Following its launch in 2023, Shibarium, a Layer-2 blockchain network for the Shiba Inu ecosystem, was widely seen as a major catalyst that could propel SHIB to new levels and potentially lift its price. However, over the past few months, activity and adoption on Shibarium have remained disappointingly quiet. Now, with the potential advancement and growing interest in the new ShibOS platform, momentum for a comeback could be building. Adding to this possible shift, SHIB whales have noticeably returned, with on-chain activity beginning to climb.

Shibarium Revival Could Take Shape With The Adoption Of ShibOS

For most of the year, Shibarium has struggled to gain meaningful traction, unable to revive and return to the level of activity investors once expected. As the number of active users decreased, developers were slow to build on it, and the price of SHIB saw little to no reaction despite its strong community backing and Shibarium’s promise of greater utility and faster transactions.

Although conditions look rather bleak, the narrative could shift as the new ShibOS platform grows and is increasingly adopted. ShibOS is a new Operating System designed to serve as the backbone of the Shiba Inu ecosystem. Rather than positioning SHIB as a simple meme-driven asset, ShibOS aims to create a functional environment where applications, utility, and identity features can thrive.

The operating system provides a framework that connects traditional businesses and Web3 developers, enabling seamless integration of blockchain features. The concept behind ShibOS places the Shiba Inu community at the center of a broader technological transformation. It introduces a structure that supports Decentralized Applications (dApps) and self-governed digital identities while offering a gateway for Web2 brands interested in experimenting with blockchain technology.

If developers and businesses begin adopting ShibOS and integrating it into their products, Shibarium could naturally benefit from the surge in activity. More applications would mean more transactions, increased users, and a healthier on-chain economy. This type of organic growth could, in turn, drive the demand for SHIB, potentially influencing its price.

Shiba Inu Whale Activity Hits Six-Month High

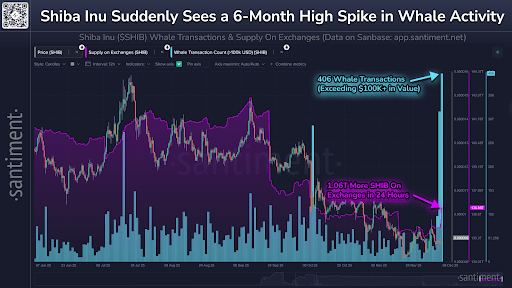

Shiba Inu is also showing signs of renewed activity in terms of on-chain transactions. According to fresh data and a chart shared by SanSights on Santiment, SHIB whale activity has surged to its highest level since early June 2025. Over the last day or so, multiple accounts have reportedly made 406 transactions, each moving more than $100,000 in SHIB.

At the same time, crypto exchanges have seen a net increase of 1.06 trillion SHIB, valued at roughly $15 million to $20 million—all deposited within 24 hours. This sudden increase in supply comes as prices surge unexpectedly this week, highlighting a rare convergence of bullish factors.

Typically, when whale activity, large deposits, and price movements happen at the same time, it can signal upcoming big changes. It could either be that whales are accumulating for a stronger price rally or preparing to sell into the current momentum.