A prominent crypto analyst says that leading digital asset Bitcoin (BTC) will spark an immense rally once it goes above a key price area.

Pseudonymous trader Rekt Capital tells his 292,000 Twitter followers that the top crypto asset by market cap is set to break out once it crosses the $43,000 mark.

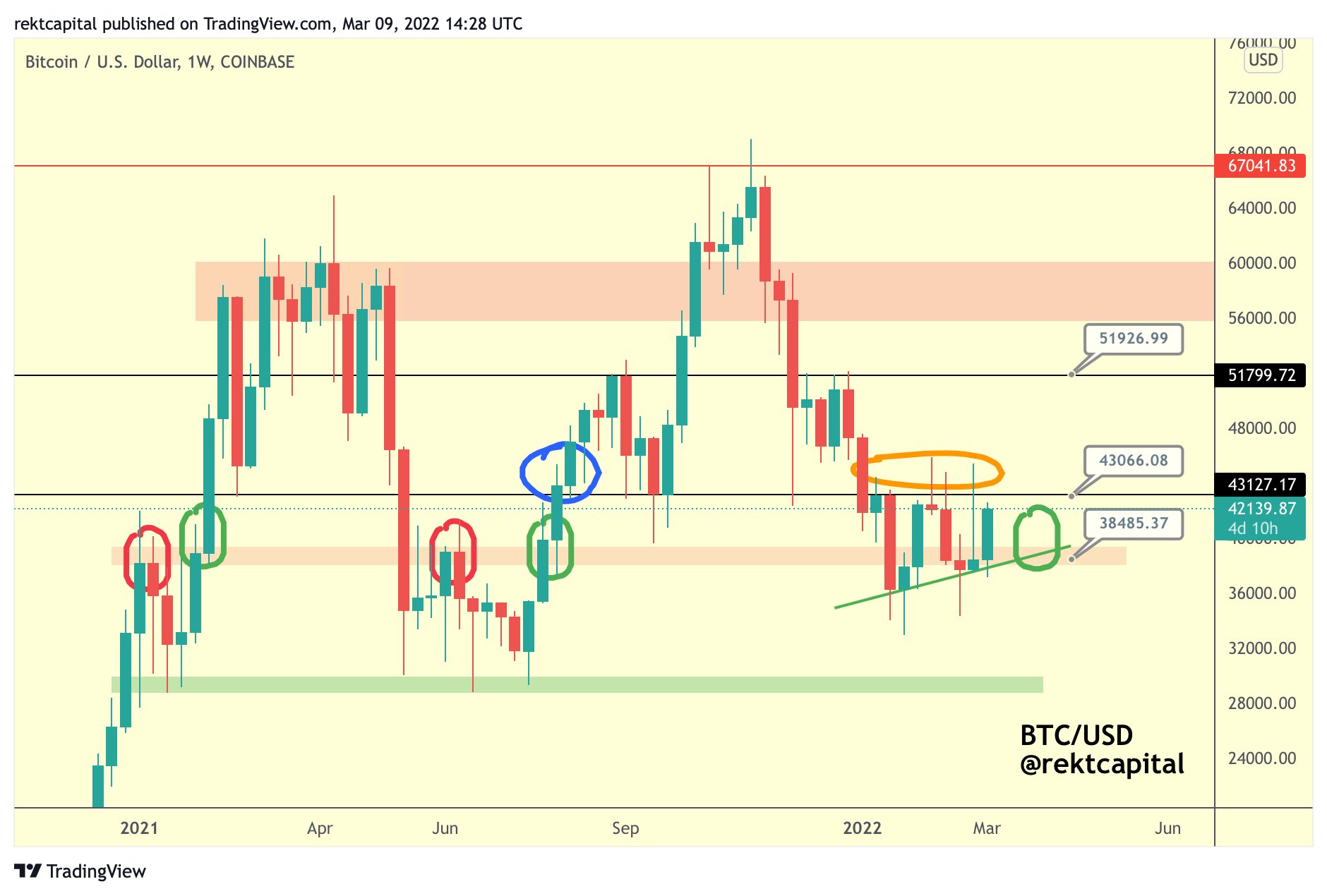

“The most important BTC EMAs [exponential moving averages] and MAs [moving averages] that have historically dictated breakouts are suggesting that the ~$43,100 level is [the] one to break for immense upside.”

Source: Rekt Capital/Twitter The analyst notes that the last time BTC shot past the $43,000 price tag while continuing to maintain its upward momentum, it led to a surge that pushed Bitcoin to its all-time high set in November 2021.

“BTC has performed upside wicks beyond the $43,100 resistance on a few occasions over the past few weeks.

Which is why it’s important that BTC performs a weekly close above this level, just like [previously] in August 2021.”

Source: Rekt Capital/Twitter The strategist then says that some of Bitcoin’s technical indicators are coming together to signal that BTC could soon see upwards price action.

“Not only is BTC forming a higher low on its price on the weekly timeframe, but it is also forming a higher low on indicators like the RSI [Relative Strength Index] or the MACD [moving average convergence/divergence].

Promising confluence.”

Bitcoin is exchanging hands at $39,237 at time of writing, a 6.5% decrease during the last 24 hours but a 5% increase from its seven-day low of $37,387.