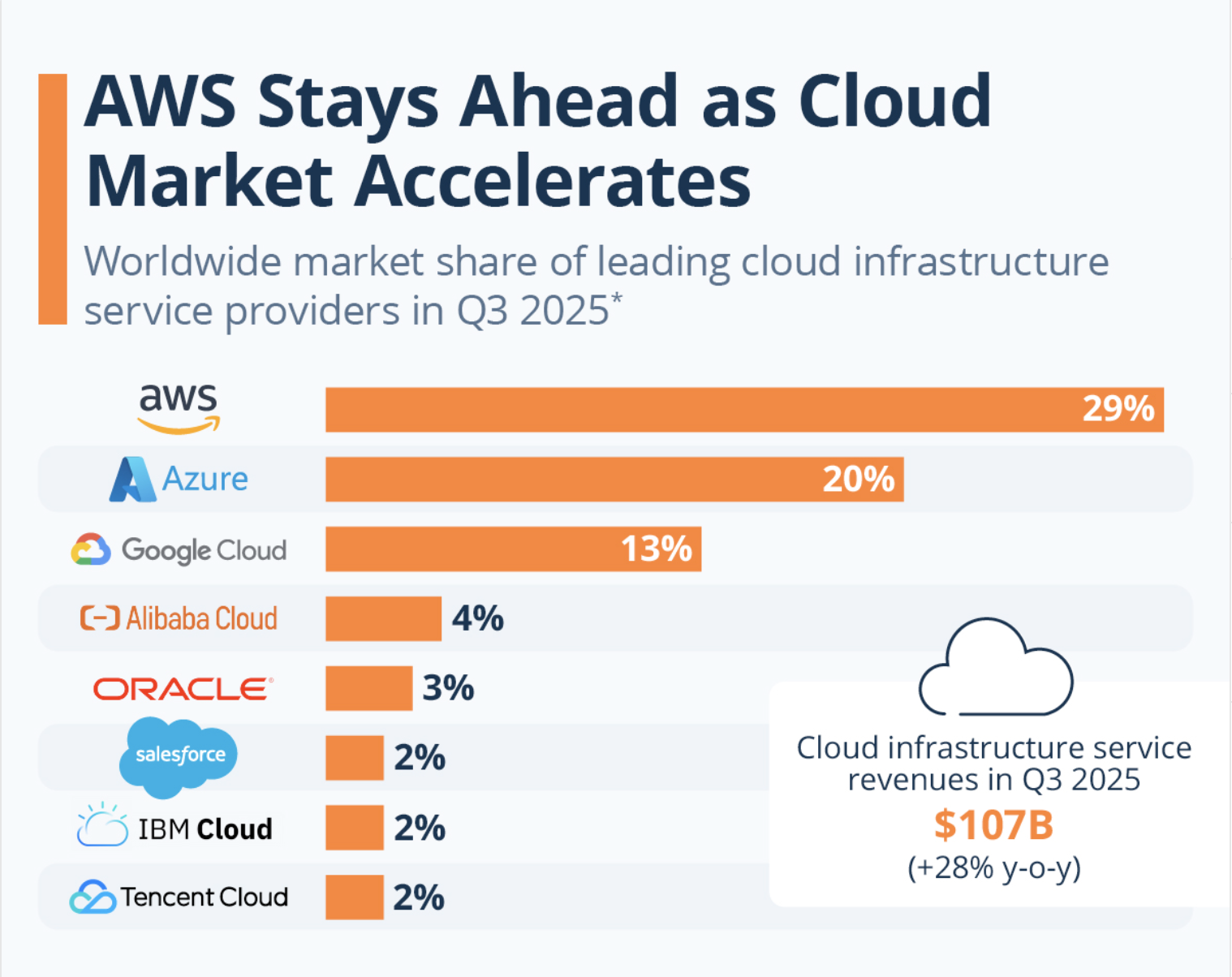

The rise of AI-powered no-code tools that allow users to create applications through linguistic prompts rather than computer code, decentralized through blockchain technology, will challenge Amazon Web Services’ (AWS) dominance of the cloud computing market.

No-code tools will democratize access to app creation and custom-tailored user experiences that will require constant updates and maintenance from AI, Lomesh Dutta, vice president of growth at the Dfinity Foundation, a non-profit organization that guides development of the Internet Computer Protocol (ICP) ecosystem, told Cointelegraph.

This rise of user-created applications eliminates the need for centrally managed software solutions stored on centralized servers.

“When applications are continuously generated and evolved by AI, you need infrastructure that is secure, tamper-resistant, and able to stay online without constant human intervention,” he said. Lomesh added:

“Decentralized blockchain networks introduced a revolutionary computing paradigm: by eliminating central points of control, they enable the creation of secure, reliable, and fault-tolerant software.”

A significant portion of crypto companies and Web3 projects rely on centralized AWS infrastructure to power their consumer-facing applications and websites, Internet Computer founder Dominic Williams told Cointelegraph.

Related: Cloudflare outage shows why crypto needs end-to-end decentralization

AWS outages rock the crypto industry in 2025

Several AWS outages occurred in 2025, impacting multiple crypto platforms and exchanges using AWS servers and data centers to host their applications.

