pressure.

The $94,000 to $98,000 range remains a key liquidity concentration zone, but BTC must avoid forming a breakdown structure below $88,000 that confirms a bearish outlook.

Liquidity Contraction Drives Bitcoin Market Trend

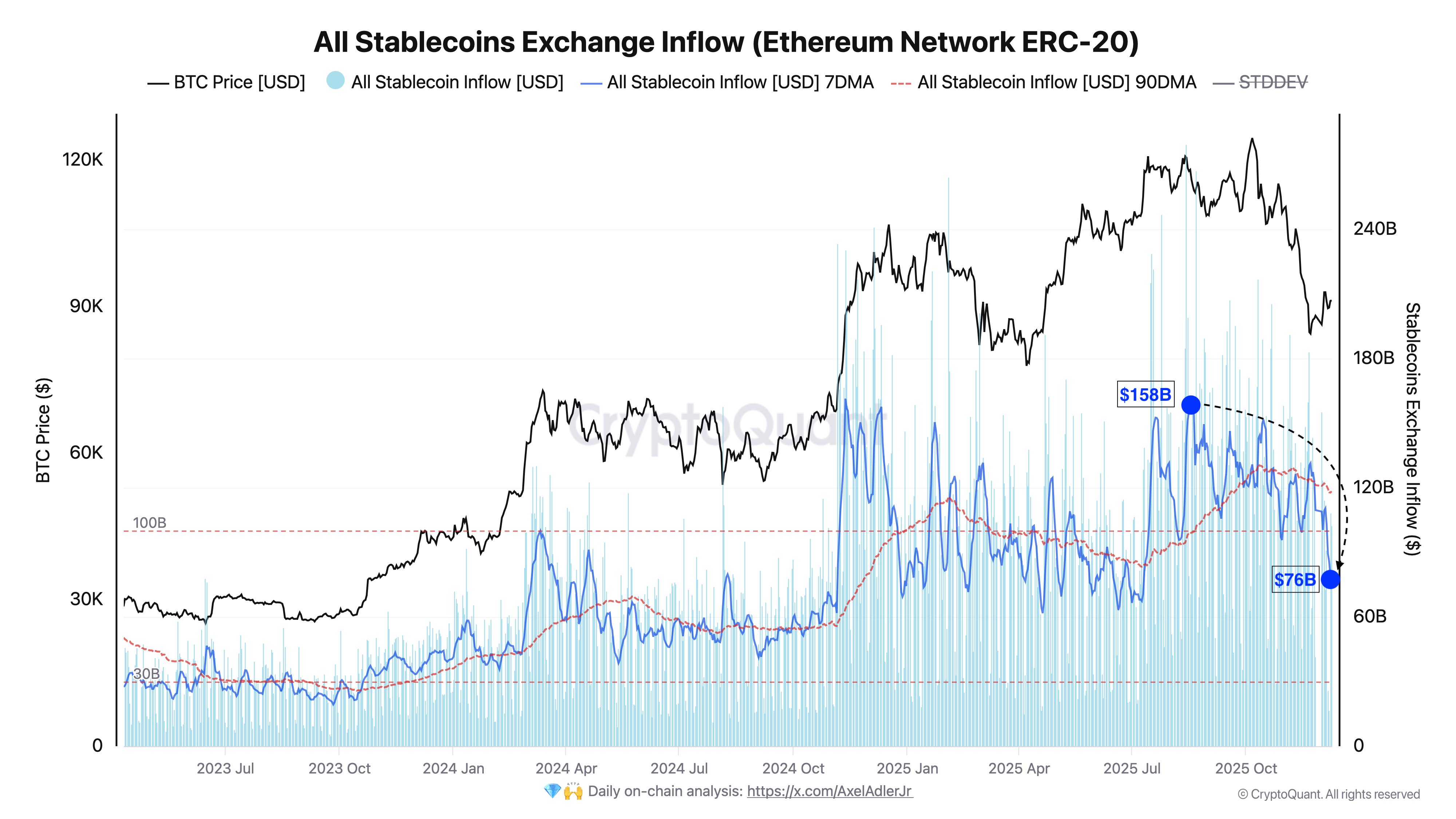

Crypto analyst Darkfost pointed out that Bitcoin's current predicament is not strongly correlated with market sentiment fluctuations but primarily stems from the continued contraction of liquidity (especially stablecoin liquidity). Stablecoin inflows into exchanges have historically been one of the most reliable signals for capital entering the market, and this indicator is currently flashing a red light.

Data shows a significant contraction in liquidity: ERC-20 stablecoin inflows have dropped from $158 billion in August to approximately $76 billion this month, a decline of nearly 50%. Even the longer-term 90-day moving average has slipped from $130 billion to $118 billion, confirming that this trend is not a temporary fluctuation but a structural deterioration.

