Bitcoin (BTC) is trading uncomfortably close to the $90,000 mark, as a mix of macro caution, thinning liquidity, and shifting market structure continues to weigh on price action.

Related Reading: Wall Street Storms Ripple In Explosive $500 Million Deal

What was once a retail-driven ecosystem is now increasingly shaped by institutional flows, with U.S. spot Bitcoin ETFs attracting substantial assets, while on-chain activity trends in the opposite direction. The result is a market that moves, but with participation patterns very different from those seen in earlier cycles.

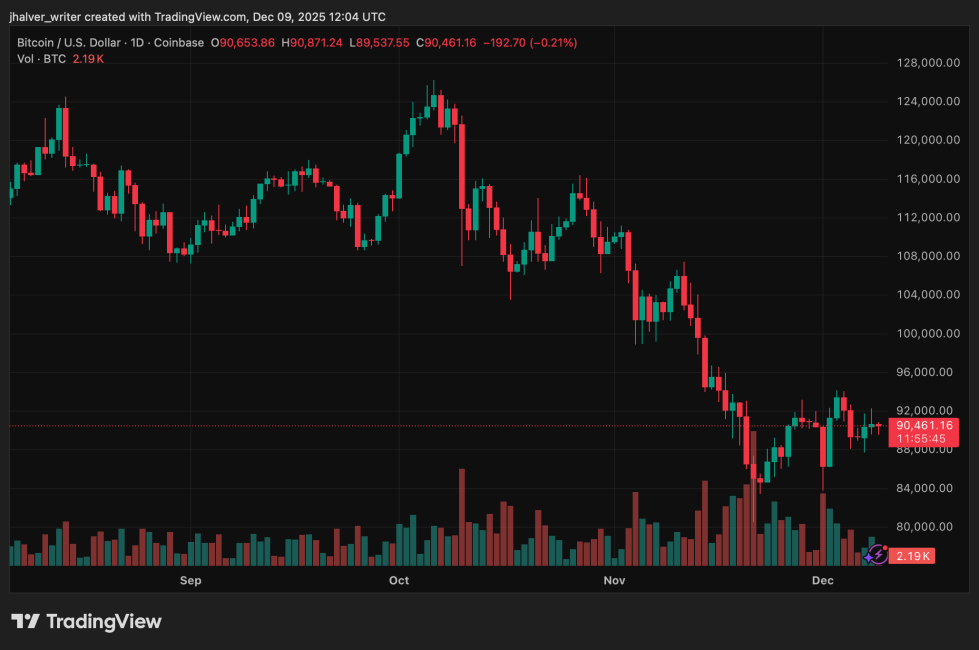

BTC's price trends to the downside on the daily chart. Source: BTCUSD on Tradingview

Bitcoin ETF Flows Rise as Retail Activity Falls

Since the launch of U.S. spot Bitcoin ETFs in early 2024, the network has experienced a steady decline in active on-chain addresses. Analysts attribute this partly to the “convenience trade,” in which retail investors opt for exposure through traditional brokerage accounts rather than managing their own Bitcoin wallets.

BlackRock’s IBIT and similar products now capture a growing share of BTC demand, even as the blockchain itself shows a decline in grassroots participation.

Industry experts argue that this shift fundamentally changes how value circulates in the Bitcoin economy. ETF issuers, not miners or network users, are now capturing a higher share of revenue.

SwanDesk CEO Jacob King describes this as a structural pivot toward off-chain monetization, with Bitcoin functioning more as a financial instrument than a peer-to-peer asset.

BTC Price Pressure Intensifies Around Macro Events

Bitcoin’s recent price behavior reflects both macro uncertainty and intraday volatility patterns. BTC has repeatedly slipped below $90,000 despite developments that historically would support bullish sentiment, such as Strategy’s (formerly MicroStrategy) latest purchase of over 10,600 BTC.

Traders remain cautious ahead of the Federal Reserve’s policy decision, where expectations for a quarter-point rate cut are high. Yet the hesitation is evident: rallies toward $92,000 continue to meet resistance, and liquidity remains thin across spot and derivatives markets.

Consequently, analysts warn that Bitcoin must hold above a key support level near $88,000 to avoid a deeper downside.

Institutional Trading Dynamics Shape Market Movements

A growing number of analysts suggest that predictable sell-offs around the U.S. market open reflect coordinated execution rather than organic selling.

Market watchers point to high-frequency firms, such as Jane Street, which hold large ETF positions, as possible contributors to these recurring patterns. While unproven, the consistency of these drops has added to trader frustration.

Meanwhile, miners face their own pressures. Hashprice has fallen to near-record lows, prompting operators to pivot toward AI infrastructure as mining profitability erodes.

Related Reading: CEOs Of Leading Banks To Discuss Crypto Market Structure With US Senators This Week

With ETFs absorbing demand, macro signals driving sentiment, and miners restructuring their businesses, Bitcoin now sits at a pivotal moment, supported by institutional capital but missing the retail pulse that once defined its cycles.

Cover image from ChatGPT, BTCUSD chart from Tradingview