Original | Odaily Planet Daily (@OdailyChina)

Author | Asher (@Asher_ 0210)

Zama's Token Launch on Its Own Platform

Project Overview

Zama is a company specializing in Fully Homomorphic Encryption (FHE) technology, one of the most hardcore innovations in the field of privacy computing. Zama has completed two rounds of financing, with a total amount of up to $130 million. In March 2024, Zama announced the completion of a $73 million Series A round co-led by Multicoin Capital and Protocol Labs; in June 2025, Zama announced the completion of a $57 million Series B round led by Blockchange Ventures and Pantera Capital.

Participation Guide and Details

Auction pre-registration link: https://www.zama.org/auction;

Auction method: Sealed-bid Dutch auction (For a detailed explanation, read: Zama's Public Sale Too Complicated? An Article to Understand the Sealed Dutch Auction Play);

Auction time: Will be held from January 12th to 15th, claiming starts on January 20th;

Public sale share: 10% of the total token supply, with 8% through the auction and 2% sold at a fixed price after the auction (capped at $10,000 per person);

Lock-up situation: Zama tokens purchased in the auction will be fully unlocked.

Octra's Token Launch on the Sonar Platform

Project Overview

Octra is an L1 project in the privacy sector, supporting an FHE blockchain network with isolated execution environments. In terms of token distribution, early investors hold 18%, Octra Labs holds 15%, and the remaining 67% is allocated to the community, including early users, validators, ecosystem grants, Echo participants, and this public sale. No single investor holds more than 3% of the tokens.

In September 2024, Octra announced the completion of a $4 million Pre-Seed round led by Finality Capital, with participation from Big Brain Holdings, Karatage, Presto, Builder Capital, and others.

Participation Guide and Details

Octra announced it will conduct a public token sale on Sonar (an ICO platform founded by Echo and recently acquired by Coinbase):

- Official token sale platform account: https://x.com/echodotxyz (The specific token sale website has not been announced yet, but account registration is now open);

- Event start time: December 18th;

- Sale quantity: 10% of the total token supply. Notably, the team stated that if subscription demand is strong, the sale allocation ratio may be increased;

- Sale model: Fixed price of $0.20, aiming to raise $20 million in this sale, corresponding to a Fully Diluted Valuation (FDV) of $200 million;

- Unlock situation: Not yet announced.

Rainbow's Token Launch on the CoinList Platform

Project Overview

Rainbow is a Web3 wallet project aimed at helping users easily explore and manage assets, including NFT collections, DeFi application connections, and cross-chain bridging, through a simple, intuitive, and secure user interface. Rainbow emphasizes a design philosophy of "fun, simple, secure," akin to a "Robinhood" tailored for Web3, lowering the entry barrier for newcomers to the crypto world. It supports ENS domain integration and provides a seamless experience on mobile and desktop.

To date, Rainbow has completed nearly $20 million in financing.