Liquidity contraction directly leads to weakened buying power. Darkfost noted that the recent rebound was not driven by strong capital absorption but rather by a temporary easing of selling pressure, meaning the market lacks the fund inflows needed to sustain higher highs or defend key support levels. Until new liquidity is injected, Bitcoin's upward momentum is likely to remain weak.

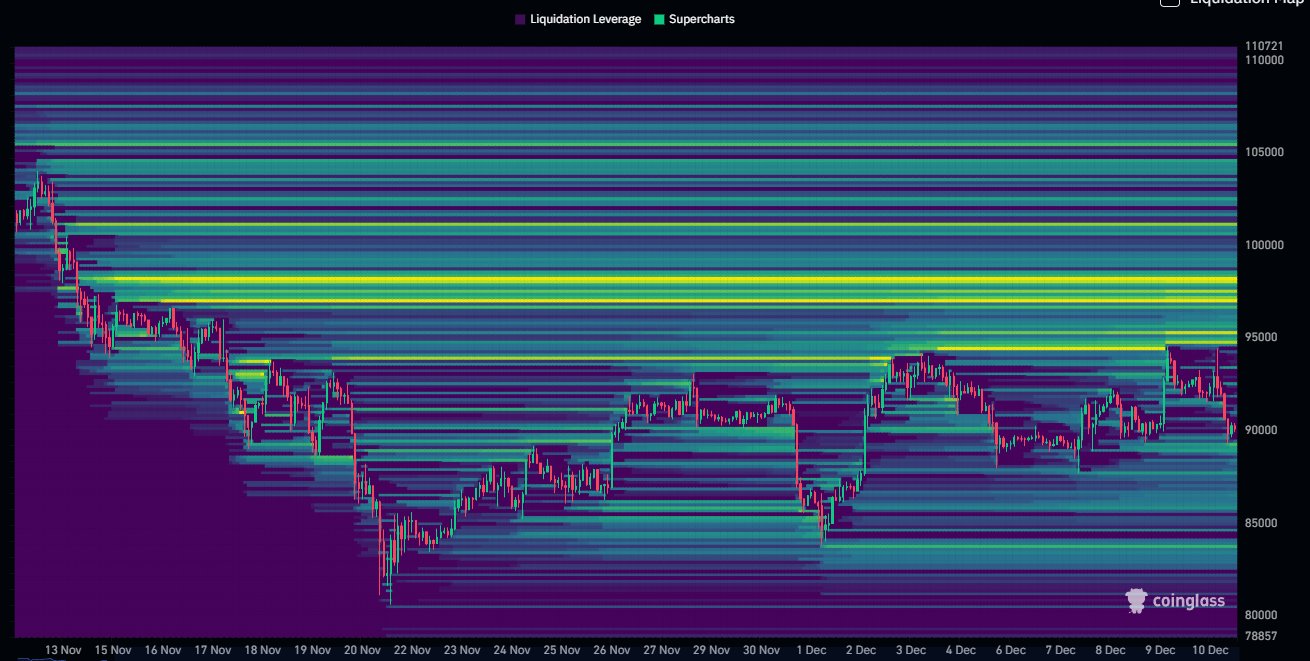

Simultaneously, trader Daan Crypto Trades analyzed that the generalized liquidity distribution chart still shows the $97,000 to $98,000 area as the next key price attraction zone. However, Bitcoin has repeatedly failed to break through the $94,000 threshold—the first barrier that must be overcome for volatility expansion to occur.

If a breakout cannot be confirmed, the market will continue to be exposed to the risk of sharp range reversals, keeping both bulls and bears stuck in a volatile stalemate.

Bitcoin Nears Key $90,000 Breakdown Threshold

From a structural perspective, Bitcoin has failed three consecutive attempts to break through the $93,000 threshold. Following the Fed meeting, the latest round of price declines has formed a typical Shakeout Failure Pattern (SFP), indicating that upward momentum has significantly weakened and trend continuity is persistently deteriorating.

Bitcoin is also approaching a confirmation point for a potential bearish head-and-shoulders pattern—if the price breaks below $88,000 and forms a bearish breakdown structure (BOS), this pattern will be officially validated. Once a breakdown occurs, it could trigger a downward probe towards the external liquidity area around $84,000, with deeper downside risks potentially pointing to the quarterly low of $80,600, a level that aligns with the previous price vacuum zone on higher time frame charts.

Despite this, bullish traders represented by Captain Faibik still insist that the current volatility is a deliberate washout by the market to clear weak holdings. To restart the upward trend, Bitcoin must achieve a weekly close above $90,000 (ideally near $93,000), which would provide the structural foundation needed for an assault on the $96,000 breakout zone, potentially truly unleashing trend momentum expansion.

Related recommendation: Netflix previews comedy film about losing $35 million in cryptocurrency passwords

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph is not responsible for any losses or damages resulting from reliance on this information.