Author: Alex Krüger

Compiled by: Deep Tide TechFlow

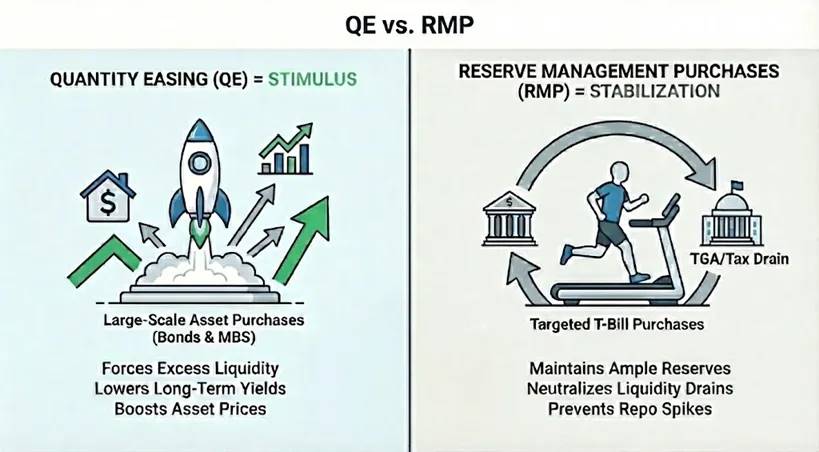

The Federal Reserve has just committed to purchasing $40 billion in U.S. Treasuries per month, and the market has already started shouting "Quantitative Easing (QE)!"

While on the surface this figure appears to be a signal of economic stimulus, the underlying mechanism tells a different story. Powell's move is not aimed at stimulating the economy but at preventing operational issues within the financial system.

Below is an analysis of how the Fed's Reserve Management Purchases (RMP) program structurally differs from Quantitative Easing (QE) and its potential implications.

What is Quantitative Easing (QE)?

To strictly define Quantitative Easing and distinguish it from standard open market operations, the following conditions must be met:

Three Mechanical Conditions

-

Mechanism (Asset Purchases): The central bank purchases assets, typically government bonds, by creating new reserve funds.

-

Scale (Large-Scale): The purchase volume is significant relative to the total market size, aimed at injecting substantial liquidity into the system rather than making fine adjustments.

-

Objective (Quantity Over Price): Standard policy adjusts supply to achieve a specific interest rate (price) target, while QE commits to purchasing a specific quantity of assets regardless of the resulting interest rate changes.

Functional Condition

-

Positive Net Liquidity (QE): The pace of asset purchases must exceed the growth of non-reserve liabilities (such as currency and the Treasury General Account). The goal is to forcibly inject excess liquidity into the system, not merely provide the required liquidity.

What are Reserve Management Purchases (RMP)?

