Bitcoin (BTC) counts down to Christmas at a crossroads with bulls and bears locked in a struggle for control.

Bitcoin price targets become increasingly divergent as frustration builds over the lack of a breakout.

Japan ruffles feathers with record bond yields as gold and silver smash all-time highs.

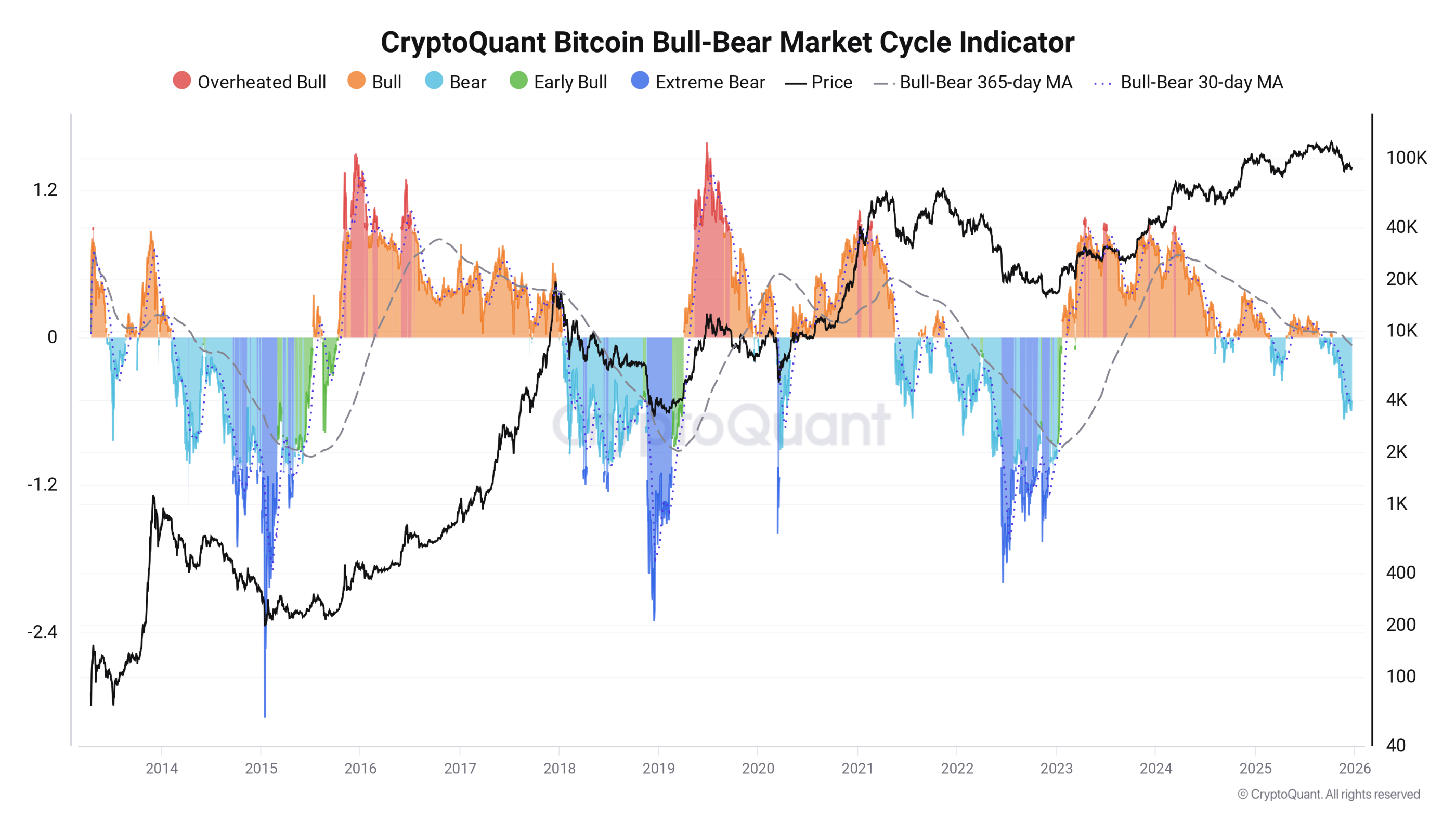

Bitcoin is anything but price discovery as the Bull-Bear Market Cycle Indicator sees multiyear lows.

