Bitcoin"Momentum Is Reigniting", But These Are Still the BTC Price Levels to Watch

Bitcoin (BTC) market participants believe that the annual opening price above $93,000 is particularly crucial as the weekly close approaches.

Bitcoin analysis has mapped out the key BTC price levels to watch before the weekend, with a focus on the annual opening price above $93,000.

Key Points:

Key BTC price levels above and below the spot price have been identified as BTC approaches its weekly close.

A weekly close above $93,000 becomes more important to confirm market recovery.

On-chain data reveals key levels to watch

Although BTC started the week with a bounce from $84,000 to impressive levels, the bullish sentiment was suppressed by selling pressure near the annual opening price of $93,000.

Data from CryptoQuant shows that the current trading price of BTC/USD is below the average realized price (cost basis) of most age groups, indicating market instability, as pointed out by CryptoQuant analyst Darkfost.

Darfost posted on X on Friday: "The first area we want BTC to reclaim is the realized price of the youngest long-term holders (LTH)," referring to the cost basis of BTC held for 6 to 12 months, which is approximately $97,000.

"This level marks the transition between short-term holders (STH) and LTH," the analyst wrote, adding:

"Breaking through this level will bring these investors back to a comfortable position, restoring their expectations of potential gains and encouraging them to continue holding rather than selling, which will bring some stability."

Darkfost added that if it fails to close above $97,000, "caution is still needed."

On the downside, the first major support is at $88,000, representing the lower boundary of BTC's price trend on higher timeframes, as analyzed by analyst Daan Crypto Trades.

$BTC Has retaken the previous range with this bounce.

— Daan Crypto Trades (@DaanCrypto) December 4, 2025

Still a lot of work to do but at least the insane selling has stalled for the time being.

Ideally this doesn't lose that ~$88K region again on the higher timeframes. https://t.co/d2MWZWpixn pic.twitter.com/TszeyRGfyF

As reported by Cointelegraph, a break and close below the $93,000 boundary, specifically below $91,000, would confirm a continuation of the downtrend towards $68,000.

BTC bulls must close the week above $93,000

Data from Cointelegraph Markets Pro and TradingView shows that BTC/USD is hovering lower, struggling to maintain the $92,000 level.

This indicates that the price is still under pressure and unable to break above the annual opening price of $93,000.

Analyst Rekt Capital pointed out in a recent post on platform X that this aligns with the "resistance in the high area of $93,500," adding:

"A weekly close above $93,500, followed by a retest of this level turning into new support (similar to the situation indicated by the previous green circle), would confirm a breakout of the range."

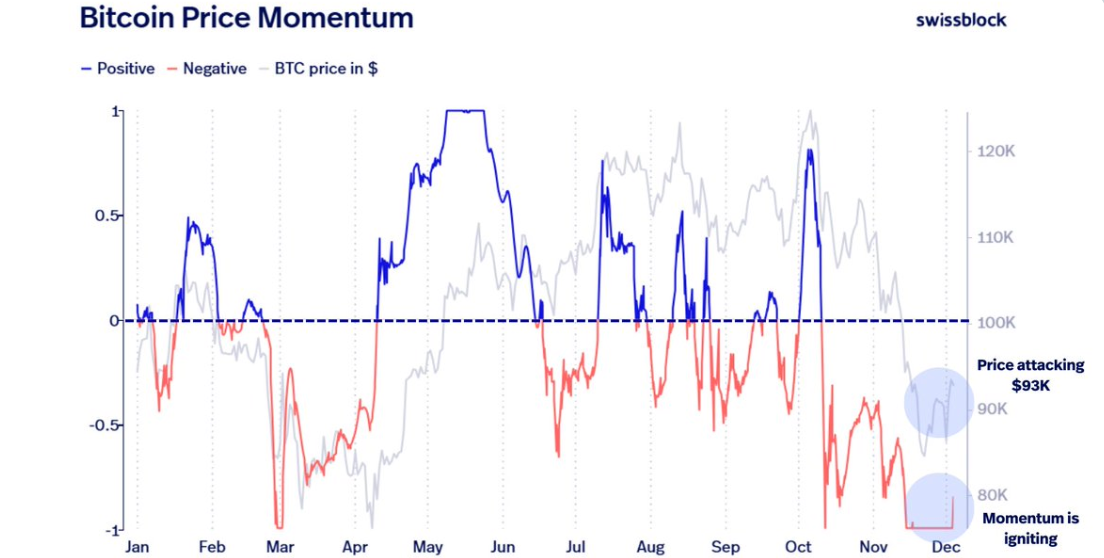

Private wealth management firm Swissblock stated that as BTC strives to solidify above the annual opening price of $93,000-$93,500, its "momentum is reigniting after weeks of completely negative conditions."

Swissblock further stated that if BTC can hold $93,000, "the next short-term target will be to break $95,000."

Another analyst, AlphaBTC, pointed out that he expects the price to rebound from current levels, with the weekly close breaking through the current resistance of the annual opening price in the final wave of the rally.

As reported by Cointelegraph, BTC's bearish trend in December may change as leverage decreases and prices reclaim key technical levels, suggesting the market is forming a more stable pattern.

Related recommendation: 21Shares founder predicts: Bitcoin (BTC) fear and greed index may show another month, low probability of new highs

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph is not responsible for any losses or damages resulting from your reliance on this information.