Bitcoin (BTC) price action has painted bearish continuation patterns on its daily chart, which may propel BTC to new lows, according to analysts.

Key takeaways:

A sharp decline in spot buying and weakening ETF demand suggests that the upside may be limited.

Bitcoin’s bear flag pattern on the daily time frame targets $67,000 BTC price.

BTC price could bottom at $66,000

The BTC/USD pair has formed a bear flag on the daily chart, as shown in the figure below. This bear flag formed following Bitcoin’s drop from $107,000 highs on Nov. 11, and the recent rebound was rejected from the flag’s upper boundary around $93,000.

Related: Bitcoin retail inflows to Binance ‘collapse’ to 400 BTC record low in 2025

A daily candlestick close below the flag’s lower boundary at $90,000 may open the way for a drop toward the measured target of the pattern at $67,380, or around the 2021 price top. This would represent a 25% drop from the current price.

“Indicators (MACD and RSI) were extremely oversold, and this movement allows them to cool off so we can continue our downtrend,” said trader Roman in a Tuesday post on X, referring to Bitcoin’s consolidation inside the flag.

Pseudonymous analyst Colin Talks Crypto said that although a move down would be the expected outcome from the flag’s validation, the $74,000-$77,000 zone “would be the likeliest bottom,” adding:

“I would also expect a powerful rebound if such a level is reached.”

Meanwhile, crypto trader Aaron Dishner said that BTC price is likely to revisit $92,200, then near $98,000 under the upper bear flag line, before continuing the downtrend.

“Volume remains too weak to drive higher highs.”

1/ Bitcoin almost tested its first resistance fan level yesterday

— Aaron Dishner (@MooninPapa) December 9, 2025

It remains inside its bear flag and likely to revisit support near $86k–$87k

If Bitcoin pumps it faces resistance at $92,216 then near $98k under the upper bear flag line

Volume remains too weak to drive higher... pic.twitter.com/choWsb94Cz

As Cointelegraph reported, Bitcoin’s failure to successfully retest the yearly open above $93,000, caused by macroeconomic uncertainty, liquidations and stagnant spot ETF flows, is causing traders to retreat from Bitcoin.

Bitcoin could drop due to weaker demand

Bitcoin’s ability to push past the yearly open above $93,000 appears limited due to the absence of buyers.

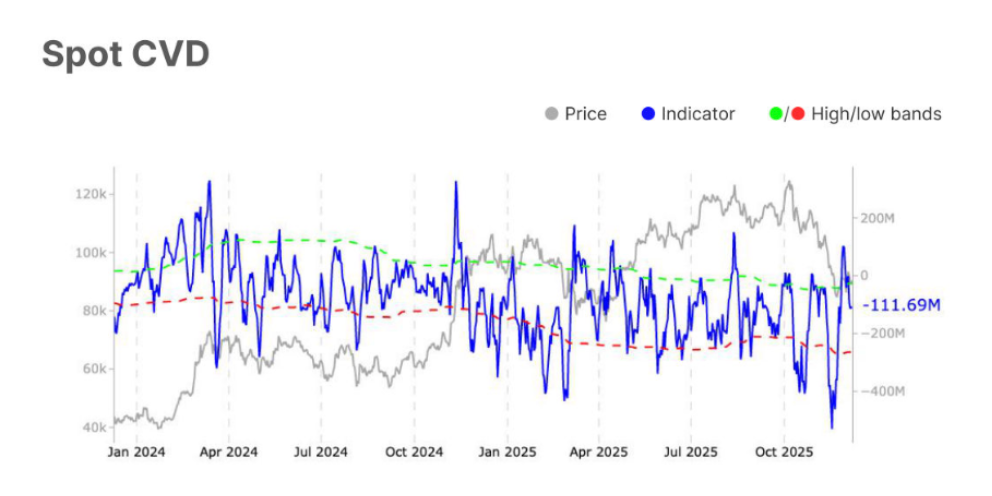

Bitcoin’s spot cumulative volume delta (CVD), an indicator that measures the net difference between buying and selling trade volumes, shows net spot buying on exchanges remains negative even after Bitcoin’s recent rebound.

Bitcoin’s Spot CVD weakened from -$40.8 million to -$111.7 million over the last week, “pointing to stronger underlying sell pressure,” Glassnode said in its latest Market Impulse report, adding:

“This sharp drop signals a clear rise in aggressive selling, suggesting softer buyer conviction and a short-term tilt toward bearish sentiment.”

Spot Bitcoin ETF demand slowed down last week, flipping from a $134.2 million inflow to a $707.3 million outflow, the market intelligence provider wrote, adding:

“The shift points to profit-taking or softer institutional demand, reflecting a more cautious tone as investors reassess positioning.”

These investment products experienced another $60 million in outflows on Monday, according to data from Farside Investors.

🇺🇸 ETF FLOWS: ETH, SOL and XRP spot ETFs saw net inflows on Dec. 8, while BTC spot ETFs saw net outflows.

— Cointelegraph (@Cointelegraph) December 9, 2025

BTC: - $60.48M

ETH: $35.49M

SOL: $1.18M

XRP: $38.04M pic.twitter.com/L4yMudTt3G

As Cointelegraph reported, Bitcoin’s recent rebound could be a bull trap, with some analysts predicting as low as $40,000 over the coming months.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.