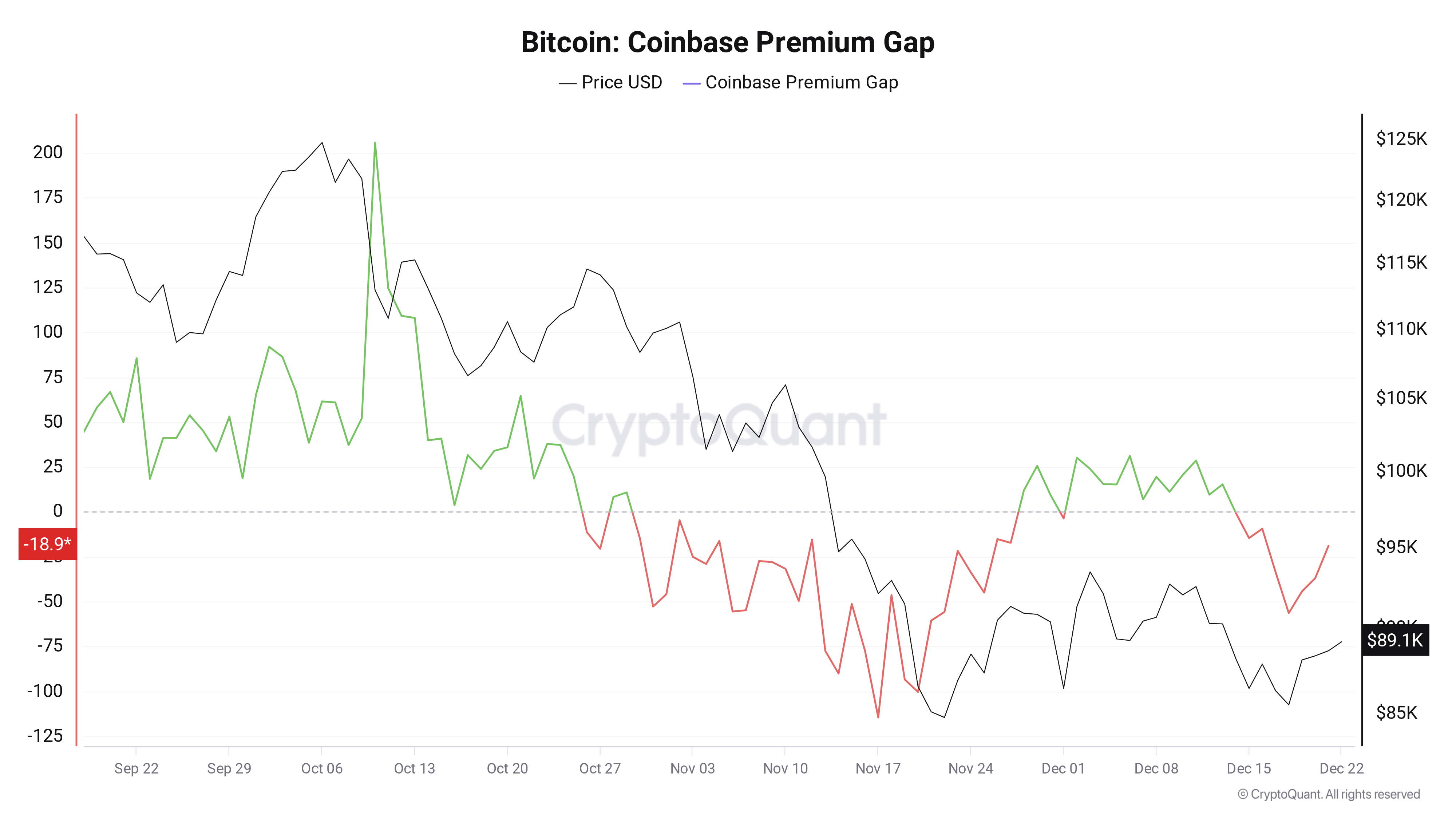

The Coinbase Premium is back in the red, with US sellers staying strong.