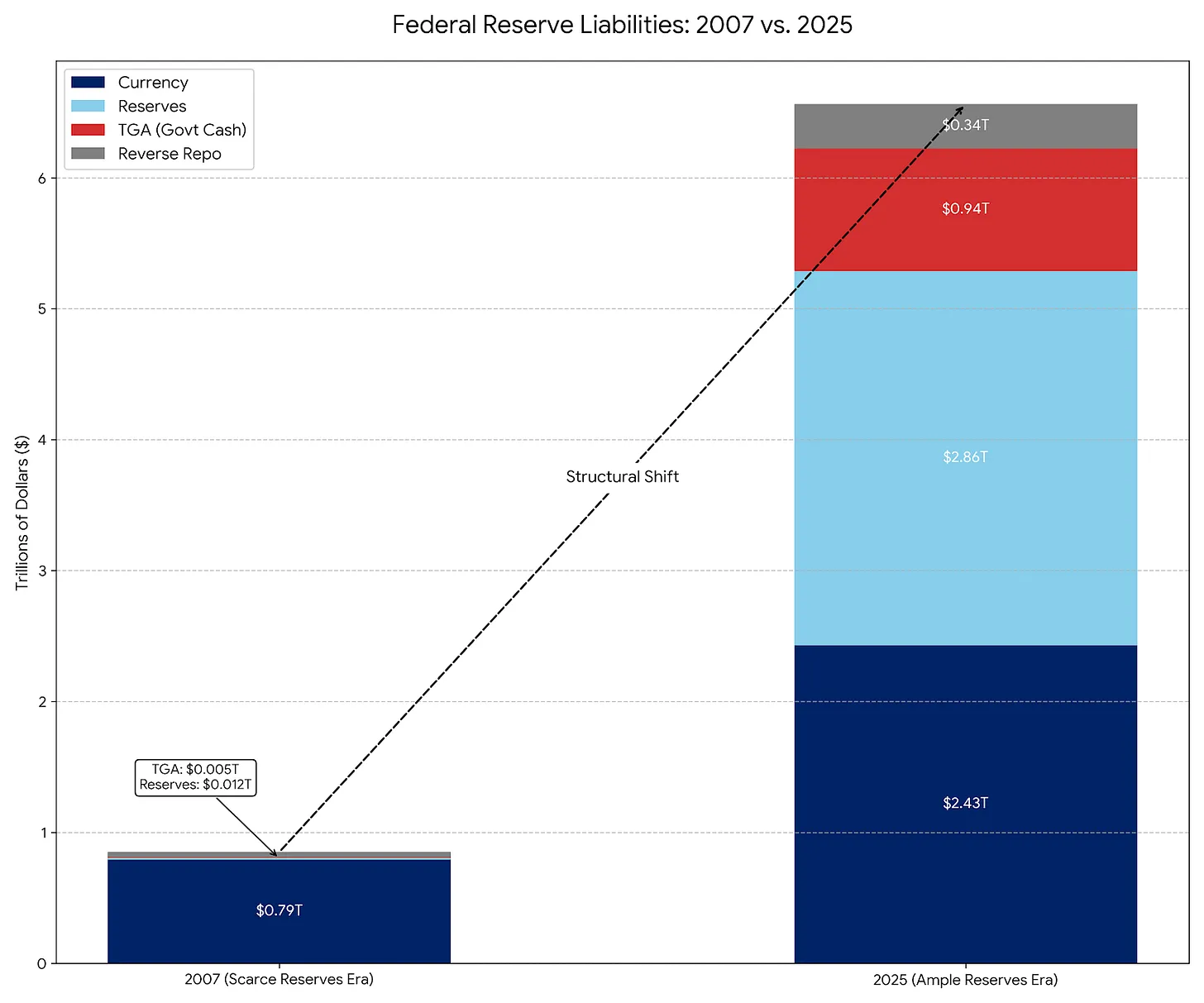

RMP is essentially the modern successor to Permanent Open Market Operations (POMO), which was the standard operating procedure from the 1920s until 2007. However, the composition of the Fed's liabilities has changed dramatically since 2007, requiring an adjustment in operational scope.

POMO (Scarce Reserves Era)

Before 2008, the Fed's primary liability was physical currency in circulation; other liabilities were minor and predictable. Under POMO, the Fed purchased securities merely to meet the public's gradual demand for physical cash. These operations were calibrated to be liquidity-neutral and were small in scale, not distorting market prices or depressing yields.

RMP (Ample Reserves Era)

Today, physical currency constitutes only a small portion of the Fed's liabilities, which are dominated by large and volatile accounts like the Treasury General Account (TGA) and bank reserves. Under RMP, the Fed purchases short-term Treasury bills (T-Bills) to buffer these fluctuations and "maintain ample reserve supplies on an ongoing basis." Similar to POMO, RMP is designed to be liquidity-neutral.

Why Launch RMP Now: TGA and the Impact of Tax Season

Powell is rolling out the Reserve Management Purchase program (RMP) to address a specific financial system problem—the TGA (Treasury General Account) liquidity drain.

How it Works: When individuals and businesses pay taxes (particularly around the December and April major tax deadlines), cash (reserves) is transferred from their bank accounts to the government's checking account at the Fed (TGA), which is outside the commercial banking system.

Impact: This transfer of funds drains liquidity from the banking system. If reserves fall too low, banks will stop lending to each other, potentially triggering a repo market crisis (similar to September 2019).

Solution: The Fed is now launching RMP to offset this liquidity drain. They are creating $40 billion in new reserves to replace the liquidity that is about to be locked in the TGA.

Without RMP: Tax payments tighten financial conditions (bearish). With RMP: The impact of tax payments is neutralized (neutral).

Is RMP Actually QE?

Technically: Yes. If you are a strict monetarist, RMP fits the definition of QE. It meets the three mechanical conditions: large-scale asset purchases ($40 billion per month) via new reserves, with a quantity-based rather than price-based target.

Functionally: No. RMP serves to stabilize, while QE serves to stimulate. RMP does not significantly loosen financial conditions but prevents them from tightening further during events like TGA replenishment. Since the economy naturally drains liquidity, RMP must run continuously just to maintain the status quo.

When Would RMP Turn into True QE?

For RMP to transform into full-fledged QE, one of the following two variables must change:

A. Change in Duration: If RMP begins purchasing long-term Treasuries or mortgage-backed securities (MBS), it becomes QE. By doing so, the Fed removes interest rate (duration) risk from the market,压低 yields, forcing investors into higher-risk assets and thereby pushing up asset prices.

B. Change in Quantity: If the natural demand for reserves slows (e.g., TGA stops growing), but the Fed still purchases $40 billion per month, RMP becomes QE. At this point, the Fed is injecting more liquidity into the financial system than is needed, and this excess inevitably flows into financial asset markets.

Conclusion: Market Impact

RMP is designed to prevent the liquidity drain from tax season from impacting asset prices. Although technically neutral, its reintroduction sends a psychological signal to the market: the "Fed Put" is activated. This announcement is a net positive for risk assets, providing a "mild tailwind." By committing to $40 billion in monthly purchases, the Fed effectively provides a floor for banking system liquidity. This eliminates the tail risk of a repo crisis and boosts confidence in market leverage.

It is important to note that RMP is a stabilizer, not a stimulator. Since RMP only replaces the liquidity drained by the TGA rather than expanding the net monetary base, it should not be mistaken for the systemic easing of true QE.