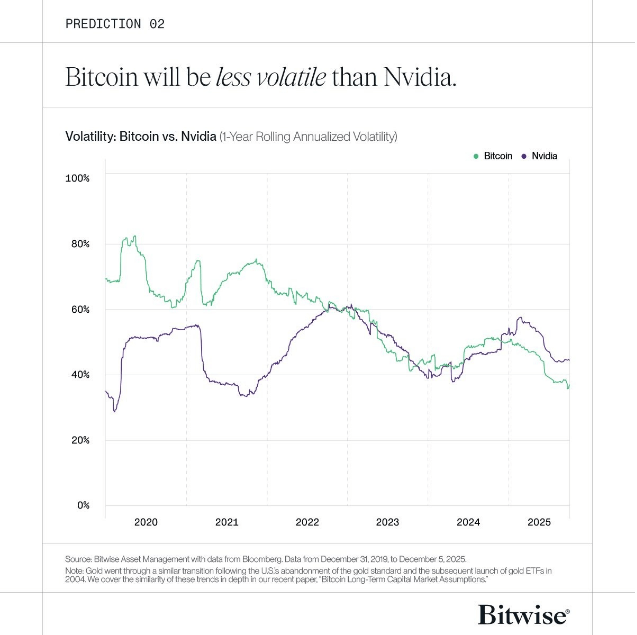

According to Bitwise, Bitcoin’s price swings are getting smaller, and that change is already showing up when compared with a fast-moving chip stock like Nvidia.

From an April low of $75,000 to an early October high of $126,000, Bitcoin moved about 68%. Nvidia, by contrast, swung roughly 120% from a low near $94 in April to $207 in late October. Those numbers show a clear gap in how rough the ride has been this year.

Volatility Comparison Shows Shift

Based on reports from Bitwise, Bitcoin will likely be calmer than Nvidia in 2026. “BTC already less volatile than Nvidia in 2025 ... thanks to institutional inflows & ETFs,” Bitwise said in an X post.

That change is linked to more traditional money coming in through products such as spot ETFs and other institutional channels. In short: more big, steady investors are in the mix now, and that tends to smooth out wild swings.

🚀Bitcoin maturing fast!

Bitwise : BTC already less volatile than Nvidia in 2025 (68% vs 120% price swing) thanks to institutional inflows & ETFs.

Volatility to stay lower in 2026 + new all-time high ahead as crypto stocks outperform tech! 🐂 #Bitcoin #BTC #Crypto... pic.twitter.com/TEyzoZQrYv

— ChartSage (@CryptoChartSage) December 18, 2025

Institutional Entry And The Bull Case

Bitwise also put forward a bullish view for next year. It expects a new all-time high and a break from the old four-year cycle. The firm listed several reasons: the halving, shifts in interest-rate cycles, and weaker boom-and-bust forces than in past runs.

The company named big institutions — Citigroup, Morgan Stanley, Wells Fargo and Merrill Lynch — as potential new entrants, and it said allocations to spot crypto ETFs should rise. Bitwise added that onchain work could speed up too, and that crypto equities might beat tech stocks in returns.

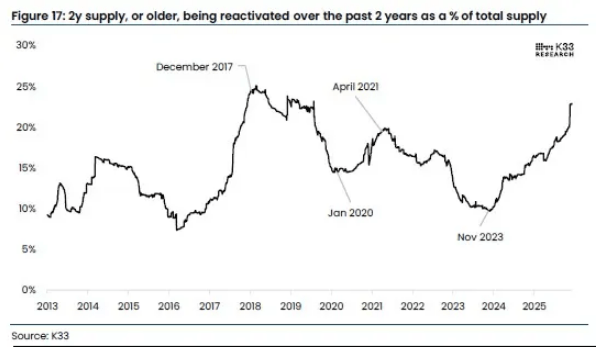

Long-Time Holders Are Selling

Reports have disclosed heavy selling from long-term holders, a trend that complicates the bullish story. K33 Research found about 1.6 million coins that had been idle for at least two years moved since early 2023.

That amount is worth roughly $140 billion. In 2025 alone, nearly $300 billion of coins that had been dormant for over one year returned to the market, according to K33 and CryptoQuant data.

CryptoQuant also flagged one of the heaviest long-term holder distributions seen in more than five years in the past 30 days.

Chris Newhouse, director of research at Ergonia, described the flow as a “slow bleed” caused by steady selling into thin bids, which can create a long, grinding fall that is not easy to reverse.

Market Divergence And Near-Term Pressure

The split with equities is clear. Nvidia shares are up about 27% year-to-date. Bitcoin, on the other hand, is down roughly 8% so far this year and has dropped nearly 30% from its record above $126,000.

That gap shows crypto is not always moving with big tech. Selling by long-term holders is one reason prices are under pressure even while some investors push for fresh gains.

Featured image from Unsplash, chart from TradingView