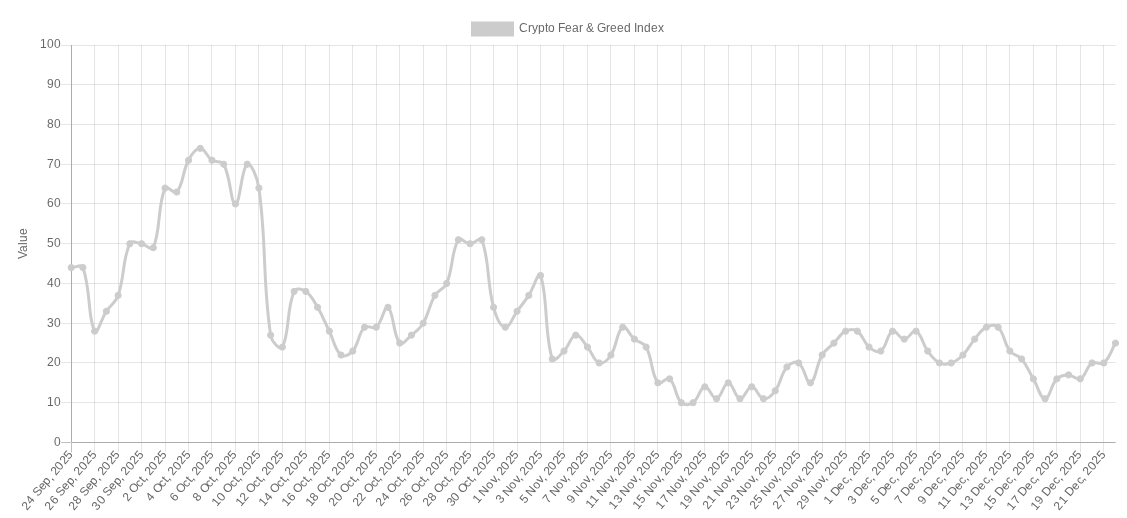

Sentiment bets give rise to calls for a contrarian market move higher.

Bitcoin end-of-year breakout bets diverge

After initially wobbling at the weekly close, Bitcoin saw some much-needed relief as bulls sought to revisit $90,000.

Data from Cointelegraph Markets and TradingView shows BTC/USD circling multiday highs on Monday.

Traders have become increasingly polarized on the outlook, with some warning of a return to yearly lows while others anticipate a full bull-market rebound.

In his latest analysis on X, trader CrypNuevo considered both outcomes possible next.

Sellers, he argued, had disposed of the majority of their capital in the two months since Bitcoin saw its latest all-time highs of $126,000.

“I believe that there probably isn’t much left to sell right now. So the main bearish scenario is a sweep of the lows,” he wrote.

“Losing $80k would take price to the next support at $73k-$72k, but this information makes it more unlikely - unless if there is a new trigger for it to happen.”

Instead, CrypNuevo eyed the 50-day exponential moving average (EMA) near the $93,500 yearly open as a potential target.

“With this information, it wouldn't surprise me to see an aggressive pump by EOY and the start of 2026,” the X thread continued.

“Clearing the local resistance at $94.5k (matches with the 1D50EMA) would be a clear sign. And then, it'd face a strong resistance at $100k.”

Expectations of the coming months also vary. Among the bearish takes is that of trader Killa, now seeing a comedown to $60,000 beginning in Q1 2026.

$BTC

— Killa (@KillaXBT) December 22, 2025

Don’t shoot the messenger, the final boss has entered the chat.

Ready for 1–2 months of chop?

The big leg down to 60K starts from Feb-March. pic.twitter.com/VgJaNEaN8H

Reiterating his comparison to the end of Bitcoin’s previous bull market in 2021, trader Roman forecast a “very boring” festive period for crypto and stocks.

Gold, silver hit records as Japan casts a shadow

A relatively short week of US macro data releases gives the Fed pause for thought until January — but traders are seeing volatility everywhere.

Jobless claims and the delayed release of Q3 GDP numbers form the backbone of the macro data prints through Wednesday before markets close for Christmas.

As the week begins, however, it is precious metals and Japan’s economy that are stealing attention.