The first outage occurred in April, causing disruptions to centralized crypto exchanges, including Binance, KuCoin and MEXC. At the time, Binance temporarily paused withdrawals until normal service was restored.

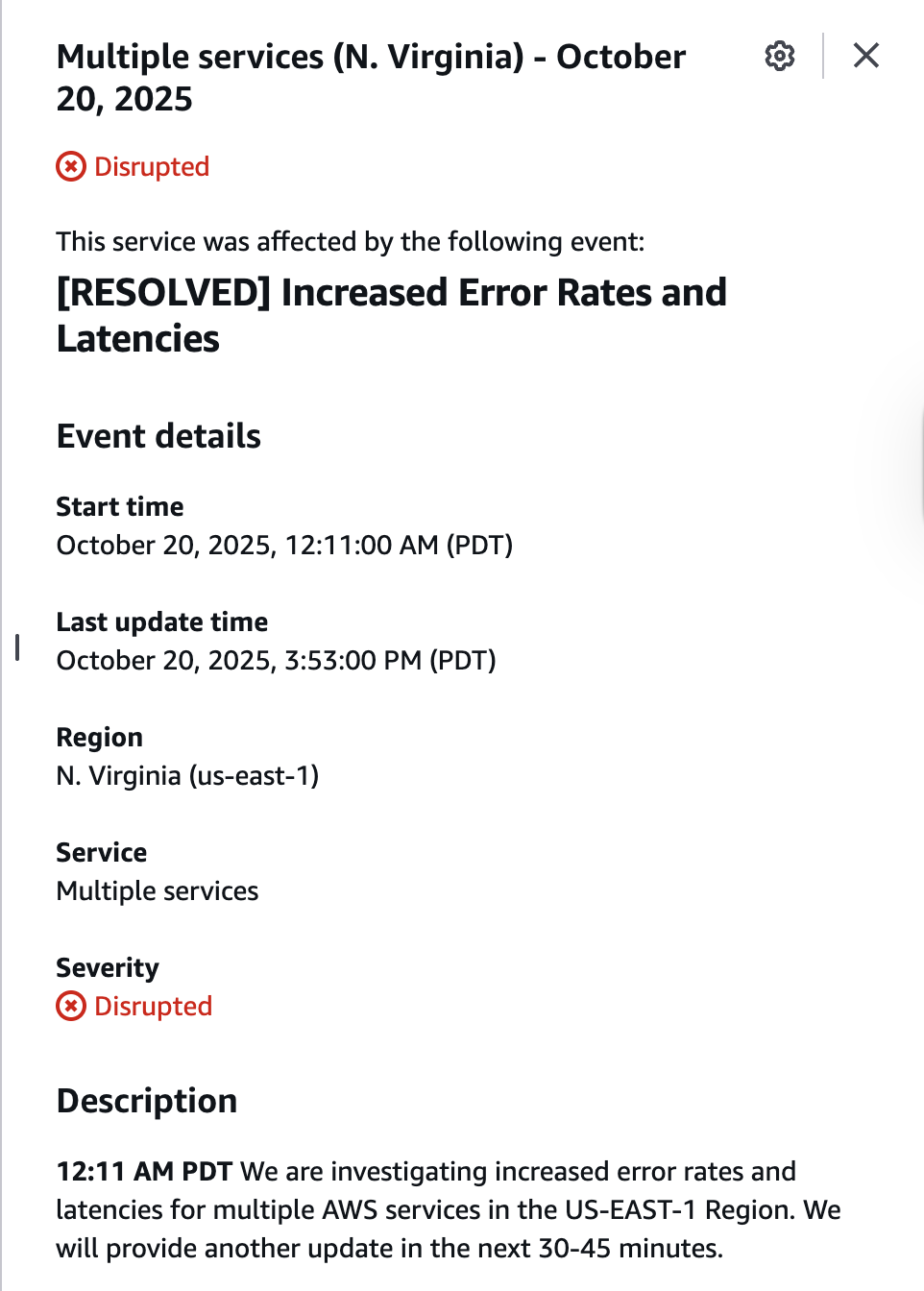

AWS experienced another outage in October, causing disruptions in crypto exchange Coinbase’s mobile application, with users reporting login problems, slowdowns and withdrawal issues.

Other financial applications were impacted by the outage, including the mixed-asset brokerage platform Robinhood and Web3 wallet MetaMask.

The October AWS outage lasted for about 15 hours and underscored the level of reliance crypto and Web3 projects, which market themselves as decentralized alternatives, have on centralized cloud infrastructure providers.

Crypto’s reliance on centralized infrastructure has drawn criticism from several crypto industry executives, including Jamie Elkaleh, chief marketing officer at crypto wallet company Bitget Wallet, and Carlos Lei, co-founder of decentralized physical infrastructure network (DePIN) marketplace Uplink.

“Decentralization has succeeded at the ledger layer but not yet at the infrastructure layer,” Elkaleh told Cointelegraph in October.

Magazine: Meet the onchain crypto detectives fighting crime better than the cops