Participation Guide and Details

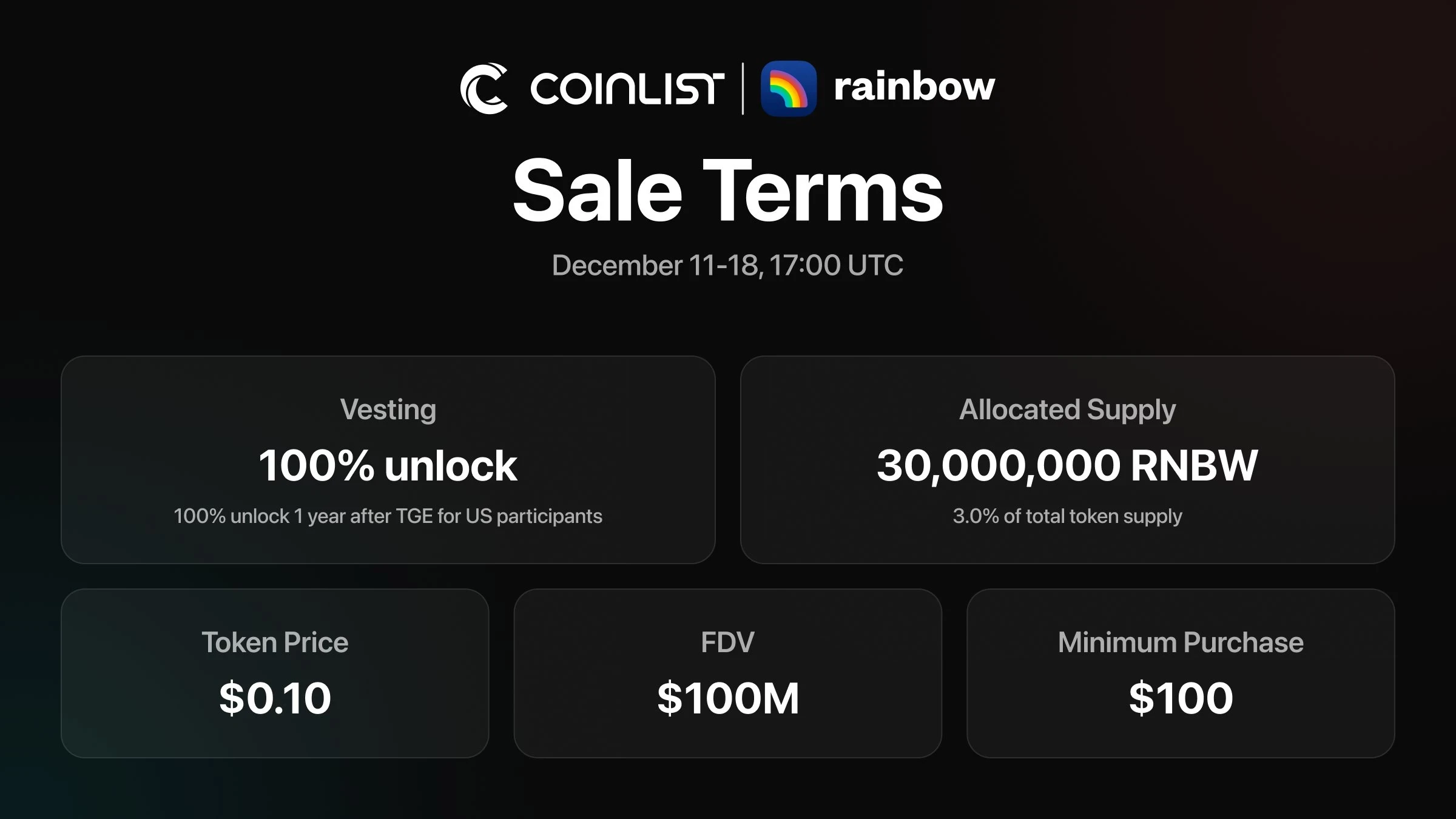

Rainbow announced it will conduct a public token sale on CoinList:

- Token sale website: https://coinlist.co/rainbow;

- Event start time: December 12th, 1:00 AM Beijing Time;

- Sale quantity: 3% of the total token supply, i.e., 30 million RNBW tokens;

- Sale model: Fixed price of $0.10;

- Unlock situation: Fully unlocked at TGE (US users will be unlocked one year after TGE);

- Minimum investment amount: $100.

Gensyn's Token Launch on Its Own Platform

Project Overview

Gensyn is an open network for decentralized AI systems. In March 2022, Gensyn announced the completion of a $6.5 million seed round led by Eden Block. In June 2023, Gensyn announced the completion of a $43 million Series A round led by a16z.