Japanese ten-year bond yields hit a record 2.1%, just days after the central bank hiked interest rates to 30-year highs and officials prepared a $140 billion stimulus package.

“Just as you think Japan's situation can't get worse, it gets even worse,” trading resource The Kobeissi Letter reacted on X.

BREAKING: Japan's 10Y Government Bond Yield surges to a record 2.10%, now up +100 basis points in 2025.

— The Kobeissi Letter (@KobeissiLetter) December 22, 2025

Just as you think Japan's situation can't get worse, it gets even worse. pic.twitter.com/EkWvc9HnR4

Uncertainty over Japan has a history of sparking weakness in crypto markets, while the reaction to the contrarian rate hike was less pronounced.

A flight to safety could already be at hand — both gold and silver are hitting new all-time highs, while Bitcoin and altcoins languish far below theirs.

Gold reached $4,420 per ounce on Monday, while silver targeted the $70 mark for the first time, up nearly 150% in 2025.

“Asset owners keep on winning,” Kobeissi commented, calling stocks’ performance this year “historic.”

“US households now own more equities than real estate as a percentage of their net worth, the 3rd such occurrence over the last 65 years,” it noted.

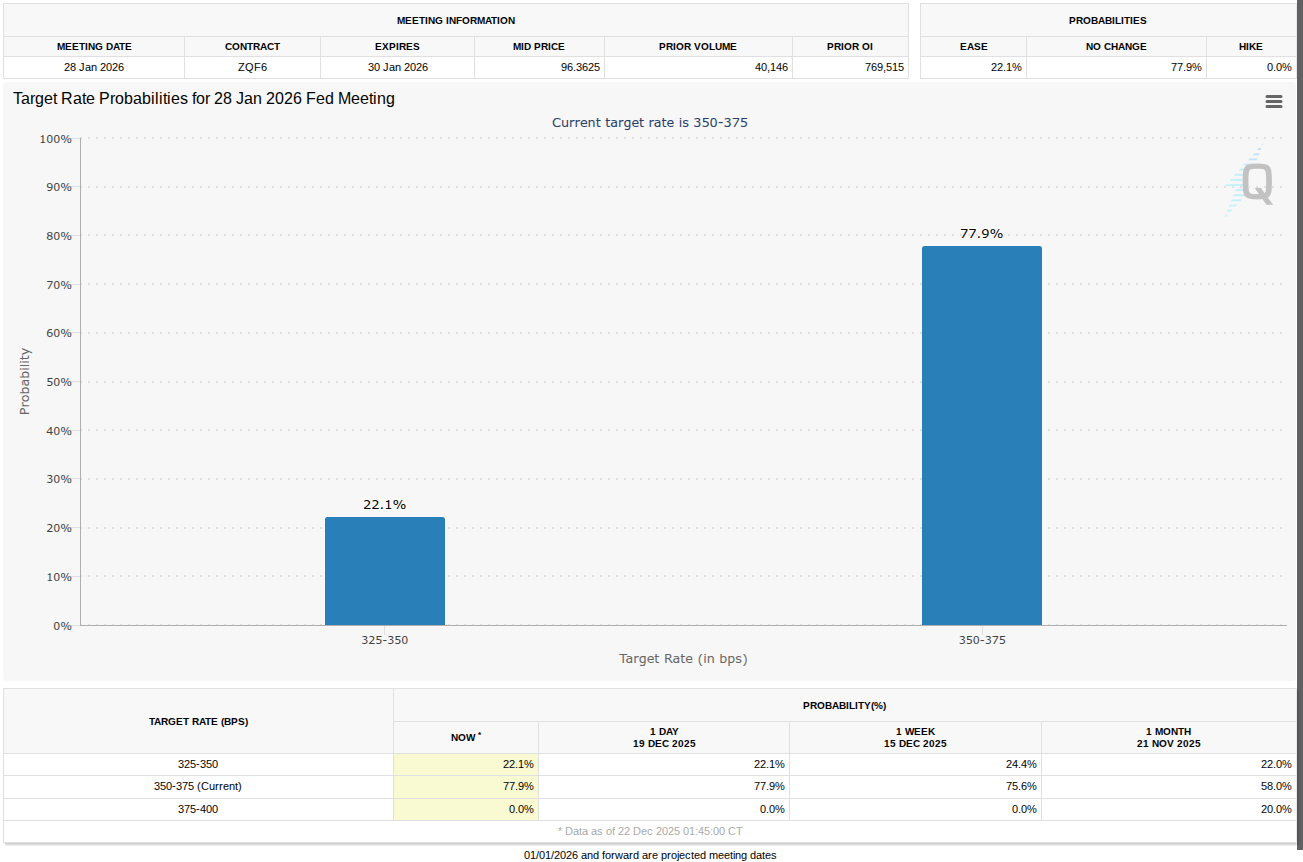

When it comes to the good times continuing, market sentiment remains skeptical. Data from CME Group’s FedWatch Tool currently puts the odds of the Fed cutting rates again in January at just 22%.

Bull or bear? Bitcoin echoes 2022

For onchain analytics platform CryptoQuant, Bitcoin is firmly in a bear market.

Among the various reasons, contributors argue, is the so-called Bull-Bear Market Cycle Indicator, which has been in negative territory since early September.

The Indicator measures the 30-day SMA of traders’ Profit & Loss (P&L) Index relative to its 365-day equivalent.

From mid-May to early September, the 30-day SMA was positive. Currently, it measures -0.52, having recently hit its lowest levels since the 2022 bear market.

“Prices enter into bear mode when the indicators switch from Bull to BEAR,” CryptoQuant explains.

Continuing, contributor GugaOnChain described the Bull-Bear data as part of an overall market slowdown.

In one of CryptoQuant’s “Quicktake” blog posts on Monday, he likened the situation to 2018, another Bitcoin bear market year, also noting reduced network activity.

“The indicators confirm a defensive scenario, and looking ahead, the comparison with 2018 suggests that periods of low activity tend to precede greater volatility, but today’s broader user base signals stronger resilience in the ecosystem,” he summarized.

Coinbase Premium fails to inspire

US Bitcoin investors continue to signal a lack of faith as selling pressure from Coinbase stays strong.

The latest readings from the Coinbase Premium, as reported by CryptoQuant, shows enduring US selling pressure.

The Premium measures the difference in price between Coinbase’s BTC/USD and Binance BTC/USDT pairs. When in negative territory, it signals that a lack of US buyer interest will likely deprive the market of upward momentum.

“Once the $BTC sell pressure there cools off, we can finally bounce,” blockchain technology expert Elja Boom commented on the issue over the weekend.

CryptoQuant shows that the Premium hit -$56 on Dec. 18 before rebounding, still in the red at the time of writing.

This, trader Daan Crypto Trades acknowledged, does not match lows seen as BTC/USD retested $80,000 earlier in the month.

“Market without any clear direction for a while now. No major outliers in the data either,” he told X followers Friday.

“Things point to a slow end of the year. Early next year we'll get a better idea of where this wants to head next.”

Sentiment primed for the worst to come

Bitcoin approaching $90,000 was enough to lift market sentiment a full nine points, per data from the Crypto Fear & Greed Index.

Related: Bitcoin weekly RSI falls to most oversold levels since $15K BTC price

Despite that, the overall mood remains one of “extreme fear” at 25/100 — a contrast to the 45/100 “neutral” reading for stocks.

🚨 NOW: Crypto Fear and Greed Index climbs to 25 (Extreme Fear) from 16 last week, showing some sentiment improvement but still deep in fear territory. pic.twitter.com/sJx5R9CuXV

— Cointelegraph (@Cointelegraph) December 22, 2025

As market consensus appears to agree that further downside is due for crypto, the few optimists going on record are holding firm.

“The markets are in extreme fear, which have often been providing to be a great opportunity to be seeing a strong move afterwards,” crypto trader, analyst and entrepreneur Michaël van de Poppe wrote Saturday.

“The recent crash on the markets for $BTC was a massive disconnect, and it's just a matter of time, in my opinion, that the markets are going back to the fair price.”

That perspective is finding limited support as price sticks within a stubborn trading range. BTC price targets even include a return to all-time highs.