Participation Guide and Details

- Token sale website: https://token.gensyn.network/;

- Event start time: December 15th;

- Sale quantity: 5% of the total token supply (sale quantity is 3% of total supply, bonus quantity is 2% of total supply);

- Sale model: English auction with a valuation cap. Specifically, the valuation floor is $1 million FDV ($0.0001 per token), the cap is $1 billion FDV ($0.10 per token), with a minimum price increment of $0.0001;

- Unlock situation: Fully unlocked at TGE (US users will be unlocked one year after TGE). Choosing to lock up can earn an additional 10% token bonus;

- Minimum investment amount: $100.

Infinex's Token Launch on the Sonar Platform

Project Overview

Infinex is a decentralized finance platform launched by Synthetix founder Kain Warwick in April 2024. The project aims to break down the boundaries between CeFi and DeFi, providing a smooth user experience similar to centralized exchanges while maintaining the non-custodial nature and security of decentralized services.

Participation Guide and Details

On November 27th, Infinex, a new project created by Synthetix founder Kain Warwick, officially announced its upcoming TGE, planning a public sale on Sonar with a $300 million FDV, intending to sell 5% of the INX token supply, aiming to raise $15 million, and chose Sonar as the launch platform.

According to Infinex's official introduction, this public sale will have two participation methods: a guaranteed quota and a lottery allocation. The guaranteed quota part is for users holding liquid (unlocked) Patron NFTs, with specific guarantee strategies as follows:

- 1 Patron NFT: $2000 quota;

- 5 Patron NFTs: $15,000 quota;

- 25 Patron NFTs: $100,000 quota;

- 100 Patron NFTs: $500,000 quota;

- Allocation follows a cumulative mechanism. For example, if you hold 32 liquid Patron NFTs, your quota will be: 100000 + 15000 + 2000 + 2000 = $119,000.

The lottery allocation is open to all users; anyone can apply to participate. Specific rules are as follows:

- The minimum subscription amount is $200, the maximum subscription amount is $5000;

- If the subscription volume exceeds the limit, orders will be allocated through a lottery;

- Each order has an equal chance of being selected. If selected, the order's subscription will be fully allocated;

- Unfulfilled orders will be automatically refunded.

It is worth mentioning that this public sale will have a one-year lock-up restriction, but it includes an early unlock clause. The specific design for early unlocking is as follows:

- At TGE, if early unlock is chosen, the subscription will be at a price corresponding to a $1 billion FDV;

- During the one-year lock-up period, this price will linearly decrease to the initially set $300 million;

- If the trading price of INX after listing is higher than the real-time early unlock price, some public sale participants might choose to unlock early, thus making the unlock curve smoother.

Fogo's Token Launch on Its Own Platform

Project Overview

Fogo is a new Layer 1 blockchain based on the Solana Virtual Machine (SVM). Its technical architecture aims to solve the performance bottlenecks of existing blockchains, providing a more efficient and lower-cost transaction experience. Fogo has currently completed seed round and community round financing, totaling $13.5 million.

Participation Guide and Details

- Token sale website: https://presale.fogo.io/, USDC transfer function is already open, users can pre-transfer USDC to the Fogo wallet (Transfer tutorial: https://community-docs.fogo.io/getting-started/transferring-to-fogo)

- Event start time: December 17th;

- Sale quantity: 2% of the total token supply;

- Sale model: First-come, first-served, price unknown;

- Unlock situation: Fully unlocked at TGE (US users will be unlocked one year after TGE). Choosing to lock up can earn an additional 10% token reward;

- Minimum investment amount: $100.

Football.Fun's Token Launch on Legion Platform and Kraken Exchange

Project Overview

Football.Fun is a sports prediction market platform deployed on the Base network. On July 18th, Football.Fun announced the completion of a $2 million seed round led by sports-focused investment firm 6th Man Ventures (6MV), with other investors including Devmons, Zee Prime Capital, Sfermion, and The Operating Group.

Participation Guide and Details

On December 9th, Football.Fun announced it will conduct a public token sale on the Legion platform and Kraken exchange. Specific details have not been announced yet. Currently, KYC verification can be completed on both launch platforms using a passport.