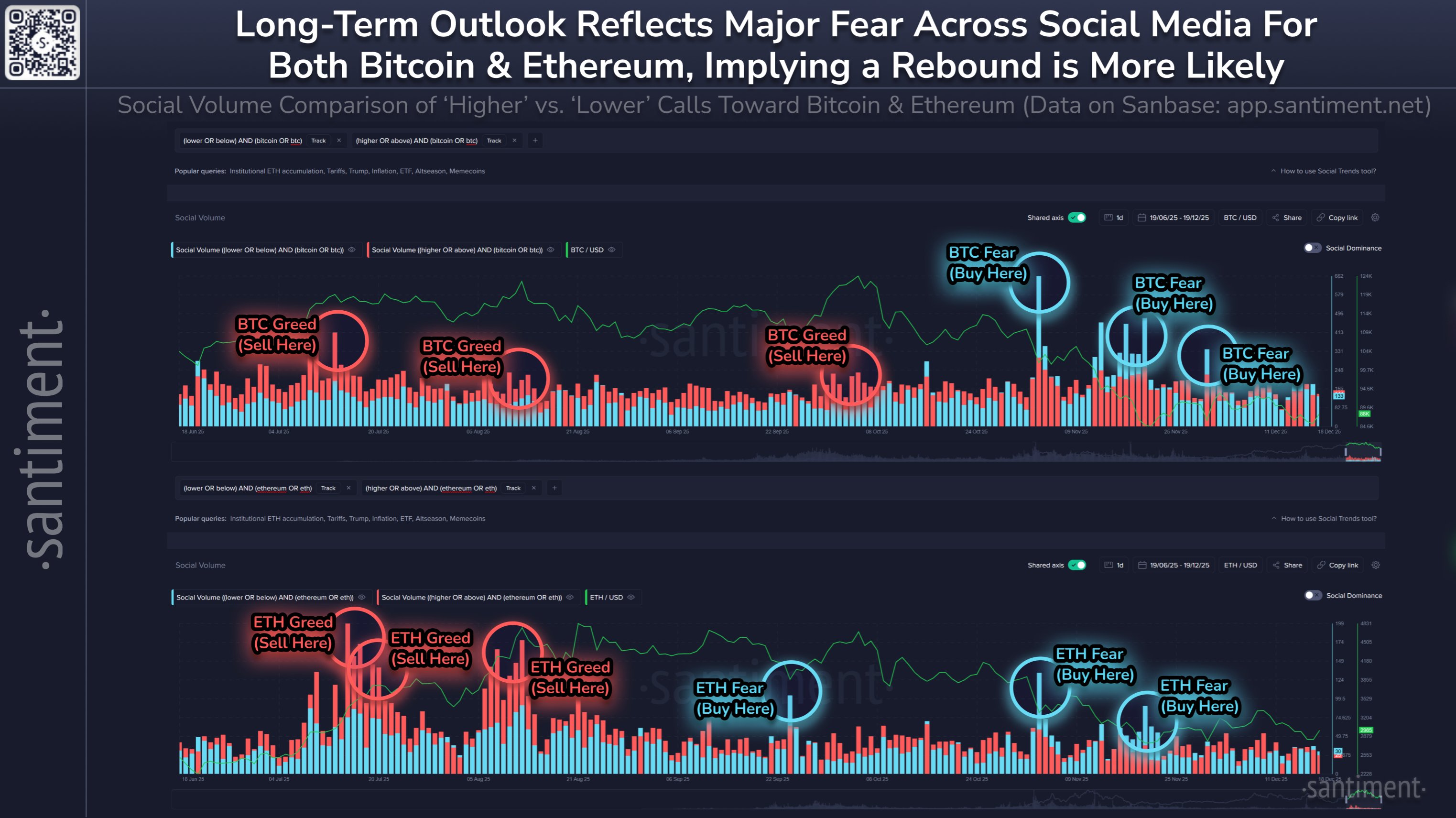

Research firm Santiment, meanwhile, reiterates that markets tend to do the opposite of what majority sentiment believes.

“For both swing trading and long-term trading, prices typically follow the path that retail traders least expect. When there are expected price climbs, prices fall. When there are expected price falls, prices climb,” it summarized Friday alongside crypto social media data.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.